Make an impairment preparation of over 1 billion yuan!In the first half of the year, the target price of 70 % of Oriental Securities was "three consecutive" by the target price of Oriental Securities

Author:21st Century Economic report Time:2022.09.01

21st Century Business Herald reporter Wang Yuanyuan Shanghai report

The performance of listed brokers in 2022 has been disclosed one after another. Non -silver analysts of various securities firms have also issued performance comments on major brokers.

In the first half of 2022, the "bleak" of the performance of each broker, and the net profit of the entire voucher industry was almost decreased year -on -year.

Among them, the Oriental Securities of the two heads of asset management companies, the net profit decreased by 76.03%year -on -year in the first half of this year. After the interim report was disclosed, he was under the target price of non -silver analysts of Huatai Securities.

Cumulative asset impairment measurement

The net profit decreased by 76.03%year -on -year. The decline in net profit from Oriental Securities seemed to be a little "eye -catching" in the entire voucher industry.

The 12th broker of this total asset ranking industry at the end of 2021, the net profit realized in the first half of 2022 was even less than the net profit ranking of the listed securities firms, which was far less than its size. Oriental Securities dropped to 22nd.

Behind net profit drop, the main reason is that Oriental Securities will add 1.044 billion yuan in asset impairment preparations in the first half of the year, resulting in the remaining net profit in the first half of the year only 6.47 yuan.

In fact, in addition to the significant amount of asset impairment reserve in the first half of this year, in the past two years, Oriental Securities has also increased the relevant amount each year.

Throughout 2021, Oriental Securities planned asset impairment preparation of 1.317 billion yuan, of which 1.318 billion yuan was about buying and returned financial assets; in 2020, Oriental Securities Planning for the asset impairment preparation of 3.882 billion yuan, of which 1.496 billion yuan was 1.496 billion yuan Regarding buying and selling financial assets.

However, due to the structural bull market in the past two years, Oriental Securities Asset Management and Huitianfu Fund under Oriental Securities are all excellent companies in the public fund industry. Not that "ugly".

However, the phrase "after the tide faded away," the "famous saying" that had been widely circulated in the field of investment in the first -level investment seemed to have also happened in listed brokers.

In the first half of this year, the domestic capital market performed poorly. The operating data of the two "cash cows" mentioned above were not very optimistic, which exposed the problems of the two integration of Oriental Securities and the impairment of debt investment.

It is worth noting that the company has carried out a large amount of impairment for several consecutive years, but in early 2021 (disclosure of disclosure of the second half of the year in 2020), it has not been disclosed in detail.

So, from the second half of 2020 to the first half of 2022, the project that has been impaired is the continuation of the previous thunder project, or is it a new two-financing project? If it is "continuing", it may mean that the possibility of the end of the year's high amount of impairment is close to the end; if it is "new", it means that the high amount of impairment measurement may be the beginning.

However, Oriental Securities did not reply directly.

Oriental Securities stated that the company's two -financing business is stable, the risk is small, the maintenance ratio is higher than the industry level, and the impact of impairment is less. The company's credit impairment loss mainly comes from stock pledge business. In recent years, the company has implemented the guiding ideology of "risk control and reduction", and has continuously reduced the scale of stock pledge business.

Oriental Securities responded to the 21st Century Business Herald reporter that in the first half of 2022, the company's equity pledge scale was further compressed. At the end of June, the company's stock pledge book was worth 5.7 billion yuan, a decrease of 21%from the beginning of the year, and a 84%decrease from the peak of the business scale. In the first half of this year, affected by factors such as domestic and foreign political, economic and epidemic, overlay some pledged objects were poorly operated and the stock price declined, and the company's total amount of stock pledge business was reduced by 861 million yuan. freed.

Oriental Securities said that overall, combined with the situation and book value of existing stock projects, it is expected that subsequent stock impairment matters have a small impact on the company's overall operating performance.

However, because the company did not disclose specific projects, the influence of subsequent stock impairment on the overall operating performance of the company may only be observed until the next quarterly or annual report.

The target price was "three -game fall" by the peers

After the interim report was issued, Dongfang Securities dropped not only the ranking of net profit, but also the target price of non -bank analysts to reduce its target. Huatai Securities ’s research report on September 1st: Oriental Securities: Drag of investment impairment, steady contribution of asset management profits", the target price given to Oriental Securities is 10.49 yuan/share, and the previous value is 11.91 yuan/share, which is reduced. 11.92%. In addition, Huatai Securities 'non -silver team's prediction of Oriental Securities' net profit in 2022 also lowered significantly. The previous forecast was 5.503 billion yuan in net profit for the annual annual annual.

In fact, since this year, Huatai Securities has lowered the target price of Oriental Securities three times, namely:

On March 31, Oriental Securities announced the 2021 financial report, Huatai Securities Research Research "Oriental Securities: Bright Broken Management, Deepening Wealth Management", which raised its target price from 17.94 yuan/share to 14.66 yuan/share;

On April 30, after the announcement of the first quarter of 2022, the Huatai Securities Research Research Report "Oriental Securities: Steady Economy of the Investment Bank, Correct Dating Development", transferred its target price from 14.66 yuan/share to 11.91 yuan/share;

On August 31, Oriental Securities announced the 2022 interim report, Huatai Securities Research Research "Oriental Securities: Drag the investment impairment, and steadily contributing to the profit of asset management", transferred its target price from 11.91 yuan/share to 10.49 yuan/share. Since this year, every time Oriental Securities announced its financial report, the stock price has been lowered. After the Huatai Securities' non -silver team made a "three consecutive declines", the target price of Oriental Securities had "shrunk" 41.53%.

As of now, CICC has also been reduced to the target price of Oriental Securities after the central report was released, and its target price of Oriental Securities is 6%to 10.7 yuan/share.

However, in addition to Huatai and CICC, since this year, many brokerage analysts have continued to reduce the target price of Oriental Securities, including Haitong Securities, CITIC Construction Investment, Zhejiang Business Securities, Anxin Securities, Huachuang Securities and other brokers Essence

For example, Haitong Non -Silver Team, after the third quarterly report of Eastern Securities announced in October last year, made its target price for the first time, from 18.92 yuan/share to 18.62 yuan/share; after this year's annual report, Haitong non -silver non -silver bank The target price of Oriental Securities was reduced to 14.52 yuan/share; after the first quarter of this year, Haitong Non -Silver continued to reduce its target price to 10.74 yuan/share, with a range of 43.23%.

It is true that due to the large fluctuations in the domestic capital market in the first half of the year, the overall performance of the brokerage firms has not performed well, and the target price has been lowered by non -silver analysts, but compared with, the target price of Oriental Securities has been repaired.

For example, after Huatai Securities disclosed the 2021 financial report in March this year, Haitong Non -Silver also lowered its target price, but after continuous reduction, its target price also dropped from 23.38 yuan/share to 16.94 yuan/share, and the range dropped. It is 27.54%.

- END -

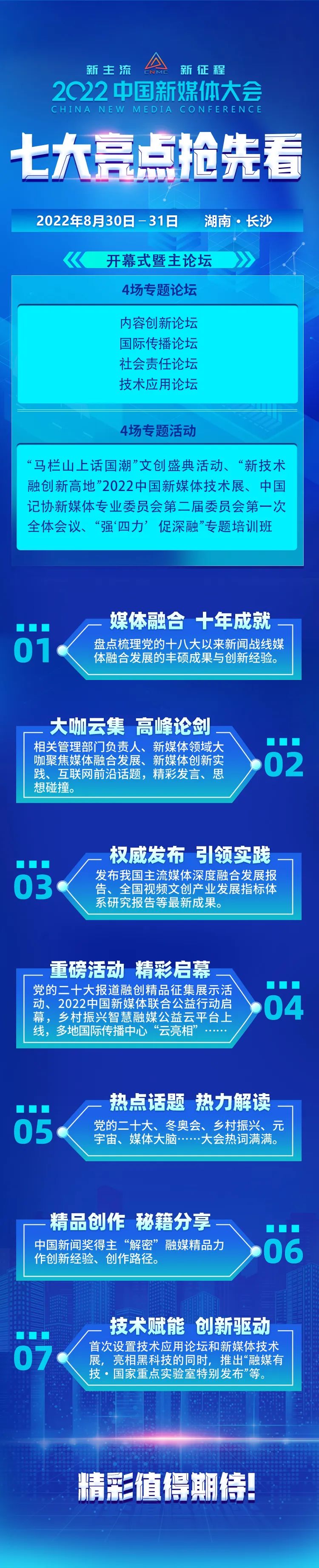

Open tomorrow!2022 Seven highlights of the China New Media Conference

Sichuan Observation (Source: Chinese Records Association)

The Agricultural Bank of China Jining Branch: The war epidemic shows the continuous file of financial services

Faced with a new round of new crown epidemic, the Agricultural Bank of China Jining Branch quickly responded, moved rapidly, strengthened overall deployment, solidly preventing epidemic prevention mea