The PRO store is Wang's "small step fast run": Naixue's tea in the first half of the year stores exceeded 900 online revenue accounted for 80%

Author:Daily Economic News Time:2022.08.31

Nai Xue decided to adopt a large -scale model to expand more cautiously.

On August 31, Naixue's tea (HK02150, a stock price of HK $ 5.71, a total market value of HK $ 9.793 billion) announced the half -annual report in 2022. The report shows that Nai Xue's tea achieved operating income of 2.045 billion yuan in the first half of 2022, a decrease of 3.8 year -on -year decrease %. In the first half of 2022, Naixue's tea record store operating profit was 195.6 million yuan, a decrease of 49.2%from the same period in 2021.

It is worth mentioning that Nai Xue is gradually changing the "big shop model" of the target Starbucks at the beginning of the brand's founding. This strategic adjustment can also be seen from its newly opened store type: 87 stores newly opened in the first half of this year are PRO stores.

Naixue's tea Pro shop picture source: Every reporter Wang Ziwei

Not only do you not open a new standard store for the time being, in the financial report, Naixue also said that in the future, there will be current standard stores on the premise of "lease expires or other leases of mall fires, and it will be transformed into PRO tea shops one after another."

One of the reason for the adjustment of the pressure comes from the rent. In the financial report, Nai Xue said that a key to the improvement of profitability in the future is the control of rental costs; and said that in early 2022, the company has re -evaluated some existing stores with relatively high actual rental cost ratios and re -evaluated, and ones, and on. Some stores seek to re -negotiate rent or take other adjustments to reduce the rigidity of rent costs.

Naixue hopes to maintain the actual rental cost of the store level within 15%in the short term.

At present, the large shop model is temporarily stranded, on the one hand, it shows Naixue's desire for profit. Earlier, Naixue issued an announcement that in June, Nai Xue's monthly unprecedented comprehensive management account achieved profitability.

On the other hand, it is the new tea "have to": in the PK of the new tea and the coffee market, the cost is always high and the first opportunity will not be available, and the new consumer market now has begun to cool down. Perhaps the new tea drink in the future. Players will be stricter to efficiency and cost.

Open the store while reducing costs and efficiency

This financial report gives people this kind of atmosphere: Nai Xue's tea now opens the shop while carefully calculating the input output ratio.

The semi -annual report shows that as of June 30 this year, Naixue has 904 self -operated stores in 85 cities across the country, of which 87 stores have been opened in the first half of the year, an increase of nearly 350 in June last year.

Naixue's tea standard store picture source: Photo by reporter Chen Qing

It should be noted that the newly opened stores in the first half of the year are all PRO store types, that is, they are all non -big shops.

In fact, Naixue's tilt of the PRO store was already obvious when it was listed. In the prospectus, Nai Xue said that from 2021-2022, Naixue's tea will be mainly opened about 300 and 350 Naisue tea stores in first-tier cities, new first-tier cities, of which about 70%of the store planning is planned as as a store plan. Naixue Pro store.

Naixue explained that when the store location is the same or similar, the income of the PRO tea shop is basically the same as the standard tea shop, and the rent and labor cost of the PRO tea shop have decreased compared to the standard tea shop. The PRO Tea Store model has been better verified.

However, deep reasons or profit margins are related to profit margins: In the first half of 2022, Naixue's tea drink store store operating profit margin was 10.4%, a decrease of 8.8 percentage points from the same period in 2021.

Zhu Danpeng, vice chairman of the Guangdong Food Safety Promotion Association, once again emphasized the reporter of the Daily Economic News that compared with coffee, new tea drinks in standardized operations, food safety and quality, and the number of personnel. High requirements.

The labor cost of large stores is relatively higher. Data show that Ruixing Coffee, which is famous for its refined operating system and the ultimate cost, has only 1.7 full -time employees in one store, and the others are part -time. The reporter once visited the Naixue Store and found that the number of employees of a large shop is more than 15.

The number of people is not because the digitalization of new tea is lower than that of coffee, but the program is more complicated. Lin Yue, the chief consultant of Lingyan consulting, told reporters that unlike coffee, the new tea series are mostly promoted according to the season and seasonal, and their relying on manpower is higher than coffee.

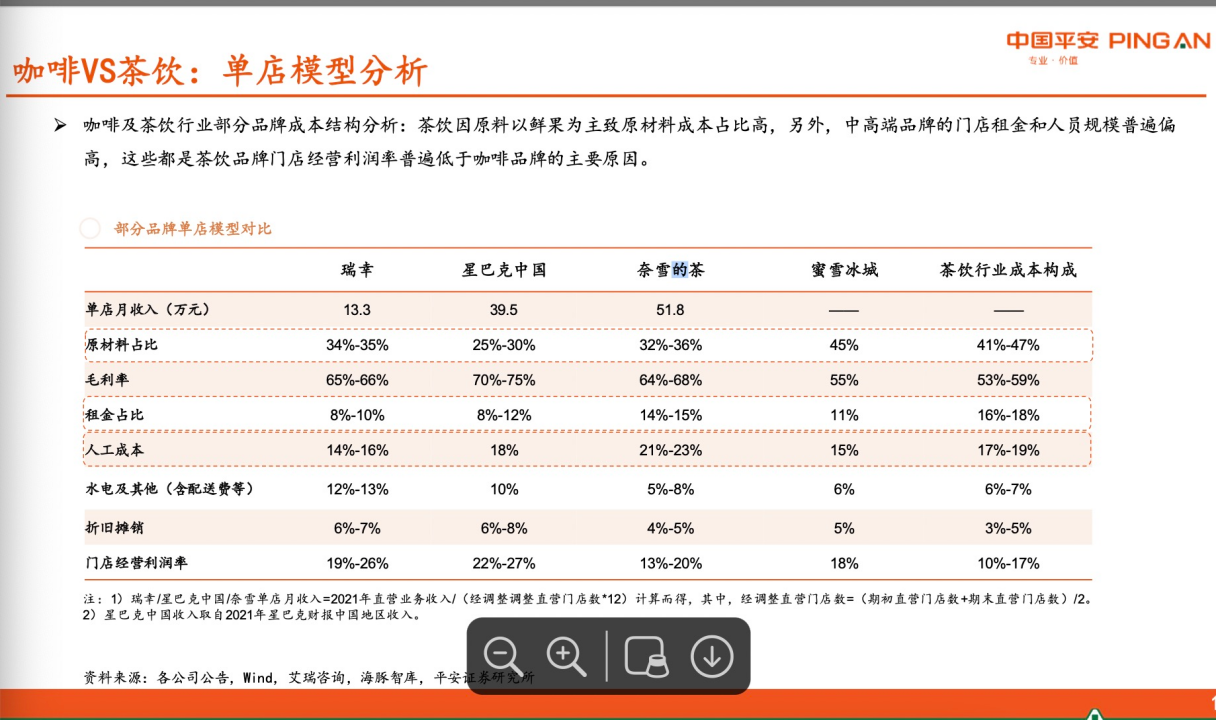

The research report of Ping An Securities also shows that in the analysis of coffee and tea single -store model analysis, the cost of tea is the main cost of fresh fruit as the main cost of raw materials; the other large piece is artificial and store rents.

Single shop model analysis of coffee and tea sources: Ping An Securities

Fruit tea is the "main force" of new tea products, and naturally cannot be cut. Manpower and renting is the main direction of Naixue's control cost.

In fact, to achieve cost reduction and efficiency, this is a problem placed in front of the new tea brand.

Internal inside of Naixue revealed to the media that the PRO store through automated equipment and overall SOP design, in terms of labor costs, conservative estimates can save 2%~ 3%than standard stores. At the beginning of the listing, the profit margin of the PRO store and the standard store had the same profit, but the cost of rent in the PRO store in the future will basically be less than 10%.

Digitalization and retail business bring new increment

Nai Xue's digital construction has been quite effective.

The financial report shows that Naixue's online order revenue accounted for 80.1%in the first half of the year. In terms of members, as of June 30, the number of members of Naixue reached approximately 49 million, an increase of 5.7 million from the end of 2021. The repurchase rate of active members was about 33.6%, an increase of 3.3 percentage points from the same period last year. Nai Xue also polished continuously in machine use to improve operating efficiency. It is understood that its self -developed "automatic milk tea machine" has been put into use in more than half of the country.

Nai Xue said that it is expected to complete the national store promotion plan on schedule by the end of September. The reporter learned that Naixue is still promoting a series of equipment such as automatic milk cover and automatic tea soup, and further improves operating efficiency.

It is also due to the light manpower model of digital transformation and PRO stores. At present, the labor cost rate of Naixue Single Store has dropped to 18.9%. In contrast, in Naixue's prospectus of the year, the cost of personnel from 2018 to the listing, accounting for 28%to 31%each year.

Since the first half of this year, the new tea -drinking head brand has begun to reduce the price. Nai Xue and Xisha tea have been reduced, stabilizing the price of the product under 35 yuan, and launched a number of new milk tea products of 19-25 yuan to seize the mid-range price belt.

The price reduction strategy does help a lot. And the new competitiveness also brought sales guarantee to Naixue. For example, this summer launched a large -capacity fruit tea series such as "domineering one -liter" and "domineering bucket melon", which sold more than 1 million cups for a week.

In addition to the current tea drinking, in the retail business, the semi -annual report pointed out that many bottles of pure tea, fruit tea and bubble aquatic products have entered offline chain malls such as Naixue. At the same time, online channels and offline stores sell. Naixue said that the three major business segments of "current tea", "Naixue Tea" and "Naixue Fruit Tea" have been formed.

However, due to the cost of laiding in the early stage, the retail business is expected to record a loss this year. However, Nai Xue has high hopes for this and said that the retail business will help increase the contact with potential consumers in the short term and help build brand cognition; in the long run, there will be another driving force for the company to continue to grow. The performance of the business will be listed separately in the 2022 annual performance announcement.

Daily Economic News

- END -

Dalen's half -year loss of 6.4142 million yuan in 2022 stopped profitable

On August 1, Darren (code: 835834.NQ) released the performance report of the 2022 Half -Annual Report.From January 1, 2022-June 30, 2022, the company realized operating income of 48.917 million yuan,

The national small and medium -sized enterprises reached 48 million households "specialized new" enterprises thrive

The Economic Reference News published an article on August 31 The National Small a...