Fosun Pharmaceuticals, although they are still honored?

Author:New entropy Time:2022.09.02

@新 新 新

Author 丨 Ruyue

Edit 丨 Monthly

Fosun Pharmaceutical turned over the car.

Fosun Pharmaceuticals is a typical pharmaceutical company that "creates and excels" through investment mergers and acquisitions to expand product pipelines and integrates the industrial chain. Is it a controversy in the "pharmaceutical company" or "investment company", but no matter how controversy, it is unshakable to rank first -class pharmaceutical companies in China.

On August 30, Fosun Pharmaceutical released its six -year operating performance, and the evaluation of "Fosun Pharmaceutical Stocks into Leeks" began to be popular in the market. Because of the first half of the year, due Yu Yiyi, the financial report shows that in the first half of 2022, Fosun Pharmaceutical achieved revenue of 21.340 billion yuan, an increase of 25.88%year -on -year; net profit attributable to shareholders of listed companies was 1.547 billion yuan, a year -on -year decrease of 37.67%

For a long time, due to investment in the overall profit, Fosun Pharmaceutical has been in doubt whether the profit has continuously. From the perspective of this financial report data, Fosun Pharmaceutical's innovative drug products have finally improved. In the future, this part of business can throw away the label of "flat performance"? What are the release of the release of Fosun Pharmaceutical's performance?

Investment over the car, increasing the income without gaining profit

In recent years, investment income has been an important reason for Fosun's business profit.

According to data from Fosun Pharmaceutical's half -annual financial report in 2022, the operating income of Fosun Pharmaceutical in the first half of the year was 21.340 billion yuan, an increase of 25.88%year -on -year; net profit attributable to shareholders of listed companies was 1.547 billion yuan, a year -on -year decrease of 37.67%, showing that increasing income did not increase the increasing increasing increasing increasing increasing increasing increasing income The phenomenon of benefits.

Specifically, due to market fluctuations, the stock price of the BNTX (Biontech Company) stock held by Fosun Pharmaceuticals decreased in the first half of 2022 compared with the end of 2021. The changes in BNTX's stock price caused a fair value loss of more than 100 billion yuan. Due to the impact of changes in the fair value of financial assets held, Fosun Pharmaceutical's non-recurring profit or loss in the first half of the year was -315 million yuan, a year-on-year decrease of 1.227 billion yuan.

In addition, Fosun Pharmaceutical's investment income was 2.167 billion yuan in the first half of the year, accounting for 85.08%and 116.32%of the operating profit and net profit of the same period. The company's investment income mainly comes from two parts: the income generated by the long -term equity investment of the equity method is 799 million yuan, and the investment income obtained by the disposal of transactional financial assets is 753 million yuan. And sell some stocks of BNTX.

In fact, Fosun Pharmaceutical has been investing for a long time.

As early as 1998, Fosun Pharmaceutical landed on the A -share main board market and opened the road to investment mergers and acquisitions. At that time, Fosun Pharmaceuticals with left -handed biomedicine and right -handed real estate "appetite" after embrace the capital market, and successively acquired Yuyuan Mall and jointly established Sinopharm Holdings to gradually establish their own business maps. When the fashion industry arrived in the consumer industry, it cost 8.4 billion yuan to acquire Indian Pharmaceutical Company in 2016 and set the highest record for overseas mergers and acquisitions.

Pharmaceutical and investment two legs are the development background of Fosun Pharmaceutical. According to data statistics in the times, in the past ten years, Fosun Pharmaceutical has participated in multiple rounds of financing of 110 projects.

With excellent investment capabilities, the proportion of investment income and net profit of Fosun Pharmaceuticals in the past ten years has been more than half, and its assets have increased from 22.322 billion yuan to 98.804 billion yuan, an increase of 4.43 times. As of the first half of this year, Fosun Pharmaceutical Assets ranked second only to Shanghai Pharmaceuticals in Chinese pharmaceutical companies. Among them, Fosun Pharmaceutical's current long -term equity investment was 22.854 billion yuan, accounting for about 25%of the company's total assets.

In the first half of the year, Fosun Pharmaceutical did not stop the footsteps of "buying and buying". According to the company's investigation data, as of August 16, Fosun Pharmaceutical's investment in 2022 involved medical imaging intelligent equipment, in vitro diagnosis, stem cell therapy, tumor tumor Hospitals, new drug research and development and pension institutions have a total of 9 investment cases, with a total amount exceeded RMB 1.7 billion.

The acquisition expansion also made Fosun Pharmaceutical's title of "investment madness" in the Chinese pharmaceutical industry.

In the past, as a pharmaceutical company, Fosun Pharmaceutical relied on investment income to contribute to the main operating profit. Because the growth of non -net profit was not high, the market questioned that the company's growth was not sustainable. However, the investment failure of this time, the market's "unsuccessful business" accusation is even more endless.

From the loss of investment in Fosun Pharmaceutical, can Fosun Pharmaceutical's conclusion that Fosun Medicine "has uncertainty in the future"?

Can the new crown oral medication support the stock price?

In the first half of the year, the sales volume of innovative drug products will become the focus of Fosun Pharmaceutical's development in the future.

According to data from Fosun Pharmaceutical's half -annual report in 2022, its non -net profit in the first half of the year was 1.862 billion yuan, an increase of 18.57%year -on -year. In terms of splitting, the contribution income of pharmaceuticals, medical devices and medical diagnosis and medical and health services in the first half of the year was 14.327 billion yuan, 4.043 billion yuan, and 2.918 billion yuan, respectively. In addition, the gross profit margin of the corresponding business was 54.57%, 34.45%, and 17.68%, respectively.

In other words, the problem of weak pharmaceutical business growth in the pharmaceutical business has been gradually improving. Specifically, the high growth of the pharmaceutical business mainly comes from the revenue contribution of new products and sub -new products: Fu Baitai (MRNA new crown vaccine) achieves more than 800 million doses of sales in Hong Kong, Macao and Taiwan; ) In the first half of the year, a total of 813 million yuan was achieved, an increase of 150.15%year -on -year; Hankan (Lifenabi Mipido injection) achieved revenue of 819 million yuan in the first half of the year; Revenue revenue of 360 million yuan.

At the semi -annual performance exchange meeting, Fosun Pharmaceutical also emphasized that the income of new products and sub -new products has accounted for more than 25%of the income of pharmaceutical business, and said that "(new product and sub -new product) 25%of the income accounted for" It will be improved. We hope to work hard to mention this proportion 35%or even 45%. Based on the company's overall strategic planning, we also hope to increase the proportion of innovative drug income to half of the overall revenue in about five years. "

Fosun Pharmaceuticals will focus on turning back to innovative medicines, and it has been seen from 2020.

At that time, Wu Yifang took over Chen Qiyu's responsibility for the formulation and management of Fosun Pharmaceutical Strategy. Wu Yifang changed the "buy, buy and buy" style of equity investment, and replaced it to sell equity to tighten financial investment. Only the investment and mergers and acquisitions on the industrial chain were cautious in many foreign speeches, and always emphasized "focusing on the main business". At the mid -term performance exchange conference in 2021, Wu Yifang decided that Fosun Pharmaceutical would reach the future of "the income of innovative varieties accounted for 50%and the profit contribution to 70%".

It is reflected in the company's management in recent years. According to the financial report data, the total investment in Fosun Pharmaceutical's research and development in the first half of the year was 2.399 billion yuan, accounting for 11.24%of the total operating income, of which the research and development investment of pharmaceutical business was 2.062 billion yuan, an increase of 16.04%year -on -year, accounting for 14.39%of the pharmaceutical business income.

It is worth noting that the new product pipeline of Fosun Pharmaceuticals has gradually ushered in the listing period. Specifically, there are 2 innovative drugs (indications) (Hans -like, Hans -like), 10 imitations (indications) in China in China in the first half of the year. Pharmaceuticals (indications) are approved in China to conduct clinical trials.

Innovative drugs are called "long -slope thick snow" due to large investment in capital, long R & D cycle, and high probability of failure.

The national collection policy has gradually landed, and innovative drugs have become a certain direction for pharmaceutical companies, and this field is also fiercely competitive. The old pharmaceutical company has "Yao Mao" Hengrui Pharmaceutical for Deep Innovation Medicine for ten years. In the first half of the year, 11 innovative medicines were listed in the first half of the year. In 20 billion, R & D has become a domestic PD-1 "Four Little Dragons". Fosun Pharmaceutical's innovative drugs initially exposed, and there will still be a long way to go in the future.

It is worth mentioning that Fosun Pharmaceutical and Real Biological Cooperation developed and commercialized the first domestic anti -new crown oral medication -Azf's fixed tablet, which was once considered to be the last medical air outlet in the new crown. After all, Jiu'an Medical's new crown kit has become the annual monster stock price, and there are the market value of Takuya Pharmaceuticals, which holds the domestic holding of Azofen for the only Azofen's raw material drug, increased by 20 billion yuan.

Perhaps based on the above expectations, on July 25th, the real creature was obtained by the Azf fixed feet to treat the new coronary virus pneumonia adaptation registration application. Zofding signed a cooperation agreement. However, the next day Fosun Pharmaceutical opened high and low, and for more than a month, its stock price has not been tired.

At present, Azf has settled in many places across the country and has been deployed in Henan, Hainan, Xinjiang and other places, but the data set by Azf in the real world have not been completely formed.

Regarding the market performance of anti -new crown products and the expectations of the company's stock price boost, Fosun Pharmaceutical stated that the new crown virus is still mutating, and the income brought by the anti -new crown product has hedged the impact of the epidemic on other products, but it still This business with pulse characteristics cannot be used as a long -term sustainable growth point.

The market value of the old pharmaceutical company

"Fosun Pharmaceuticals aggravated my spiritual internal consumption." An investor holding Fosun Pharmaceutical posted after his release of his semi -annual performance.

Xinhua Pharmaceutical and Real Biological Cooperation harvested 11 daily limit. China Resources Shuanghe and real biological cooperation have harvested 9 daily limit. Fosun Pharmaceutical and real biological cooperation have gained a large yin line. Fosun Pharmaceutical Investment, known for "Medicine PE", has spoken by many investors.

Fuxing Pharmaceutical's performance in the secondary market is indeed unsatisfactory. Fosun Pharmaceutical's market value has fallen 15.33%since the beginning of the year. As of September 1st, its market value was 190.189 billion yuan, and Hengrui Medicine's market value of Hengrui Pharmaceutical, which was also among first -class pharmaceutical companies in China, was 219.055 billion yuan. ; Let's look at the "burning money" Baiji Shenzhou has not yet been profitable, and the market value has exceeded Fosun Pharmaceutical and has reached 133.085 billion yuan.

Investigating its "investment sequelae."

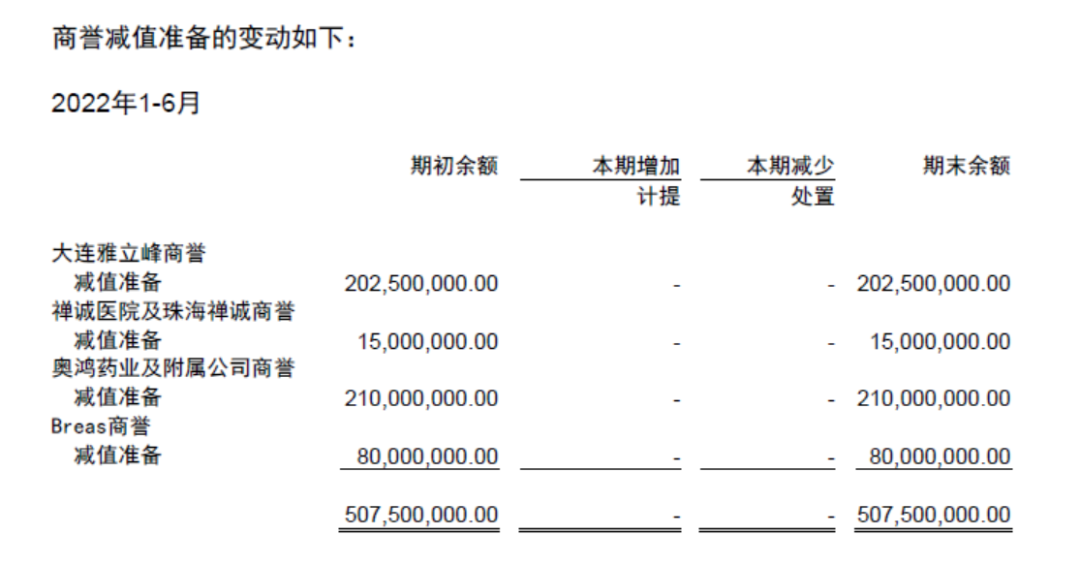

First of all, a large investment has made Fosun Pharmaceutical's pressure on debt repayment. According to the semi -annual report data, as of the first half of the year, Fosun Pharmaceutical's mobile assets totaled 32.137 billion yuan, and the total liabilities totaling 31.967 billion yuan, which was close to 1. Compared with Hengrui Pharmaceutical's current flow ratio of 8.05, the decreased liquidity ratio was behind it. It is a signal that Fosun Pharmaceutical's short -term debt repayment capacity and monetization capacity have gradually slowed down. The capital market is different from the market value evaluation of the two. Secondly, the huge goodwill brought by mergers and acquisitions continuously. If you want to wear its crown, you will be inherited. In the long run, "buying and buying" has caused Fosun Pharmaceutical to accumulate a heavy goodwill. According to the financial report in the first half of 2022, as of the end of the reporting period, Fosun Pharmaceutical's goodwill was as high as 9.934 billion yuan, and the preparation of goodwill impairment was 506 million yuan.

From the perspective of the capital market, nearly 10 billion yuan in goodwill will face the preparations for the preparation of huge asset impairment in the future, which is unbearable by investors. On the one hand, facing the comprehensive implementation of collection, pharmaceutical companies first stepped from generic drugs to innovative drugs, and then squeezed their heads into the national medical insurance catalog. On the other hand, the new crown epidemic continued and the industry was exposed as a whole. Fosun Pharmaceutical's investment empire is difficult to guarantee the risk of thunderstorms. At that time, Fosun Pharmaceutical's goodwill will face major impairment.

Chinese companies love the benchmark, and Fosun Pharmaceuticals have repeatedly speeches to the outside world, saying that the benchmarking company is benchmarking, and the latter is also a pharmaceutical company that attaches importance to mergers and acquisitions. But now, Johnson & Johnson's market value has reached 2926.331 billion yuan, and Fosun is still jumping over and down the market value of 100 billion yuan. Although it is understandable to learn Johnson's mergers and acquisitions. Performance is the road of stability.

- END -

"Early repay compensation" must be well balanced

Zong Zongming/WenCong Bank recently announced that it will adjust the personal mor...

The four major exchanges gathered!Listed Enterprise Cultivation Center in Xiangzhou District, Zhuhai City launched

Text/Yangcheng Evening News all -media reporter Qin XiaojieOn the afternoon of Aug...