"Fengkou Research Report · Company" IVD testing laboratory+intensive purchasing in the hospital+self -developed quality spectrum/glycae. This company has accumulated more than 4,000 testing laboratories and extension to join hands with the Chinese Medicine Communist Market.In the end

Author:Federation Time:2022.09.01

①Ditid test laboratory+intensive purchasing in the courtyard+self -developed mass spectrometer/glycated meter. This company has accumulated more than 4,000 testing laboratories and extension to join hands with the Chinese Medicine Communist Market. The valuation next year is only 10 times; Volumes, high dividend strategies have become the best solutions for "lying down". Analysts preferably prefer these companies for reference, with a maximum dividend rate of 16%.

"Fengkou Research Report" Today Introduction

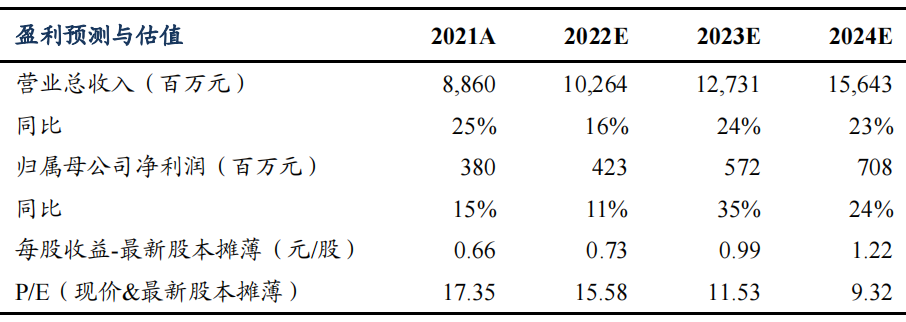

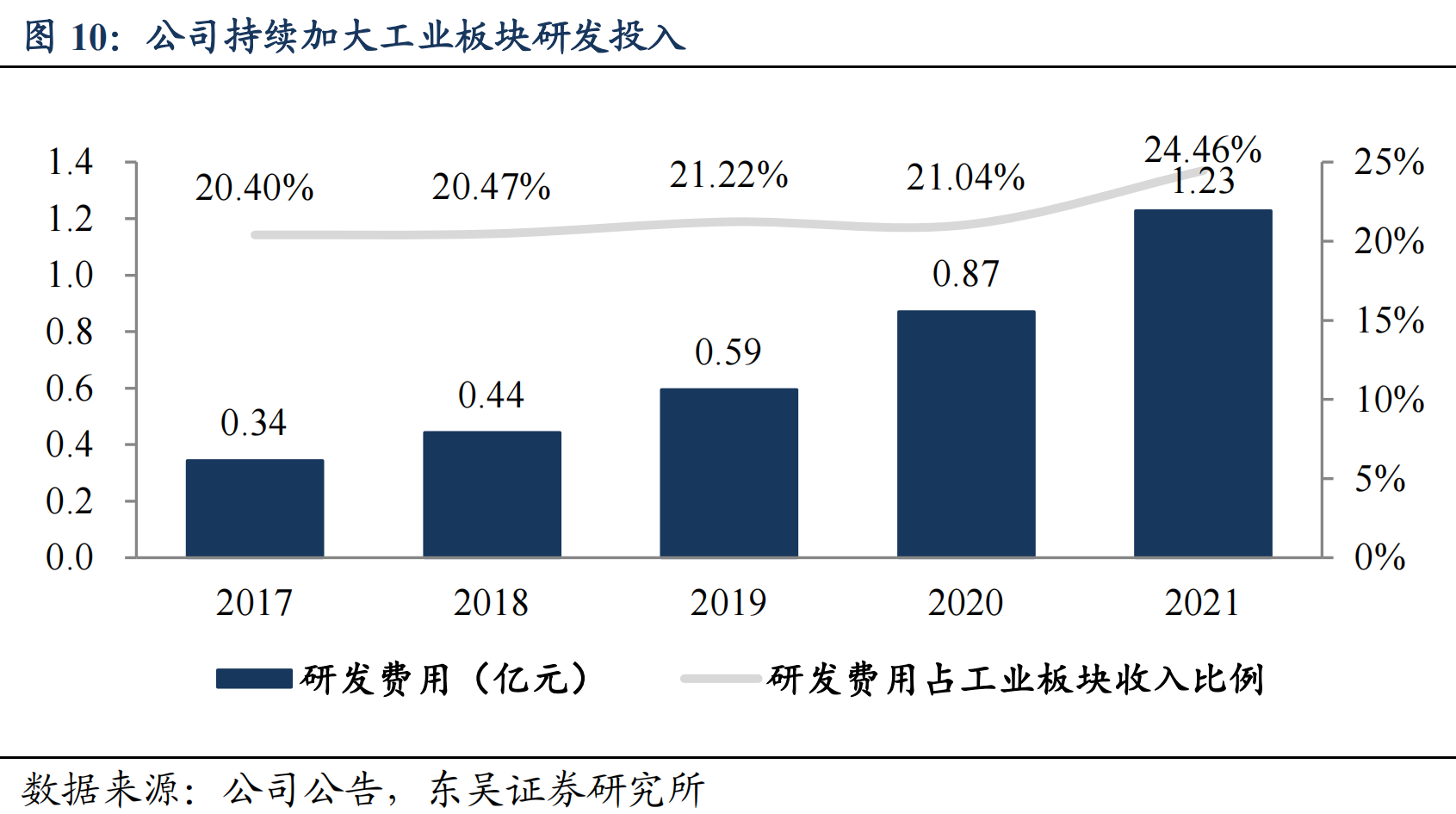

1. Company 1: ① Zhu Guoguang, Soochow Securities, believes that in the context of DRG and other fees, public hospitals pay more and more attention to the cost control and quality management of inspection subjects. In order to reduce the cost of inspection section, it is one of the major trend; ② The company is an in vitro diagnostic intensive leader. The product covers more than 1,200 manufacturers and 19,000 items; the number of downstream service customers is at the forefront of the same industry. More than 4,000 laboratories across the country provide services, and cooperate in depth with Chinese medicine holding to open up the largest domestic drug distribution network; ③ the company's industrial pipelines are accelerated, and the quality spectrometer, the new glyca instrument are listed, and the external heavy cooperation Osondo will be in the Osondo. In-depth cooperation in the field of inspection and other inspection of immune diagnosis, while actively deploying third-party laboratory inspection services outside the hospital; ④ Zhu Guoguang expects the company's net profit from the company from 2022-2024 to the mother's net profit of 4.2/5.5/690 million yuan, an increase of 11%/35%/24 year-on-year year-on-year increase %, The corresponding PE is 16/12/9 times; ⑤ Risk reminder: The intensive model promotion is not as good as expected, and the industrial bar promotion is not as good as expected.

2. Company 2: ① The high dividend sector is more concentrated in traditional industries. Large market value, high debt ratio and sufficient cash flow are its main features. When the market performs poorly, the performance of the high dividend sector will often be better and obvious. The characteristics of the "bear market umbrella"; ② Domestic in the country that transition from "wide currency+tight credit" to "wide currency+wide credit", the wide credit environment is good, and my country's economy may be in a low interest rate environment for a long time. High -dividend -style asset allocation will be more valuable; ③ Caixin Securities Huang Hongwei recommends to screen low -value stocks in real estate, infrastructure, energy, consumption, banks and public undertaking sectors; ④ Risk reminder: style switching No expectations.

Theme one

IVD Testing Lab+In -hospital intensive procurement+self -developed mass spectrometer/glycated meter. This company has accumulated more than 4,000 testing laboratories and extension of the Chinese Medicine Communist Market.

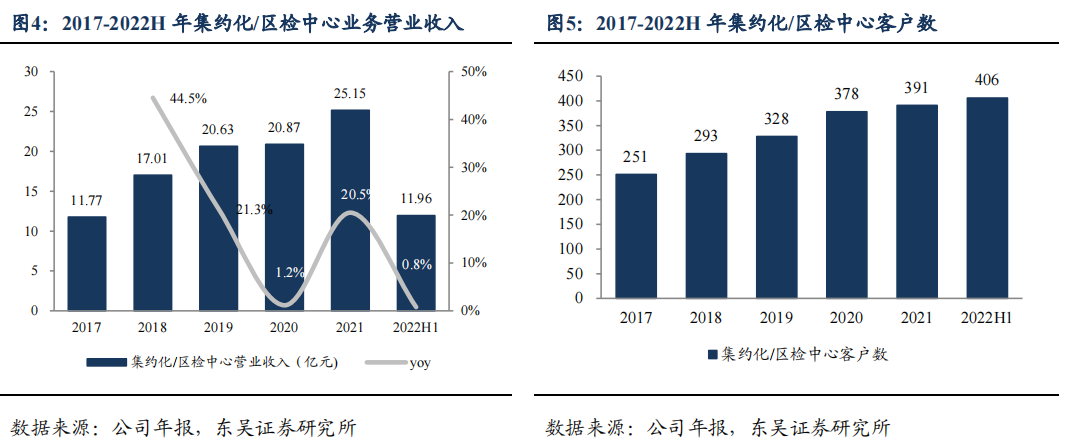

In the context of DRG (Disease Diagnostic Related Groups) and Tarnery Policy, public hospitals have stricter the requirements for the management and control of IVD inspection costs and quality management. In this context, the intensive model can use large procurement scale and strong bargaining ability to help the inspection department reduce procurement costs, and at the same time provide incremental services such as new technical clinical training services and report interpretation services.

Dongwu Securities Zhu Guoguang excavated the comprehensive service leader Runda Medical (603108) in the hospital. The advantages of channel resources, combined with the company's service advantages to form complementary advantages, and further expand the size of the commercial service platform.

In addition, with the accelerated layout of the company's industrial pipelines, the quality spectrometer and the new glyca instrument are listed on the market, and the external heavy cooperation of Osonado will be in -depth cooperation in the field of testing and other testing fields. The company has achieved rapid establishment of the industrial product matrix through independent research and development+extension mergers and acquisitions, and gradually covers the IVD characteristic technology field.

Zhu Guoguang expects the company's net profit from the company from 2022-2024 to be 4.2/5.55/690 million yuan, respectively, an increase of 11%/35%/24%year-on-year, and the corresponding PE is 16/12/9 times.

Under the pressure of medical insurance control fees, intensiveization is one of the future trends

Since its establishment, the company has continued to focus on the field of in vitro diagnosis and is committed to providing overall solutions for medical laboratory disease diagnosis diagnosis. At the same time, with its own resource advantages, it also actively deployed third -party laboratory testing business in the hospital.

Zhu Guoguang believes that in the context of DRG and other fees, public hospitals pay more and more attention to the cost control and quality management of the inspection department. One of the trends.

As of now, the company's products cover more than 1,200 manufacturers and 19,000 items; the number of downstream service customers is at the forefront of the same industry, and the company has provided services to more than 4,000 laboratories across the country. Under the support of the core advantages, the company's integrated/district inspection service business and customers have a strong viscosity. The contract cycle is 5-8 years. As of the end of 2021, the renewal rate of old customers is as high as 99.6%.

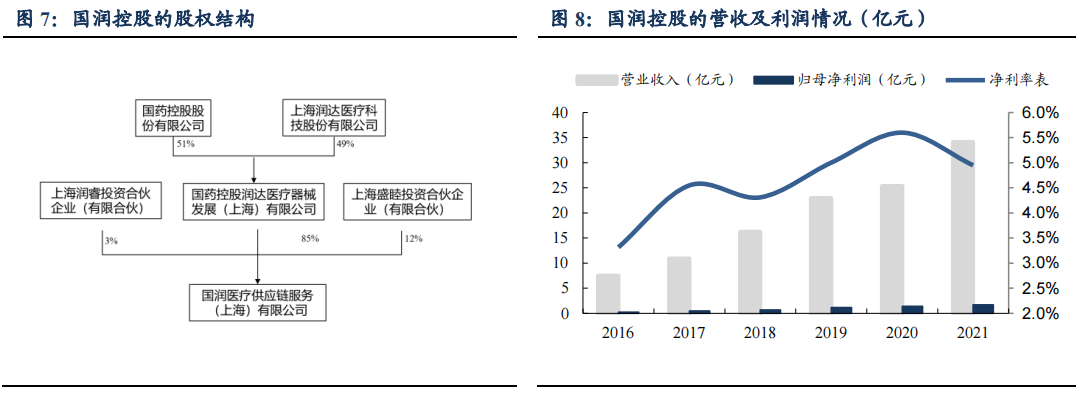

In addition, the company's joint venture of Guoyun Holdings, the company, established Gurun Holdings. The compound growth rates of revenue and mother's net profit returned from 2016-2021 were 35.4%and 46.7%, respectively. Sinopharm Holdings is China's largest pharmaceutical and health care product distributor and leading supply chain service providers. It has the largest pharmaceutical distribution network in China, which can supplement with the company, which is conducive to improving delivery efficiency and service quality.

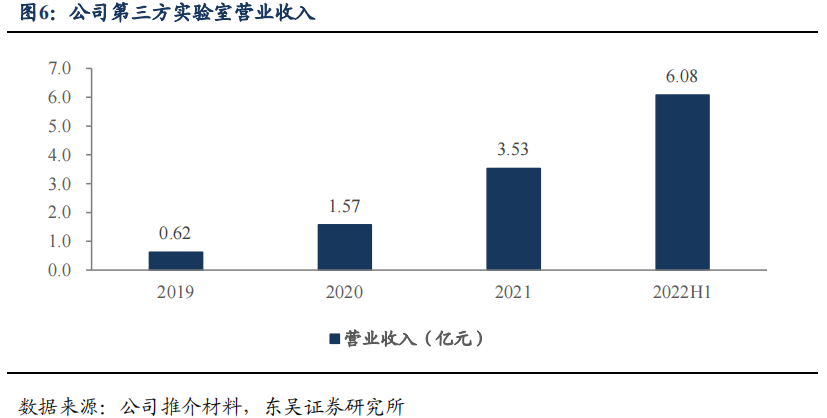

The business model continues to extend, and third -party laboratories outside the hospital step into the profit period

After the company's intensive business and regional inspection center's business stable development, the company actively deployed a third -party laboratory inspection business outside the hospital. The company's Sino -Kwanda Laboratory has a mature PCR detection foundation and has a strong and effectively responding to the operation and management capabilities of nucleic acid testing during the epidemic. In the first half of 2022, revenue reached 608 million yuan, an increase of 298.94%year -on -year. In addition, the company has increased the IVD characteristic areas, and independent brand products have covered multiple fields such as quality control, glycation, biochemistry, mass spectrometer, POCT, and molecular diagnosis. In the future, the company will continue to deploy emerging fields such as gene sequencing to further enrich and improve the independent brand product system.

Recently this column pharmaceutical & medical series:

On August 30th, "Company OTC channel advantages are significant, the product lines of autonomous andrology are rich and significant for two consecutive years, and the year of operation and performance inflection point in 2022" August 29 "The valuation is at the bottom and the fund is seriously low. Analysts are optimistic about the current medicine worthy of strategic configuration. This segmentation track coincides with policy and 100 billion yuan promotion. The demand is expected to be released in the next 3 years. "On August 28 In the second quarter, 300%increased from the previous quarter. This 5 billion market value "black horse" and the latest HIV improved variety were approved during the year. It is expected to compete for 50 billion U.S. dollars in the future "August 15" Non -alcoholic fatty hepatitis ( NASH) Pharmaceuticals or created a hundred billion markets and US stocks related companies have reached 40%a day. This company's diagnosis and treatment equipment is a must -have for research and development of NASH new drugs, and is mostly used in the huge market space of liver disease rooms. "On August 10," Global The supplier's only three high value -added raw medicines. This "small and beautiful" expansion of 6 times the scale will reach the world's first and downstream demand continued to balance.

Theme two

The research of the growth industry is too much, and the high dividend strategy has become the best solution for the current "lying". Analysts prefer these companies for reference, with the highest dividend rate of 16%

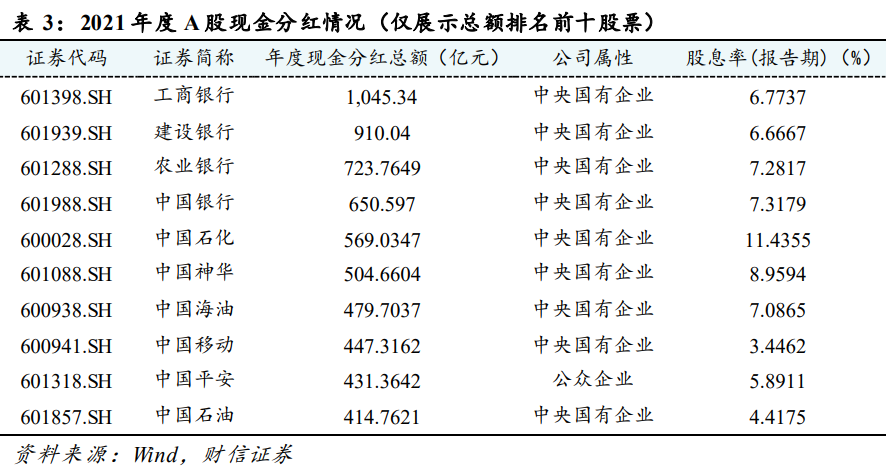

A shares have been weak in the near future, their styles have changed frequently, and their economic uncertainty will still be large next year. Under this background, the high -scalter strategy has a relative advantage. CITIC Securities Huang Hongwei believes that the overseas Federal Reserve has accelerated the tightening of liquidity, the domestic low interest rate environment and fiscal pressure highlight the value of high dividends, have the attributes of debt -like, or can win in such an environment.

This dividend rate is one of the most important indicators of high dividend investment, but in addition to this, whether the dividend distribution is stable is also one of the important factors that need to be considered. Some industries such as steel and banks are greatly affected by macro expectations. You need to pay attention to "value value value. trap".

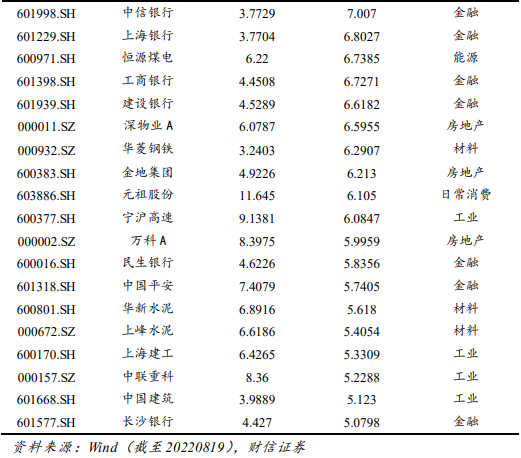

Huang Hongwei suggested that investors observe the stability of the dividend issuance of corporate interests based on 5 years. The larger and stable enterprise is the first choice. Its preferably high -dividend listed company is as follows:

The Federal Reserve ’s interest rate hike will benefit the value and high division style

High -dividend sectors are mostly concentrated in traditional industries. Large market value, high debt ratio and sufficient cash flow are its main features. It is mainly concentrated in traditional industries such as banks and transportation. When the market performance is not good, the performance of the high dividend sector is often better, which has obvious "bear market umbrella" characteristics. After 2018, the dividend sector's dividend rate rate is significantly higher than the 10 -year Treasury yield. Compared with bonds, the income obtained by investing in high dividends in the long run is also higher than bonds.

Through observing the looseness and tightening phase of the Fed in history, the domestic style is manifested as: During the loose period of US monetary policy from 2012-2015, my country's growth style is relatively good; the Fed in 2015-2018 enters the interest rate hike period, and my country's value style is relatively good; From 2019-2021, the Fed launched an unlimited quantitative easing policy, and the domestic growth style has obviously benefited. By 2022, the Federal Reserve raised interest rates, and the market style will turn to the value style again.

Low interest rate environment highlights high dividend value

Comparing the historical data of the China Stock Exchange Index with the 10 -year Treasury yield, it is found that there is a certain negative correlation between the high dividend stock stock and the interest rate.

Domestic in China is in the stage of transition from "wide currency+tight credit" to "wide currency+wide credit". The wide credit environment is good value. In the process of wide currency to wide credit conduction, the high dividend rate sector usually performs better. As my country's economy may be in a low -interest environment for a long time, high -dividend -style asset allocation will be more valuable.

Because high dividend strategies are mainly suitable for investors with long -term holding stocks, dividend rates are one of the most important indicators for high dividend investment.

In addition, the company also needs to maintain a healthy and stable cash flow and be able to continue to issue dividends every year. Therefore, it is also one of the important factors that need to be considered whether the interest distribution is stable. It is recommended that investors observe the stability of corporate dividend issuance based on 5 years.

Taken together, Caixin Securities recommends to screen low -value stocks in the sections of real estate, infrastructure, energy, consumption, banking, and public utilities.

Company 1: Runda Medical (603108)

Company 2: High dividend (Daqin Railway, Yangtze River Power, China Shenhua)

- END -

Henan will build "Henan Good Grain and Oil" nationally famous regional brand

How to further brighten Henan grain and oil brands and stimulate industrial vitality? On July 6, the reporter learned from the Provincial Food and Material Reserve that the Provincial Food and Materia

Heavy measures in Siming District!This reward is not capped

District linkage dividendHelp the company to relieve the rescueFollowing Saturday ...