Latest deployment: Flexible use of special borrowings of the insurance delivery building!Real Estate ETF (159707) continues to rise by 2.7%

Author:Capital state Time:2022.09.01

On the first trading day in September, the A -share real estate sector continued to rise!Huafa rushed to the daily limit, Binjiang Group exceeded 5%, Vanke A, China Merchants Shekou, Sunshine City, and Nanjing Hi -Tech rose more than 2%.

Real Estate ETF (159707) has continued to rise in the market. So far, it has risen 2.7%. The one -hour transition rate of 1 hour in the morning is 10%, which continues to be active.

On the news, on August 31, the relevant meeting pointed out that supporting rigid and improving housing needs, local "one city, one policy" should be used to make good use of policy toolboxes, and flexibly use staged credit policies and special borrowings for insurance.

The special borrowing is accurately focused on the "keeping traffic, stabilizing the people's livelihood", and the dedicated of closed operation and special funds.

In this regard, Everbright Bank analysts pointed out that domestic real estate is currently in a stable stage.In response to the current situation of the property market, supporting policies in various places, using sufficient credit policy space, will better support the resumption of stability in the real estate market!

- END -

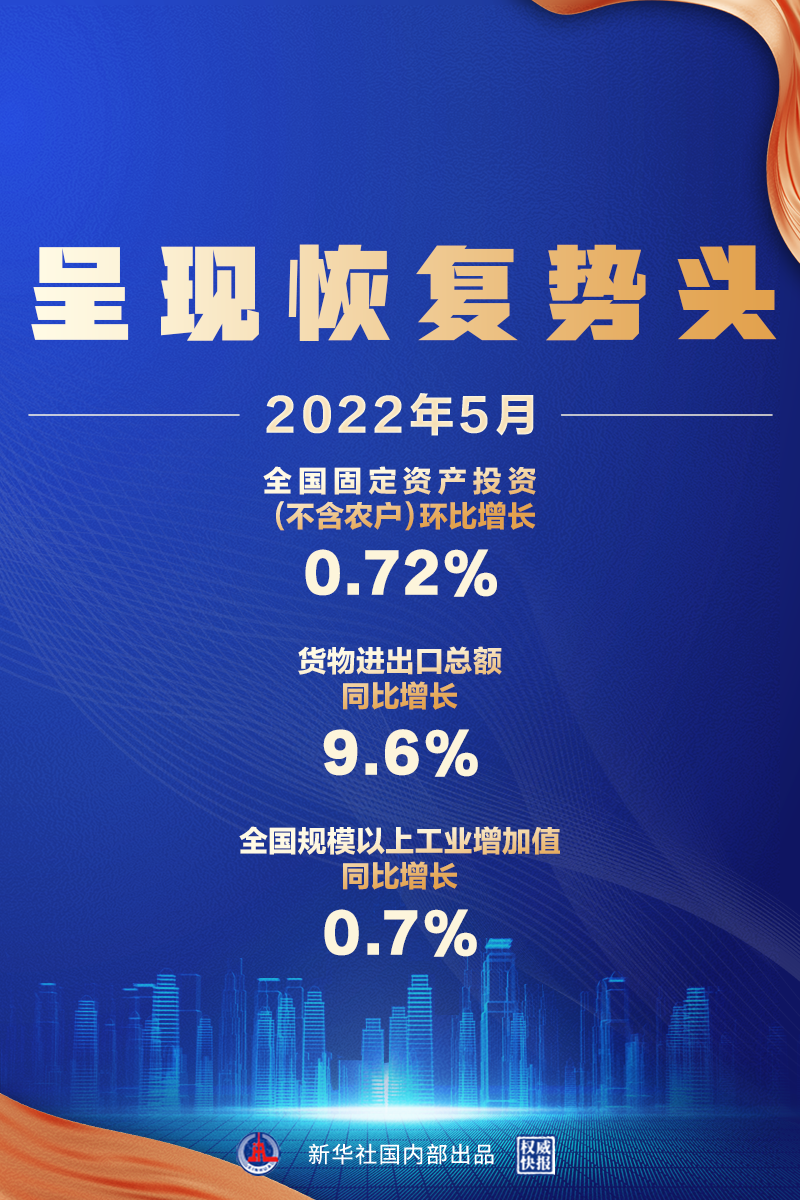

In May, the national economy operation showed a restoration momentum

According to the National Bureau of Statistics released data on June 15MayNational...

Tai'an Publishing and Printing Industry Chain to Beijing to carry out chain investment promotion activities

Qilu.com · Lightning News August 7th from August 4th to 5th, the Standing Committ...