What did the Beijing Stock Exchange's first anniversary?

Author:Zhejiang Daily Time:2022.09.03

Zhejiang News Client reporter Zhu Cheng

Today, the Beijing Stock Exchange is officially registered for its first anniversary. In the past two trading days, two more Zhejiang companies sounded the listing clock.

This year, the listing enterprises of the Peking Stock Exchange had reached 110, with a total market value of nearly 200 billion yuan.

Some people say that since the development of the Beijing Stock Exchange, a small and medium -sized enterprise listed development path with distinctive characteristics is initially formed.

The data shows that the current Supervisor of the Beijing Stock Exchange is 70 % of SMEs, with an average listing review cycle of only 121 days. On average, each enterprise can achieve public issuance and financing of 210 million yuan.

Some people say that the current liquidity of the Beijing Stock Exchange is too weak and the valuation is not conducive to enterprise development.

Since the beginning of this year, the Beijing Stock Exchange has encountered a "breaking wave", and the break rate of new shares has reached 80%-90%. As the secondary market is not active, the fixed increase plans of many listed companies have frequently encountered cold.

What changes did the Beijing Stock Exchange coexist in surprise and troubles? Yong Jinjun talked to professionals such as enterprises, securities firms, scholars, and other followers.

The Beijing Stock Exchange is listed, can you go?

Do you want to go to the Beijing Stock Exchange? This is a choice of a company.

For Zhao Guomin, the chairman of Guangmai Technology, the decision was right in November last year.

"If the Shanghai -Shenzhen market is compared to the air -conditioned bus, the Beijing Stock Exchange may be a large truck. I think as long as you can take the company to enter the right track and reach the destination, it is a good car." Zhao Guomin said.

After the Beijing Stock Exchange's "get on the car", Guangmai Technology has accelerated this year: some equity of repurchase some equity is used to motivate employees, introduce high -end teams, and start building Guangmai Building ...

Zhao Guomin said that in the past year, the company's brand favorability and reputation have risen significantly, and it has also brought about bonus in various aspects such as policies, credit, cooperation, and internal stability, which is difficult to reach before listing.

Langhong Technology and Tianming Technology, a family of electronic equipment anti -theft display products, occupied half of the mountains and mountains. The other is the domestic off -road twisting leader.

Talking about the feelings of this listing, the heads of the two companies mentioned a word invariably, which is efficient.

Compared with the Shanghai -Shenzhen Exchange's launch journey for more than one year, they are like taking the Fuxing train. Among them, Tianming Technology has only used 97 days to submit the application materials to the issuance of the report in March this year.

In addition, through the public issuance market of the Peking Stock Exchange, Langhong Technology's electronic product anti -theft equipment industrialization base project and Tianming Technology's high -end off -road modification component production projects and R & D centers construction projects have reached expectations, and the two companies will be able to get in order Strengthen R & D and expand production, and use the efforts to "ride the wind and waves" on their respective tracks.

There are also enterprises who are dissatisfied with the soil and water. A industry insider engaged in listed services revealed that some companies have said that they have "disappointment" -the Bei Stock Exchange is not liquid and the stock premiums are small. Essence

Another person in charge of the company also said vaguely that the current Beijing Stock Exchange belongs to the "vulnerable group" in the capital market, and will still feel "low people" in front of the Shanghai -Shenzhen stock market.

In this regard, Zhao Guomin held different views. He believes that the dividend of listing is not only reflected in financing cash, but also the identity of listed companies is an endorsement of corporate brands and reputation.

"As an entrepreneur, you should never stare at the stock price in front of you. You must learn to take the initiative to use the rules of the capital market and create conditions to win the opportunity instead of waiting for the stock price to take off." He said.

"It is necessary to harden the iron. Enterprises must be developed by the way, and they must drive double -wheel drive. The lack of business and capital is indispensable." Zhang Song, chairman of Tianming Technology, agreed.

In fact, the current Beijing Stock Exchange market has initially achieved the gathering of high -quality enterprises. The total market value of 110 listed companies in the Beijing Stock Exchange was nearly 200 billion yuan, and the proportion of strategic emerging industries and advanced manufacturing industries accounted for more than 80%, with an average R & D intensity of 4.6%, which was 3.3 times that of enterprises above designated size.

More and more high -quality enterprises are constantly rushing to the Beijing Stock Exchange.

According to relevant data statistics, there are more than 400 companies planned to be listed on the Northern Stock Exchange currently being reviewed or counseled. Among the 115 declared enterprises accepted by the Beijing Stock Exchange in the first half of the year, more than 40%of the net profit of more than 40%of the enterprises exceeded 50 million yuan.

Insufficient liquidity, what do you think?

It was cool for a while.

In the long run, there is insufficient liquidity and low valuation, which is still a problem that the Bei Stock Exchange cannot avoid.

"If the liquidity of the Bei Stock Exchange cannot improve and the market value cannot be improved, it does hit the enthusiasm of enterprises' financing." Many companies admit that this is the main reason for enterprises to shake.

Related data show that the daily average daily turnover rate of the Peking Stock Exchange is 2.03, which ), GEM (39.77) also has a certain gap. Its investment accounts have just exceeded 5 million households, which is far less than that of Shanghai and Shenzhen.

The record of several transfer stocks also proves this reality on the side: the first day of the presence of the Code Code Defense Board was 458 million yuan, which has exceeded the overall turnover of the Beibei Stock Exchange of 350 million yuan; The stock price in the market once soared more than 100%, and Hanbo High -tech was a "record". It once created a record high of 42.22 yuan/share in the market.

This can't help but make people feel that the Beijing Stock Exchange is making wedding dresses for others, and high -quality listed companies "turn to solve thousands of sorrows."

In this regard, experts believe that this is the "troubles of growth" of the Bei Stock Exchange because of many reasons.

According to an industry analysis, the establishment of the Bei Stock Exchange is not long. On the one hand, the investor's ecology is not yet sound, and the market has a reservation attitude towards it. In addition, some companies have not fully demonstrated their own value.

The analysis of Qian Shui and Water, the dean of Zhejiang University of Technology and Commerce, is mostly small and medium -sized enterprises, with a large development uncertainty, and the market attention is inevitably affected. However, the deeper reasons come from the economic environment. "In the first half of this year, the economic situation was facing intensified pressure, and the short -term capital market lacked sufficient expectations and confidence. The Beijing Stock Exchange, which grew up in this environment, is really not easy."

How to deal with it? Qian and water believe that if necessary, the system should be appropriately changed. For example, drawing on mature capital markets abroad, introducing mixed -making business systems and short -term trading mechanisms that can hedge risks, provide margin financing and index preparation, encourage and support social security, insurance, pension and other medium and long -term funds to enter the market, attract more Investors enter, etc.

"Of course, the key to the development of the Bei Stock Exchange is to discover high -quality listed companies and make characteristics and brands." Qian, water and soil supplements. From the top -level design point of view, the Bei Stock Exchange is a unique financing channel for high -growth SMEs. Therefore, how to find high -quality SMEs is the core issue that the Bei Stock Exchange will consider next step.

In addition to changing, enough patience is also the wisdom of resolving growth troubles.

Zhang Qicheng, chairman of Caitong Securities, believes that "as the youngest exchange market in China, there is still a lot of room for growth in the market capacity of the Beijing Stock Exchange. It is necessary to cultivate more investors suitable for this market in a certain time."

From the perspective of the current inclusiveness and review efficiency of the Bei Stock Exchange, the number of listed companies in the Beijing Stock Exchange will not be too long from more than 100 small and medium -sized enterprises to 500 to 600. At that time, the market value and gradient of the entire market will naturally expand. "At that time, consider reducing the threshold of investors and activating liquidity, it is naturally successful." Zhang Qicheng said.

"In the future, the Beijing Stock Exchange should be such a market." Qian Shui and Turkey said, "Let more technology -based SMEs with fast growth have accelerated. Enterprises develop and financing during the listing process. The agglomeration effect of scientific and technological innovation SMEs, forming a demonstration effect of the "specialized new ', creating its own star enterprises, and also allows investors to have better investment targets, thereby achieving a win -win situation of the three parties."

There are more or less?

From the perspective of geographical distribution, the first echelon of the Bei Stock Exchange is 19 Jiangsu Province, 14 Guangdong Province, and 11 in Beijing and Shandong Province. Zhejiang, a large capital province, ranked fifth in Zhejiang, with 9.

Fifth place, it is really surprising. After all, Zhejiang Province has been leading the country in Zhejiang Province, fine, special, and new "little giants". Many experts believe that this structural difference may be because Zhejiang's capital market is relatively mature, and the number of new listed companies has ranked among the top three in the country for many years. Wait.

"But in the long run, Zhejiang's strength is full of strength." Zhang Qicheng said. Since the establishment of the Beibei Stock Exchange, Caitong Securities has successfully counted a number of Zhejiang enterprises to list, ranking first in the province.

At present, the Zhejiang enterprises of the Bei Stock Exchange are quite distinctive. According to data analysis, Zhejiang manufacturing enterprises accounted for 88.88%in the Bei Stock Exchange, and 11 percentage points in the country, especially the general equipment manufacturing industry and electrical machinery and equipment manufacturing enterprises, highlighting the characteristics of the province of Zhejiang's manufacturing province.

From the perspective of counseling data, Zhejiang companies have also caught up and ranked second in the country. According to statistics from the Zhejiang Securities Regulatory Bureau, as of the end of August, Zhejiang Province had a total of 50 companies to be declared by the North Stock Exchange (of which 30 were in the counseling stage and 20 during the application stage)

Yong Jinjun also noticed that various actions against the Beijing Stock Exchange have been carried out one after another:

Earlier this year, the Zhejiang Provincial Government issued the "Regional Equity Market Zhejiang Innovation Pilot Implementation Plan", and set up a "special specialty new board" in the regional equity market to establish a "special board -to -multi -layer" listing mechanism to tap and cultivate listing. Listing reserve corporate resources. Governments of various local governments have also incorporated the North Stock Exchange into the Northern Stock Exchange in terms of market cultivation and promotion, fiscal policy awards, and work incentive assessment.

In order to provide convenience and acceptance, the Zhejiang Securities Regulatory Bureau has set up a special channel for the Beijing Stock Exchange. Many relevant departments have provided policy answers and professional suggestions for many "specialized new" enterprises organized by the "specialized new" enterprises in the joint organization last year.

Brokerage is an important link for enterprises to connect with the capital market. Zhang Qicheng told reporters that Caitong Securities will be committed to serving the real economy and promoting the high -quality development of Zhejiang enterprises. "We will particularly focus on small and medium -sized science and technology specialized new enterprises to carry out the company's full life cycle."

- END -

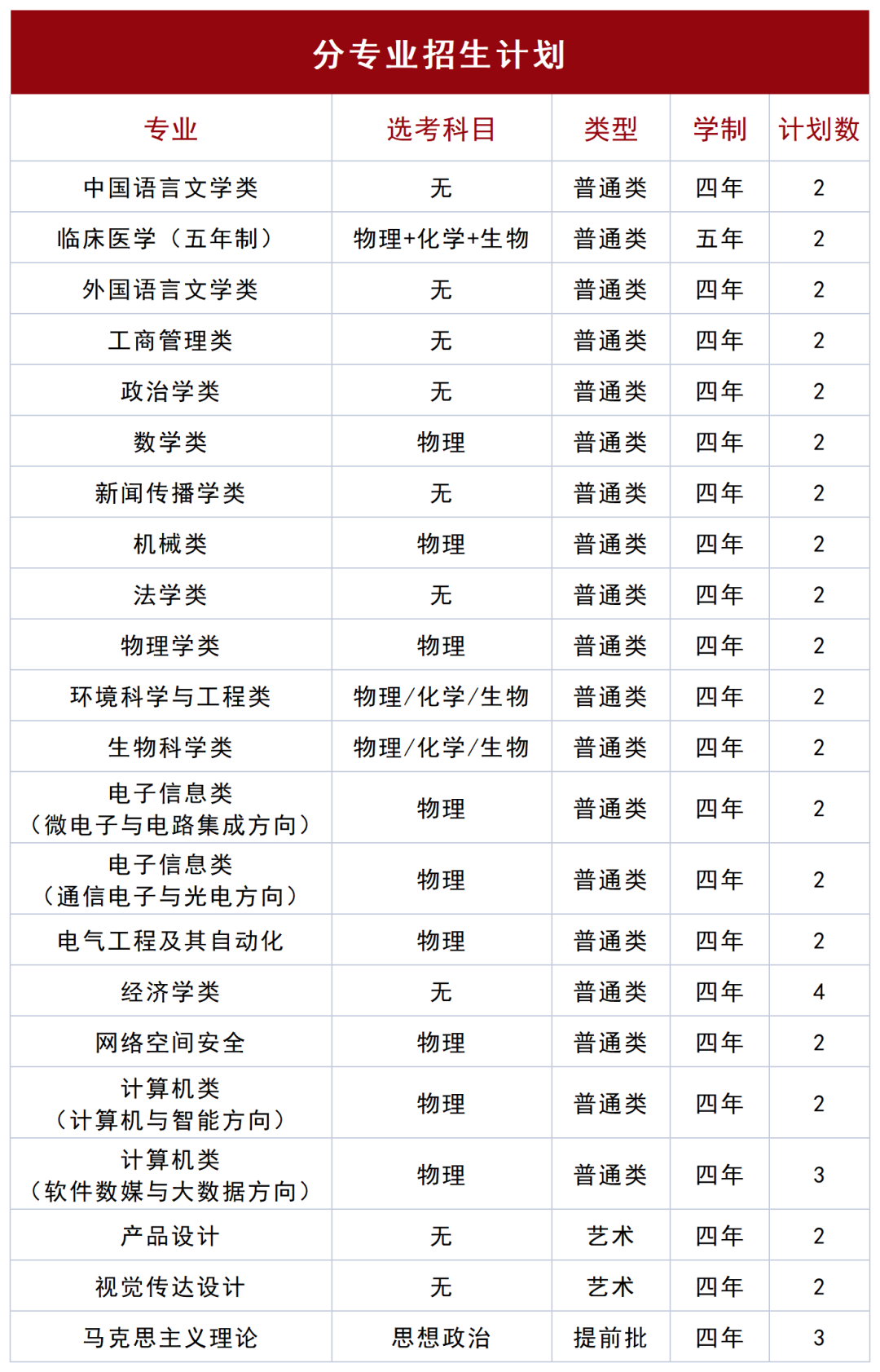

Heavy!Shandong University 2022 Undergraduate Admissions Plan

Shandong University is a key comprehensive university directly under the Ministry ...

Agricultural distribution Bijie Branch organizes emergency desktop deduction of emergencies

Recently, some areas of Guizhou Province have discovered the adverse factors that ...