In the first half of the year, the balance of inclusive small and micro loans and the dual growth of customers to help companies help enterprises to help companies play the role of "head geese"

Author:Securities daily Time:2022.09.01

1SEP

Our reporter Lu Dong's "strong profit and high dividend rate" has always been a golden signboard of the six major state -owned banks. In the first half of this year, while maintaining a steady growth of its own performance, the six major national banks, while comprehensively increasing credit investment, continued to make efforts to support the real economy and help small and micro enterprises. Related data show that as of the end of June, the total balance of inclusive small and micro loans in the first half of this year increased by 20.99%from the end of last year. The total increase in inclusive small and micro -enterprise loans increased by 1.138 million. This set of data can be said to be a true portrayal of the "head geese" in the six major states of the state -owned banks, which reflects the responsibility and responsibility of the "national team" in the financial field. As of the end of August at the end of August, the loan balance of inclusive small and micro enterprise loans and loan customers was released. While exposure the financial data of the first half of this year, the six major national banks have achieved full results in supporting the real economy and strengthening financial support for small and micro enterprises. In the first half of this year, the credit investment of the six major banks of the country was more active, achieving the "dual growth" of the growth rate of inclusive small and micro enterprise loans and households. According to the semi -annual report, as of the end of June, the balance of loans of small and micro -enterprise loans of the six major national banks was 7.84 trillion yuan, an increase of 1.36 trillion yuan from the end of last year, an increase of 20.99%. The balance of loans of the six major national -owned banks, small and micro enterprises, has increased by double -digit growth from the end of the last year. Among them, the Agricultural Bank of China ranks first with a growth rate of 28.4%; the growth rate of the Bank of China is also higher than the average level of loans in various industries; the loan balance of the postal savings bank's inclusive small and micro enterprises accounts for more than 15%of the total customer loan. Stable in the forefront of state -owned big banks. In terms of loan scale, except for the Bank of China, the remaining banks' loan balances of inclusive small and micro enterprises as of the end of June have reached a trillion yuan. Among them, the balance of loans for CCB Including small and micro enterprises reached 2.14 trillion yuan; the Bank of China and Postal Savings Bank exceeded the first time this year. In terms of inclusive small and micro -enterprise loans, the six major national banks also maintain a collective growth trend. As of the end of June, there were 8.3289 million inclusive small and micro -enterprise loans of the six major national -owned banks, an increase of 1.138 million households from the end of the previous year. Among them, the Agricultural Bank of China and CCB's inclusive small and micro -enterprise loans as of the end of June have more than two million customers, including 2.4158 million households and 2.252 million households, respectively. According to the "Notice on Further Strengthening the Development of Small and Micro -Enterprises in 2022" issued by the CBRC, under the premise of ensuring the expansion of the incremental expansion of credit, we will strive to issue a new inclusive small and micro enterprise loan in the entire year. Interest rates have decreased compared to 2021. In this regard, while the six state -owned banks are increasing, while increasing inclusive small and micro loans, this year is also focusing on reducing the interest rate of inclusive micro -loan, and reducing the cost of comprehensive financing of enterprises by actively reduced the cost of expenses. According to the semi -annual report, as of the end of June, the average interest rate of the loan loans issued by the six major state -owned banks has decreased compared with the end of last year. Inside. "The six state -owned banks of inclusive small and micro enterprises have maintained a rapid increase in loans, showing a trend of increased quantity, expansion, and price decline. It helps to promote the development of domestic inclusive finance and enhance the ability of the banking industry to serve the high -quality development of the real economy. "Zhou Maohua, a macro researcher of the Financial Market Department of Everbright Bank, said in an interview with the Securities Daily reporter. Chen Hao, a senior analyst at Xingye Research Financial Supervision, said in an interview with a reporter from the Securities Daily that many state -owned banks focused on the semi -annual report that they have created a number of inclusive online products with digital transformation and development. The online exhibition industry and cooperation with various platforms have expanded the reached surface of inclusive small WeChat support, thereby obtaining the double harvest of the number of inclusive small and micro customers and the double harvest of credit balance. "It is supported by multiple favorable factors, it is expected that the balance of small and micro loans of state -owned banks in the future will still maintain a growth trend." The coverage rate of large banks' allocation will not significantly decreased. The amount of allocation of allocation can improve credit investment capacity by thickening capital. In April this year, the country often encouraged large -scale banks with higher levels of preparation levels to reduce the coverage of allocation in an orderly manner to further increase financial support for the real economy. According to relevant regulations, the "red line" of commercial banks' allocated coverage rate was set to 150%. After the "Notice on Adjusting the Supervision of Commercial Bank Loans for Loans for Loans" was issued in 2018, the coverage of commercial banks' allocation was loosened, and the regulatory "red line" was adjusted from 150%to 120%to 150%. However, the semi -annual report shows that as of the end of June this year, the coverage rate of the six major national banks has not disappeared compared with the end of last year. The coverage rate of other large bank dialing has increased to varying degrees. However, the level of preparation rates of the six state -owned banks is large. As of the end of June, the preparation rate of the Bank of Communications was the lowest at 173.10%, and the postal savings bank with the highest allocation rate was as high as 409.25%. For the reason why there are no significant changes in the coverage of six state -owned banks, Chen Hao believes that it is mainly due to limited time.

The semi -annual report reflects the data at the end of June. It is often proposed to encourage large banks with higher levels of preparation levels to reduce the preparation coverage in an orderly manner.It is difficult to change significantly in time.However, the increase in the four preparation coverage rates has been significantly weaker than the same period last year and the second half of last year.Over time, banks with relatively high coverage of the six major national banks will be more significant in the future.Recommended reading

Vanke Yu Liang: Excessive market shrinkage will accumulate spontaneous repair momentum.

Midea, Gree, and Haier's three large home appliance giants "Finale PK": Who is the most profitable?Who is the fastest growth rate?

Picture | Bag Picture Network Station Cool Hero Production | Liu Zhizhi

- END -

Walking in front of the new bureau 丨 "multi -wheel drive" helps Tai'an "ascend to the far away"

[Lightning Comment] Deng Mount Tai and Small World. Today, Mencius's eternal sente...

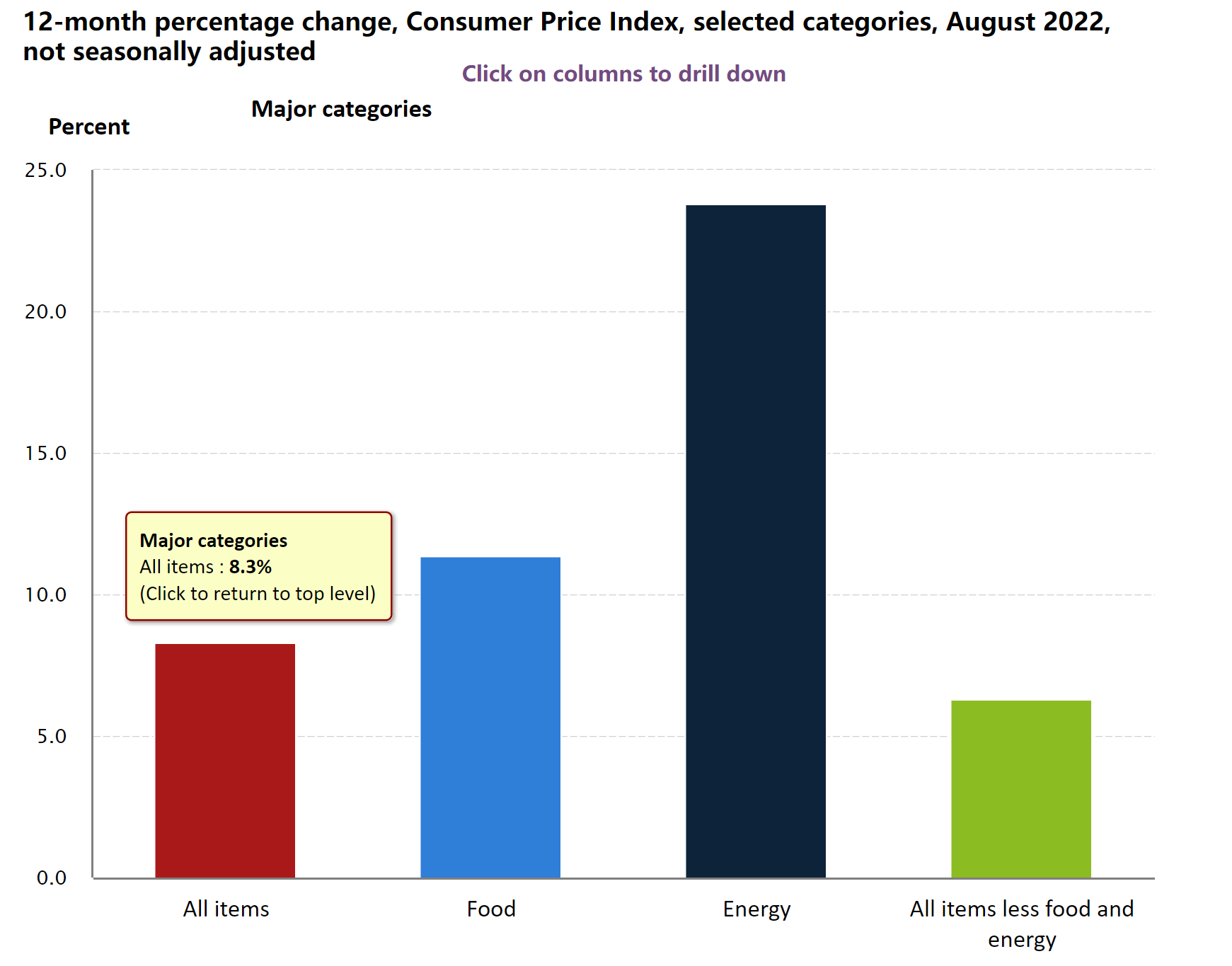

The increase in CPI in August exceeded expectations!The Dow once fell more than 660 points, and the US dollar index rose by 109, and the market began to bet on 100 basis interest rates.

On September 13, local time, data released by the U.S. Labor Statistics showed tha...