"Bull Market Flag Man" half -year collective stall: 3 have withdrawn from the tens of billions of clubs, the company's net profit drops sharply by 16000%

Author:Zhongxin Jingwei Time:2022.09.01

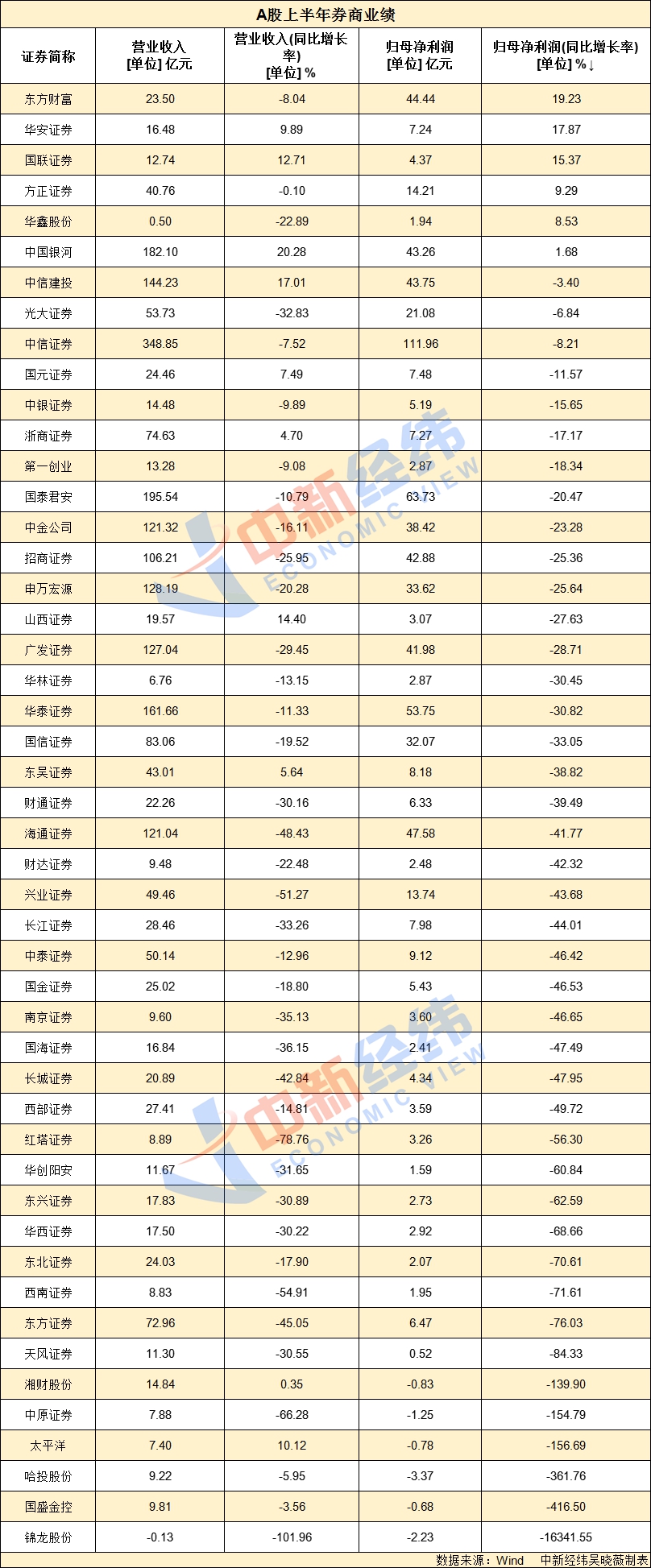

Zhongxin Jingwei, September 1st, the curtain of the central newspaper fell. In the first half of the year, the brokerage industry performed a stall from the same period last year.

The business data of the securities company released by the China Securities Association in the first half of 2022 shows that 140 securities companies' operating income in the first half of 2022 decreased 11.4%year -on -year; net profit decreased by 10.06%year -on -year, of which 115 securities companies achieved profitability.

In terms of listed companies, 10 of the 48 stocks covered by Wind Securities industry exceeded 10 billion yuan in revenue, and 13 were in the same period last year. 12.5%realized net profit is growing, while in the same period last year, this data was 77.08%. Only Hua'an Securities, Guolian Securities, and China Galaxy's three securities firms have doubled in revenue and net profit.

The net profit of only 6 securities firms is growing

Specifically, the revenue of 10 securities firms won 10 billion yuan. Among them, CITIC Securities led 34.885 billion, and Guotai Junan, who was second in the second place, had exceeded 10 billion. Subsequently, China Galaxy, Huatai Securities, CITIC Jiaotu, Shen Wanhongyuan, Guangfa Securities, CICC, and Haitong Securities ranked 10.621 billion yuan, which was about 2.3 billion yuan from the eleventh Guoxin Securities ranked 11th. Essence The revenue of Jinlong Co., Ltd. is negative, and is -13.5 million yuan.

In terms of ranking, compared to 2021, among the top ten business income, Haitong Securities has fallen from second to ninth, Guotai Junan rose from third place to second, and Oriental Securities withdrew from the top ten.

From the perspective of net profit, only six brokers have achieved positive growth, half of which are the single digits. Oriental Wealth was made up with 19.23%increase, and subsequently was Hua'an Securities, Guolian Securities, Founder Securities, Huaxin, and China Galaxy. The net profit growth rate was 17.87%, 15.37%, 9.29%, 8.53%, and 1.68%. Essence

Jinlong's net profit has dropped by 100 times year -on -year

In the ranking of performance, the largest decline was Jinlong shares, with a loss of 223 million yuan in the first half of the year, a year -on -year decrease of 16341.55%; investment income was 203.188 million yuan, a decrease of 45.89%from the same period last year. According to Jinlong's semi -annual report, the company's main business is the securities company business. The company holds 67.78%of Zhongshan Securities and 40%of Dongguan Securities.

Among them, Zhongshan Securities, the holding subsidiary of the holding subsidiary, realized operating income of 48.7371 million yuan, and realized the net profit attributable to the owner of the parent company-194.572 million yuan; the operating income of Dongguan Securities in the company's participating company achieved operating income of 1209.48 million yuan, and realized net profit attributable to the owner of the parent company. 425.7959 million yuan.

Jinlong shares explained to this that before, the securities regulatory authorities have adopted regulatory measures to restrict some business activities on Zhongshan Securities. Affected by this, the business income of Zhongshan Securities Investment Bank during the reporting period has declined. In addition, affected by the macroeconomic and industry policies, the valuation of the real estate bonds in Zhongshan Securities has fallen, and the fair value changes have suffered losses.

In terms of business, the total operating income of only one structured main business in Jinlong in the first half of the year has increased year -on -year, an increase of 150.58%.

Poor self -operated business performance

According to the China Securities Association data, in the first half of 2022, the securities industry realized the net income of agency trading securities (including the lease of the transaction unit seat) of 58.307 billion yuan, a slight increase of 0.46%year -on -year.

According to Wind data, 6 brokers of Guotai Junan, Huatai Stock Exchange, China Galaxy, China Merchants, Guangfa Securities, and CITIC were followed closely. The net income of CITIC Construction Investment and Huatai Securities agency trading securities has grown positively, and the rest has declined to varying degrees.

The net income of CITIC Securities Agent Sale Securities ranked first in the net income of 5.886 billion yuan, but fell 12.69%year -on -year. Small and medium -sized securities firms still have a high degree of dependence on the brokerage business. Founder Securities, Tianfeng Securities, Central Plains Securities, Central Plains, Hualin Securities, and Southwest Securities account for more than 40%.

In the first half of the year, a number of securities firms stated in the interim report that the main reason for the change in operating income was that self -operated business income fell year -on -year. 11 securities companies including Changjiang Securities, Xingye Securities, and Guoyuan Securities have lost their own business. In addition, the income of self -operated business income of 27 brokers such as Guohai Securities, Guojin Securities, Haitong Securities, and Northeast Securities has decreased by more than 20%. Only BOC Securities, Founder Securities, Oriental Fortune, Pacific Securities, Galaxy of China, Guilian Securities and Guosheng Financial Holdings have been growing on the same year -on -year.

These two stock prices have fallen by nearly 30 % in half a year

From the perspective of the stock price, in the first half of the year, shareholders who invested in the securities sector could not benefit well. Wind data shows that only Hualin Securities, Huaxin and Everbright Securities have achieved stock prices, and during the period, the increase was 12.03%, 6.15%, and 5.56%. In addition, Guosheng Financial Holdings rose by 0%for half a year. The most headache for investors is Caida Securities and Oriental Securities, with a stock price of 29.55%and 29.43%in half a year.

On the first trading day in September, as of the afternoon closing, the Wind Securities Index fell 0.18%in half a day.

Shanxi Securities' non -silver research team stated that with the semi -annual reports, the performance of listed brokers accelerated accelerated. At the same time, due to the differences in professional capabilities in investment banks, investment and asset management business, the performance was differentiated. Recently, the secondary market for the securities sector has performed active, and securities companies have benefited from the improvement of market recovery under the stability of the stable growth policy, which has improved valuation. It is recommended to pay attention to the recovery of performance in the second quarter, the performance of the performance of the performance of the performance, and the leadership of the wealth management institution business. The Central Plains Securities Research Report mentioned that after the July, the brokerage index continued to adjust after experiencing a large volume, and the short -term shocks were set up for a short -range shocks in the short -term platform in the end of the month. Although the equity indexes have continued to adjust, market transactions remain at a level of trillion. Since August, the securities firms have continued to fall rapidly at the beginning of the month, and approached the low level at the end of April. Then they rebounded significantly again and maintained horizontal shocks. During the short medium period, after the experience was fully adjusted, the overall operation of the industry returned to the normal state. The securities firms have the potential to challenge the high point of rebound in June again. Actively maintain the medium and long -term attention of the brokerage sector, pay attention to the specific situation of the listed brokerage interim report, and pay attention to the low valuation of the low valuation in the sector in the second quarter performance. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Huitong's disclosure of the 2022 semi -annual report achieved revenue of 2.446 billion yuan

On August 29, A -share listed companies will release the semi -annual performance report in 2022.From January 1, 2022-June 30, 2022, the company realized operating income of 2.446 billion yuan, an inc

48 projects!130 billion yuan!Inner Mongolia is full at the Silk Expo!

JPEG Webkit-Playsinline Interconnection and mutual integration • Common shared ...