Whenever the trading will be known (afternoon version) 丨 The two cities were sold for 746.6 billion yuan, and the land navigation and communications stocks were strong; the net outflow of funds from the north

Author:Daily Economic News Time:2022.09.02

At 15:00 on September 2nd, Beijing time, the Shanghai Stock Exchange Index closed up 1.5 points, an increase of 0.05%, and closed at 3186.48 points, with a turnover of 313.338 billion yuan. At the point, the turnover was 433.295 billion yuan; the GEM finger closed down 0.83 points, a decrease of 0.03%, and the close of 2533.02 points, with a turnover of 143.42 billion yuan; The turnover was 184.468 billion yuan.

Solid stocks rose more, and more than 3,500 stocks in the two cities rose. The turnover of Shanghai and Shenzhen today was 746.6 billion, a shrinkage of 48.2 billion compared with the previous trading day, and the transaction amount continued to reach a new low in the near future. The net outflow of funds from the north was 3.783 billion yuan on the day, of which 2.761 billion yuan was sold at the Shanghai Stock Connect, and the net sales of Shenzhen Stock Connect sold 1.022 billion yuan

On the market, the Beidou navigation sector broke out, and the stocks in the sector set off a tide of daily rising. The rise in navigation stocks has driven communication, military, chips and other related sectors to strengthen the collective sector. In addition, the low -themed stocks have performed active, and the east -counting and western calculations, games, Yuan universe, media and other sectors have strengthened. The track stocks rebounded in the morning, but gradually shook in the afternoon, and the rebound was weak. In terms of decline, consumer sectors such as food have been adjusted.

The top five industries were 4.48%of communication equipment, 4.27%of communication services, 3.45%of ship manufacturing, 3.45%of computer equipment, and 3.24%of optical optical electronics.

The top five industries are wind power equipment -1.19%, brewing industry -1.07%, coal industry -0.92%, food and beverage -0.68%, and energy metal -0.57%.

Southwest Securities released a research report on September 02 that Lan Dai Technology (002765.SZ, the latest price: 9.37 yuan) was given to buy rating rating. The reasons for rating mainly include: 1) the rapid growth of power transmission parts, and the development of new energy vehicle business is expected; 2) touch display business is dragged down by the industry, and the vehicle is displayed as a new growth point; Maintain stable. Risk reminder: The price of raw materials may fluctuate sharply, market expansion may not be expected, production capacity is expanded or less than expected.

AI Comment: Lan Dai Technology has received a focus on research reports in the past month and bought 1.

Tianfeng Securities released a research report on September 02 that the Bank of Communications (601328.SH, the latest price: 4.58 yuan) increased its holding rating at a target price of 5.87 yuan. The reasons for the rating mainly include: 1) the scale of the scale drives the expansion of revenue, and the efforts of the provision of allocation; 2) the expansion of the scale of credit, and the net interest rate difference has decreased slightly; Risk tips: Weak credit, fluctuations in credit risk, and decline in the economy exceeding expectations.

AI Comment: In the past month, Bank of Communications has received 3 attention reports from brokerage firms, an increase of 1 holdings, with an average target price of 5.66 yuan, which is 1.08 yuan higher than the latest price of 4.58 yuan, and the average target price increases by 23.47%.

Tianfeng Securities issued a research report on September 02 that the pilot intelligence (300450.SZ, the latest price: 51.74 yuan) was given to buy rating. The reasons for the rating mainly include: 1) Demolition of the company's business, the rapid development of the echelons of various products; 2) steadily promoting lean management, excellent cost management and control performance; 3) good policy+industry high prosperity+technology leading, driving the company's performance at high speed; 4) The competitive advantage of platform companies is prominent. Risk reminder: Macroeconomic cycle fluctuation risks, management risks caused by scale expansion, risks of mergers and acquisitions integration, new product R & D risks, and goodwill risks.

AI Comment: In the past month, I have obtained 13 brokerage research reports in the first month of the guide intelligence. Buy 10 and increase the holdings of 2. The average target price is 69.12 yuan. Compared with the latest price of 51.74 yuan, it is 17.38 yuan. %.

Pacific released a research report on September 02 that it was given a rating rating for Sany Heavy Industry (600031.SH, the latest price: 15.61 yuan). The reasons for the rating mainly include: 1) Affected by the continued influence of the industry's downward cycle+new crowns, the revenue and performance in the first half of the year have fallen sharply; Leading the development of the industry; 4) the internationalization strategy has achieved remarkable results, and sales have achieved high -speed growth. Risk reminder: The domestic construction machinery industry has declined, overseas export growth is less than expected.

AI Comment: Sany Heavy Industry has received 4 brokerage research reports in the past month. It bought 3, with an average target price of 18 yuan. Compared with the latest price of 15.61 yuan, it is 2.39 yuan high, and the average target price increases by 15.31%.

Central Plains Securities released a research report on September 02 that Kunlun Wanwei (300418.SZ, the latest price: 14.7 yuan) increased its holdings. The reason for the rating mainly includes: 1) Opera platform focuses on the high ARPU value market, and the number of users and performance has grown strongly; 2) Starmaker cost control is valid, and AI empowerment content creation; Risk reminder: The global economic recession has led to decline in the willingness of users to pay; market competition intensifies; user preference transfer; exchange rate risk.

AI Comment: Kunlun Wanwei has received a focus on research reports in the past month, adding 1 to increase holdings. Chuangyuan Technology (000551.SZ) said on the investor interactive platform on September 2 that Su Jingan, a subsidiary of the company's wholly -owned subsidiary Jiangsu Su Jing, is mainly engaged in research and development, production, and sales Hot pumps and other products. Air energy heat pump products have not yet entered European foreign markets.

Yagol (600177.SH) said on the investor interactive platform on September 2 that the company further adjusted its sixth five -year plan and decided to withdraw from the health care industry.

Kaig Jing (301338.SZ) said on the investor interactive platform on September 2 that the company's printing equipment can be applied to the field of photovoltaic production.

Jiahe Intelligent (300793.SZ) said on the investor interactive platform on September 2 that the company has no energy storage business at present and has participated in Jiangxi Ganfeng Lithium Electric Technology Co., Ltd. through investment. Further layout through talent reserves, industrial cooperation or investment.

Rongtai Health (603579.SH) said on the investor interactive platform on September 2 that (1) Xiaomi is an important partner of the company, and the company's cooperation with Xiaomi is subject to the company's announcement. (2) The company's exports are mainly settled in US dollars, and the depreciation of the renminbi has a certain positive impact on the company's exports.

Joint Chemistry (301209.SZ) said on the investor interactive platform on September 2 that the company's main business is the R & D, production and sales of puppet organic pigments, squeezing the base ink, and the products are mainly used in ink.

Qingdao Port (601298.SH) said on the investor interactive platform on September 2 that the company's controlling shareholder Qingdao Port Group launched a turnover business, and the borrowed Qingdao Port stocks will be automatically returned after the borrowing expires. Our company strictly abides by regulatory rules and fulfills the obligation of information disclosure.

On September 2nd, Sanyo Energy (688349.S) stated on the investor interactive platform on September 2 that my country's wind power investment operators are mainly large power generation groups or large power construction groups, such as State Power Investment, China Electricity Construction, National Energy Group, Huaneng, Huaneng, Huaneng, Huaneng Wait, the customer concentration of the wind power whole machine company is high, but the customer concentration is not directly related to the gross profit level. In recent years, the gross profit margin of Sanyi Heavy Energy Finoma is higher than the level of the same industry. The main reason is: 1. The company took the lead in research and development to launch an affordable fan to the market, forming a leading advantage; The cost advantage brought by the cooperation management of strategic suppliers; 3. The company's persistence in the business chain operating ideas, including the self -made blades and motors, also improved the level of gross profit margin.

Xingye Mining (000426.SZ) said on the investor interactive platform on September 2 that the company's subsidiary Rongbang Mining Plant was changed on May 1, 2022 (increased from 300,000 tons/year to 450,000 tons of year /Year), the production transfer was completed on June 16, 2022, and after the technical reform, Rongbang's mining capacity was increased by 50%. The second phase of the Jinda Mining Zone is the central construction project of 900m to 1200M, the scope includes: 1460M main Pacific and 1460M vertical wells, vertical wells, clustering wells, 1200M, 1150M, 1100M medium transport lane and 1100M mid -range parking lot, and cutting and cutting Engineering, mineral projects, ventilation engineering, pimple projects, and corresponding projects such as power supply, water supply, and wind supply. As of now, the relevant projects have been under construction to be accepted by the expert group, and it is expected to be put into production in mid -September. The annual mining capacity can reach 300,000 tons.

Yueyang Forest Paper (600963.SH) said on the investor interactive platform on September 2 that the company has no green loan involving sewage treatment, and the impact of government environmental subsidy funds received in the past five years has less impact on net profit.

Daily Economic News

- END -

Caifeng | Golden Fruit is full of splasm, and the smelting of the Central Plains adds scenery

Whenever the summer solstice comes, the golden golden fruit has been covered with ...

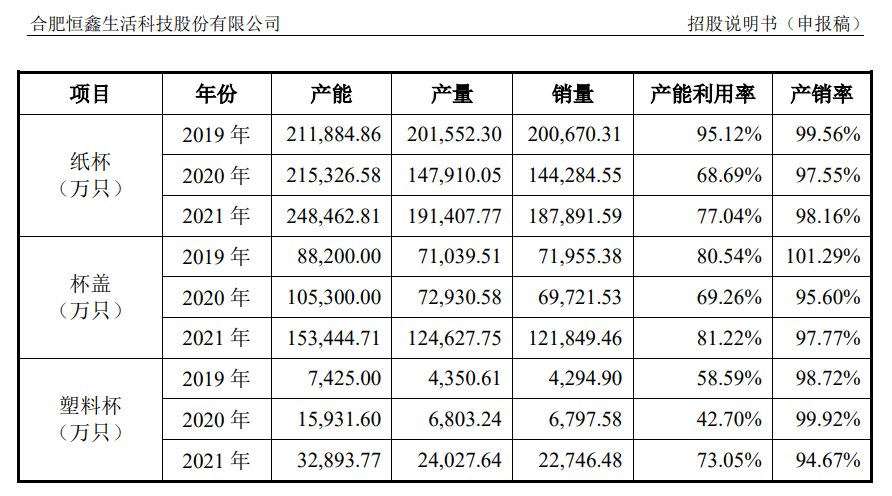

The couple sells cups to Xicha Rui Xing, now I want the IPO

Huancha has not been listed yet, but its supplier has to be an IPO.The investment ...