Bad!Bitcoin fell below $ 18,000, exceeding 120,000 people burst out, and Musk was uncomfortable.

Author:Beijing Commercial Daily Time:2022.06.19

Bitcoin, the largest market value of Bitcoin, still has a blood flow after losing 20,000 US dollars!

On June 19, Bitcoin lost $ 18,000 twice within the day and a minimum of $ 17,600, which was the lowest price of Bitcoin since December 2020.

From the perspective of a single -day transaction price, Bitcoin has fallen for 11 consecutive days, setting its longest continuous decline since its birth in 2009. The timeline was stretched again. In early June, Bitcoin began at $ 32,000. Among the 19 trading, Bitcoin had risen in only 5 trading days.

Other cryptocurrencies are also fierce. Ethereum fell below $ 900. The well -known cottage currency such as dog currency and Shiba Inu coins also vomited back to the previous increase, and the trend was weak.

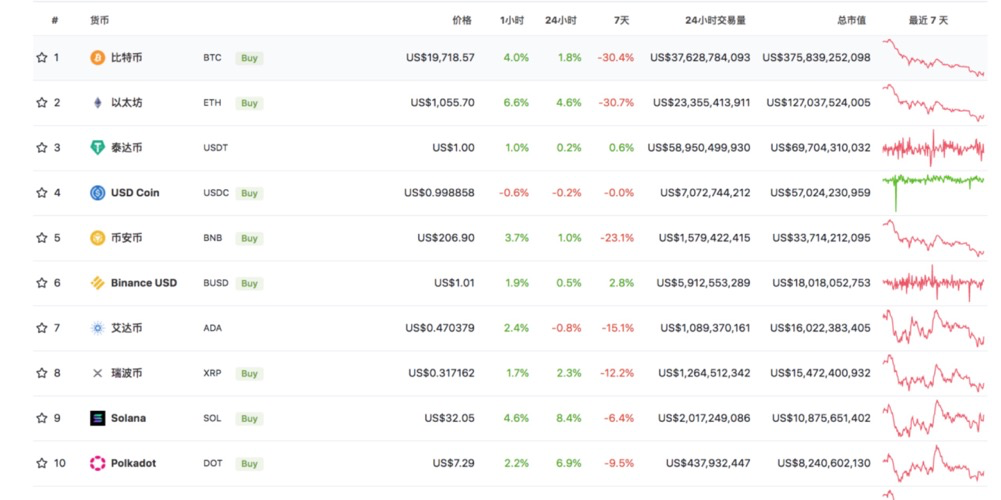

On the afternoon of June 19, after twice below $ 18,000, Bitcoin came out of reversal. According to the global currency price website Coingecko data, as of 18:30 on June 19, Bitcoin reported at $ 19718.57, a 24 -hour increase of 1.8%, and the decline in the past 7 days; 4.6%, a decline of 30.7%in the past 7 days.

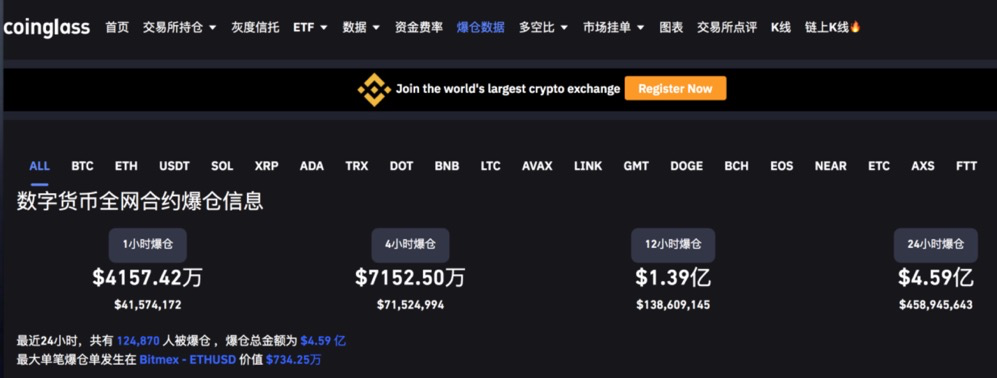

Under the plunge, the currency circle was also intensifying. According to data from the global currency price website Coinglass, as of 8:00 on June 19th, a total of over 124,000 people in the cryptocurrency market on the entire network had been exploded in the past 24 hours. Essence

Chinese richest man's wealth evaporates nearly 90%

Musk also lost money too

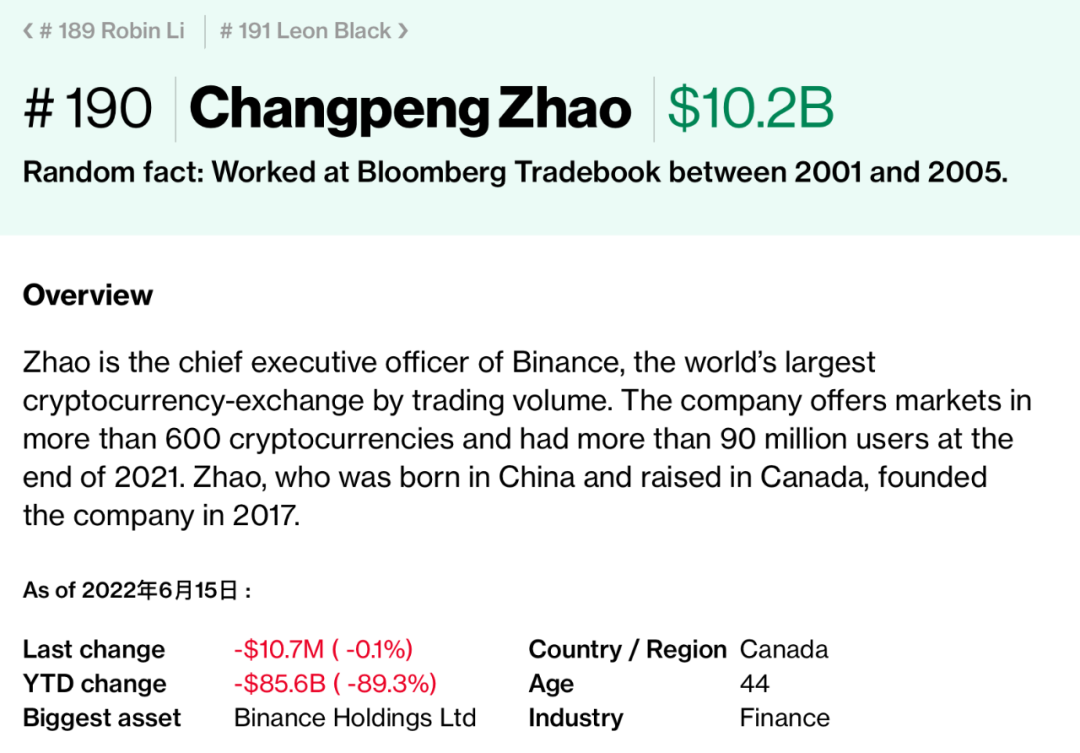

According to the China Fund, the boom of cryptocurrencies has made Zhao Changpeng, Sam Bankman-Fric, Mike Novogratz and other digital asset holders become 100 million yuan Thousands of people. But now their wealth is disappearing at an amazing speed.

According to the Bloomberg billionaire index, Bitcoin's historical highs have been hovering around $ 21,000 from November 9th, and seven billionaires related to cryptocurrencies have lost $ 114 billion in a total of $ 114 billion.

The worst loss on the list is the net at the end of last year with a net worth of nearly 96 billion US dollars (about 610 billion yuan) to surpass the 424.4 billion yuan of the founder of Nongfu Spring. Zhao Changpeng, founder of Biance.

Image source: Observer Net micro -losing video screenshot

Data show that only 10.2 billion US dollars remain in their net worth, and the wealth has evaporated nearly 89%. Some netizens joked that this was "returning to poverty overnight."

The diving of virtual currency also made Tesla, who was optimistic about Bitcoin, was "injured".

According to data that tracks the company's Bitcoin Treasury bonds with Bitcoin companies worldwide, Tesla currently has 4,3200 tokens and ranks second among companies holding the most Bitcoin. The lead is Microslategy.

Based on the price of about $ 19,000 a Saturday, Musk's Tesla's Bitcoin value is less than $ 900 million. Compared with the $ 1.5 billion purchase in early 2021, Tesla's related investment losses may have reached more than $ 600 million.

Musk

Tesla had previously stated that the purpose of investing in Bitcoin was to diversify the source of liquidity and make the asset allocation more flexible, and Musk also promoted the virtual currency platforms such as Bitcoin and dog coins many times. In the first few months of buying Bitcoin at Tesla, Tesla did not lose money due to the rise of Bitcoin prices, and instead made a lot of money, especially on November 10 last year, Bitcoin hit 69044.77 At the historical high of the dollar, Tesla made a lot of money.

Earlier, Tesla said in a document submitted to the US Securities and Exchange Commission (SEC) that by the end of 2021, it would hold a Bitcoin worth 1.99 billion US dollars.

During the company's holding Bitcoin, the agency continued to fluctuate sharply. It reached US $ 66,000 in May 2021, fell 28,000 US dollars in July 2021, and reached a record high of $ 68,000 in November 2021.

After buying Bitcoin last year, Elon Musk said Tesla would let customers use cryptocurrencies to buy cars.

However, in the middle of the year, he withdrew the statement due to the fact that Bitcoin mining had a negative impact on the environment and led to climate change. Then he revealed that if the miners used clean energy mining, Tesla is still acceptable.

The currency circle storm continues

User confidence is obviously insufficient

Bitcoin traded most of the $ 30,000 mark in May, but in June, with the global new inflation shock and concerns about the Federal Reserve's interest rate hike, the price of Bitcoin fell sharply. Investors have been selling assets that are regarded as high -risk, such as cryptocurrencies and technology stocks.

What worsen all the snow was that at this time, the liquidity crisis of decentralized finance (DEFI) platform began to be transmitted to the entire encryption market. More and more encrypted companies have begun to feel the pain of being called the "encrypted market winter".

In the past week, many investors in currency circle suddenly found that they are in a thunder areas that may encounter a "disaster" every step. Last month, the collapse of the algorithm stabilized coin triggered LUNA coin diving plunge is just the beginning of all disasters -from CELSIUS CELSIUS, which is 10 billion yuan this week, the cryptocurrency hedge funds three arrows before weekend The Three Arrows Capital considers the sale of assets and formulates a rescue plan, and Bei Bao Financial, a cryptocurrency loan institution, also suddenly announced the frozen withdrawal of all accounts ... A senior blockchain researcher analyzed to the Beijing Business Daily reporter that the virtual currency was highly lever by high leverage. The prosperity that is maintained is shattered due to the "black swan" incident such as LUNA collapse and Sanjian Capital. In addition, the global central bank represented by the Federal Reserve continues to raise interest rates, which has led to the lack of sufficient liquidity in the cryptocurrency market. Market consensus urgently needs urgent needs reconstruction.

"The main problem is the lack of liquidity, because the plunge of Ethereum has caused many DEFI projects that maintain high leverage to face a liquidation crisis, and the user confidence is also obvious." The above -mentioned senior blockchain researcher said.

For Bitcoin's goal under the market under the US $ 20,000 mark, according to the CCP report, the "debt king" Ganglak warned in an interview on Wednesday that Bitcoin's plunge may not end.

"It seems that it (Bitcoin) is about to be liquidated. So I am not optimistic about Bitcoin at $ 20,000 or $ 21,000. If it falls to $ 10,000, I will not be surprised at all." Ganglak said, " The trend of cryptocurrencies is obviously not optimistic. "

Wang Peng, associate professor of Renmin University of China, analyzed: "Comprehensive Bitcoin trading characteristics and the support of no actual value support. Once a negative factor affecting the trend of the currency price, the market sentiment is obviously pessimistic, which is prone to" step -by -step accidents ", which has caused further plunge to plummet. Therefore, cryptocurrencies are also expected to be in the near future. "

Chen Jia, a researcher at the Institute of International Monetary of Renmin University of China, bluntly bluntly that, from historical experience, although crypto assets claim to electronic gold, there is no real gold monetary function, and it is difficult to decompose the core pain points of encrypted assets in the short term.

Of course, there are currently some big brothers who try to help the market restore the calm currency circle that investors do not need to worry too much about Bitcoin's plunge. They believe that the phased decline is taken for granted. The bear market of encrypted technology is different from the bear market of the stock: the low point is more extreme, but the high point is more extreme.

In any case, this weekly "despair weekend" that makes the currency circle's frightening wind will never be the end of the story of the "encrypted winter" story, and the future trend is still worth paying attention to.

Source 丨 Beijing Commercial Daily (Reporter Liao Meng), Financial Association, China Fund News, 21st Century Business Daily, etc.

Image source 丨 Visual China, Yitu.com, Sina Weibo @Elonmusk, Observer.com Video Screenshot, Bloomberg Billionaire Index Screenshot, Coingecko Screenshot, Coinglass Screenshot

Edit 丨 Zhang Yajing

- END -

Sword refers to irrational hype, which can be worn on the "tight puppet curse"

In the first half of 2022, the capital market is generally sluggish. The convertible bond market is one of the few highlights, but some convertible bonds have set off a huge wave. Stir fry the sky

The Ministry of Finance issued 673 million yuan in agricultural production disaster relief funds to actively support the prevention and control of major crops such as food and other crops

In order to implement the Party Central Committee and the State Council on the dep...