[38 tax reductions in 2022] Value -added tax policy for export cargo insurance

Author:Yunnan released Time:2022.06.19

At present, my country's economic development is facing the contraction of demand, impact, and expected weakening triple pressure. The tax reduction policy is an effective "pressure reduction valve", which helps to stabilize market entities and thereby stabilize the basic economic market. In 2022, the state implements a new combined tax support policy. It provides tax support for market entities, especially small and medium -sized enterprises, individual industrial and commercial households, manufacturing, and special difficulties.

The "2022 tax reduction and fee reduction 38" column focuses on the relevant policies of tax reduction and fees, helping enterprises and individuals better understand policies, grasp policies, make good use of policies, and release policy dividends to the greatest extent, stimulate market vitality, and stabilize market confidence.

Enjoy the subject

Domestic units and individuals that occur in corresponding cross -border taxable behavior.

Content

The following cross -border taxable behavior of domestic units and individuals exempts VAT: product liability insurance based on export goods as insurance targets; product quality assurance insurance with export goods as insurance targets.

Policy enforcement period

From January 1, 2022 to December 31, 2025

Policy basis

"Announcement on the General Administration of Taxation on Export Cargo Insurance VAT Policy" (Announcement of the General Administration of Taxation of the Ministry of Finance No. 37, No. 37)

△ Identify the QR code to view the original file

- END -

Advanced Trace of the "Top Ten Science and Technology Workers in Rural Revitalization" in Luliang City 丨 Wang Honghong and Qin Yueming

On the occasion of the sixth National Science and Technology Worker Day, the Lulia...

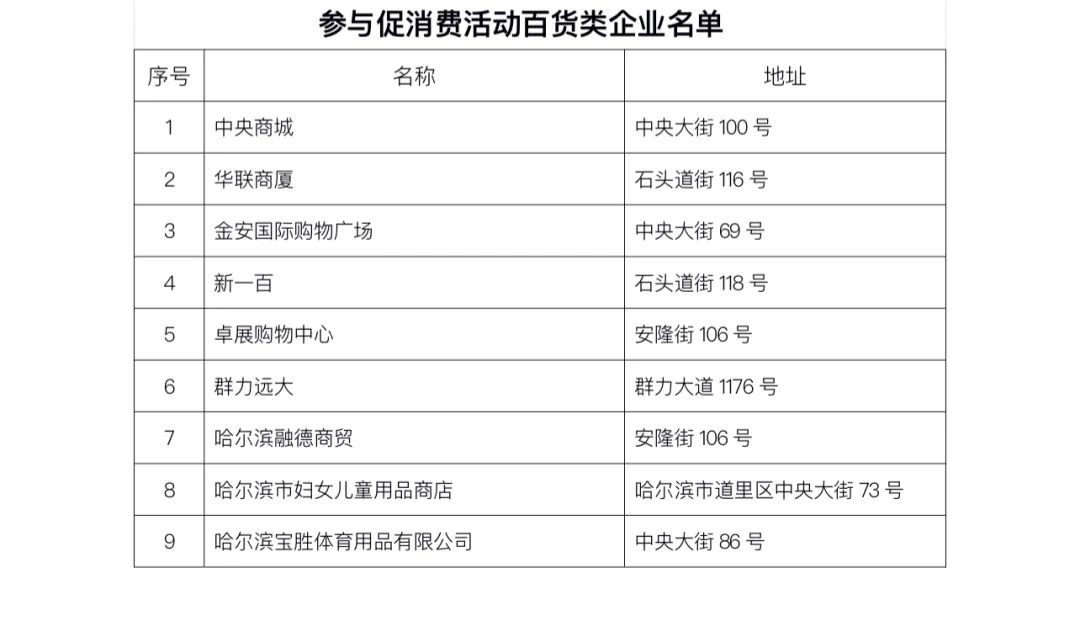

Published on the 25th!The second round of consumer subsidies are here

The reporter learned from the Daoli District of Harbin City that in order to furth...