The "bleeding" of Tuhu car "bleeding" impact: 14 billion yuan and a half years, and the stores have reduced 5,800 stores in half a year.

Author:Radar finance Time:2022.08.31

Radar finance produce | Li Yihui edited | Deep Sea

After a lapse of seven months, Tuhu's car raising impacted the capital market again.

On August 29th, according to the documents of the Hong Kong Stock Exchange, Tunhu's car raising and then submitting a listing application materials to the Hong Kong Stock Exchange prepared to be listed on the main board of the Hong Kong Stock Exchange. Essence

On January 24 this year, the Touki car raising was submitted to the Hong Kong Stock Exchange. The prospectus failed on July 25 this year. The updated prospectus shows that Tuhu still loses obvious losses.

In the first half of 2022, Tuhu's car maintenance achieved revenue of 5.468 billion yuan, a loss of 952 million yuan. From 2019 to 2021, the revenue of Tuhu car maintenance was 7.040 billion yuan, 8.753 billion yuan, and 11.724 billion yuan, respectively. During the period, the loss was 3.428 billion yuan, 3.928 billion yuan, and 5.845 billion yuan.

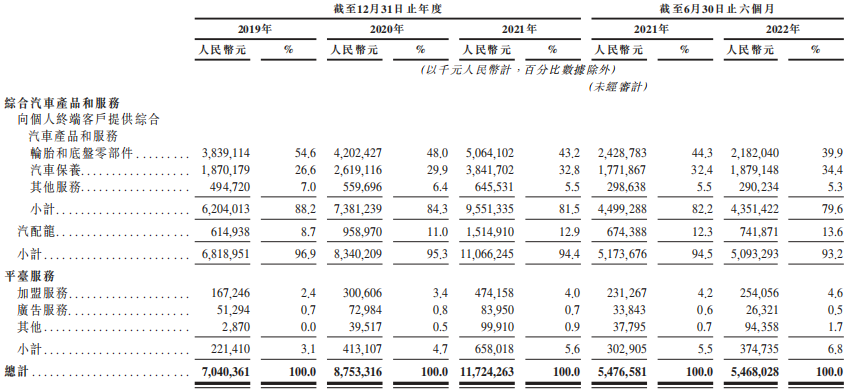

The income of Tunhu car maintenance includes two categories: comprehensive automotive products and services, and platform services. The former is subdivided into tires and chassis parts, car maintenance, other services, auto parts dragons, etc. The latter serves franchise services, advertising services and other.

In terms of stores, there are three different types of stores in Tunhu, namely self -operated stores, Touki Factory Stores, Joining Touhu Workshop Store and third -party cooperation stores. In the first half of 2022, the company's revenue from joining, self -employment, cooperation and direct sales was 4.055 billion yuan, 255 million yuan, 376 million yuan, and 358 million yuan. Obviously, the company's revenue relied on the franchise model.

However, in the first half of this year, the company has reduced 5,862 stores, mainly due to the relocation of the Touki workshop store, poor performance, and personal reasons for each franchisee.

At present, there is more than Tuhu family in the automotive aftermarket. Tmall car maintenance and JD.com are also staring at it, especially JD.com's plan to expand to 100 core cities this year, which will bring challenges to Tuhu.

In the first half of the year, the revenue dropped slightly, and the loss was difficult to solve

The prospectus shows that the Tuhu car maintenance was established in 2011. The founder was Chen Min. At first, it cut into the car after the car with tire e -commerce.

During the eight years from 2013 to 2021, Tuhu maintained a total of 16 rounds of financing. Investors were not short of well-known enterprises such as Tencent, Baidu, FAW, Sequoia China, Gaoma Capital, Junlian Capital, and Yue Capital.

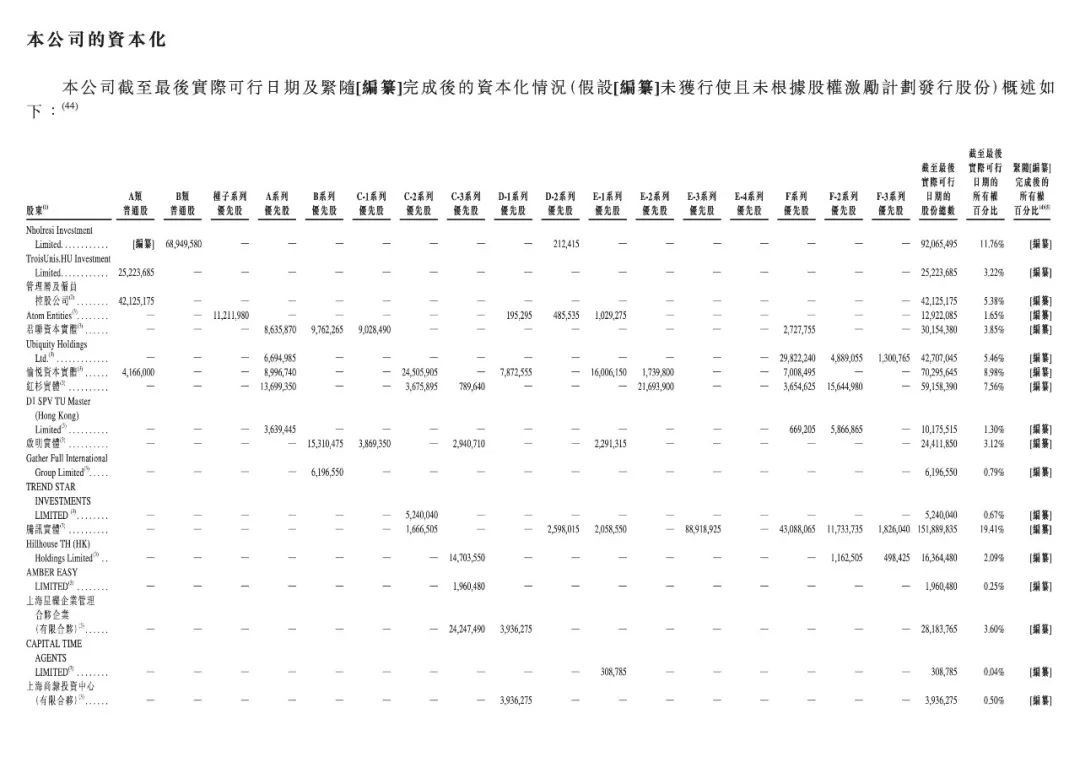

Before the IPO, Tencent's company held a total of 19.41%of the Landhu car maintenance, Chen Min, chairman and CEO of the company's board of directors, held 11.76%of the shares, 8.98%of the share capital entities, 7.56%of Sequoia China, Fangyuan Capital Holding 5.46%, the company's co -founder and president Hu Xiaodong holds 3.22%.

The prospectus shows that the company is one of China's leading online integrated car service platforms. With the customer -centric model and efficient supply chain, the company creates a car service ecosystem consisting of car owners, suppliers, car service stores and other participants.

As of the middle of 2022, the company's online store revenue accounted for nearly 75%, which was the main income model. In the same period, the registered users of the Tuhu platform were 86.4 million, the transaction users were 15.7 million, and the average monthly active households were 9 million.

From 2019 to the first half of 2022, the revenue of Tunhu's car raising was 7.04 billion yuan, 8.753 billion yuan, 11.724 billion yuan, and 5.468 billion yuan. In the first half of this year, revenue declined slightly compared with 5.477 billion yuan in revenue in the same period last year.

In terms of profits, from 2019 to 2021, in the first half of 2022, the company lost 3.428 billion yuan, 3.928 billion yuan, 5.845 billion yuan, and 950 million yuan. The total loss of three and a half years reached 14.153 billion yuan. Among them, the losses narrowed sharply in the first half of this year, and the loss of 3.125 billion yuan in the first six months last year.

The company said that due to the previous issuance of a large number of convertible and redeemed preferred shares, its fair value changes seriously affect the company's performance until it is converted to ordinary shares. From 2019 to 2021, the losses caused by changes in the fair value of preferred shares were 1.9 billion yuan, 3 billion yuan and 4.4 billion yuan, respectively.

If you deduct the fair value loss of such convertible redeemable priority shares, only look at the adjustment of net loss data, the company loses 1.036 billion yuan, 894 million yuan, 1.285 billion yuan, and 428 million yuan from 2019 to 2022, and still 428 million yuan. Showing increasing income and increasing profits.

From the perspective of income structure, the income of Tuhu car maintenance includes two categories: comprehensive automotive products and services, as well as platform services. Services, advertising services and others.

Among them, the income contribution of tires and chassis parts and car maintenance is high.

However, from the perspective of growth trends, the proportion of revenue of Tunhu's tires and chassis parts has been declining, from 54.6%in 2019 to 39.9%in the first half of 2022. The proportion of revenue of automobile maintenance business showed an upward trend, from 26.6%in 2019 to 34.4%in the first half of 2022.

In addition, from 2019 to 2021, in the first half of 2022, the gross profit of Tunhu's car raising was 523 million, 1.080 billion, 1.870 billion, and 997 million yuan; the gross profit margin in the same period was 7.4%, 12.3%, 16.0%, and 18.2%. Specifically, the platform serves the highest gross profit margin, with more than 70%during the period; followed by 28.7%in the first half of the year, and the gross profit margin of tires and chassis components is 13.3%. As of June 30, 2022, the cash and cash equivalents of Tuhu car were 3.133 billion yuan, and the company's corresponding liabilities during the same period were 5.142 billion yuan.

Half -year stores reduced 5,862, and the income dependence on franchise model

At present, there are three different types of stores in the Tunhu car, namely the self -operated Touhu workshop store, joining the Touhu Workshop Store and a third -party cooperation store.

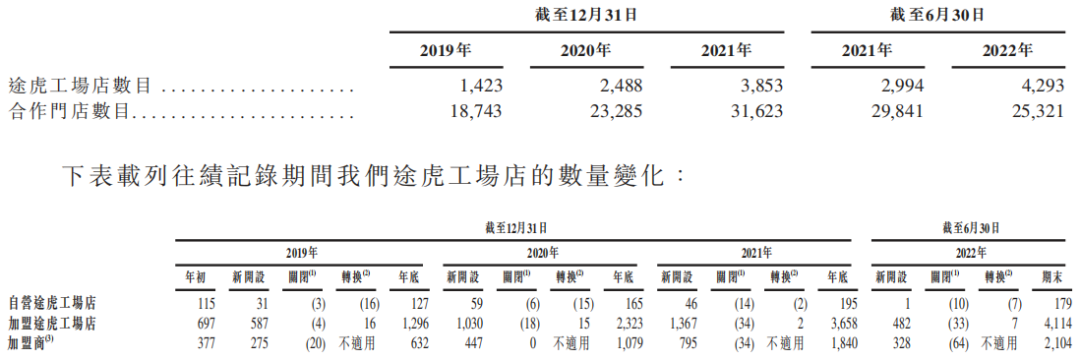

The prospectus states that joining the Touki Factory store is operated with the same standards and proprietary technical systems as the self -operated Touhu workshop store. As of June 30, 2022, the Touhu Workshop Store Network included 179 self -operated stores and 4114 franchise Touhu workshop stores (managed by 2104 franchisees).

Compared with half a year ago, this set of data has decreased, and franchise stores have increased. According to the previous prospectus disclosed by the company, as of September 30, 2021, the Touhu's workshop network included 202 self -operated stores and 3,167 franchise Touhu workshop stores (managed by 1538 franchisees).

All the Touhu workshop stores make the use of the tiger brand. Among them, joining the Touko workshop store is the company's strategic focus, which can help Tunhu expand in efficiently in the light asset model.

In addition, Tunhu also has a large number of "cooperative stores" all over the country. It mainly provides installation services to customers who order the online platform through Tunhu. At the same time, accumulate customer insights.

As of June 30, 2022, Tunhu had 2,5321 cooperative stores across China. In contrast, in the prospectus announced in January, Tunhu said that as of September 30, 2021, the company had 33,200 cooperative stores in China.

However, since the third quarter of last year, Tunhu's workshop stores and three -party cooperation stores have opened a round of shrinkage.

According to the latest disclosure, as of December 31, 2021, it was 3853 Touhu Workshop Stores and 31,623 cooperative stores, with a total of 35,476.

As of June 30, 2022, Tunhu car maintenance has 4,293 Touhu workshop stores (4114 of which is operated by franchisees) and 25,321 cooperative stores, with a total of 29,614.

Based on this calculation, in the past six months, Tuhu's car raising has been reduced by 5,862 stores, of which 440 in the workshop store and 6,302 cooperative stores.

In the prospectus, Tunhu's car raising stated that during the track record, the company closed a small number of franchise stores, mainly due to the relocation of the Touki workshop store, poor performance, and personal reasons for each franchisee.

In addition, there are some self -operated Tutu workshop stores converted to joining the Touki workshop store. Taking the first half of this year as an example, Tunhu opened a new self -operated store and closed 10 self -operated stores. The other seven self -operated stores were converted into Tunhu franchise stores.

From the end of 2019 to the end of the first half of 2022, the self -operated Touki workshop stores of Touhu carried car were 127, 165, 195 and 179, respectively.

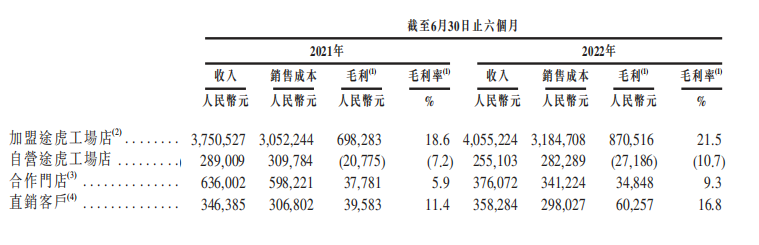

From the perspective of income, franchise stores have contributed most of Tuhu's revenue, and the company's gross profit is mainly contributed by the franchise model. Self -operated stores are still in a state of gross loss.

Taking the company in the first half of 2022, the company's income from joining, self -employment, cooperation and direct sales was 4.055 billion yuan, 255 million yuan, 376 million yuan, and 358 million yuan.

During the period, Tuhu's self -operated stores lost 27.19 million, but the franchise model achieved gross profit of 871 million yuan and gross profit margin of 21.5%. At the same time, the gross profit margin of the cooperative store was 9.3%, which was lower than the franchise model, but higher than the self -operated model.

Tuhu is quite dependent on the franchise model, but how to manage franchise stores and unified service levels is a challenge. Earlier, some media commented on the chaos of "black under the light" of Tuhu Gate. On the black cat complaint platform, there are a total of 976 complaints related to Touyu car raising, involving false propaganda, stored in the store to deceive consumers and service attitude.

According to the information of Tianyan, there is also a leakage of the management of Tuhu's car maintenance on their own employees, and they have been punished in a timely manner for failing to submit employee information. Specifically, in mid -February 2019, Zeng Mou and Hu were located in the work point of Shanghai Mansu Information Technology Co., Ltd., the main body of the Touhu car maintenance operation entity in the Ushangyu Economic and Technological Development Zone of Hangzhou Bay, to work. The limited company did not submit the information of the two to the public security organs on time, and at the same time did not informed the two to apply for residential registration, and was seized by the public security organs. According to Article 8 and 34 of the "Regulations on the Registration of Lives in Zhejiang Province", it was decided to give a fine of 200 yuan and order administrative penalties that were ordered to make corrections within three days.

Faced with the changes in the competition and demand, how can a Tiger Tiger break through?

After the automotive market, it is regarded as the "gold industry" in the automotive field. In addition to the Tuhu car raising, there are also Tmall cars and JD.com.

The prospectus states that Tuhu has become China's largest independent car service platform. According to the income, Tunhu's car raising car income in 2021 was 11.7 billion yuan, accounting for 1.0%of the market share, and more than the cumulative car service revenue of more than the second to fifth participants. It is worth mentioning that, according to the prospectus of the previous version, in the field of Chinese automobile services, Tunhu's car raising accounts for 0.9%of the market share, ranking 5th in the industry. The first and second -ranking service providers also account for only 2%and 1.4%of market share.

Obviously, the automotive aftermarket is a highly scattered and competitive market. But the opponent standing in front of Tuhu is not small.

In 2017, Jingdong announced the entry into the automotive after -sales service market. In 2018, the five major strategies of supply chain, system, service, logistics, and financial capabilities were fully opened to build the "central brain" of the automotive market. In October 2021, JD.com launched the "Jingdong Auto Parts" application.

On August 18 this year, JD Automobile held a press conference to announce the integration of Jingdong Automobile's supply chain, the BOE service store, and the third -party service network, and launch a new brand of "Jingdong Car Conservation". 100, at the same time, promote the construction of tens of thousands of online and offline third -party certification stores, and explore the brand cooperation model of multi -type stores.

The Tmall car owner, which was officially operated in December 2019, promoted the "Smart Store" plan. In its official release of the 2022 development strategy, Tmall car maintenance also implemented an investment franchise policy. Li Yi, general manager of Xinkangzhong COO and Tmall car maintenance, said in a recent round table that Tmall car maintenance is currently opened for 1,700 stores, and will exceed 10,000 stores in the next 5 years.

Although Tmall and Jingdong are currently slightly inferior to the number of stores, the same expansion means and online service online services have challenged Tunhu. Under the development of the Internet giant, competition in the automotive aftermarket may be more intense.

In addition, with the rise of new energy vehicles, the consumption demand in the automotive aftermarket has changed, or it has a certain impact on the existing service model.

For example, in terms of maintenance and maintenance, pure electric vehicles have lower demand for the maintenance of its power system compared to fuel vehicles; during the life cycle of the entire electric vehicle, compared with the total expenditure of maintenance and maintenance services, replacing the battery pack for battery packs, the battery pack. The cost is relatively higher. Many users' car service demand also focuses on the maintenance and replacement of batteries from engines and gearboxes.

In addition, the three -electricity and other issues involved in the maintenance of new energy vehicles have higher maintenance threshold than fuel vehicles. New energy vehicles are complex of batteries, machinery, and information technology. The maintenance store does not meet the requirements.

Tunhu supports the car that the company is actively exploring the relevant opportunities of new energy vehicles and establishes business cooperation with Zero Run and BAIC Fox. However, the current industry competition is fierce, and Tuhu has been trapped in profitability. In the face of the changes in the demand for the automotive market, it will take time to verify whether it can take out a practical solution to impress investors.

- END -

"Shed shopkeeper" makes the shed farmer a "hand shopkeeper"

In Yang Ling, there is an intelligent control device applied in the greenhouse. It...

Shijiazhuang: Run out the "acceleration" to accumulate new kinetic energy

In the midsummer season, everything is parallel. Walking in the provincial capital...