The Hubei listed company was profitable in the first half of this year, and the medical energy company "flew by the wind"

Author:Pole news Time:2022.09.03

Extreme news reporter Xu Wei

The semi -annual report of the listed company has come to an end. According to statistics from reporters, a total of 4,876 listed companies in Shanghai, Shenzhen, and North Stock Exchange disclosed the semi -annual report in 2022. The total operating income of listed companies achieved a total operating income of 3.45 trillion yuan, and its net profit attributable to her mother was 3 trillion yuan, an increase of 12.7%and 8.7%compared with the same period last year (4454 listed companies), respectively. The epidemic and new energy have become the biggest factor that affects listed companies. What is the performance of the Hubei listed company? Jimu News reporters combed and found that nearly 80 % of the listed companies were profitable and the net profit doubled was listed companies on the two major outlets of medical and energy.

Mingde Bio is the most profitable pharmaceutical company

The top three of net profit are CITIC Special Steel, Xingfa Group and Mingde Bio. It is worth noting that CITIC Special Steel and Xingfa Group have been in the forefront all year round, but Mingde Biological has replaced old listed companies such as Huaxin Cement this year as a new "exploration flower".

According to the announcement of Mingde Bio, the company's operating income and net profit in the first half of 2022 were 5.253 billion yuan and 2.76 billion yuan, respectively, an increase of 360.27%and 376.29%over the same period of the previous year, respectively. During the reporting period, the company's immune diagnostic product revenue increased significantly year -on -year. The company's new crown antigen detection reagent recorded revenue of 1.25 billion yuan, an increase of 27.4 times year -on -year.

The reporter noticed that after the company's 2021 report launched a generous dividend plan for 10 yuan, the company continued to launch a 10 -faction 15 yuan dividend plan this year. From the perspective of past history, the company's cumulative dividend amount in 2020 was 138 million yuan, and the cumulative dividend amount in 2021 reached 459 million yuan.

It is worth mentioning that Mingde Bio not only performed well in Hubei listed companies, but also occupied a seat in listed companies in A -share medical device. The top three of the net profit of Mindray Medical, Daian, and Mingde Bio reached 5.288 billion yuan, 3.557 billion yuan, and 2.76 billion yuan, respectively. Judging from the year -on -year growth rate of net profit at home, Yalong, Mingde Biological, Outai Biology, Kaipu Biology, Daannet, and Wanfu Biological ranking ranked among the top 100%year -on -year.

Fuxi Medicine, another medical leader in Hubei, has also made excellent transcripts. The company realized operating income of 10.535 billion yuan, an increase of 8.95%year -on -year; net profit was 1.594 billion yuan, a year -on -year increase of 140.63%. Renfu Pharmaceutical said that the growth of performance was mainly due to the steady growth of core pharmaceutical products and increased profits contribution.

Shuanghuan Technology is the growth rate of Hubei

In the net profit growth data, a company performed very well. This company is Shuanghuan Technology, which increases by 2138%year -on -year, ranking first.

According to Shuanghuan Technology Half-annual report, in the first half of this year, the company achieved operating income of 2.299 billion yuan, an increase of 110.11%year-on-year; the net profit attributable to shareholders of listed companies was 515 million yuan, which was a profit from the same period of the same period of the same period last year to 25.2575 million yuan. Essence

Screenshot of Shuanghuan Technology Half -annual Report

The reporter noticed that Shuanghuan Technology's net profit in the first half of this year has exceeded the whole year of last year. In 2021, the company's net profit was 423 million yuan. Regarding the reason for the significant increase in revenue in the first half of the year, Shuanghuan Technology explained that on the one hand, the sales volume of the company's main products and ammonium chloride increased significantly compared with the same period last year, and the sales price rose sharply; on the other hand In the affiliated exchange of Yingcheng Yizhou Chemical Co., Ltd..

In addition, Xingfa Group, Huachangda, Hubei Yizhe, Dinglong Co., Ltd. and other listed companies involving energy concepts have increased by more than 100%year -on -year profit.

Among them, after experiencing the completion of the bankruptcy and reorganization in 2021, "Tesla Concept Stock" Huacchangda may have come out of the shadow of the past. The semi -annual report shows that the company's operating income and net profit in the first half of 2022 are respectively. It was 1.822 billion yuan and 50.3015 million yuan, and operating income increased by 133.12%compared with the same period of the previous year. The net profit was also successful from a profit from the same period last year.

The most interesting Tesla concept on Huachangda, but the company repeatedly responded to the outside world that according to the confidentiality agreement signed by the company and the Tesla cooperation project, it was inconvenient to disclose specific content. The company also mentioned once again in the half -annual report of 2022 that the company's three -dimensional warehouse is in a leading position in the field of frame and body storage. Customers include major domestic mainstream car manufacturers and foreign companies such as Tesla.

ST Zhongan lost 517 million yuan in the first half of the year

From the perspective of the industry, affected by factors such as the repeated epidemic and the high price of raw materials, companies such as real estate, catering, tourism, and consumption are still in trouble, and one or two can be seen from listed companies in Hubei.

For example, the South State Real Estate of Power Construction Real Estate achieved operating income of 1.596 billion yuan in the first half of 2022, an increase of 61.78%over the same period last year, and a net profit of -372 million yuan, a loss of 52 million yuan from the same period last year.

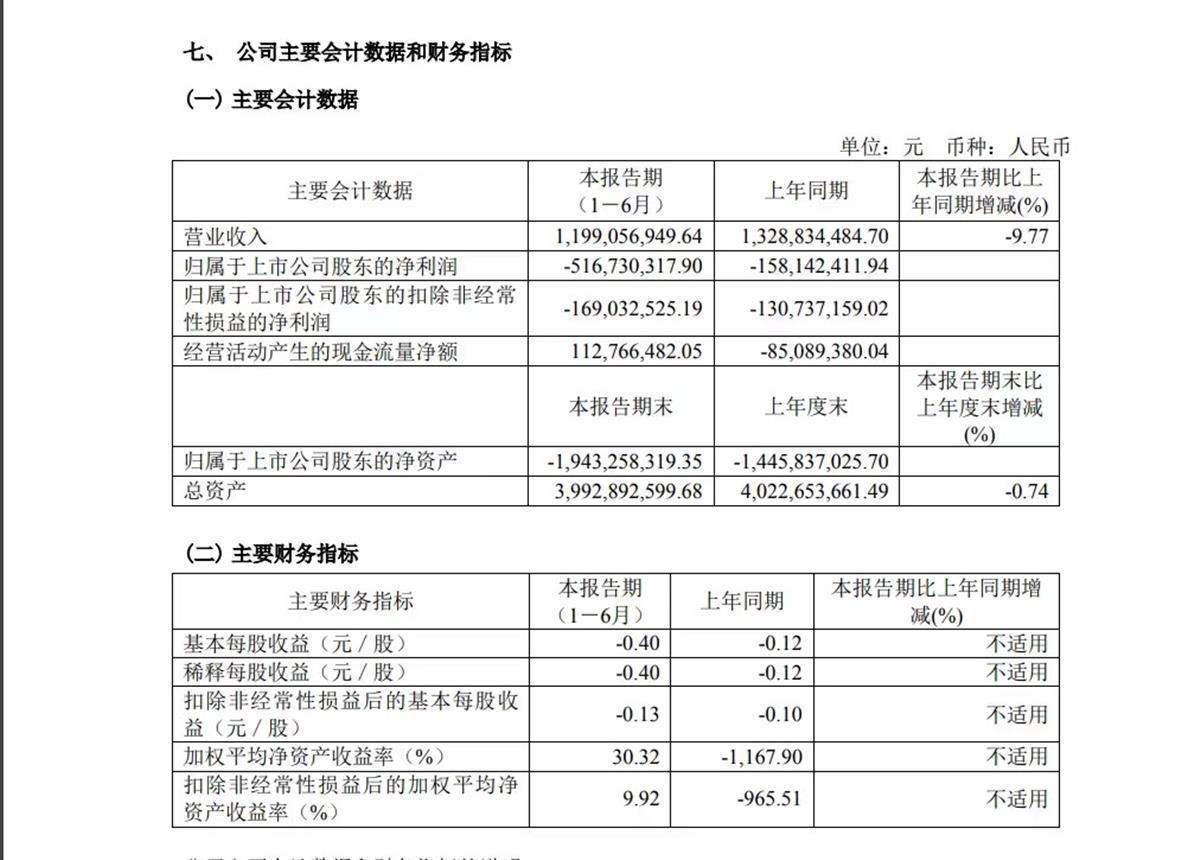

In the first half of the year, the most "miserable" of the listed company in Hubei was ST Zhongan. According to the announcement, the company achieved operating income of 1.199 billion yuan from January to June 2022, a year-on-year decrease of 9.77%, and the net profit was 517 million yuan.%.ST is known as Zhonganke Co., Ltd., which was established on December 31, 1991. It was listed on the Shanghai Stock Exchange on December 19, 1990. The main business is the integration of security fire protection systems, product manufacturing, and comprehensive operation services.ST Zhongan Bannan News Screenshot

The reporter learned that ST Zhongan was applied for bankruptcy and reorganization last year.Not only this, ST Zhongan also faces a lot of lawsuits and arbitration.Including bond transaction disputes, trading contract disputes, equity transfer disputes, product procurement contract disputes, commission contract disputes, and false statement of securities false statement responsibility disputes, etc.

Judging from the performance of the secondary market, ST Zhongan was approaching the face value to delist, and it has been hovering near 2 yuan/share in the near future.

(Picture source: Wind data screenshot)

- END -

The former richest man in Qinghai was sentenced to three years in prison for illegal mining, and the latest value exceeded 24 billion

Radar Finance | Zhang Kaijing Edited | Deep SeaFive years ago, the eleven Golden W...

Competition technology and speed new crown vaccine market staged a "upgrade battle"

China Commercial Daily (Reporter Ma Jia) Recently, a reporter from China Business Daily learned in an interview that major vaccine companies are staged a ability and speed competition for the second