Every time it is traded (evening edition) 丨 Dragon and Tiger List funds to raise the concept of Beidou; BYD's car sales in August are about 175,000, an increase of 155.23%year -on -year;

Author:Daily Economic News Time:2022.09.02

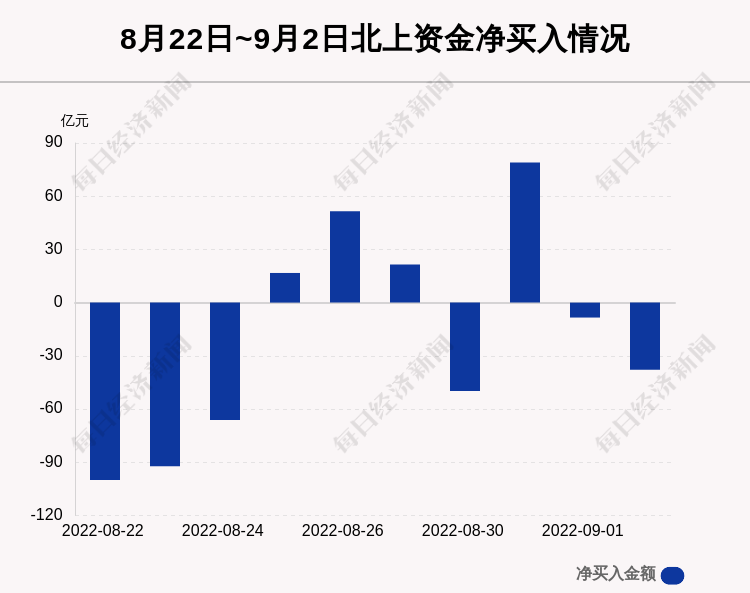

On September 2, the Shanghai Index rose 0.05%. Northern Fund sold 3.783 billion yuan today. Among them, the Shanghai Stock Connect was sold 2.761 billion yuan, and the Shenzhen Stock Connect was sold 1.022 billion yuan.

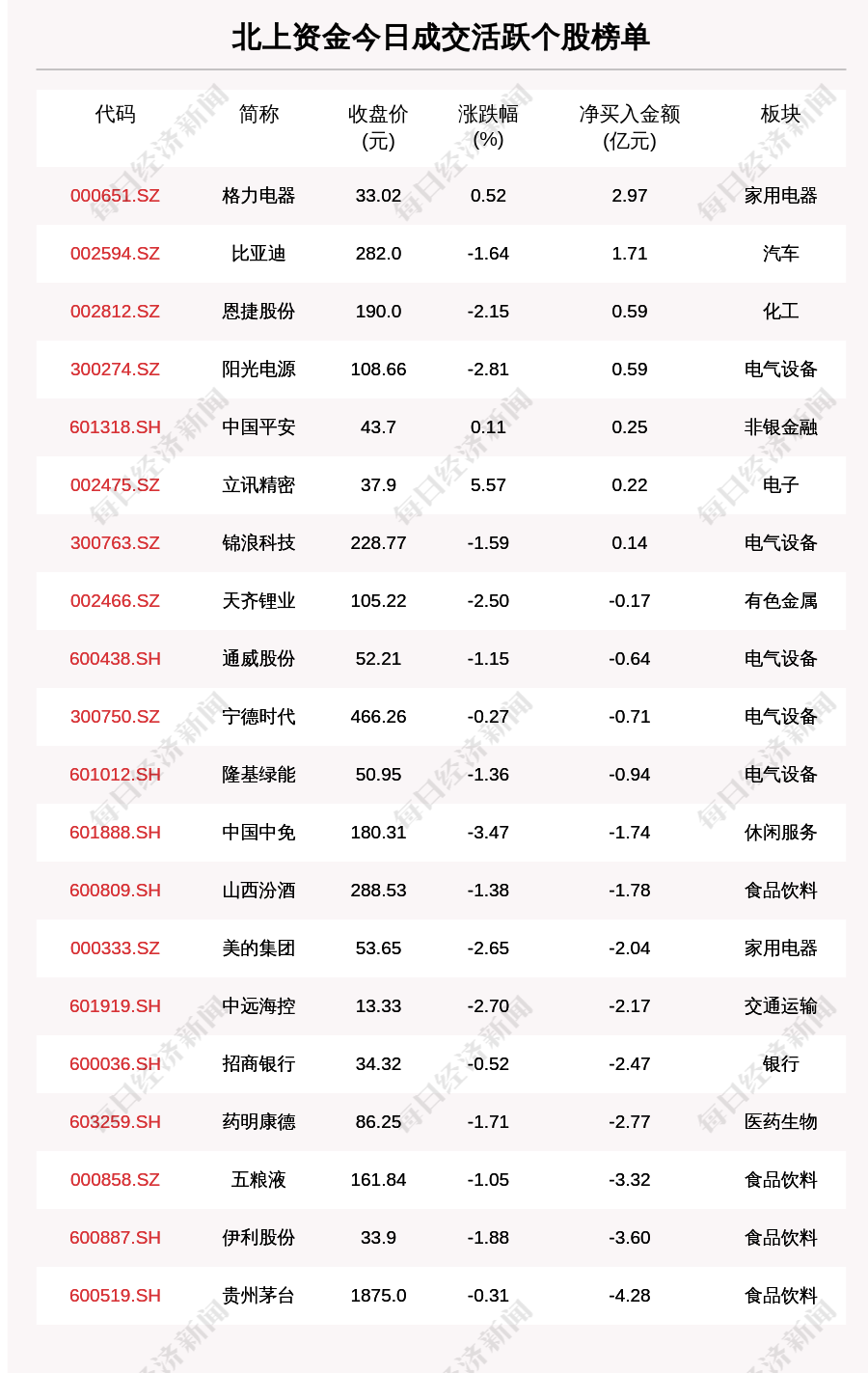

On September 2nd, in the list of active stocks in the North Shanghai Fund Transaction, there were 7 net stocks, and the largest amount was Gree Electric (000651.SZ, closing price: 33.02 yuan), net purchase of 296.9 million yuan; net sell There are 13 individual stocks, and the largest amount is Guizhou Maotai (600519.SH, the closing price: 1875.0 yuan), which sells 427.9 billion yuan in net.

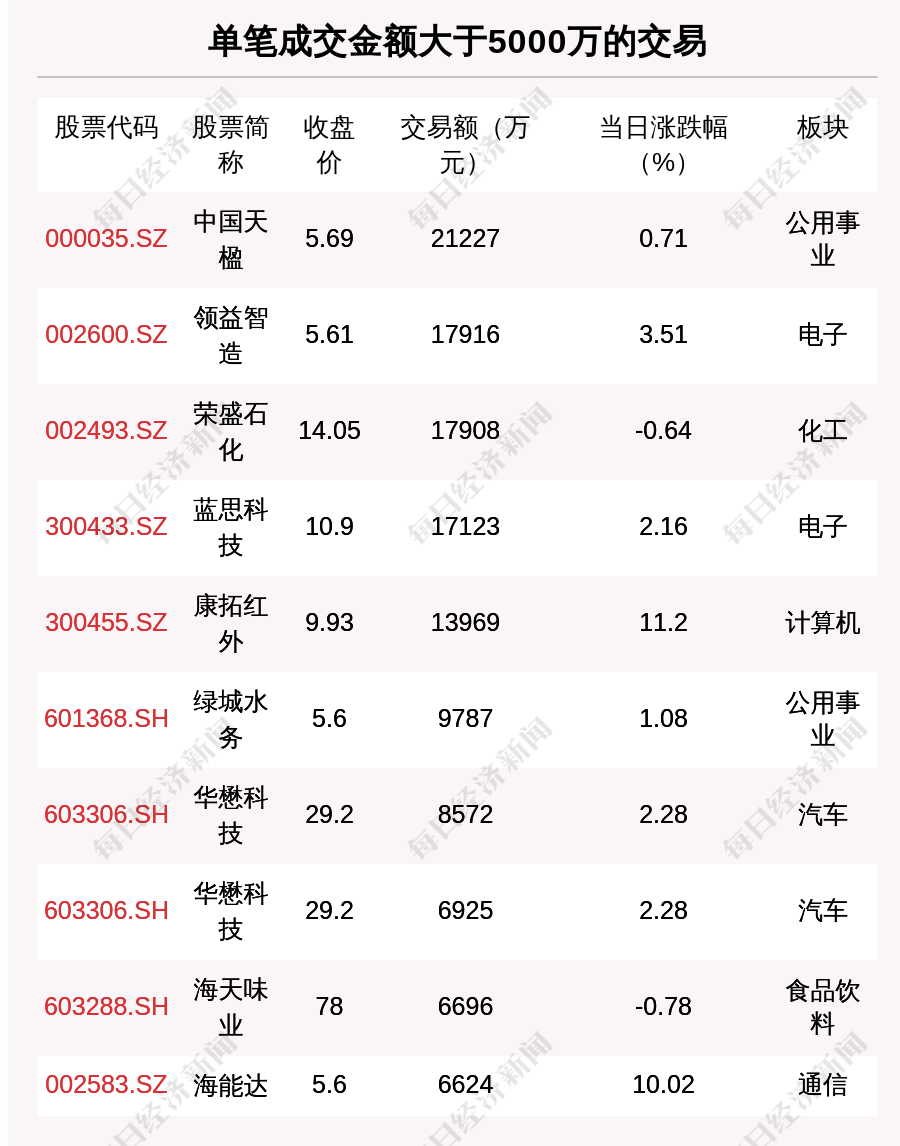

On September 2, 2022, a total of 156 large transactions occurred in the Shanghai and Shenzhen cities, with a total of 2.641 billion yuan, involving 84 listed companies.

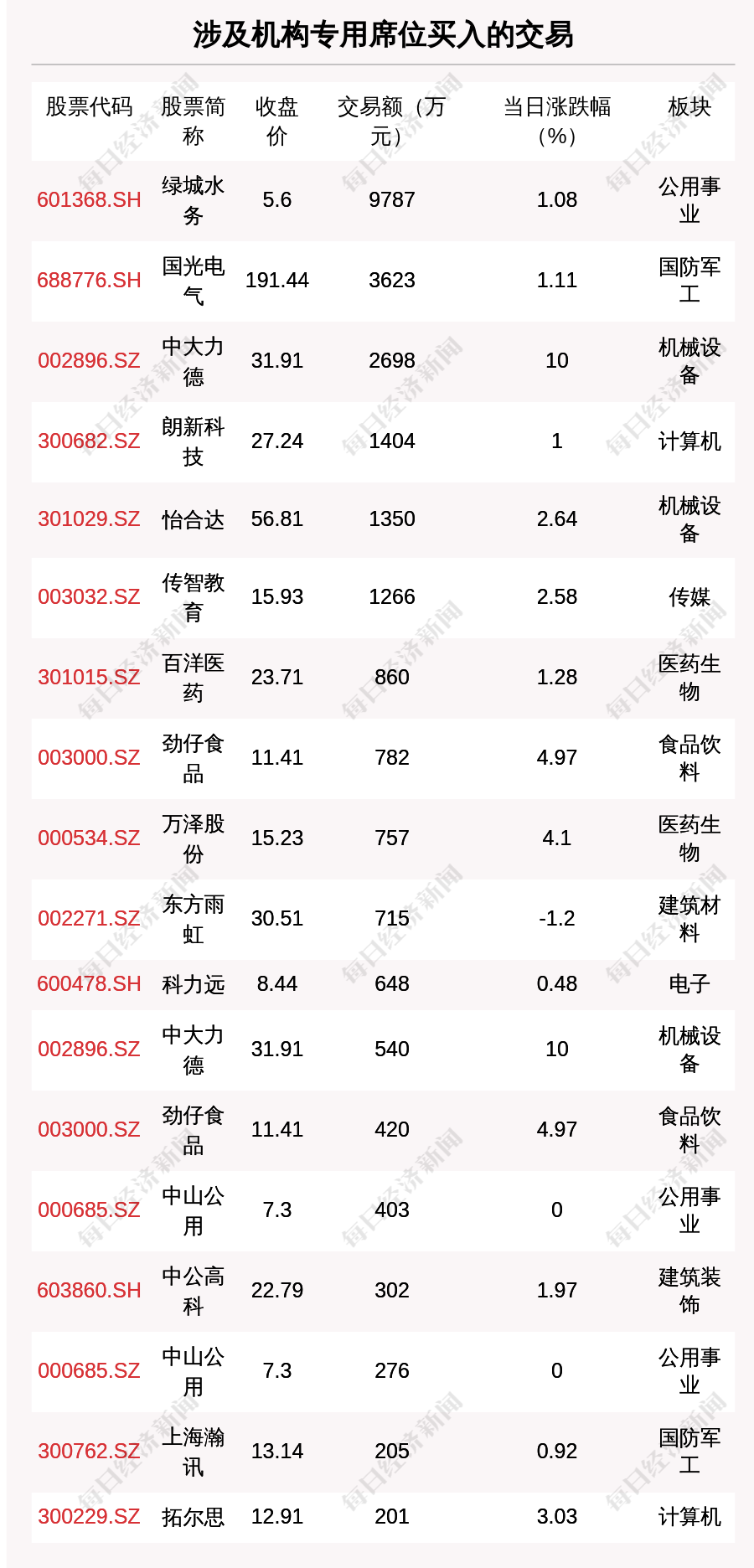

On September 2nd, a total of 32 stocks were on the list.

In the Dragon and Tiger List, there are 17 stocks involving special seats in the institution. The top three of the net purchase are Jinlu Electronics, Poly United, and Wufang Optoelectronics, which are 43.719 million yuan, 27.631 million yuan, and 250.561 million yuan, respectively.

Jianlong Weina (688357.SH) said on the investor interactive platform on September 2 that the company's special molecular sieve in the field of air separation includes lithium, calcium -based, and sodium -based molecular sieves. The company's molecular screening products use a single discussion strategy, and make reasonable adjustments in combination with production costs and market changes.

Jin Tingling (300091.SZ) stated on the investor interactive platform on September 2 that 1. The company and the Nuclear Research Institute and the Nuclear Energy Research Institute are jointly developing a new product related to the super -critical carbon dioxide and nuclear energy -related products. 2. The company has conducted some research on thermal systems and pneumatic performance in the development of supercritical carbon dioxide swelling machines. The engineering design has not been officially launched. 3. In the development of nuclear power products, the company mainly undertakes the related business of steam turbine equipment. The first set of nuclear power generation systems developed by jointly developed the first set was completed; the company's related equipment was recognized by the joint development unit.

Lihexing (301013.SZ) said on the investor interactive platform on September 2 that MLCC has achieved small batches of production and delivered products to customers at the same time, but there is still uncertainty in the development of new businesses. Subsequent applications still have greater uncertainty.

International Medicine (000516.SZ) said on the investor interactive platform on September 2 that the company is building a construction area of 425,000 square meters and 3,600 beds in Xi'an International Medical Rehabilitation Hospital. Children's hospitals, obstetrics and gynecology hospitals, elderly medical hospitals, traditional Chinese medicine hospitals, six major branches, and center of trauma and critical condition. It plans to set up medical -grade confinement clubs. After completion, it will greatly meet the needs of patients and effectively supplement the lack of service supply in the market.

Rongbai Technology (688005.SH) said on the investor interactive platform on September 2 that the company's manganese -phosphate iron lithium products have been shipped stably to some two -wheeled heads, and the production capacity and shipments are the first echelon in China. At the same time, the company is actively cooperating with some four -wheeled header enterprises to develop new models and leads the advanced progress. The company expects manganese iron lithium and ternary blending products to complete mass production certification by the end of this year, pure products will complete mass production certification in the first quarter of next year, and in 2023, it is realized in the batches of some models.

Super map software (300036.SZ) said on the investor interactive platform on September 2 that the company has been exploring the combination of Big Dipper. On the one hand, the GIS platform software can manage a large amount of location data generated by Beidou and provide relevant space analysis and map display capabilities; on the other hand, it is also exploring related Beidou application projects. At present, some corresponding results have been achieved, but the business accounts for relatively small business.

Youzu Network (002174.SZ) said on the investor interactive platform on September 2 that "Metal Duel" is a product released by the company's agency overseas. In February 2022, the company launched the company's shareholding plan, with a total repurchase funds of 20 to 300 million yuan. As of the end of August 2022, a total of 136,99900 shares had been repurchased, with the repurchase amount of about 160 million yuan.

Ruifeng High Materials (300243.SZ) said on the investor interactive platform on September 2 that the company's annual output of 60,000 tons of PBAT project is currently preparing for trial production related work. As an emerging industry in China, degradable materials are currently in the early stages of development. It is currently being restrained by raw material prices and incomplete industrial supporting systems. The market promotion of degradable materials is facing certain pressure.

Jiang Bolong (301308.SZ) said on the investor interactive platform on September 2 that the Requir Sa M2 time machine products have network storage functions. Users can access and access photos, videos and other related personal data through the Internet. The specific product functions are no longer unfolding here.

Zhongfu Shenying (688295.SH) said on the investor interactive platform on September 2 that the company's current T800 -level high -performance carbon fiber has been pre -approval by the COSCO PCD. Require. In the future, the company will continue to advance its cooperation with COMAC and further expand the layout of downstream aerospace applications.

Nanda Optoelectronics (300346.SZ) said on the investor interactive platform on September 2 that the company's ARF Optical Platform has a variety of products to verify in many major customers. Two customers who have passed the verification have a number of ARF products. Further verification. The company will increase market expansion and strive for early sales to achieve scale sales. Liad (300296.SZ) said on the investor interactive platform on September 2 that 1. NPQD® R1 Micro LED chip jointly developed by Liade and SAPHLUX is used The cost -effective products really let LEDs show that they enter the civilian and home market: 2. The Apple industry chain has not yet made progress. 3. Recently, the company has received 10 movie screen orders and plans to complete the delivery within this year.

Kangqiang Electronics (002119.SZ) said on the investor interactive platform on September 2 that the company's production of semiconductor packaging materials and bonding filaments belong to the material industry in the upper reaches of the semiconductor industry chain. The company's products are widely used in microelectronics and semiconductor packaging. The downstream packaging products are used in many fields such as aerospace, communications, automotive electronics, green lighting, IT, home appliances, and power devices of large devices. The industrial chain is very close. In addition to the recognition of directly customers, it is also important for manufacturers such as consumer electronics, automotive electronics you mentioned.

Rongbai Technology (688005.SH) said on the investor interactive platform on September 2 that the company's new production capacity construction this year was promoted as planned, and production capacity was expected to reach 250,000 tons by 2022. Among them, the production line of 05,000 tons/annual production line in Zhongzhou, South Korea has been completed, and the 1-2 period of 15,000 tons/annual production line has been completed in the near future. With the production and new products of the South Korean and Guizhou plants, the company's customer structure will be gradually optimized. In the second half of this year, the company has received orders from 100 tons of overseas customers.

BYD (SZ 002594, closing price: 282 yuan) issued an announcement on the evening of September 2 that BYD's total car sales in August 2022 were about 175,000 units, an increase of 155.23%year -on -year; this year cumulative sales of about 984,000 units, an increase of 164.03%year -on -year increased by 164.03% Essence From January to June 2022, BYD's operating income composed of: 72.55%of the transportation equipment manufacturing industry, 27.27%of daily electronic devices manufacturing, and 0.18%of other proportion.

Langxin Technology (SZ 300682, closing price: 27.24 yuan) issued an announcement on the evening of September 2 that recently, the company received the "Notice on the Progress of Shares' Reduction" issued by Yue Qi. As of September 2, 2022, Yue Qi reduced the company's shares of 11.454 million shares through the large transaction method, accounting for 1.1%of the company's total share capital (the number of shares in the company's repurchase of special securities accounts was about 1.039 billion shares).

Huarui (SZ 300626, closing price: 9.08 yuan) issued an announcement on the evening of September 2 that about 11.77 million shares holding Huarui Electric Co., Ltd. (6.54%of the company's total share capital) Shanghai Lian Chuangyong Yi Venture Investment Center (limited partnership) intends to reduce the number of holdings by centralized bidding or transaction methods of not more than 5.4 million shares (accounting for 3%of the company's total share capital).

The New Asian Process (SZ 002388, closing price: 6.17 yuan) issued an announcement on the evening of September 2 that the company received a notice from the company's controlling shareholder Xinlida Group on September 1, 2022 to learn that Xinlida Group in September 2022, 2022 On the 1st, the "Share Transfer Agreement" was signed with Xiangcai New Materials. Xinlida Group intends to transfer 39.41 million shares (7.76%of the company's total share capital) at a price of about 5.27 yuan/share. The method is transferred to the new material of Hunan material.

Hainan Haiyao (SZ 000566, closing price: 4.35 yuan) issued an announcement on the evening of September 2 that the company intends to publicize the transfer of 43%of Shanghai Lisheng's 43%equity. Evaluation Group Co., Ltd. is determined on the basis of 554 million yuan on the evaluation value of the entire equity of Shanghai Lisente Company on March 31, 2022 as the basis. For 100 million yuan, the public listing price is not less than about 238 million yuan. The final trading opponent and transaction price will be generated and determined in accordance with the relevant rules of the Beijing Property Exchange.

Xinghui Entertainment (SZ 300043, closing price: 3.21 yuan) issued an announcement on the evening of September 2 that the company's shareholder Chen Dongqiong reduced from July 26, 2022 to September 2, 2022, the company's shares of the company's shares were 24.88 million shares, and the proportion of holdings was reduced. It is 1.9997%. From January to June 2022, Xinghui Entertainment's operating income composed of 41.56%of sports business, 30.77%of the game and advertising business, and 21.72%of infant supplies and other toys.

Xinying Optoelectronics (SZ 301051, closing price: 58.39 yuan) issued an announcement on the evening of September 2 that the shareholder of Ningbo Meishan Bonded Port District, Ningbo Meishan Bonded Port District, holding Shenzhen Xinyu Optoelectronics Technology Co., Ltd. Management Center (Limited Partnership) and shareholders who hold about 1.12 million shares of the company Ningbo Jundu Shangzhangzhangzhang's equity investment partnership (limited partnership) plans to concentrate on concentrated bidding within six months after the disclosure of this announcement. Within six months of the date of the disclosure of this announcement, the company's shares were reduced in total within six months after the three trading days (6.1%of the company's total share capital). Lanwei Medical (SZ 301060, closing price: 31.26 yuan) issued an announcement on the evening of September 2 that the issuance objects of this issuance were not more than 35, and the issuance of no more than 405 million shares (including about 405 million shares), intended The raising does not exceed about 664 million yuan, and the fundraising funds are used for the following purposes: provincial laboratory construction projects, with a total investment of about 353 million yuan, and intended to invest about 353 million yuan. 100 million yuan, intended to invest about 237 million yuan; supplemented with mobile fund projects, with a total investment of 75 million yuan, and planned to invest 75 million yuan.

Daotong Technology (SH 688208, closing price: 27.35 yuan) issued an announcement on the evening of September 2 that Shenzhen Daotong Technology Co., Ltd. intends to ask Mr. Li Hongjing, Ms. Nong Yingbin, Shenzhen Daotong Information Consulting Enterprise ( Limited partnership), Shenzhen Daoche Wanderer Information Consulting Enterprise (Limited Partnership), Shenzhen Daocongxing Information Consulting Enterprise (Limited Partnership) transferred the company's wholly -owned subsidiary Shenzhen Daotong Intelligent Automobile Co., Ltd. %, 19%, 10%, and 10%of equity have a total of 65%of the equity. The transfer price of this transaction is determined according to the joint negotiation of the two parties. The total is 79.625 million yuan, all of which are paid in cash.

Furong Technology (SH 603327, closing price: 18.92 yuan) issued an announcement on the evening of September 2 that as of the disclosure of this announcement, the Fujian State -owned Enterprise Reform Investment Fund (Limited Partnership) held about 12.95 million shares, based on its own Considering funding needs, it is planned to reduce the holding of the company's shares from about 12.95 million shares from September 8, 2022 to November 30, 2022. Among them The company's total share capital is 1%; the reduction of not more than 10.43 million shares through the major transaction is not exceeding 2%of the company's total share capital.

Ding Sheng New Materials (SH 603876, closing price: 57.62 yuan) issued an announcement on the evening of September 2 that as of the disclosure of this announcement, Jiangsu Coastal Industry Investment Fund (Limited Partnership) holds Jiangsu Dingsheng New Energy Materials Co., Ltd. Unlimited Co., Ltd. The sales conditions were about 12.54 million shares, accounting for about 2.56%of the company's total share capital. All relevant shares are derived from the shares held before the company's first public offering. This part of the shares have been lifted and listed on April 18, 2019. The coastal coastal coast has been disclosed on the day after the announcement of the announcement of 15 trading days, within 6 months of the concentrated bidding reduction of about 9.78 million shares within 6 months, the total reduction ratio does not exceed 2%of the company's total share capital.

Limoshima New Materials (SH 603937, closing price: 11.57 yuan) issued an announcement on the evening of September 2 that the total amount of convertible bonds issued this time did not exceed RMB 300 million (including 300 million yuan); The term of debt is 6 years from the date of issuance; after deducting the issuance fee of the raised funds, the investment of the following projects: an annual output of 86,000 tons of new energy battery collection of new aluminum projects (Phase II) projects. The amount is 300 million yuan.

Guangxin Co., Ltd. (SH 603599, closing price: 27.11 yuan) issued an announcement on the evening of September 2 that the company's shareholders Zhao Qihua, Bai Dongmei, and Wu Jianping's reduction plan were completed, and a total of about 7.75 million shares of the company's shares were reduced, and the shares were reduced. It accounts for 1.2%of the company's total shares. From January to December 2021, the operating income of Guangxin Co., Ltd. is: chemical pesticide manufacturing accounts for 100.0%.

Zhejiang Culture Interconnection (SH 600986, closing price: 5.58 yuan) issued an announcement on the evening of September 2 that as of the disclosure of this announcement, Shandong Keda Group Co., Ltd. held approximately 88.49 million shares of Zhejiang Culture Interconnection Group Co., Ltd. 6.69%of the company's total share capital; Shandong Kodak's unanimous actor Liu Shuangxi held about 560,000 shares in Zhejiang Culture, accounting for 0.04%of the company's total share capital. In order to meet the needs of its own business development, within 6 months after the disclosure date of this announcement, Shandong Keda plans to reduce its holdings by centralized bidding and large transactions. Thousands of shares.

UFIDA Network (SH 600588, closing price: 20.15 yuan) issued an announcement on the evening of September 2 that as of August 31, 2022, the company's cumulative repurchase of about 34.71 million shares, accounting for 1.0108 of the company's current total share capital of 1.0108 %, The highest price purchased is 24.98 yuan/share, the lowest price for purchases is 20.21 yuan/share, and the total amount of the payment is about 803 million yuan.

Sumida (SH 600710, closed price: 6.61 yuan) issued an announcement on the evening of September 2 that it is to optimize the asset structure, further promote the recovery of funds, and effectively integrate resources. The company will transfer the Dongying Shuguang Solar Energy Co., Ltd., Kenli Wanheng New Energy Co., Ltd., Xuzhou Zhongyu Power Generation Co., Ltd., Enfei New Energy (Zhongning) Co., Ltd., Sanmenxia Peng Huixin Energy Co., Ltd., Suqian Dexin Taihe Energy Technology Co., Ltd., Ningwu County Shuojing Energy Technology Co., Ltd., Huaianmei Heng Vocer Power Power Power Power Power Station project company 100%equity, and withdraw the above 8 companies to the company to the company The subsidiary borrowing. Fosun Pharmaceutical (SH 600196, closing price: 40.21 yuan) issued an announcement on the evening of September 2 that as of September 2, 2022, the controlling shareholder Shanghai Fosun High Technology (Group) Co., Ltd. held a total of Shanghai Fosun Pharmaceutical ( Group) Co., Ltd. Co., Ltd. Unlimited sales of about 1.01 billion shares (of which: about 938 million A shares, about 71.53 million H shares), accounting for about 37.82%of the company's total share capital. Fosun High -tech plans to reduce the holding of A shares with a concentrated bidding and the transaction method that does not exceed 3%of the company's total share capital. Based on September 2022, the total share capital of the Japanese company's company, that is, no more than 80,089,656 A shares, the reduction price reduction price reduction price Determined according to market price.

Sanchao New Materials (SZ 300554, closing price: 24.38 yuan) issued an announcement on the evening of September 2 that Nanjing Sanchao New Materials Co., Ltd. held the seventh meeting of the third board of directors on August 23, 2022, and the third board of directors, the third of the third board The seventh meeting of the Supervisory Committee reviewed and approved the "Proposal on the" Three Super Convertibles "in advance". From August 1st, 2022 to August 23, 2022, the company's shares have closed for 15 trading days. The price is not less than 130%(that is, 22.27 yuan/share), which has triggered the conditional redemption clauses provided in the "Nanjing Sanchao New Materials Co., Ltd. GEM Publicly issued convertible company bonds". Redemption registration date: September 14, 2022.

① As of 19:42 at Beijing time, Dow Futures fell 0.16%, the S & P 500 Index Futures fell 0.20%, and the NASA futures fell 0.39%.

② Argentina reports the third case of unknown causes of pneumonia. (CCTV News)

③ SoftBank Group (9984, the stock price of 5493 yen, a market value of 9.46 trillion yen) is reported to lay off at least 20 % of the head of the vision fund department of losses.

④ Qualcomm (QCOM, a stock price of US $ 129.92, a market value of 145.9 billion US dollars) and Meta (META, 165.36 US dollars, and a market value of US $ 444.413 billion) will sign an agreement to produce custom chipset for its QUEST VR equipment.

⑤ SEA (SE, the stock price of $ 61.32, a market value of US $ 27.918 billion) in Southeast Asia) will stop its game live platform after reporting a quarterly loss of nearly $ 1 billion, and it is expected to close the blockchain and other projects and reduce the relevant related projects. post.

⑥ Kaitou macro estimates that the British economy may fall into recession, and next year, the British pound and the US dollar may be close to parity.

团 Credit Suisse Group (CS, $ 5, a market value of $ 1.31 billion) is reported to consider 4,000 layoffs, a large part of them will be in Zurich.

⑧ Novawacus (NVAX, a stock price of US $ 31.95 and a market value of US $ 2.499 billion) said that clinical data shows that vaccine enhanced agents have a role in Omikon poison. It is expected that after the review of the US Food and Drug Administration (FDA), the company's new crown vaccine will be approved by people over 18 years of age as a reinforcement needle.

U Starbucks (SBUX, stock price of $ 85.4, a market value of 97.988 billion US dollars) appointed Laxman Narasimhan as the next CEO, and replaced HOWARD SCHULTZ, who is currently the temporary CEO.

20 At 20:30 on September 2, Beijing time, follow the US non -agricultural employment report in August.

Daily Economic News

- END -

Zheng's eyes look: the CRO section is severely frustrated on the broader market.

On the first trading day (Tuesday) after the Mid -Autumn Festival holiday this year, A shares rose slightly and the transactions narrowed slightly. As of the close, the Shanghai Composite Index rose 0

Emancipating the mind is really hard -working | The seven leading industries in our city have shown

Implement the chain length system of the industrial chain to build a new highland ...