In the first half of the year, the profitability of public funds was shrinking!Guangfa Fund's insurance fell out of the "billion club", and the net profit of revenue was doubled

Author:Huaxia Times Time:2022.09.02

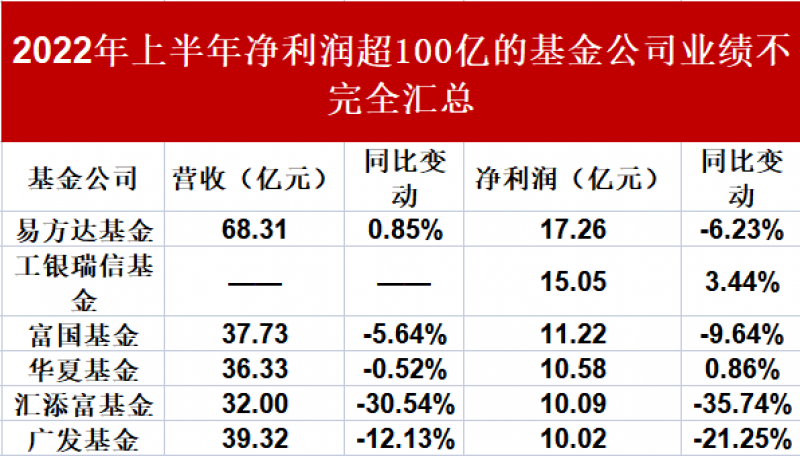

Data source: half -annual report of listed companies; deadline: August 30, 2022

China Times (Chinese Times.net.cn) Reporter Ge Aifeng, a reporter Qi Meng Shenzhen report

On August 30, with the successive disclosure of listed companies in the semi -annual report of 2022, the performance of the fund companies involved in shares emerged. According to incomplete statistics from the reporter of the Huaxia Times, the performance of 56 fund companies has been released.

According to the disclosure data as of August 30, in the first half of 2022, six fund companies had net profit exceeding 1 billion yuan, namely Yifangda, ICBC Credit Suisse, Wells Country, Huaxia, Huitianfu, and Guangfa Fund. There are two in the Bay Area, which are E Fund Fund and Guangfa Fund. Yifangda Fund reappeared again at a net profit of 1.726 billion yuan, while the other place in the Guangdong -Hong Kong -Macao Greater Bay Area in the first half of the year of the Guangdong -Hong Kong -Macao Greater Bay Area was 1.02 billion yuan, which fell out of the "billion club", a year -on -year decrease of 21.25%. Half -year operating income was 3.932 billion yuan, a year -on -year decrease of 12.13%.

In response, the reporter of the Huaxia Times sent an interview letter to the Guangfa Fund, but as of the time of press time, the reporter did not receive a reply.

In fact, not only the Guangfa Fund, from the current disclosed data, the net profit of 30 funds has declined, and 26 net profit has increased.

Regarding the decline in the net profit growth of many head funds companies, Shen Meng, chief strategist of Guangke Consulting, told the reporter of the Huaxia Times that this is mostly related to the weakness of the majority of A shares in the first half of the year. In addition to fixed income such as management fees, it is mainly related to the performance of the fund. Although A shares in the first half of the year, although individual stocks or individual sectors have grown well, most sectors are still weak and put pressure on the revenue and net profit of public funds. "

At the same time, Zhou Di, a national science and technology expert and senior engineering engineer of the Ministry of Science and Technology, pointed out to the reporter of the Huaxia Times that "the downturn of the real economy will inevitably bring a reduction in the income of financial investment, and the increased difficulty of fundraising will also cause a direct impact. At the same time, the epidemic situation will be The impact on many industries has become increasingly prominent. In addition, this year the market has experienced a sharp decline and shock in the first quarter, and the overall market direction is not clear. With the large decline in equity funds, some funds have been redeemed by investors by investors. Cause the scale of the fund. "

In the first half of the year, the net profit of the revenue of Guangfa Fund

According to the data currently disclosed, the net profit of 6 fund companies in the first half of 2022 exceeded 1 billion yuan, and there were two in the Greater Bay Area.

Among them, the net profit of Guangfa Fund in the first half of the year was 1.02 billion yuan, and the danger fell out of the "billion club", a year -on -year decrease of 21.25%, and the net profit of the E Fund Fund also decreased by 6.23%year -on -year, but it still ranked first at the net profit of 1.726 billion yuan; In terms of operating income, the operating income of Guangfa Fund in the first half of the year was 3.932 billion yuan, a year -on -year decrease of 12.13%, and both revenue and net profit fell. Essence

In this regard, some people in the industry have pointed out that the decline in the net profit of the Guangfa Fund is mostly related to the weakness of the majority of A shares in the first half of the year. It is reported that in the first half of 2022, the A -share market fluctuated, and the three major indexes found on the same day on April 27, and then reached a rebound. The Shanghai Stock Exchange Index, Shenzhen Stock Exchange Index, GEM Index, and Science and Technology 50 Index fell 6.63%, 13.20%, 15.41%, and 20.92%in the first half of the year.

It is worth noting that, in terms of revenue, although the Guangfa Fund fell 12.13%year -on -year in the first half of the year, in the data disclosed at present, it is still second in revenue. However, the net profit level only ranks sixth in the industry. In this regard, Shen Meng said: "High revenue and low profits indicate that its cost is higher than friends."

In terms of fund products, according to the latest semi-annual report (January 1, 2022-June 30, 2022) disclosed by the 487 fund products (separated) disclosed by Guangfa Fund, it shows that the net value of 164 products increase Rate is positive. The latest semi-annual report (January 1, 2022-June 30, 2022), the latest semi-annual report (January 1st-2022, 2022), the net value growth rate of its 425 fund products (separate calculations) of its 425 fund products.

At the same time, according to the data of public fund fundraising in the first half of 2022, all 8,420 funds in the first half of 2022 have 2 GF Fund fund products, which are Guangfa Dow Jones American Petroleum A RMB and CSI. There are 4 Yi Fangda Fund, which are Yi Fangda Crude Oil A RMB, E Fund Pioneer Growth A, Yifangda Supply Reform, and Yifangdari Heng.

At the same time, according to the statistics of the 2022 Middle -reporting Sunshine Power Fund's shareholding data from the reporter from the reporter of the reporter, 44 products at the Guangfa Fund were suspected of taking the Zhuang Sunshine Power for 83.999 million shares, and the value of the circulating stock market was 8.2417 million yuan. Five products enter the top ten shareholders of the Sunshine Power, and have suspected of being highly controlled through the advantages of funds, forming a highly controlled disk, which attracts the collective discussion of Kimin.

In this regard, Shen Meng said: "If the regulatory agency is determined to manipulate individual stock prices, then it is illegal and violations. It will not only be punished by civil penalties, but also criminal investigations."

In terms of fund scale, the Yifangda Fund and the Guangfa Fund, located in the Greater Bay Area, have achieved outstanding results. In the first half of 2022, the public fund -raising of the public fund managed by the Yifangda Fund totaled 1.62 trillion yuan; the total scale of the currency market fund was 1.14 trillion yuan, ranking first in the industry. The size of the public fund managed by the Guangfa Fund was 13100 billion yuan, an increase of 15.97%from the end of 2021; the total scale of the currency market fund was 714.238 billion yuan, and the industry ranked third. The industry is expected to recover in the second half of the year

In general, the development trend of public fund funds in the first half of this year has continued in recent years. The scale of public funds rose to 26.7 trillion yuan, an increase of 6.7%month -on -month. In the first half of the year, due to the fluctuations in the market of equity, the total cost of public funds was slightly reduced by 3.834 billion to 121.3 billion yuan in the middle of last year; the public offer funds spent a total of 15.261 billion yuan from the custodian custody, an increase of 11.79%compared to the same period last year. In terms of the structure of the holder, the market value of the individual holding public funds exceeds 13.79 trillion yuan, accounting for 51.87%. %And 72.46%. In terms of asset allocation, hard technology represented by high -end manufacturing has gradually become the core assets of public funds.

Regarding the outlook of the public fund industry in the second half of the year, CITIC Securities released the "Inventory and Outlook of the Public Fund Industry in 2022" in 2022, pointed out that the industry's ecology is continuously enriched and the development of the industry is still in a good period of opportunity.

Specifically, the industry ecology continued to be rich in the first half of the year, and banks still occupy the main advantages. The size of the securities firms has a bright growth rate. In the second quarter of the channel, the stock of the stock and hybrid funds had a total scale of 1239.8 billion yuan, an increase of 9.1%month -on -month, and the market share was 19.6%. Product innovation was in full swing. In the first half of 2022, the interbank deposit index fund was sought after Category and theme ETF; regulatory self -discipline and care industry ecology. On June 10, 2022, the China Fund Industry Association issued the "Guidelines for the Performance Assessment and Salary Management of Fund Management Company"; the interconnection of the Mainland and the Hong Kong market was newly included in ETF varieties.

The industry development in the second half of the year is still in a good period of opportunity. CITIC Securities focuses on supporting factor that is conducive to the development of the fund industry, including the growth of fund scale, changes in product structure, continuous growth of residential wealth, and the development potential of my country's public fund in the field of capital management.

In addition, CITIC Securities also mentioned that in the context of macroeconomic transformation, public funds as large capital capacity varieties can bear the heavy responsibility of investment and financing, promote reasonable pricing of assets and optimize the allocation of economy resources; Asset risk income characteristics. Under the advancement of the registration system, the supply of stocks is more market-oriented, similar to the large fluctuations in 2007-2008 and 2015, it is even more difficult to appear; residents' investment channels are limited. The investment attributes of real estate are difficult to recover. Among the investable options, the relative status of public funds has increased.

Editor -in -chief: Xu Yunqian Editor: Gong Peijia

- END -

The export scale exceeded 100 billion yuan for the first time.

Zheng Kangxi, a reporter from Southern Finance and Economics, reported that since this year, the risk challenges facing foreign trade in my country have increased significantly, and new formats such a

Vegetable cold storage "summer avoidance", meat cold chain "lock" ... high temperature every day, Songjiang "vegetable basket" fresh summer

High temperatures have brought a lot of challenges to the transportation and prese...