A -share 2022 Semi -annual report 丨 A -share listed company total revenue of 3.455 trillion yuan, an increase of 12.7%year -on -year, the epidemic and new energy became the biggest victory

Author:Daily Economic News Time:2022.09.01

On August 31, Wind data showed (the same below), and a total of 4,876 listed companies in Shanghai, Shenzhen, and North Stock Exchange disclosed the semi -annual report in 2022. The total operating income of listed companies achieved a total operating income of 3.45 trillion yuan, and its net profit attributable to her mother was 3 trillion yuan, an increase of 12.7%and 8.7%compared with the same period last year (4454 listed companies), respectively.

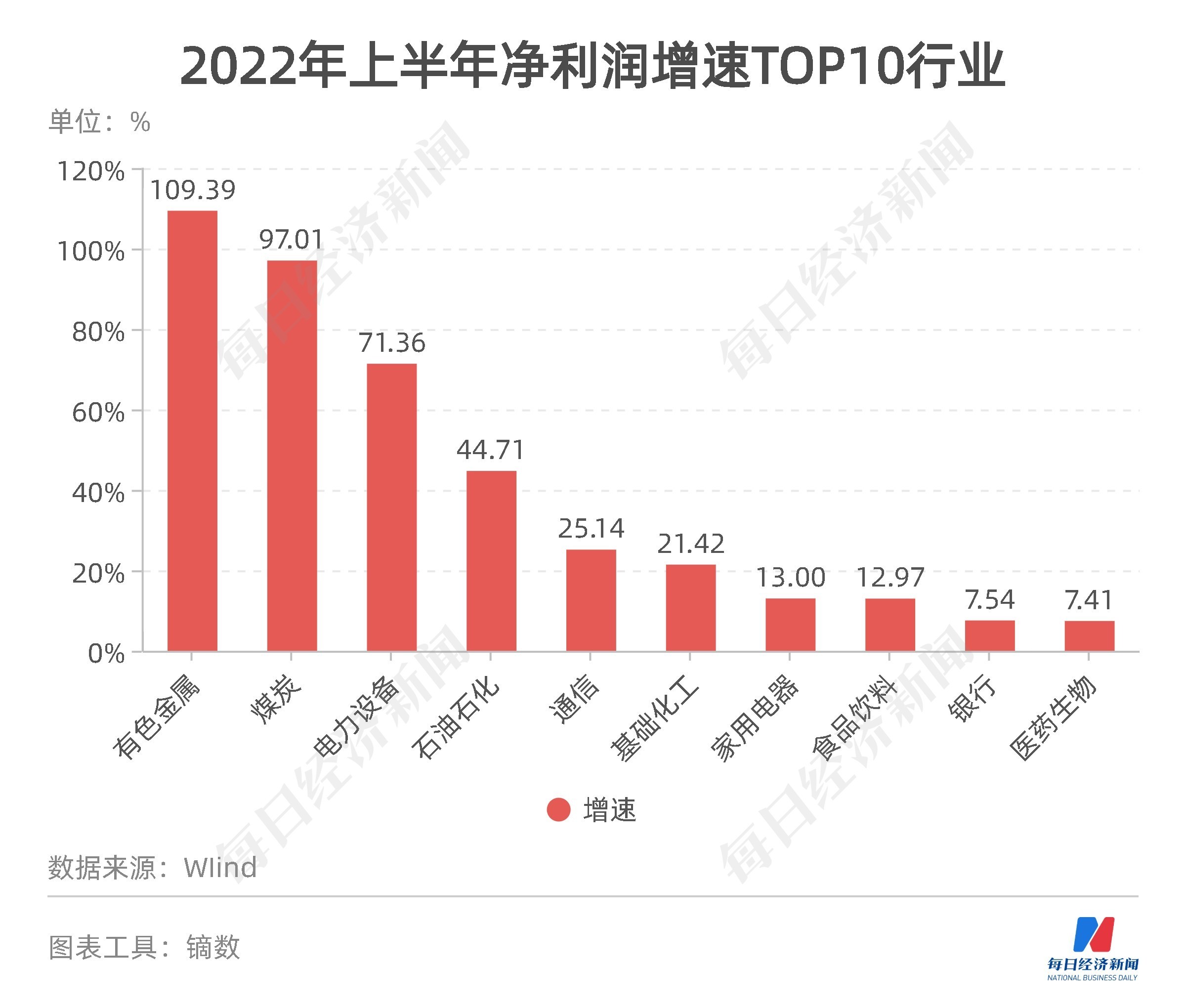

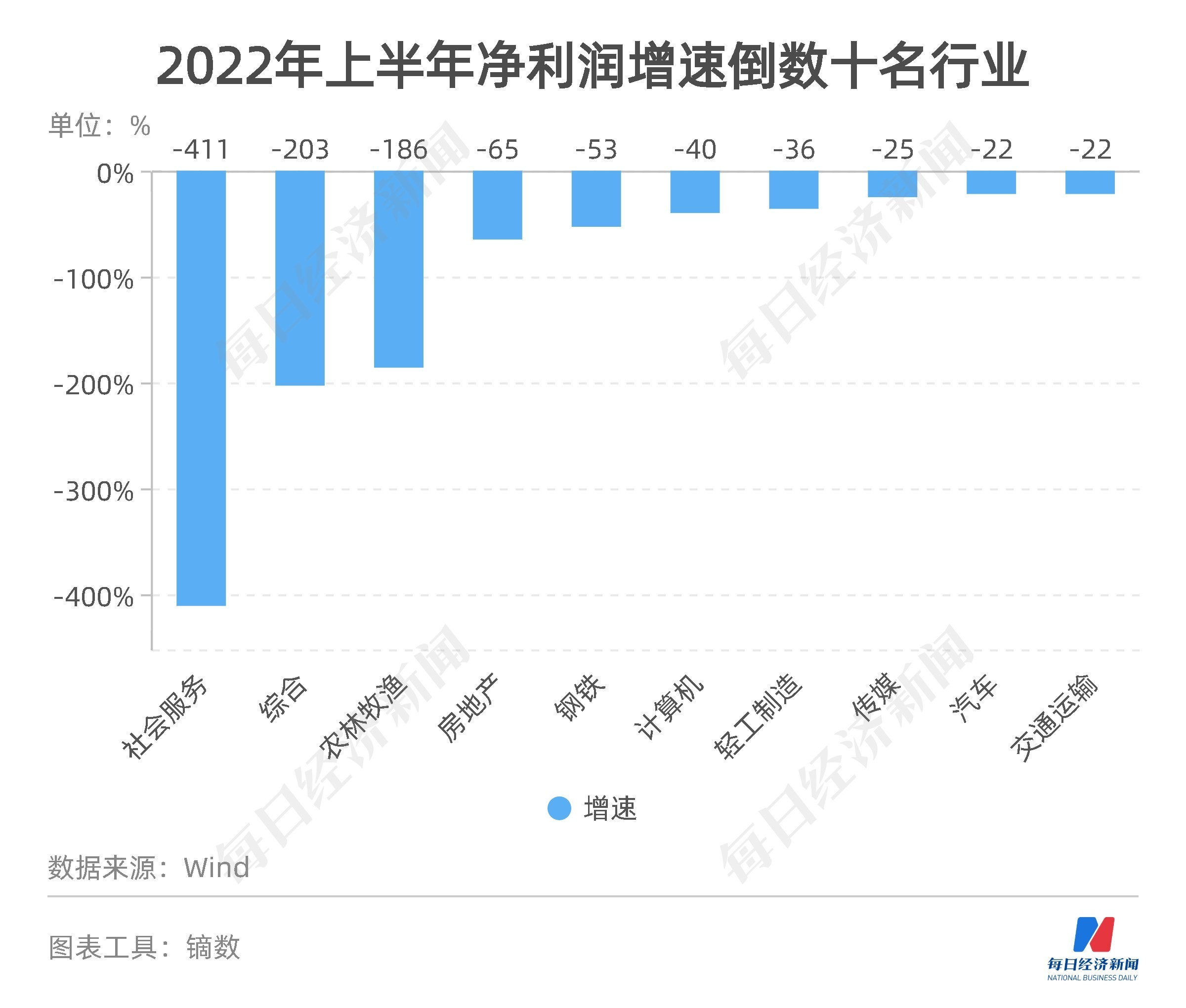

Listed companies with the fastest growth rate of revenue and net profit return are from the medical industry. The fastest industry is a non -ferrous metal, and the "picking beam" in the industry is naturally lithium companies. The epidemic and new energy have become the biggest factor that affects listed companies.

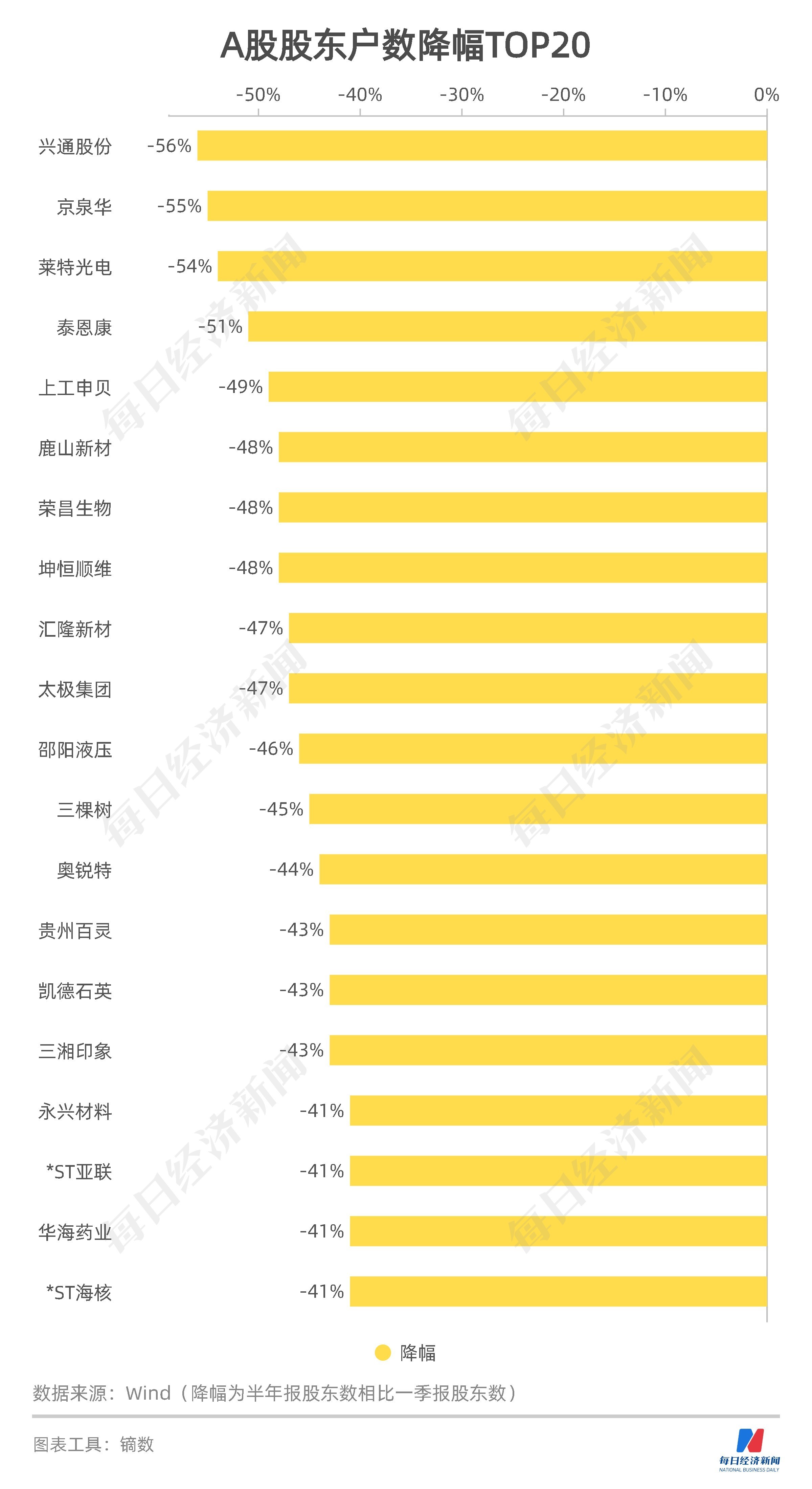

Compared with the end of the first quarter, as of June 30, 2022, the number of shareholders of A -share listed companies had a total of 82.253 million households, an increase of 2.7%compared to the end of the first quarter.

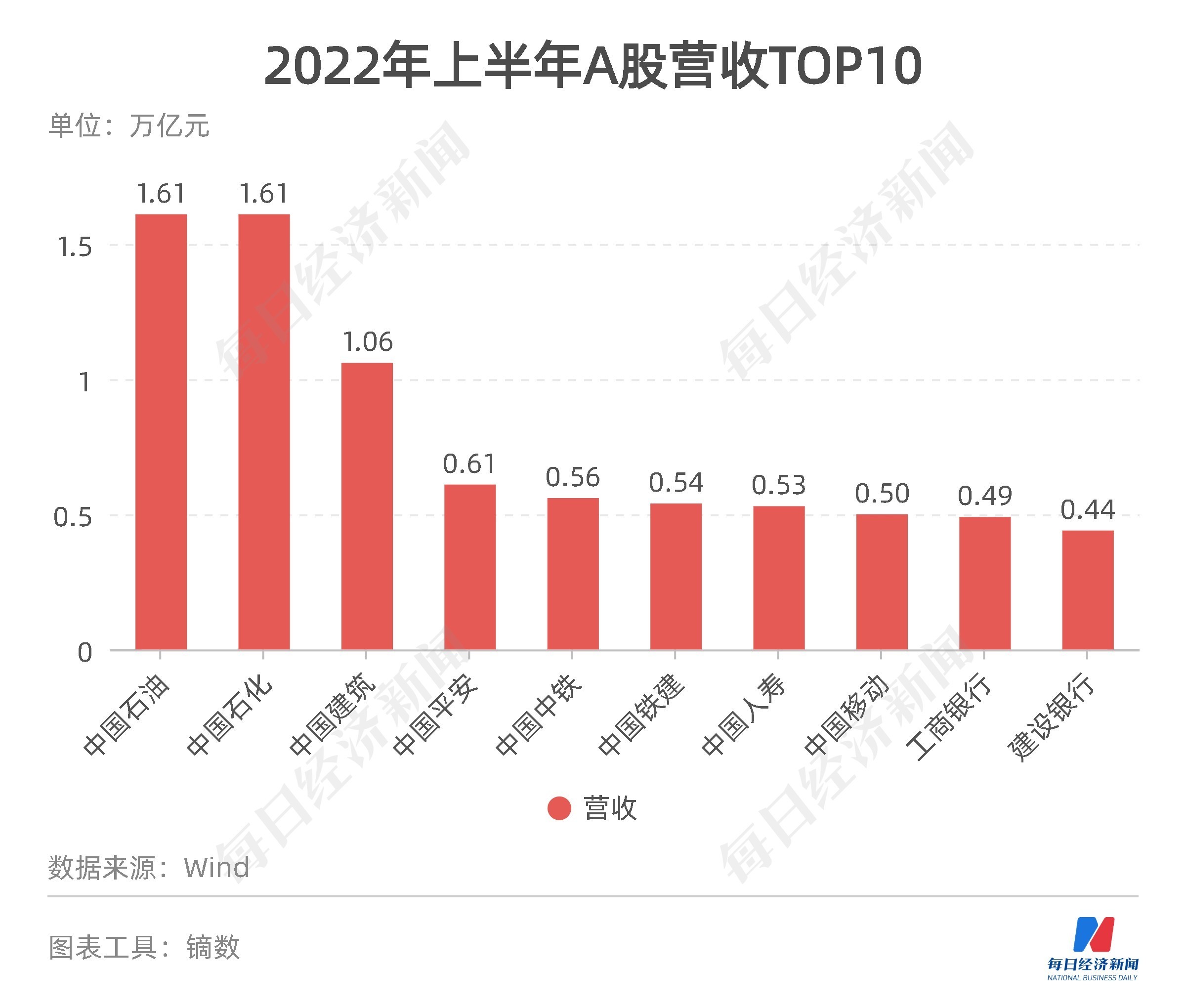

Total revenue of 34.55 trillion: "two barrels of oil" revenue is about 1.61 trillion

In the first half of 2022, A -share listed companies realized total operating income of 3.455 trillion yuan, an increase of 12.7%year -on -year. "Two Oils" led A -share revenue. In the first half of the year, PetroChina (SH601857, stock price was 5.36 yuan, market value of 980.992 billion yuan), Sinopec (SH600028, stock price 4.23 yuan, market value 512.131 billion yuan) operating income was also about 161 trillion yuan , Year -on -year increased by 34.9%and 27.9%, respectively.

Among non -finance and oil companies, Chinese architecture (SH601668, a stock price of 5.15 yuan, and a market value of 215.962 billion yuan) ranked first with its operating income of 1.06 trillion yuan (year -on -year) in the first half of 2022). The company's semi -annual report shows that from January to June 2022, the total output value of the national construction industry was 12.9 trillion yuan, an increase of 7.6%year -on -year; 100 million square meters, a year -on -year decrease of 12.5%, the completion area of 1.47 billion square meters, an increase of 4.4%year -on -year.

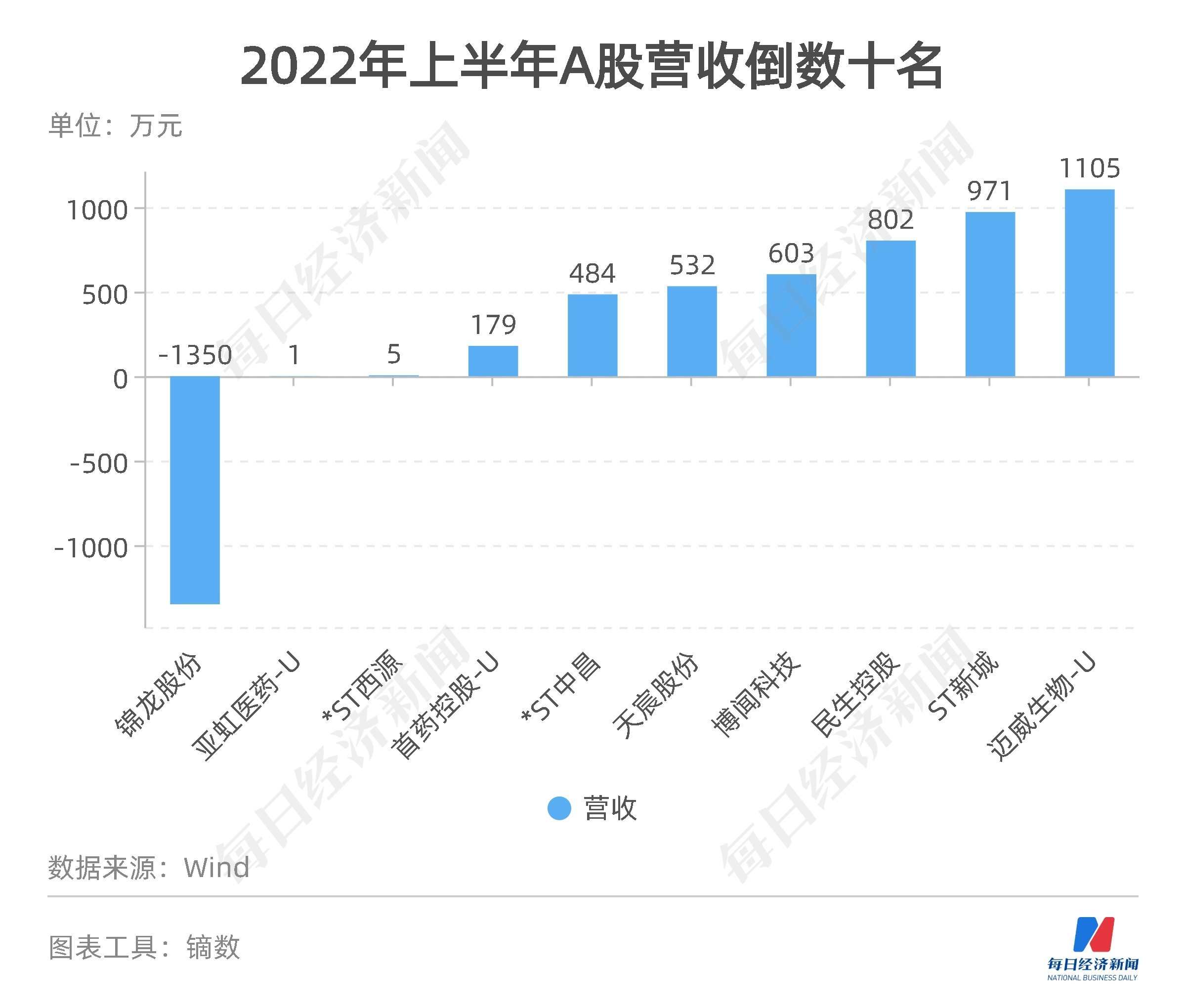

In the first half of 2022, a financial company in A-share listed companies had a negative operating income. Jinlong (SZ000712, a stock price of 14.27 yuan, and a market value of 12.786 billion yuan) in the first half of the year was -13.497 million yuan, mainly in Zhongshan The fair value of the securities, the income of investment income, the fees, and the net revenue of the commission has been significantly reduced compared with the same period last year (the above -mentioned profit and loss change account for accounting into the operating income of financial enterprises).

In addition to financial enterprises, Yahong Pharmaceutical -U (SH688176, the stock price of 11.66 yuan, a market value of 6.646 billion yuan) only realized 9149.76 yuan in operating income in the first half of the year. Yahong Pharmaceutical is a globalized innovation pharmaceutical company focusing on the URogenital System tumor and other major diseases. In the first half of the year, R & D investment totaling 930.49 million yuan.

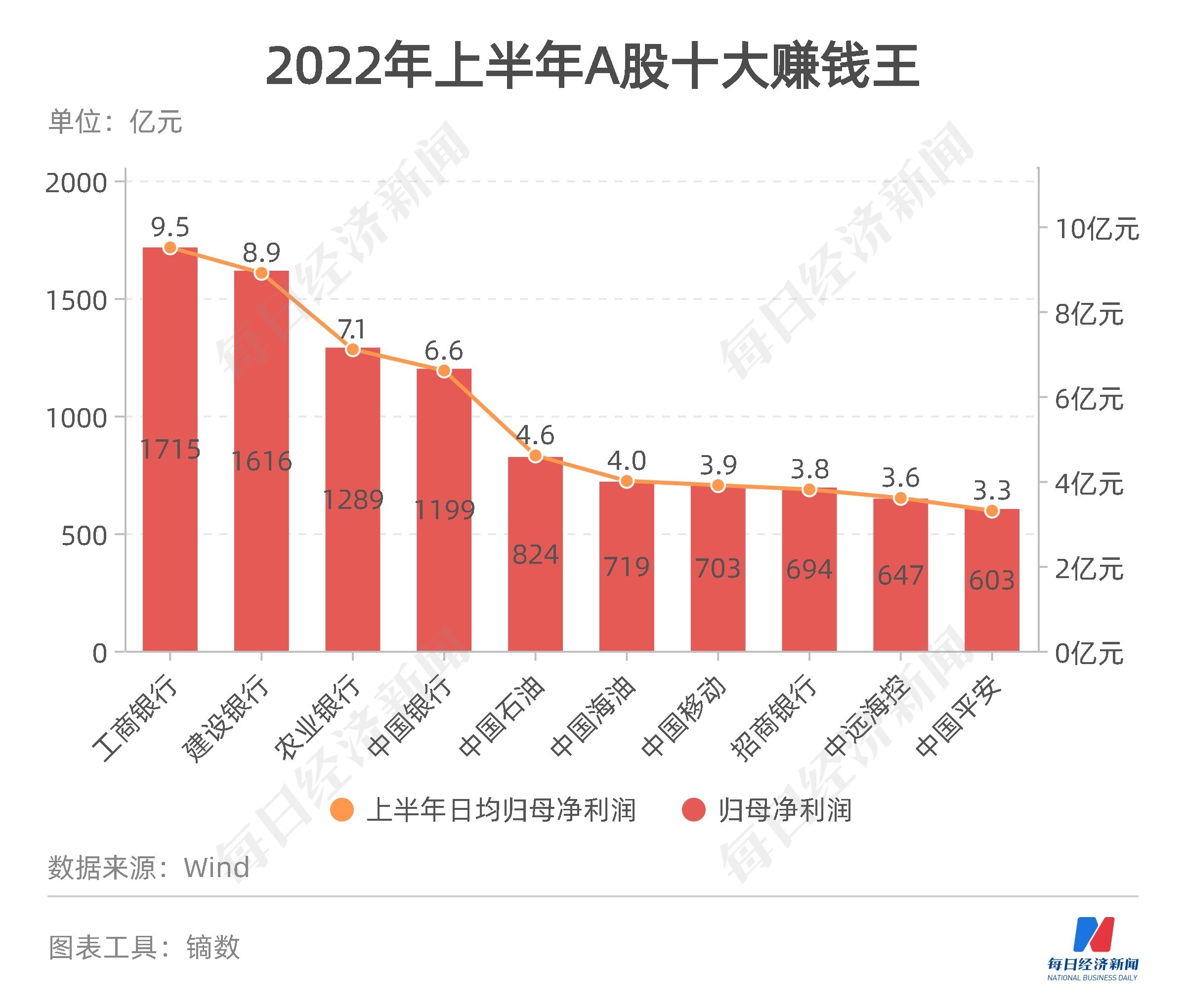

A total of 3 trillion yuan in net profit to mother: Telecom giant finds a new growth point

In the first half of 2022, A -share listed companies achieved a net profit of 3 trillion yuan, an increase of 8.7%year -on -year.

Large state -owned banks have stable performance. PetroChina, China Oil (SH600938, 16 yuan, market value of 762.199 billion yuan) and other petroleum companies have also achieved considerable results in the first half of the year. From the perspective of the average daily profitability, the ten companies on the list can also complete 3 "small goals" per day, and more can complete 9.5 "small targets" every day.

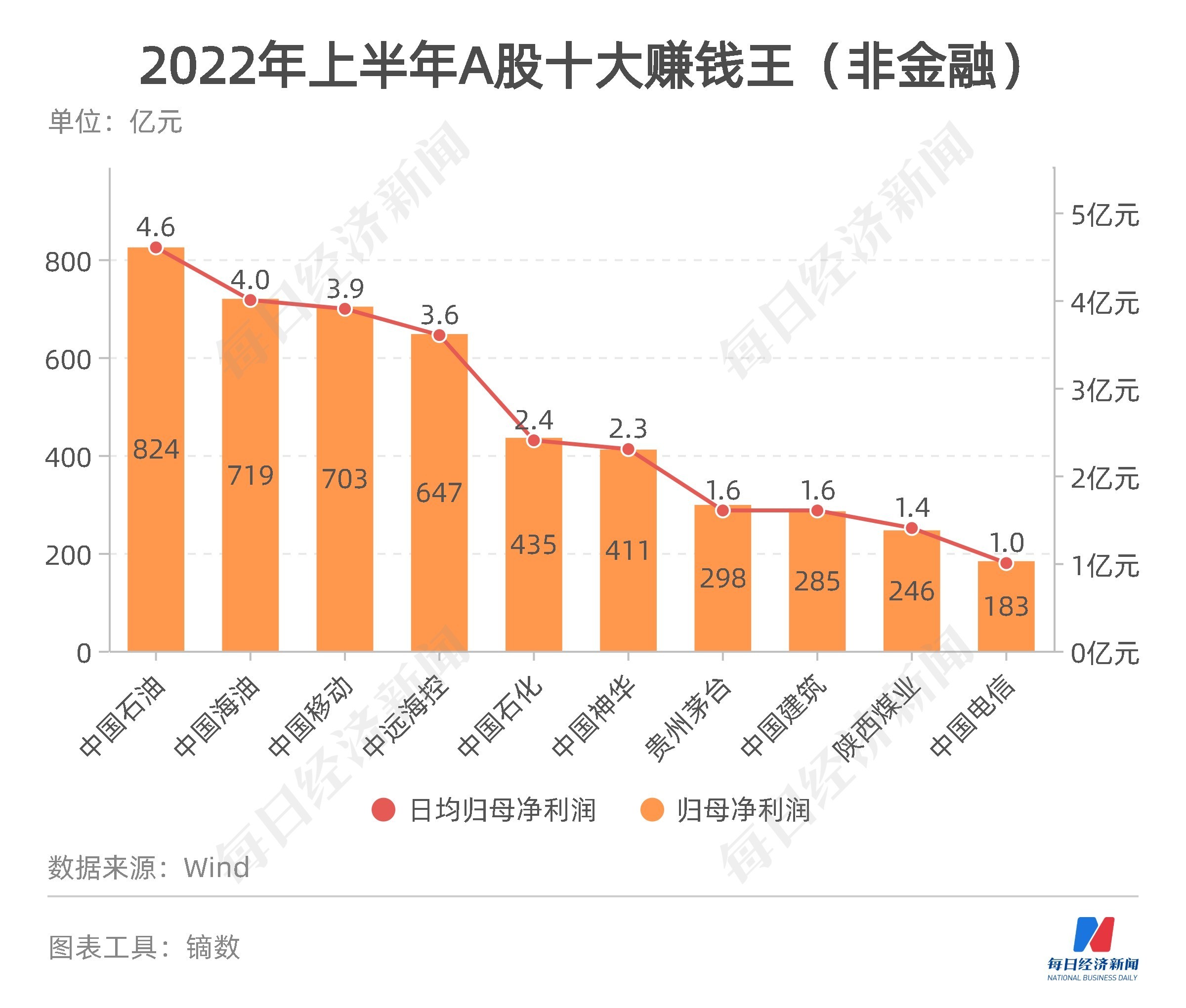

If the "Big Mac" financial company is removed, then Guizhou Maotai (SH600519, the stock price is 1880.89 yuan, the market value is 2362.77 billion yuan), and Chinese buildings will surface.

In addition to financial and petroleum listed companies, Telecom Giant China Mobile (SH600941, stock price of 64.46 yuan, market value of 1.38 trillion yuan) In the first half of 2022, a net profit of 70.275 billion yuan was recorded, an increase of 18.87%year -on -year. The company said in the semi -annual report that thanks to the rapid expansion of information service business such as digital content, smart family, 5G vertical industry solutions, and mobile clouds, digital transformation revenue reached 110.8 billion yuan, an increase of 39.2%year -on -year, accounting for 39.2%, accounting for the main business revenue The ratio of 26.0%is the main driving force to promote the company's income growth.

As the new crown epidemic was distributed in the first half of the year, the four major airlines were still affected. Air China (SH601111, stock price of 9.84 yuan, market value of 142.924 billion yuan), China China Eastern Airlines (SH600115, stock price of 4.7 yuan, market value of 88.71 billion yuan), average of more than 100 million yuan in net profit loss.

China Air China stated in the semi -annual report that aviation transportation production continued to be affected by the epidemic, but overall accelerated the trend.

In the first half of the year, the number of aviation passengers rose first, and the domestic market recovered. Although the volume of aviation freight has declined, international freight has continued to grow.

Revenue growth: Hualan vaccine increased by 96.25 times year -on -year

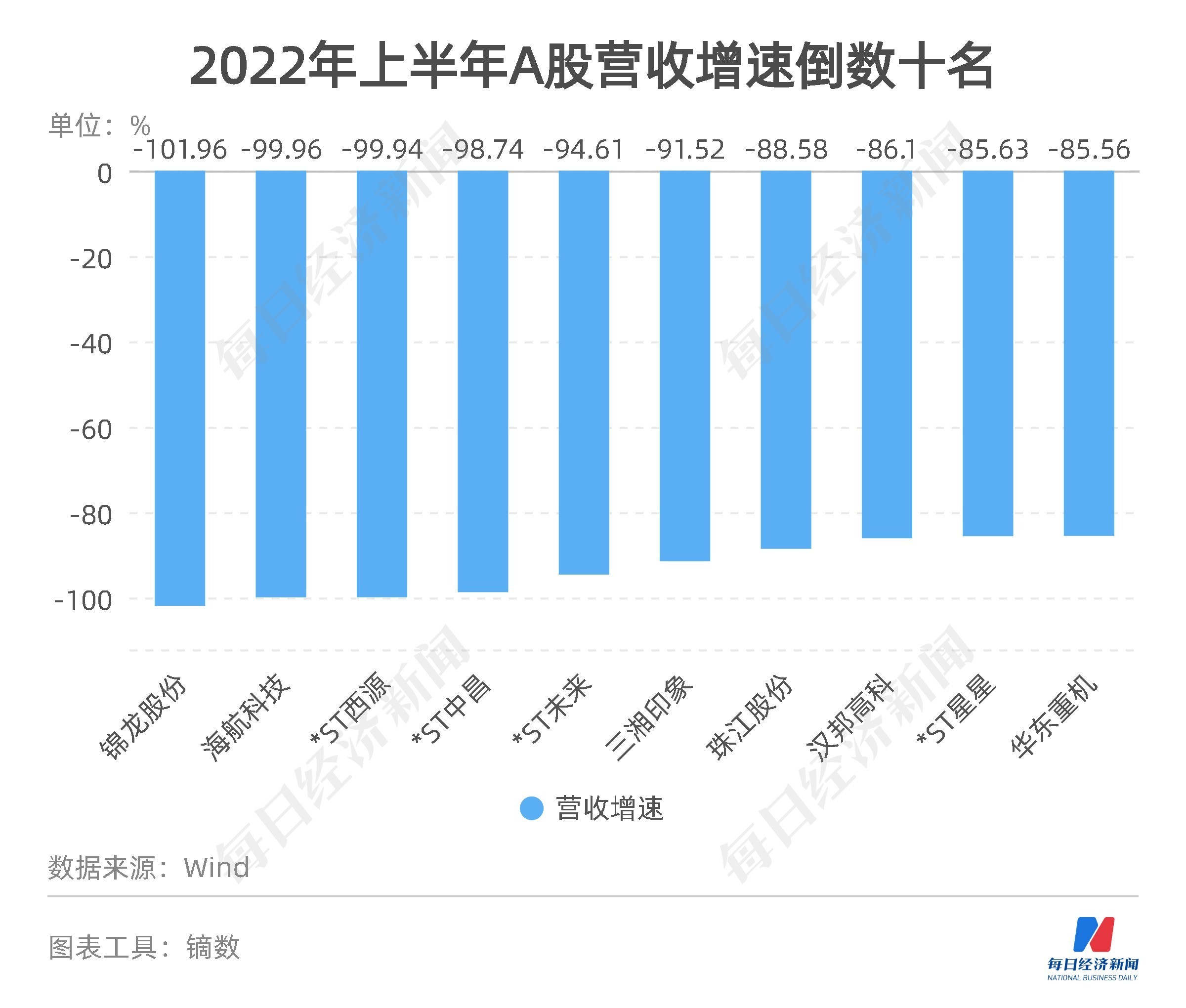

In terms of performance growth, Hualan Vaccine (SZ301207, the stock price of 56.11 yuan, and a market value of 22.445 billion yuan) ranked ranked first in the first half of 2022 with a revenue growth rate of 9625%. It is said that the influenza vaccine in 2022 began to be approved and sold in May, and the influenza vaccine was approved and sold in the second half of the year. Therefore, sales and income in the first half of 2022 increased significantly year -on -year. With the performance of Zhongshan Securities, Jinlong (SZ000712, a stock price of 14.27 yuan, and a market value of 12.786 billion yuan) not only had a negative operating income in the first half of the year, but also became the listed company with the most revenue year -on -year revenue in the first half of 2022.

In terms of the growth rate of net profit returning to the mother, the new crown reagent manufacturer Jiu'an Medical (SZ002432, the stock price of 53.98 yuan, and a market value of 25.989 billion yuan) has outstanding profits. In the first half of 2022, the net profit returned to the mother was 15.244 billion yuan, a year -on -year increase of 27728.49%. In the first half of the year, the company invested its main energy and resources into the research and development, production and sales of the iHealth kit product, and successively passed the FDA and EUA certification, which opened the company's overseas sales channels in Europe and the United States.

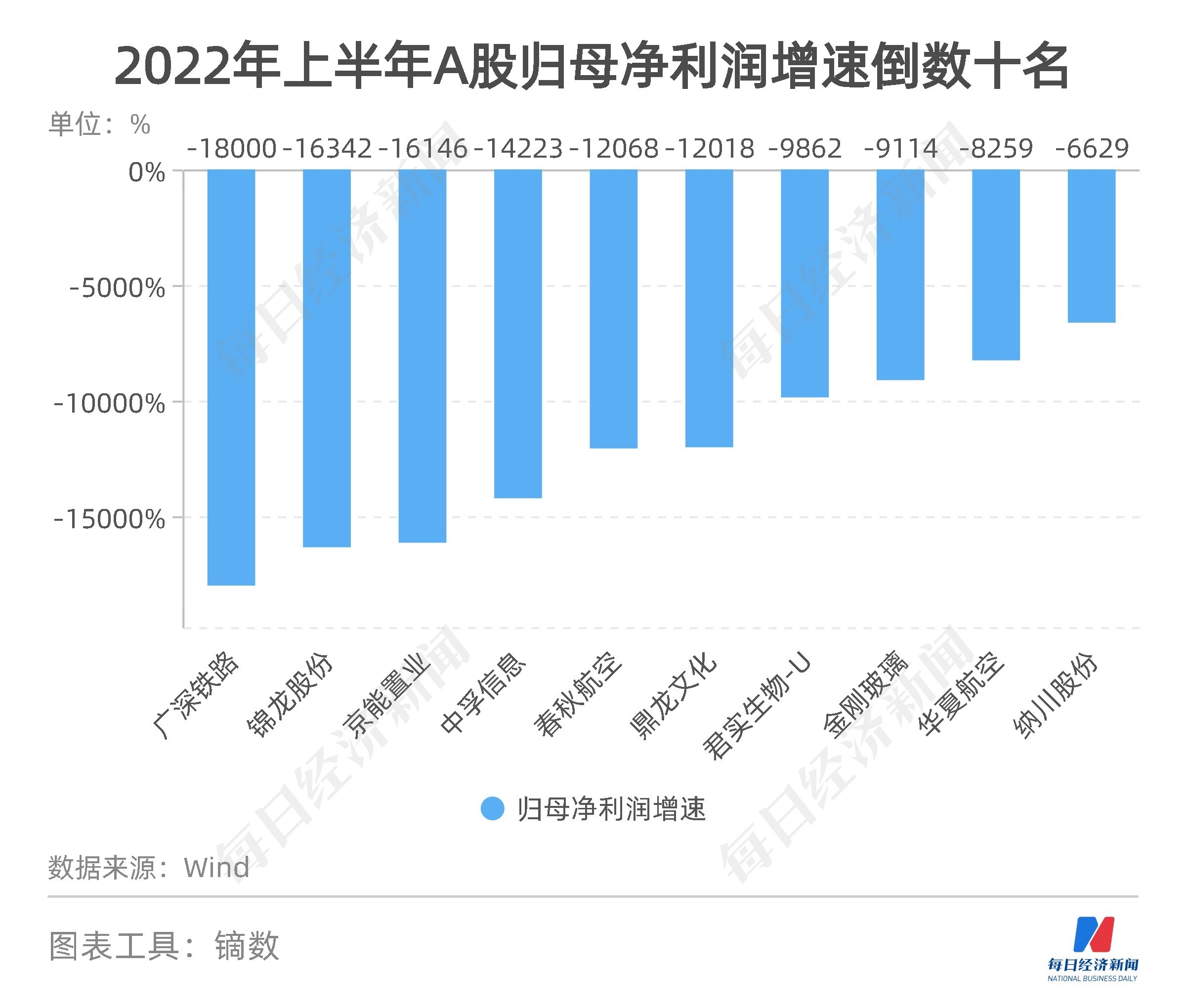

Affected by factors such as the domestic new crown pneumonia and the macroeconomic situation, the Guangshen Railway (SH601333, a stock price of 2.05 yuan, a market value of 14.521 billion yuan) lost 765 million yuan in the first half of 2022, a year -on -year decrease of 18,000.12%.

Industry growth: Lithium companies have no accident to dominate

From the perspective of industry dimension (according to the classification of the application in the application of the application), the operating income and net profit of the mother of the mother of A -shares in the first half of 2022 in the first half of 2022 achieved a positive growth. Among them, the top growth rate is non -ferrous metals, coal, power equipment and other industries; agriculture, forestry, animal husbandry, fishes, comprehensive, social services, etc. are ranked at the end of the growth rate list.

In the non -ferrous metal industry, the top three operating income growth rates are Tianqi Lithium (SZ002466, the stock price is 107.92 yuan, and the market value is 177.121 billion yuan), Tianhua Chaoping (SZ300390, the stock price is 74.9 yuan, the market value is 44.049 billion yuan), the Tibetan mining industry (Tibet SZ000762, the stock price of 48.28 yuan, a market value of 25.145 billion yuan), in the first half of 2022, the company's operating income increased by 508%, 443%, and 439%year -on -year.

Number of shareholders: increased by 2.7% year -on -year

Compared with the end of the first quarter, as of June 30, 2022, the number of shareholders of A -share listed companies had a total of 82.253 million households, an increase of 2.7%compared to the end of the first quarter. Among them, 20 listed companies with the highest decline in shareholders include Xingtong (SH603209, a stock price of 33.58 yuan, a market value of 6.716 billion yuan), Jingquan (SZ002885, a stock price of 31.5 yuan, a market value of 5.67 billion yuan), and Litt Optoelectronics (SH688150) The stock price is 20 yuan, and the market value is 8.049 billion yuan).

Xingtong is one of the companies with a decrease of shareholders in the second quarter. As of the end of the first quarter, the number of shareholders of Xingtong's shareholders was 4,4540, while the end of the second quarter fell to 19,476 households. At the same time, the top ten shareholders of Xingtong Co., Ltd. in the second quarter, the new entry into seven institutional shareholders, including the Bank of Communications-Huaan Strategy Optimized Hybrid Securities Investment Fund. The company's stock price fell 18.3%in the second quarter. But as of the close of September 1, the company's stock price rose 48.78%since the third quarter.

(The data comes from Wan De, please check before use)

Daily Economic News

- END -

Nine teeth cost 160,000 yuan, why are you so expensive to grow your teeth?

The Yangtze River Daily Da Wuhan Client September 4th. Huang Xi, 49, has planted 8...

[Firm confidence to stabilize the economy] Ancient waves: agricultural quality improvement and efficiency rural economy continues to improve

Gulang County insisted on solving the problem of agriculture, rural areas, and rur...