Jin Guangheng, the exhaust gas treatment equipment company, plans to list the New Third Board of the New Third Board, has a high concentration, and there is a historical generation.

Author:Daily Economic News Time:2022.09.02

After three years of delisting in the New Third Board, Jin Guangheng Environmental Protection Technology (Nanjing) Co., Ltd. (hereinafter referred to as "Jin Guangheng") was submitted again, and it was submitted to the new three -board listing.

Jin Guangheng mainly provided process exhaust gas treatment equipment and related environmental protection engineering services for pan -semiconductor enterprises. In 2020 and 2021, the company realized operating income of 154 million yuan and 151 million yuan, respectively, and the net profit was 7.1702 million yuan and 16.665 million yuan, respectively.

"Daily Economic News" reporter noticed that in December 2019, Jin Guangheng introduced external shareholders Jiangsu Gaotuyi Da Ninghai Entrepreneurship Investment Fund (limited partnership) (hereinafter referred to as "Yida Ninghai"). The agreement promised that Jin Guangheng's net profit in 2019 and 2020 was not less than 20 million yuan and 24 million yuan, respectively. But in 2020, Jin Guangheng's actual net profit was less than one -third of the promise.

However, it may be to cooperate with the Link Guangheng to apply for the new third board listing and the listing of the Bei Stock Exchange. In March 2022, the above -mentioned gambling matters were lifted through the form of the "Confirmation Letter".

Existing agency matters during the previous listing

金广恒曾于2016年4月至2019年8月在新三板挂牌,并于2016年10月进行第一次定向发行股票,共发行215万股,其中的140万股、15万股分别由董事长于Pei Yong, Director and General Manager Jobo subscribed. At the time, the hosted brokerage firms and law firms clearly stated that "there is no situation of equity holdings and holding platforms for this stock issuance."

In fact, Yu Peiyong's 490,000 shares in the subscription of shares and the 150,000 shares subscribed for Zhu Fengyong, Huang Jian, Xunchen, and Zhong Wei were held on behalf of the shares. investor. Until the company's delivery, in November 2019, Yu Peiyong lifted its equity holding on its equity through equity transfer.

For historical generations, the listing review department asked the company to explain whether the company's high -person personnel knew the above matters, whether they were loyal and diligent, and ensured the information disclosure of the information was true, accurate and complete, and provided sufficient evidence.

From the delisting of the New Third Board, in January and November 2020, Jin Guangheng introduced two external investors through capital increase expansion, namely Yida Ninghai and Nanjing Industrial Development Fund Co., Ltd. (hereinafter referred to as "Nanjing Industrial Development Fund").

According to the gambling agreement signed by Jin Guangheng's actual controller and Yida Ninghai, it promised the company's performance goals in 2019 and 2020. If it is not completed, the actual controller shall make cash compensation or equity supplement to the investors. But in fact, Jin Guangheng's net profit in 2020 was 7.170 million yuan, which is far from the net profit of 24 million yuan in the target of gambling, and it touches the "non -net profit target of any year in the middle of 2019 to 2022 in the middle of 2022 in the repurchase right. 70%of profit ".

The reporter noticed that in 2018, Jin Guangheng's operating income was 125 million yuan, and the net profit of shareholders attributable to listed companies was 12.6201 million yuan. In other words, compared to 2018, Jin Guangheng's net profit level in 2020 fell a significant decline.

In March 2022, Jin Guangheng's actual controller Yu Peiyong, Shao Xiaoting and Yida Ninghai signed a confirmation letter to lift the above -mentioned gambling matters.

As for another foreign shareholder Nanjing Industrial Development Fund, in November 2020, it obtained a 2.71%equity of Jin Guangheng for 10 million yuan. The agreement agreed to the investment period of 3 years, and the gambling agreement was signed. However, only one year after holding, in December 2021, Jin Guangheng repurchased all shares held by the Nanjing Industrial Development Fund for 10.2633 million yuan and made capital reduction.

In the feedback response, Jin Guangheng said that due to subsequent cooperation, the internal approval process of the Nanjing Industrial Development Fund has a long time and considering that its subsidiary funds can be successfully logged in to the capital market in the future. In July 2021, in July 2021 The two parties negotiated and initially reached the consensus of repurchase equity.

Customer concentration is higher, and the change is large

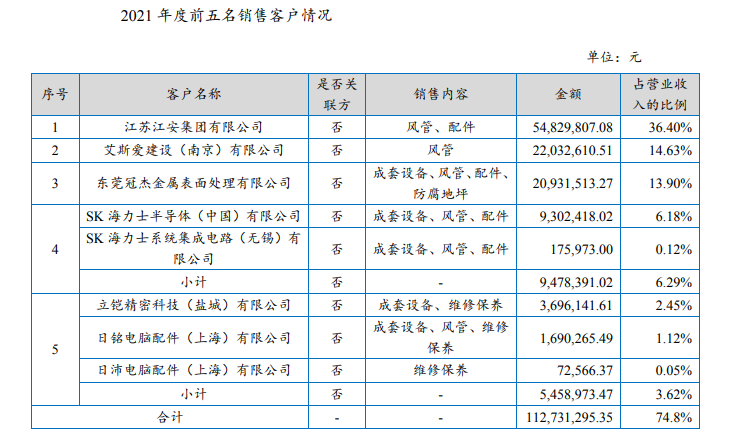

Jin Guangheng's income mainly comes from exhaust gas treatment equipment and environmental protection engineering services. The downstream terminal customers are mainly focused on the pan -semiconductor industry, such as Samsung Semiconductor and SK Hynix. Due to the characteristics of the pan -conductive industry, Jin Guangheng has the risk of high customer concentration. In 2020 and 2021, the sales revenue of the top five customers accounted for 68.72%and 74.84%. It will adversely affect the company's operating performance.

The reporter noticed that the list of the top five customers of Jin Guangheng has changed a lot. Among the top five customers in 2020, only Aisai Construction (Nanjing) Co., Ltd. and SK Hynix continued to rank among the top five customers in 2021; and 2018 The top five customers, only Aisi Kai Construction (Nanjing) Co., Ltd. (SK Hynix) appeared among the top five customers in 2020 and 2021.

So, does the company cooperate with major customers have sustainability? According to Jin Guangheng's disclosure, from January to April of 2020, 2021, and 2022, the company's new customer revenue accounted for 5.78%, 60.74%, and 32.05%, respectively. Essence

Jin Guangheng believes that the overall company's stock customers have a relatively high sales, and have a long history of cooperation with major customers. The main customer suppliers choose strict, and the main business is stable and sustainable. As for the high income of new customer income in 2021, the two customers of Jiangsu Jiangan Group Co., Ltd. (hereinafter referred to as "Jiangsu Jiangan") and Dongguan Guanjie Metal Surface Treatment Co., Ltd. accounted for a relatively high income, ranking among 2021, respectively, respectively, respectively. First and third largest customers.

Image source: Announcement Screenshot

In 2021, Jin Guangheng's sales amount to Jiangsu Jiangan was 54.8298 million yuan, and his income accounted for 36.40%. The end customer of Jiangsu Jiangan FM Valley project was Samsung Semiconductor, and the company mainly sold the air ducts and accessories. It is worth noting that the gross profit margin of the project is 41.16%, which is much higher than the company's overall gross profit margin (28.44%) in 2021, which is the main reason why its net interest rate level increased significantly in 2021.

Jin Guangheng said that the project's terminal owner Samsung Semiconductor needs the product to meet the FM certification conditions, the FM certification threshold and industry recognition are high, so the company has a strong premium capacity on the project. After deducting the impact of the project, Jin Guangheng's comprehensive gross profit margin in 2021 was 21.16%, which was not much different from the comprehensive gross profit margin (19.36%) in 2020.

However, as the owner of Jiangsu Jiang'an project designated the resin and wind valve of the DONG-IL CNE Co., LTD (hereinafter referred to as the "Korean Dongyi") brand, the higher unit price of its products caused a large amount of raw materials. In 2020, South Korea Dongyi is the company's largest supplier. The company purchases 40.7742 million yuan, and its procurement accounts for 38.46%.

In this regard, the second feedback asked the company to supplement the method of obtaining the order of Jiangsu Jiangan's FM air pipe project, and the follow -up cooperation with Jiangsu Jiangan; the reason and rationality of the purchase from South Korea Dongyi Explain the specific situation of FM certification, the reasons and rationality of the high gross profit margin.

The reporter noticed that as of the signing of the public transfer instructions, Jin Guangheng and Jiangsu Jiangan had no new cooperation project; from January to April 2022, as the Samsung semiconductor air pipe project had been completed, the company did not continue to purchase raw materials from East One in South Korea.

Regarding the relevant matters related to the New Third Board, on September 1, a reporter from "Daily Economic News" called Jin Guangheng and sent an interview email. The company personnel declined the interview.

Daily Economic News

- END -

The four strengths of Chengdu behind the word "fight"

Photo source: Every reporter Zhang JianThe train runs fast, relying on the front b...

The first nationwide!Ningbo charter organizes foreign trade enterprises to go abroad to "expand the market"