In the first half of this year, the total daily earnings of the State -owned Bank of China earned exceeded 3.7 billion, and the balance of non -performing loans went up.

Author:Costrit Finance Time:2022.08.31

As of the evening of August 30, the six major state -owned banks (Industrial and Commercial Bank of China, Agricultural Bank, Bank of China, Construction Bank, Postal Savings Bank and Bank of Communications) 's performance in the first half of 2022: A total of net profit attributable to shareholders (next The same) 673.171 billion yuan, a total of more than 3.719 billion yuan.

In terms of net profit growth, the first half of this year of workers, agriculture, middle, construction, and Jiaotong concentrated at about 5%-6%, and decreased from a collective profit growth of more than 10%in 2021.

In terms of asset quality, the balance of non -performing loans for the six major state -owned banks has increased from the end of last year, but the four have continued the decline in the decline in the non -performing rate last year.

The growth rate of net profit collectively falls collectively

Compared with the end of 2021, the sixth National Congress of the State of the CPIC has not changed in the ranking of assets in the first half of this year.

List of the scale and profitability of the six major banks in the first half of 2022

The "Cosmic Bank" ICBC's ability to make money is still leading. The net profit attributable to the bank's shareholders in the first half of the year was 171.506 billion yuan. The CCB followed closely. In the first half of the year, the net profit attributable to shareholders was 161.642 billion yuan. The net profit attributable to shareholders was 128.945 billion yuan and 119.924 billion yuan, and the postal savings banks and Bank of Communications realized net profit attributable to shareholders of 47.14 billion yuan and 44.04 billion yuan.

In terms of net profit growth, the sixth major banks in 2021 averaged the net profit growth rate of double digits. In the first half of this year, only the net profit growth of the postal savings bank exceeded 10%, which was 14.88%, which was also lower than that of 14.88%, which was also lower than lower than that 18.65%in 2021.

The remaining five net profit growth rates are equal. ICBC, CCB, Agricultural Bank, Bank of China, and Bank of Communications have attributed to shareholders' net profit in the first half of this year. The year of 10.27%, 11.61%, 11.70%, 12.28%, and 11.89%.

In terms of operating income, only the postal savings banks have achieved double -digit growth. In the first half of this year, operating income increased by 10.03%by 10.03%. ICBC's operating income in the first half of the year was still the highest, reaching 4.10%of 443.788 billion yuan.

Bad loan balance collective recovery

In terms of asset quality, the balance of non -performing loans of the State -owned Six State Bank in the first half of this year has risen collectively, and two of them have a double rise of non -performing loans.

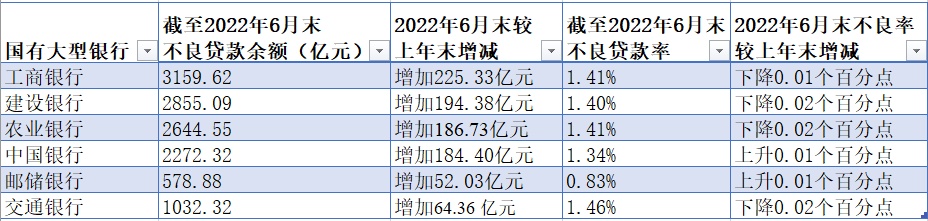

As of the end of June 2022, the situation of non -performing loans of the six major banks of state -owned banks

Among them, the non -performing rate of postal savings banks is still much lower than the other five. As of the end of 2022, the non -performing rate was 0.83%, a slight increase of 0.01 percentage points from the end of the previous year.

The remaining five non -performing loans have also remained stable. As of the end of June, the non -performing rates of ICBC, CCB, Agricultural Bank, Bank of China and Bank of Communications were 1.41%, 1.40%, 1.41%, 1.34%, and 1.46%, respectively. Among them, the non -performing rate of ICBC decreased by 0.01 percentage points from the end of last year. The non -performing rate of CCB, Agricultural Bank and Communications decreased by 0.02 percentage points from the end of last year. The non -performing rate of the Bank of China and the Postal Savings Bank increased slightly by 0.01 percentage points.

In terms of the increase in the balance of non -performing loans, ICBC increased by 22.533 billion yuan in the first half of the year, the highest among the six major banks of the state, and the balance of non -performing loans in the first half of this year of CCB, Agricultural Bank of China increased by 19.438 billion yuan, 18.673 billion yuan, and 18.440 billion yuan Yuan.

At the midterm performance meeting, state -owned executives are more confident in the quality of assets in the second half of the year.

Wang Jingwu, Vice Governor and Chief Risk Officer of ICBC, stated at the midterm performance meeting on August 30 that the confidence was due to the overall stable economic operation of my country, huge toughness and growth potential, and the fundamental fundamentals will not change for a long time. On the other hand, thanks to the bank's ability to improve risk management, continue to implement risk digestion, actively consolidate the quality of assets, and continuously thicken the buffer pad for future risks, laid a good foundation for the next stage of responding to risk challenges, maintaining the stability of asset quality stability Essence

Wang Jingwu said that the next stage will continue to strengthen the forward -looking and active management of various risks, multi -pronged, comprehensive policies, and fully maintain the asset quality and controllable assets with high quality risk control.

- END -

Xiao Gang: "Asset Management+Investment Bank+Technology", enhance the core competitiveness of asset management institutions

[Dahe Daily · Dahecai Cube] (Reporter Ding Qian) On August 20, the China Fortune ...

Suizhou High -tech Zone Discipline Inspection and Supervision Working Committee teaches the secretary of the village (community) party organization

Recently, the 5 -day village (community) party organization secretary training cla...