After issuing a financial report, the stock price plummeted by more than 14%. What was the performance of Tubu in the first half of the year?| Zhi Yan Comments

Author:36 氪 Time:2022.08.31

Step Children's Business and Professional Sports Brand Sales Performance is particularly eye -catching.

Wen | Li Xin

Edit | Huang Yida

Source | 36 氪 Finance (ID: krfinance)

Cover Source | Vision China

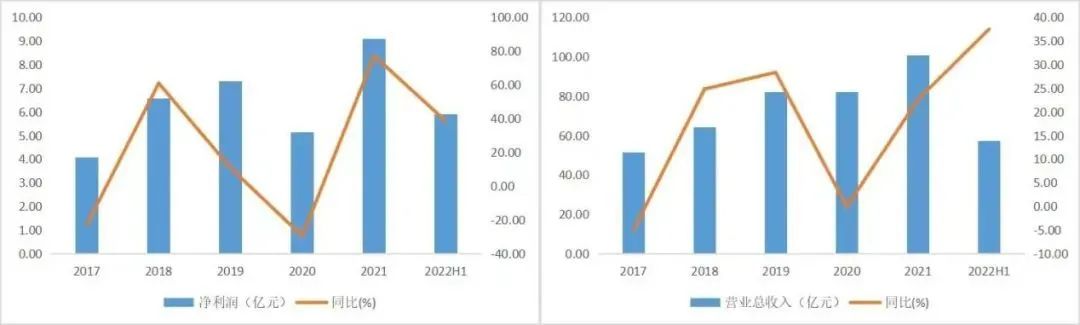

Recently, Tubu International announced the mid -term performance in 2022. According to the financial report, in the first half of 2022, Tsob's revenue was 5.684 billion yuan, a year -on -year increase of 37.5%; net profit of home mother was 590 million yuan, a year -on -year increase of 38.4%.

On the day of its financial reports, Tuban's stock price closed more than 6%, plunging more than 14%the next day.

Tippace revenue, net profit and growth rate

Source: Wind, 36 氪 Organize

On the whole, due to the repeated epidemic, the total retail sales of Chinese consumer goods in April to April. In this context, Tuba achieved double growth in revenue and net profit in the first half of the year, showing strong business toughness. Among them, the sales performance of Tibu Children's Business and Professional Sports Brand E -commerce is particularly eye -catching. But at the same time, the problem of surge in inventory during the reporting period is also worthy of attention.

In terms of income end, the brands of the division, the brand of Tubu includes Tubu of the Volkswagen Sports Department, the Gai Shiwei, Paladin of the Fashion Movement Division, and the Soccuni and Mai Le of the Professional Sports Division. Readent pillar. In the first half of the year, the revenue of the special brand brand was 4.898 billion yuan, an increase of 36.2%year -on -year, and revenue accounted for 86.2%. The growth was mainly driven by brand power and product power, and the growth of children's product growth. Among them, Tsob Children's Business has grown rapidly after the reorganization of products and retail networks, and its revenue increased significantly by 83.7%year -on -year in the first half of the year to 721 million yuan.

In the Fashion Sports Department, Ge Shiwei and Paladin recorded revenue of 630 million yuan in the first half of the year, an increase of 36.3%year -on -year, and the proportion of the group's revenue was 11.1%. In the first half of the year, the revenue of the professional sports branch was 156.5 billion yuan, an increase of 106.4%year -on -year, and the proportion of the group's revenue was 2.7%. When the offline business was impacted by the epidemic, e -commerce channels contributed large sales. During the 618 shopping festival this year, Soconni online sales increased significantly by 135%year -on -year.

From the perspective of the store network, the group has maintained the new store as a whole in the first half of the year. As of the end of June 2022, the number of special brands stores in the specialty brand was 6,251, which was 100 stores at the beginning of the year. It was 236 stores from the same period last year. 33%.

Other brands, as of the end of June 2022, the number of stores in the Asia -Pacific region of Paladin was 71, an increase of 14 from the beginning of the year. The number of second -tier cities was 46, which was increased by 2 compared with the beginning of the year. The number of stores in the first and second -tier cities in Mainland China was 7, which was 1 net.

In terms of profitability, the overall gross profit margin during the reporting period has improved slightly. In the first half of the year, the overall gross profit margin of the Tuber Group was 42.0%, a year -on -year increase of 0.2 percentage points. In terms of brands, the gross profit margin of the specialty brand in the first half of the year was 42.2%, a year -on -year increase of 0.7 percentage points; the gross profit margin of the Fashion Movement Division was 39.8%, a year -on -year decrease of 3.6 percentage points; 1.2 percentage points.

On the expense side, the sales cost rate of Tubu in the first half of the year was 18.4%, a year -on -year decrease of 0.3 percentage points; the management cost rate was 11.5%, a year -on -year decrease of 0.2 percentage points; the research and development cost rate was 1.9%, a year -on -year decrease of 0.6 percentage points.

Through strong cost control capabilities, Tuba achieved a slight increase in net interest rates in the case of multiple brands still at a loss. The net interest rate in the first half of the year was 10.4%, a year -on -year increase of 0.1 percentage points.

Judging from the operation of several sub -brands that suffered losses in the first half of the year, the operating loss of the Fashion Movement Branch was 54 million yuan, compared with the loss of 41 million yuan in the same period of the previous year, the loss expanded; Compared with the loss of 34 million yuan in the same period last year, the loss was narrowed.

In terms of operating capabilities, the number of inventory days during the reporting period has increased significantly, thereby dragging the cash flow of business activities. As of the end of June 2022, Tibban inventory was 2.313 billion yuan, an increase of 111.04%year -on -year; the number of days of inventory was 106 days, a year -on -year increase of 27 days. In the first half of the year, the group's operating cash outflows reached 268 million yuan. The slowdown in the inventory turnover is mainly due to the resistance of the epidemic. In the second quarter, Tubao took the initiative to cancel part of the orders in the epidemic control area.

Looking forward to the second half of the year, under the increasing product strength of the special brand brand, the further volume of children's business, and the rapid growth of new brands, the expected income will maintain growth. Step management maintains the growth rate of 25-30%of the revenue growth rate of the main brand throughout the year. Essence At the same time, with the improvement of the epidemic, the recovery of the supply chain, and through the promotion activities such as 618, Double 11, and Double 12, the level of inventory in Tubu is expected to improve in the second half of the year.

*Disclaimer:

The content of this article only represents the author's opinion.

Market risk, the investment need to be cautious. In any case, the information in this article or the opinions expressed in this article does not constitute investment suggestions for anyone. Before deciding to invest, if necessary, investors must consult with professionals and make careful decisions. We have no intention of providing underwriting services or any services that need to be held in the transaction parties.

36 The official public account of its subsidiary

I sincerely recommend you to follow

wx_fmt = pNG "data-nickName =" 36 氪 Finance "data-alias =" krfinance "data-signature =" 36 氪's official account. The market is smarter than 99%of investors. "Data-from =" 2 2"data-is_biz_ban =" 0 " />

Let's "share

During the Step Reporting period, inventory surge

- END -

New consumption and new vitality: Foreign companies share China's consumption upgrade "big cake"

On July 21, in a fishing gear sales online store in Gengdian Township, Gu'an Count...

Add chaos to the Taiwan Strait!One picture understands the concept of US $ 70 billion in Taiwan's military sales

Source: People's Daily WeiboUS Secretary of State recently said that the current s...