Why is there a clue of China's economic growth in Baidu's financial report?

Author:Financial and economic Time:2022.09.03

Wen | Tao Weibin

"Autonomous driving is very close to us." On September 1st, at the opening ceremony of the World Artificial Intelligence Conference in 2022, Li Yanhong, the founder, chairman and CEO of Baidu (09888.HK), became a firm way of autonomous driving. By.

In fact, China's autonomous driving technology is at the forefront of the world -at least 10 cities have landed the commercial operation of autonomous driving. Taking Baidu as an example, as of July this year, Baidu's autonomous driving service volume exceeded 1 million.

As for the commercialization of autonomous driving, Li Yanhong also put forward his own point of view at the conference.

This is different from the gradual route that the industry thinks, and Li Yanhong's basis is definition of the responsibility of autonomous driving accidents.

"L2 is responsible for the driver, and the L4 is responsible for the accident." L3 is not easy to commercialize because "L3 needs to take over when the driver needs to take over, making the definition of responsibility accidents difficult. "

Obviously, when everyone is still considering technical issues, Baidu has begun to calculate how to truly commercialize.

"The speed of technical progress of autonomous driving is super expected." Li Yanhong is very confident in autonomous driving. Of course, to some extent, his confidence comes from the 10 years of Baidu in the field of artificial intelligence. "These 10 years We have invested more than 100 billion yuan in R & D, and the proportion of R & D each year exceeded 15%. Last year, it reached 23%. This was rare in the global large -scale technology Internet companies. "

Two days before Li Yanhong's speech, Baidu issued a 2022 Q2 financial report. In the second quarter of this year, Baidu achieved a total revenue of 29.65 billion yuan, with a net profit of 5.54 billion yuan, of which Baidu Smart Cloud increased by 31%year -on -year and 10%month -on -month. momentum".

Since the beginning of this year, the secondary market seems to be as harsh for Baidu as before -although "underwriting" is still a topic that cannot be avoided, but compared to the old guys, objectively speaking, Baidu is already good.

Taking the Hong Kong stock market as an example, Hong Kong stocks Tencent fell from 485 yuan/ share at the beginning of the year to 288 yuan/ share. Now it is difficult to keep the barrier of 320 yuan, a decline of more than 30%. Ali is also a difficult brother. Compared with the highest point of this year, Hong Kong stocks have fallen by more than 40 %.

The trend of Baidu's Hong Kong stocks is very special. Although the highest point of this year has also increased by more than 40%, it has risen all the way. Now it has risen to more than 140 yuan/share, which is only 15%away from this year's high.

It seems that in BAT, Baidu seems to be more down -behind the fall, on the one hand, it reflects the toughness of the company's basic disk, and on the other hand, investors are optimistic about the market outlook.

Through Baidu's latest financial report, we try to understand Baidu, a "familiar and unfamiliar" company, so as to understand from a financial perspective, what is the stability of Baidu? At the same time, from the perspective of long -term investment, what are the highlights of Baidu?

Baidu takes the money that can be seen steadily

Baidu Group's revenue is divided into iQiyi and core businesses, including the advertising income brought by the mobile ecology, and an innovative business income composition of smart cloud and smart driving.

Q2 financial report data shows that the quarterly Baidu core business revenue was 23.2 billion yuan, and the operating profit margin was 22%, an increase of 5 percentage points from the first quarter of 2022.

Frankly speaking, several important cities in China in the second quarter of this year have successively appeared in the epidemic, and the investment of advertisers tends to be conservative, but even so, Baidu's performance exceeds many analysts' expectations. The proportion increased to 49% -while two years ago, the income of the hosting page accounted for only one -third.

The growth of Baidu's hosting page revenue proves that Baidu's Internet advertising business has been established in addition to "traffic" and has established a more "ecology" of moat.

The power of this ecology is obvious -the growth of the hosting page business must not be "single soldiers". QuestMobile data shows that in June, when the full network monthly active households fell, the monthly survival of the Baidu App increased against the trend, an increase of 8%year -on -year, and in June reached 628 million, the first time surpassed Tencent QQ.

This is not easy in the environment of mobile Internet traffic.

Of course, among the major sections of Baidu's core income, the most bright is undoubtedly the smart cloud business -this is also the current second growth curve of Baidu.

Even with the disturbance of the epidemic, Baidu Smart Cloud's business continued to break through. In the second quarter, revenue increased by 31%year -on -year and 10%month -on -month.

Objectively speaking, the current transformation of digital intelligence in China has just begun, so the growth rate is relatively high, but this means that there is still a lot of imagination in this market. From now on, Baidu advocated the "" " Yunzhi "Intelligent Cloud business is becoming leaders in the industry.

According to the recent evaluation of Credit, Creditses stated that in the past three years, Baidu's smart cloud business has achieved 2.4 times the growth, and this speed is far exceeding the industry's general level.

In the "2021H2 China AI Cloud Service Market Research Report" released by IDC, Baidu once again occupied the top of the AI public cloud service market share. This is the sixth time Baidu has won the first place on this list.

I am most afraid of people who are smarter but more diligent than you. Baidu also achieved good cost control in the second quarter. The financial report showed that Baidu's sales and management cost rates in the second quarter were 16.1%, a year -on -year decrease of 2 points.

At the same time, as of the first half of this year, the mobile funds on Baidu's accounts were 5.5 billion yuan. Obviously, "there is food in your hands without panic", this confidence has also supported Baidu to continue to increase research and development investment. In the second quarter, Baidu's R & D investment was at least 5 billion yuan, and the core R & D expenses had accounted for more than 20%of Baidu's core revenue for 7 consecutive quarters.

In Li Yanhong's words, this is "pressure -stricken, marathon -style R & D investment".

Baidu holds out "Tomorrow" money

It is no exaggeration to say that if you understand Baidu's financial report, you can seize the potential of the next growth of the Chinese economy.

After a closer look, Baidu's current Internet advertising business has obviously have the characteristics of "cash cows" -and the ability to resist risks is continuously strengthened, and innovative business represented by smart clouds and autonomous driving is Baidu stringing tomorrow tomorrow tomorrow Strong crawler.

Baidu's intelligent cloud business, compared with Huawei Cloud, Alibaba Cloud, and Tencent Cloud, the biggest feature is the unique advantage of "cloud and wisdom", and this advantage comes from Baidu's long -term service to the industry in service B -end customers. Deep understanding of demand and pain points.

To put it simply, Baidu's intelligent cloud has "entered" the industry instead of a simple tool mentality. At present, it has covered key areas such as manufacturing, water, energy, transportation, and public undertakings.

Taking the "Crown" in the field of industrial manufacturing, the automobile manufacturing industry as an example, from head car companies such as Geely and SAIC to new forces such as Weilai and ideal, they have established in -depth cooperation with Baidu Smart Cloud. Geely and the hybrid cloud platform jointly created by Baidu Intelligent Cloud successfully helped Geely to reduce the cost of management operation and maintenance by 30%, and the resource utilization rate increased by 20%.

In the field of intelligent transportation, in the second quarter, Baidu won multiple road projects and urban road projects. As of the end of the second quarter, based on the cumulative contract amount of more than 10 million yuan, the Baidu ACE intelligent traffic solution has been adopted by 51 cities, and the coverage has continued to increase from 20 cities a year ago.

In the industrial field, there is a widely circulated three -degree horizon theory, which means that enterprises should plan products in accordance with the "production generation, reserve generation, and research and development generation."

Looking at Baidu with this perspective, the Internet advertising business is the first -level product that brings stable revenue to Baidu. Smart Cloud is the second -level product that has already appeared. Autonomous driving is obviously the third -level product that is most expected in the future.

According to the financial report, in the second quarter, the scale of the radish running operation of Baidu's autonomous driving service platform continued to expand, providing 287,000 ride services, an increase of nearly 500%year -on -year. As of July 20, 2022, the cumulative order volume of radish running reached 1 million orders, which has stabilized the world's largest self -driving travel service provider.

In July this year, Baidu launched the six -generation production cost of APOLLO RT6 2.5 million, which allowed the cost of unmanned vehicles for the first time in China to enter the price range of electric vehicles in the mass market. A month later, radish running will start unmanned business operations in Chongqing and Wuhan. Baidu has become the first company in China and the only company to provide the public with unmanned autonomous driving travel services on the open road.

"When we want to obtain autonomous driving operating qualifications in a certain area in a city, it is generally possible to have about 20 days of preparation time." Li Yanhong said at this World Artificial Intelligence Conference.

For the commercialization of autonomous driving in the future, Li Yanhong has been eager to try. In the context of the transformation of carbon neutralization and automobile industry, the huge potential of the autonomous driving market is almost "visible to the naked eye". In the future, unmanned travel services will inevitably create huge economic and social values.

Baidu attracts "smart money"

Baidu is attracting "smart money" -ly they always chase future potential. At the beginning of August this year, Baidu was confirmed to be included in the HSI and became the first AI company in the HSI.

As the highest proportion of technology companies, this also means that Baidu has been certified by the Hong Kong Stock Exchange and large institutional investors with its unique model and future potential potential.

It is due to the continuous investment in R & D, Baidu has obtained the ammunition library of "winning the next competition" by relying on real technology.

Baidu ranked first in China for four consecutive years in terms of AI patent applications and authorization volume. Last year, the number of applications for deep learning patents and the number of autonomous driving patents ranked first in the world. Last year, Baidu won the only Chinese patent gold award in the field of artificial intelligence interaction, becoming a high -tech enterprise with the highest and highest award -winning level in the field of artificial intelligence.

In terms of underlying innovation, Baidu created the first domestic -level industrial -grade deep learning platform flying paddle in China. In the field of cutting -edge technology exploration, Baidu also released superconductant quantum computers to "start", and the world's first full -platform quantum hard and hard integrated solution "quantitative".

In addition to the exchange, the international securities firm also gives positive evaluations.

"We are still optimistic about Baidu through a relatively flexible advertising business, (more than 40%of the operating profit margin) to achieve the path of profit growth, which will promote the rapid growth of Baidu's smart cloud and autonomous driving business. These two businesses are gradually taking off and and these two businesses are gradually taking off and and these two businesses are gradually taking off and and they are gradually taking off.Obtained commercial returns. "Goldman Sachs described in the report that, like Credit, Goldman Sachs also gave a" buy "rating.Morgan Stanley and Morgan Chase gave "holding" rating, with target prices set at $ 180 and $ 160, respectively.

"We believe that the worst situation of advertising has passed." Morgan Stanley wrote in the analysis. In fact, for Baidu, after "carrying" the challenges brought by the overall environment and its own transformation, or it, or or for its own transformation, orIt will usher in a new wave of "see more".

- END -

The A -share express industry was released in the semi -annual report: the stock price rose and decline under the general rise of performance

Cover reporter Ma MengfeiWith the end of August, the A -share express company SF H...

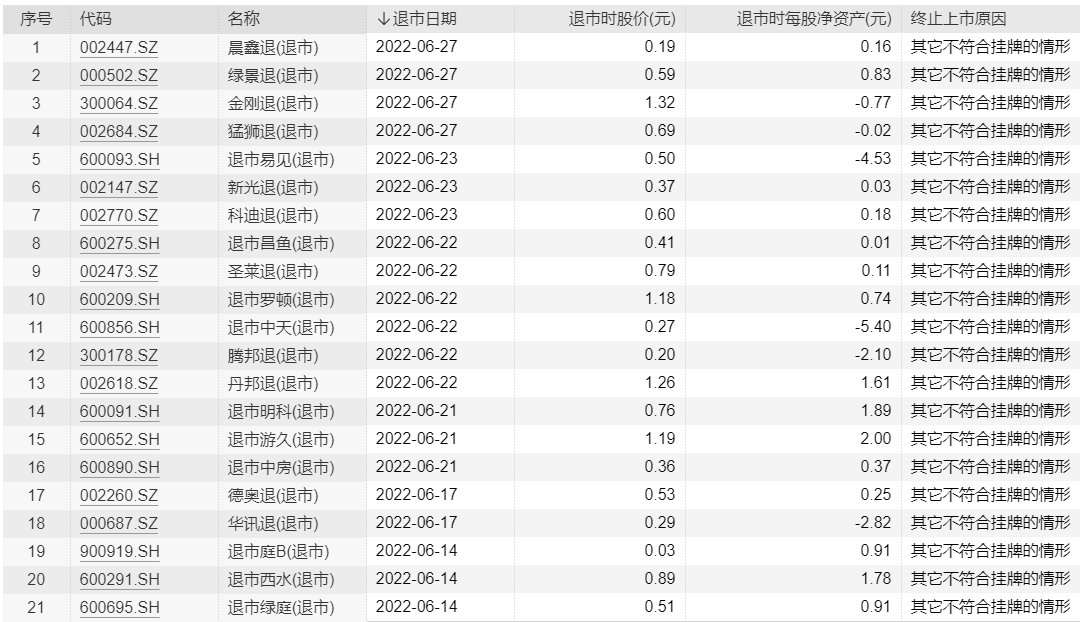

Detoning a major case of financial fraud, the "artificial diamond king" delisted!4 delisted a day, and the number of delisting in June was recorded

On June 27, Lvjing retired, Chen Xin retired, Mammoth retreat, and Vajra retreatin...