Shandong state -owned enterprises run out of the acceleration!Huaru Group's 6 -year net profit increased by 7.36 times

Author:Jinan Times Time:2022.09.03

At present, state -owned enterprise reforms are in full swing. High -quality development, maximizing the use of resources, maximizing benefits, and improving the competitiveness of state -owned economy can be described as an important direction of state -owned enterprise reform. Judging from the effectiveness of the reform of Shandong state -owned enterprises, Hualu Holdings Group Co., Ltd. (hereinafter referred to as "Huaru Group") can be described as one of the typical model: the total amount of assets accounted for 1.27%of the provincial enterprises contributed 11.46%of the total profit, 13.87%of the total profit, 13.87% Net profit and 14.78%of the net profit of mother -in -law; in the past 6 years, the total profit has jumped from 1 billion to 9 billion, and the yield of net assets has ranked first in the provincial state -owned enterprise for three consecutive years.

Behind such a high -speed growth, what is the driving force?

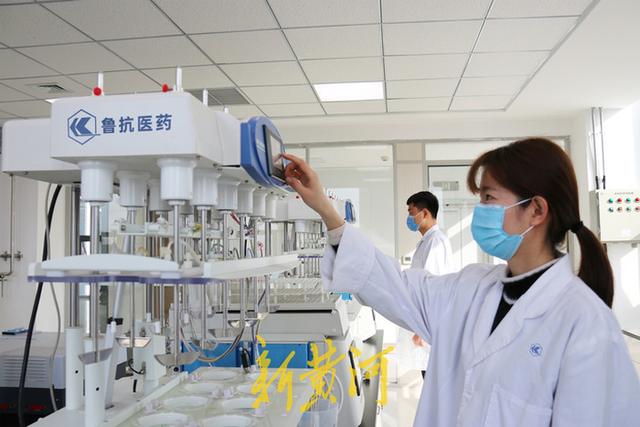

As the Shandong Provincial Window Corporation, since it was renovated to a state -owned capital investment company in 2015, Huaru Group focused on the three main business of high -end chemical, biomedicine, and ecological and environmental protection, and ran out of development acceleration.

In the first seven months of this year, Huaru Group achieved a total of 27.316 billion yuan in revenue, an increase of 27.86%year -on -year; the total profit was 6.064 billion yuan, a year -on -year increase of 6.81%. The total return on total assets and 15.1%of the net assets yield, and continued to maintain the provincial enterprise first.

After leaving the time span, the operating performance of the Huaru Group can be described as rising, and it has repeatedly set a record. Compared with the end of 2015, the total assets increased from 24.352 billion yuan to 50.713 billion yuan, an increase of 1.08 times; operating income increased from 15.873 billion yuan to 39.55 billion yuan, an increase of 1.49 times; 9.147 billion yuan, an increase of 7.12 times; net profit increased from 919 million yuan to 7.683 billion yuan, an increase of 7.36 times; net profit at home increased from 237 million yuan to 2.488 billion yuan, an increase of 9.5 times; the operating income profit margin from the operating income profit margin from the profit margin of the operating income profit. 6.88%increased to 23.1%; increased by 2.36 times.

From the perspective of the state -owned enterprises in Shandong Province, the three indicators of Hualu Group's total assets, net asset yields, and asset -liability ratios have ranked first in provincial enterprises for five consecutive years.

Fan Jun, Secretary of the Party Committee and Chairman of the Huaru Group, said that in recent years, the quality of Huaru Group's development has increased significantly, and the total profit has increased from 3 billion in 2019 to 9 billion in 2021; The rate reached 27.2%, ranking first in provincial enterprises for three consecutive years.

New Yellow River Reporter: Huang Min

Edit: Liu Yuhong

- END -

The upper limit of the Beijing Provident Fund's deposit: The upper limit of the deposit base is 31884 yuan

According to the website of the Beijing Housing Provident Fund Management Center on the 28th, the Office of the Beijing Housing Provident Fund Management Committee issued the Notice on the issue of t

Countermeasures of the current status and problems of the asset management of the supply and marketing cooperatives

The assets of the supply and marketing cooperative refer to the various forms of a...