In August, the manufacturing PMI rose to 49.4% of the production and operation activities of my country's enterprises, the general recovery trend

Author:Securities daily Time:2022.09.01

On August 31, the National Bureau of Statistics released data. In August, in August, the manufacturing procurement manager index (PMI) was 49.4%, which was lower than the critical point, an increase of 0.4 percentage points from the previous month, and the level of manufacturing prosperity picked up.

Zhao Qinghe, a senior statistician of the Service Industry Survey Center of the National Bureau of Statistics, said that in general, in the face of unfavorable factors such as epidemic and high temperature, various regions and departments conscientiously implement the decision -making and deployment of the Party Central Committee and the State Council. Development.

From the perspective of the classification index in August, the five classification indexes that constitute the manufacturing PMI were lower than the critical point. Among them, the production index was 49.8%, which was the same as last month; the new order index was 49.2%, which was higher than 0.7 percentage points last month. Both index continued in the contraction range, indicating that the recovery of manufacturing production needs to be strengthened.

Dongfang Jincheng chief analyst Wang Qing told the "Securities Daily" reporter that in August, the production demand index was "one flat and one liter", and the production index continued to be in the contraction range. Production caused certain disturbances; and the new order index rose in August, mainly driven by a new round of stable growth policy.

It is worth noting that the policy effect of stabilizing the economic market is still emerging. On August 15, the People's Bank of China launched a 400 billion yuan medium -term loan convenience (MLF) operation (including the continuation of MLF expiration on August 16) and the 2 billion yuan open market reverse repurchase operation, MLF operation and open market reverse The bid interest rates of the repurchase operation have decreased by 10 basis points.

On August 24th, the State Frequently deployed the continuation policy and measures for the stability of the economy. On the basis of the first 33 measures, 19 continuation policies were deployed.

Wen Bin, chief economist of Minsheng Bank, told reporters of the Securities Daily that these policies are expected to form a joint force, thereby promoting credit expansion, "ironing" economic fluctuations, and further consolidating the foundation of economic restoration development.

In August, the price index rose low. The purchase price index and the factory price index of the main raw materials were 44.3%and 44.5%, respectively, an increase of 3.9 percentage points and 4.4 percentage points from the previous month. The overall level of the manufacturing market price was narrowed.

"Recently, the price of international commodities such as crude oil has gone through a wave of downward processes, which are transmitted to the country. At the same time, it is affected by many factors such as the policy stability policy, and the price of building materials such as domestic coal and cement is also in a downward trend." Wang Qing Say.

Zhao Qinghe said that the results of the survey showed that the proportion of enterprises that reflected high raw materials in August accounted for 48.4%, a decrease of 2.4 percentage points from the previous month. The first time in the year was less than 50.0%, and the cost pressure of corporate costs relieved.

Wang Qing predicts that the PPI in August may fall from 4.2%last month to about 3.0%. This means that the cost pressure of raw material costs in the early and downstream companies in the early stage is significantly alleviated, which also helps to maintain overall domestic prices in the second half of the year.

From the perspective of the size of the enterprise in August, the large enterprise PMI was 50.5%, an increase of 0.7 percentage points from the previous month, and returned to the critical point. The PMI of the medium -sized enterprise was 48.9%, an increase of 0.4 percentage points from the previous month, which was lower than the critical point; The PMI of small enterprises was 47.6%, a decrease of 0.3 percentage points from last month, lower than the critical point.

Data show that in August, the non -manufacturing business activity index was 52.6%, a decrease of 1.2 percentage points from the previous month, and it was still higher than the critical point. Non -manufacturing maintained recovery expansion for three consecutive months.

The reason why Zhao Qinghe analyzed said that on the one hand, the recovery of the service industry slowed down. In August, affected by factors such as the epidemic and high temperature weather, the business activity index of the service industry fell to 51.9%, which was 0.9 percentage points from the previous month, which was still higher than the critical point, and the pace of expansion of the service industry slowed down. On the other hand, the construction industry has maintained a rapid expansion. The business activity index of the construction industry was 56.5%, which was lower than 2.7 percentage points last month. It is still located in the high boom range. The construction industry production activities continue to expand.

Wen Bin said that under the context of the use of special bonds and successively landing on the end of August and the development of developmental policy, infrastructure investment remained rapidly growing. In August, the new order index and business activities of the construction industry are expected to recover 2.4 percentage points and 1.9 percentage points to 53.4%and 62.9%compared with the previous month. The employee indexes are flat at 47.7%, indicating that infrastructure project construction has accelerated, and market demand has available market demand. After the rise, the employment of the enterprise continued to increase, and the industry maintained a steady growth.

"However, the real estate industry is still weak." Wen Bin said that from the perspective of high -frequency data, the area of commercial housing in 30 large and medium -sized cities in August decreased by 21.3%year -on -year. Fall 9.1%. However, with the lowering of LPR more than 5 years and policies such as credit in the "one city, one policy", the real estate industry is expected to usher in a phased inflection point.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said in an interview with the Securities Daily reporter that from the perspective of the trend, domestic economic demand is in the track of restoration, and the real estate market is in the stage of stabilizing the recovery. The pace will be accelerated again.

- END -

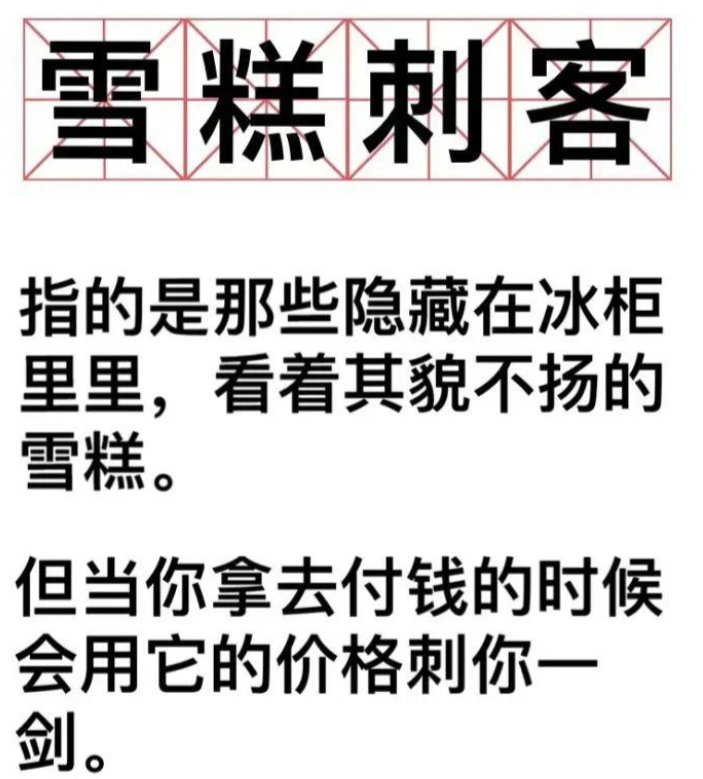

Let the "ice cream assassin" go!It will be implemented from July!

This summer, the word ice cream assassin became hot.What is the ice cream assassin...

During the middle school entrance examination, Wuhan buses are arranged like this

Jimu News reporter Huang YongjinCorrespondent Wei Xinbo Tu ShuxueIntern Hu YutongO...