Multiple insurance companies have launched "new citizens" insurance to help new citizens live happily

Author:Pole news Time:2022.09.01

Jimu Journalist Leihara

What is "new citizen"? Which groups are "new citizens"?

Recently, the concept of "new citizens" has become a hot spot in many industries. The China Banking and Insurance Regulatory Commission pointed out that new citizens are mainly due to their entrepreneurial employment, children attending school, and voting for children to live in cities and towns. They have not obtained various types of local household registration or have been obtained by local household registration for less than three years. There are currently about 300 million graduates of the New Employment University. Under the guidance of regulatory agencies, many financial institutions have introduced corresponding products and services for new citizens' financial needs in key areas of entrepreneurship, employment, housing, education, medical care, and pensions.

Screenshot of the Bank of China Supervision Web Page

Multiple aspects to improve new citizen insurance protection

In June this year, in order to improve the acquisition and convenience of financial services in Hubei New Citizens, the "Hubei Banking Insurance Industry New Citizen Financial Services Work Plan" (hereinafter referred to as the "Plan") was officially launched. Jimu Journalists sorted out and found that the "Plan" made requirements for insurance companies from various aspects such as employment, housing, education, and pension.

In terms of employment, it is required to improve entrepreneurial employment guarantees. Encourage insurance institutions to focus on new citizens, especially new citizen groups with prominent professional risks such as construction workers, courier riders, and online car drivers, carry out product innovation, strengthen the connection with work injury insurance policies, develop suitable for new citizens' occupations Employer liability insurance, comprehensive accident insurance and other businesses have improved the level of insurance protection for new citizens' entrepreneurial employment.

In terms of housing, housing rental insurance protection services should be increased. Support insurance funds to provide long -term financial support for affordable leased housing projects through direct investment or subscription of debt investment plans, equity investment plans, and insurance fund funds; encourage affordable leased housing project owners at the project construction period to build project insurance projects under construction. Insurance, the property and insurance of the property insurance operated by the project during the project operation period; actively strengthen the innovation of insurance products, carry out insurance business such as the leaser liability insurance, the lessee liability insurance, etc. to support the development of the long -term rental market; promote and promote family property insurance Citizen families resist the risk of property loss.

In terms of education, insurance institutions are encouraged to actively develop insurance businesses such as academic insurance, children's promotion subsidy insurance, internship liability insurance, and education institution liability insurance; actively develop inclusive prior education liability insurance and accident insurance business The worries of the previous children's education.

In terms of pension, the development of new citizens' pension financial products. Increase the income characteristics of new citizens such as new industries, new industries, and various flexible employees, and the promotion of the exclusive commercial pension insurance products of pension needs, and do a good job of expanding the pilot work.

Multiple insurance companies have launched new citizen insurance

Due to factors such as large work liquidity and "separation of households", the flexible new citizen groups who are flexible do not basically have no basic social medical protection in the local area, and have weak resistance to diseases and accidents. huge loss.

In this regard, the China Banking Regulatory Commission promotes insurance institutions in the province to accelerate the promotion of urban customized commercial health insurance, incorporate new citizens into the scope of insurance, so that new citizens can enjoy high -quality insurance services of "low price, full guarantee, and high insurance amount" to meet New citizens' multi -level health protection needs prevent poverty due to illness. At the same time, the insurance institutions are encouraged to strengthen the innovation of insurance products in response to the short -term and temporary workers of the new citizen group to meet the actual needs of new citizens in various living scenarios. High -efficiency health insurance product services.

The reporter learned that at present, Hubei Provincial Branch of PICC Property Casino provides 23 insurance products in serving new citizens, of which: 11 in employment and entrepreneurship, 3 in peacetime and consumption, 6 training and children's education, health medical care, health medical care There are 3 ones. From January to May this year, a total of 2,530 insured units and 2.69 million personnel provided risk protection 1.4 trillion yuan, and a total of 110 million yuan had been paid. In order to reduce the risks such as accidents and travel safety facing new citizens in work travel, people's insurance launch a flexible employment version of personal accident insurance, small and medium -sized micro -enterprise Anfu insurance group insurance products, providing risk protection for 12 small, medium and micro enterprises and insurance individuals 30.78 million Yuan. In order to reduce the risk of accidents in the work of online car drivers, the company launched the Harro Shunfeng car driving risk, providing 1.78 million people with a risk guarantee of 800 billion yuan.

Taikang's online "New Citizen Employer Responsibility Insurance" as an example. It is reported that the above -mentioned products are created by the problem of work injury protection of the "new citizen" group, which can provide protection including dying disability, accident medical care, misrepresents, nutritional fees, and third party responsibilities.

China Taibao targets the financial needs of new citizens in key areas of entrepreneurship, employment, housing, education, medical care, and pension, strengthen product and service innovation according to local conditions, expand financial supply at high quality, and enhance the equalization and convenience of financial services. In terms of supporting new citizens' entrepreneurship, China Taipu Insurance has pioneered products such as "Talent Entrepreneurship Insurance" and "Entrepreneurship Security Insurance". Through the project's full life cycle management, "insurance+service" and other models, the entrepreneurial team relieves the worries of the entrepreneurial team.

- END -

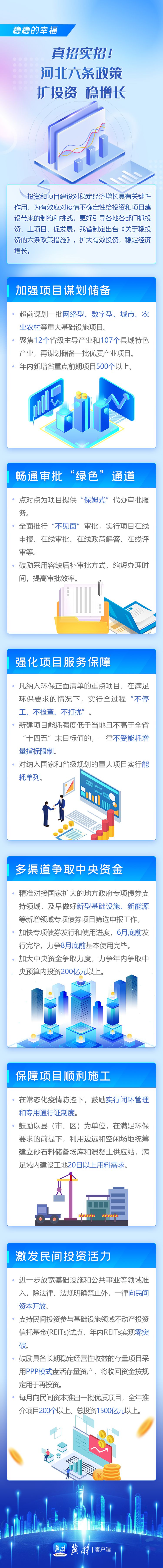

Real tricks!The six policies of Hebei have expanded investment in investment steadily

Text Source: Hebei Provincial People's Government website

Chen Guo, secretary of the party committee and president of the Yueyang Branch, went to Yunxi District Sub -branch to carry out key work supervision

Chen Guo, secretary of the party committee and president of the Yueyang Branch, went to Yunxi District Sub -branch to carry out key work supervisionOn the afternoon of September 4th, Chen Guo, the par