A -share listed securities firms will add new members in the first half of the year, over 80 % of the net profit will decline year -on -year

Author:Cover news Time:2022.09.02

Cover Journalist Xiong Ying

The A -share listing brokerage team will add new members! On the evening of September 1, the CSRC released the 99th meeting of the 1899th meeting of the 1822 of the Eighth Development and review Committee showing that the first securities IPO meeting was founded.

Established in 2000, it is a securities company controlled by the Beijing State -owned Assets Supervision and Administration Commission. The main business segments include asset management business, investment business, investment banking business and retail and wealth management business.

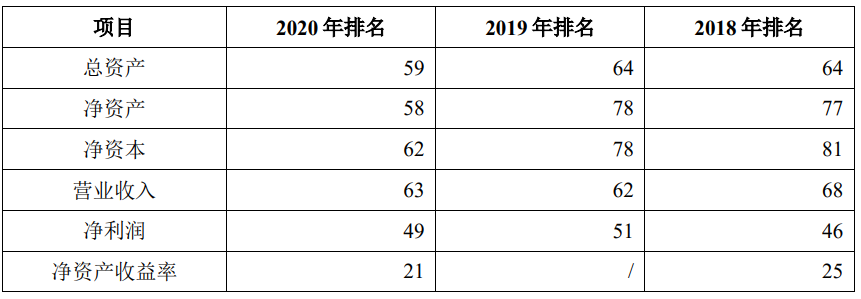

According to statistics from the Securities Industry Association, from 2018 to 2020, six index industries including the first of the first stock assets, net assets, net capital, operating income, net profit, and net asset yields are not outstanding. Good net asset yields are ranked 21st.

The ranking of the first securities business index industry ranking

In this regard, the first securities also stated in the prospectus that compared with large securities companies, the company has insufficient capital, brand awareness, diversified product and service capabilities, customer foundation, and branches. The rate needs to be improved.

In fact, from the disclosure of the semi -annual report of the final disclosure, the overall performance of listed brokers is not ideal.

According to statistics from reporters, according to the Shenwan industry, only 6 of the 48 listed brokers have achieved net profit growth year -on -year in the first half of the year, and the rest are negative growth.

In the first half of the year, the net profit of the six brokers rose up

Among them, the largest increase was Oriental Wealth. During the reporting period, net profit achieved a net profit of 4.444 billion yuan, a year -on -year increase of 19.23%. Although it is already the best performance, compared to the past three years, the growth rate has reached a new low. According to the financial report, Oriental Fortune's net profit in the first half of 2019-2021 was 55.88%, 107.69%, and 106.08%, respectively.

Jinlong, whose net profit declined, lost 223 million yuan during the reporting period, a decrease of 16341.55%over the same period last year.

The financial report shows that Jinlong Co., Ltd. mainly relies on Zhongshan Securities and Dongguan Securities to carry out securities business, holding 67.78%equity of Zhongshan Securities and 40%of Dongguan Securities. Earlier, the securities regulatory authorities have adopted regulatory measures to restrict some business activities on Zhongshan Securities. Due to this, the business income of Zhongshan Securities Investment Bank during the reporting period has declined to decline. In addition, affected by the macroeconomic and industry policies, the valuation of Zhongshan Securities' positions holding real estate bonds

Falling, changes in fair value suffered losses.

In the first half of the year, 10 brokerage companies exceeded 10 billion yuan

From the perspective of revenue data, 38 of the 48 listed brokers have revenue decline in the first half of the year. The largest decline is also Jinlong shares. The revenue during the reporting period fell by 101.96%year -on -year. 20.28%.

As of the end of June, a total of 10 brokerage revenue exceeded 10 billion yuan, and CITIC Securities topped the list for 34.885 billion yuan in revenue. Guotai Junan and Galaxy China followed closely, and during the reporting period, revenue achieved revenue of 19.554 billion yuan and 18.21 billion yuan, respectively.

On the whole, the poor performance of listed securities firms is mainly dragged down by self -employed business. In addition, the year -on -year decrease in underwriting revenue of investment banks is another major factors. A few days ago, the data released by the China Securities Industry Association also showed that in the main business income of securities companies in the first half of the year, securities investment revenue (including changes in fair value) declined significantly, a decrease of 38.41%.

Shanxi Securities' non -silver research team stated that with the semi -annual reports, the performance of listed brokers accelerated accelerated. At the same time, due to the differences in professional capabilities in investment banks, investment and asset management business, the performance was differentiated. Recently, the secondary market for the securities sector has performed active, and securities companies have benefited from the improvement of market recovery under the stability of the stable growth policy, which has improved valuation.

- END -

80!Changsha A -share listed enterprise is the first place in the provincial capital of the central part

Since the beginning of this year, financial institutions have given full play to t...

Clear!This type of item cannot be sold for this kind of food cannot be sold

Gold foil coffee, gold coffee, and gold foil life -saving pot. These local tyrant ...