UnionPay Business is "slimming", intending to transfer Beijing Yinshi Equity and Assets.

Author:Daily Economic News Time:2022.08.31

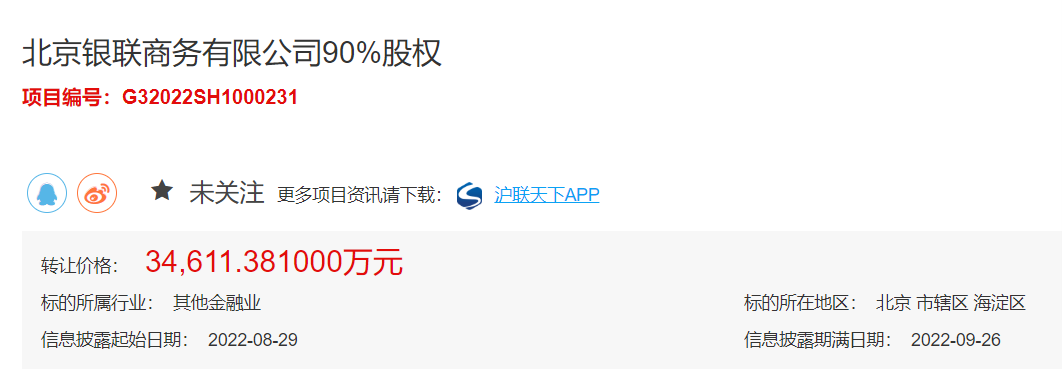

Recently, the Shanghai United Property Exchange also disclosed two listed transfer projects on Beijing UnionPay Business Co., Ltd. (hereinafter referred to as "Beijing Yinshi"). Yuan; the other is "Beijing UnionPay Business Co., Ltd. related assets, liabilities and related rights", with a transfer price of 660.595 million yuan. The information disclosure of the two projects is the same date, both from August 29 to September 26, and the disclosure period is nearly 1 month.

It is worth noting that Beijing Yinshi is a third -party payment institution. The above -mentioned equity transfer projects include UnionPay Business Co., Ltd. (hereinafter referred to as "UnionPay Commerce") all 75.5%of the equity. At the same time, UnionPay Commerce is also the transferor of the above -mentioned asset transfer projects.

Source: Shanghai United Property Exchange

Broadcom analyzed the senior analyst of the financial industry Wang Pengbo in an interview with a reporter's WeChat interview that the listing of equity and assets at the same time means that UnionPay Business is preparing to completely draw from Beijing silver merchants.

In addition to Beijing's silver merchants, "Daily Economic News" reporters found that in the past two years, UnionPay Commerce transfer its equity of its payment institutions has been frequent. Experts believe that UnionPay Business's payment license is mainly to respond to the spirit of supervision, and it plays a demonstration role in the industry in terms of compliance.

Equity and assets are transferred at the same time, and the asset transferee is limited to the payment institution

According to the information disclosed by the above -mentioned equity transfer project, Beijing Yinshi is a state -owned controlling enterprise. The registered address is located in Haidian District, Beijing. The legal representative is Wang Yilin. The company was established in July 2002 and the registered capital was 100 million yuan.

There are 4 shareholders in Beijing Yinshi, and UnionPay Business Co., Ltd. (hereinafter referred to as "UnionPay Commerce") holds 75.5%of the major shareholder UnionPay Business Co., Ltd. The shares were 14.5%; the remaining two shareholders were Beijing Shiguan Fangzhou Technology Development Co., Ltd. and Beijing Jianjun Science and Technology Development Co., Ltd., both of which held 5%of the shares.

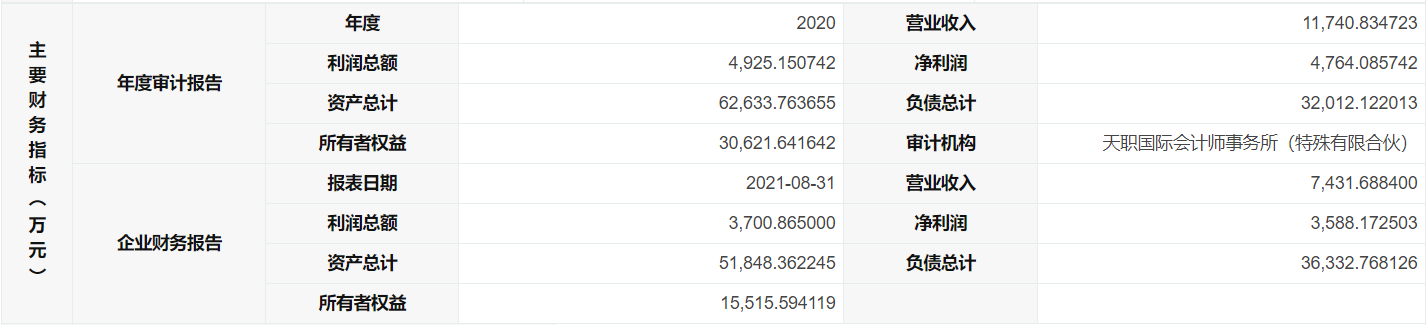

According to the listing information of the equity transfer project, Beijing Yinshang's operating income in 2020 was 117 million yuan, the total profit was 49.251 million yuan, and the net profit was 47.6409 million yuan. The financial report on August 31, 2021 showed that Beijing's banks' operating income was 74.3169 million yuan, the total profit was 37.087 million yuan, and net profit was 35.8817 million yuan. The asset evaluation situation shows that Beijing Yinshi Assets has a total of 518 million yuan and a net asset of 155 million yuan.

Source: Shanghai United Property Exchange

The listing information of the equity transfer project also disclosed that according to the "Administrative Measures for the payment of non -financial institutions", the final transfer party of this property rights to be a shareholder of the target enterprise needs to obtain the approval of the equity transfer of this equity; After the equity transfer, the name of the target company will no longer contain the word "UnionPay".

The transferor's briefing shows that there are two transferors in the equity transfer project. In addition to the total shareholders UnionPay Business intends to transfer all 75.5%of the equity held, there is also two -share Tokyo Rongda, and all 14.5%of the equity of the transfer is planned. The two account for 90%of Beijing Yinshi equity.

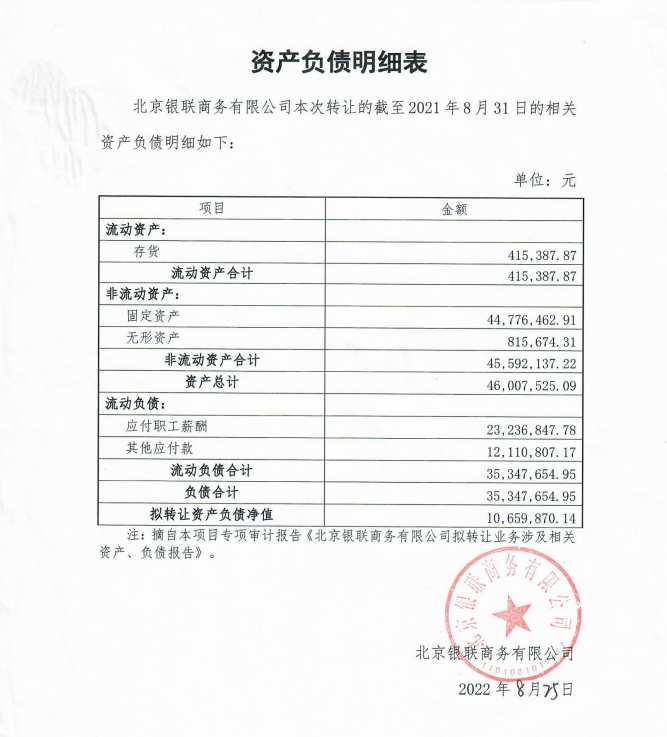

The above -mentioned asset transfer projects show that the target of this transfer is the relevant assets, liabilities and related rights after the evaluation benchmark on August 31, 2021. The relevant asset -liability details of Beijing Bank's transfer as of August 31, 2021 showed that the total assets were 46.075 million yuan, the total liabilities were 35.3477 million yuan, and the net asset -liability value was 10.659 million yuan.

Source: Shanghai United Property Exchange

The asset transferee must agree that changes in the asset -liability from the date of evaluation from the date of the assessment to the date of delivery shall be enjoined or undertaken by the transferee. The transferee must adopt the principle of "employees voluntarily choose local conversion and recognize working age", and unconditionally undertake the staff and labor dispatch employees of Beijing UnionPay Business Co., Ltd. unconditionally.

It is worth noting that in the qualification conditions of the transferee of the asset transfer project, the intention of the intention to be transferred should be established in accordance with the law, effectively surviving and in Beijing with a bank card acquisition business qualification. And should have good financial conditions and payment capabilities.

In other words, the asset transferee must be a payment institution with a bank card collection qualification in Beijing, and the players outside the payment circle will be rejected. At the same time, the asset transferee will undertake 363 employees disclosed by Beijing Yinshi.

According to the official website of the central bank, Beijing Yinshi holds a third -party payment license, with business types including bank card receivable (Beijing), prepaid card acceptance (Beijing) and Internet payment (national). The first license date of the payment license is May 3, 2011, which is valid until May 2, 2021. During the renewal of the payment license license in May last year, Beijing Bank of China stopped the exhibition.

UnionPay Business: I have been in contact with dozens of intentions to be transferred

The official website shows that UnionPay Commerce is a large non -bank payment institution in China, which provides comprehensive payment services based on bank card receipts and network payment.

It is worth noting that, in addition to holding a payment license, UnionPay Commerce also controls many other licensed payment institutions. In addition to the above -mentioned Beijing silver merchants, there are Guangzhou UnionPay Network Payment Co., Ltd. and Shanghai UnionPay Electronics Payment. Service Co., Ltd., Ningbo UnionPay Business Co., Ltd., Shenzhen UnionPay Financial Network Co., Ltd., Beijing Digital Wangfujing Technology Co., Ltd., etc. UnionPay Business Branch Information Source: UnionPay Business Official Website

On August 30, each reporter asked UnionPay Business to the transfer of the property rights transfer of Beijing Bank through email, and received an email response from the other party the next day.

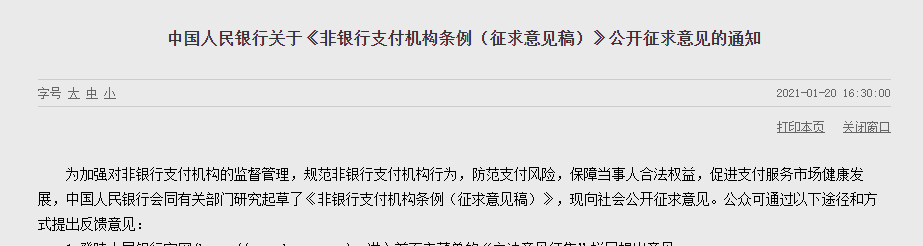

UnionPay Commerce said in the response email that UnionPay Commerce actively responded to the relevant regulatory requirements and spirit of the "Regulations on the Non -Bank Payment Institution (Consultation Draft)" in January 2021, further focus on the main business, and actively integrate its subsidiary of its financial holding subsidiaries , And mainly adopted integration including "equity transfer" and "acquisition merger".

"For a period of time, the company has been in contact with dozens of intentions to be transferred. After the listing transaction process is completed, the company will strictly follow the regulatory requirements of the People's Bank of China to perform changes in major investors, actual controllers, and company names. Applying for the application procedure, the final result is based on the announcement of the public announcement of the People's Bank of China. During the integration process, the company and related subsidiaries will also do a good job of customer notifications and communication in time to ensure that customers' silence, business continuation, funding security, marketing, and marketing Stable and continue to provide high -quality services for customers. In the future, UnionPay Business will also adhere to the business philosophy of compliance operations and high -quality development to contribute to the health and stable operation of the payment industry. "UnionPay Commerce mentioned in the mail in the email arrive.

At the beginning of last year, the central bank issued the "Regulations on the Non -Bank Payment Institution (Draft for Opinions)" (hereinafter referred to as the "Regulations"). It is mentioned that "the same legal person must not hold two or more non -bank payment institutions of more than 10%of equity, and the same actual controller shall not control two or more non -bank payment institutions."

UnionPay Business Transfer's Payment License Action Activity

Although the formal "Regulations" have not yet been introduced, it is clear that UnionPay Commerce at the same time holding a number of payment institutions at the same time does not meet Article 11 requirements of the draft for solicitation.

Every reporter noticed that since the release of the Regulations, five UnionPay Commercial Holdings have been suspended from the renewal since last year.

The central bank mentioned in the renewal of the payment license plate announced by the central bank in May last year that Guangzhou UnionPay Network Payment Co., Ltd., Beijing Digital Wangfujing Technology Co., Ltd., and Beijing UnionPay Business Co., Ltd. intend to carry out integration work with its controlling shareholder UnionPay Business Co., Ltd. A suspended renewal review application was submitted to the People's Bank of China, and the business was continued during the suspension of the censorship.

The result of the renewal of the payment license license in December last year also mentioned that due to the situation stipulated in Article 24 of the Implementation Measures for the People's Bank of China, the central bank decided to suspend the suspension of Ningbo UnionPay Business Co., Ltd. and Shenzhen UnionPay Finance Network Co., Ltd. Review of the "Payment Business License" renewal application. After the relevant suspension of the situation disappears, the People's Bank of China will resume the review.

With the suspension of the payment license license, UnionPay Commerce has also frequently appeared in the transfer of equity of its payment institutions in the past two years.

Source: Beijing Property Exchange

In addition to Beijing's silver merchants, UnionPay Commerce also has 60%of Beijing Digital Wangfujing Technology Co., Ltd. is listed on the Beijing Property Exchange for transfer, with a reserve price of 109 million yuan.

Source: Shanghai United Property Exchange

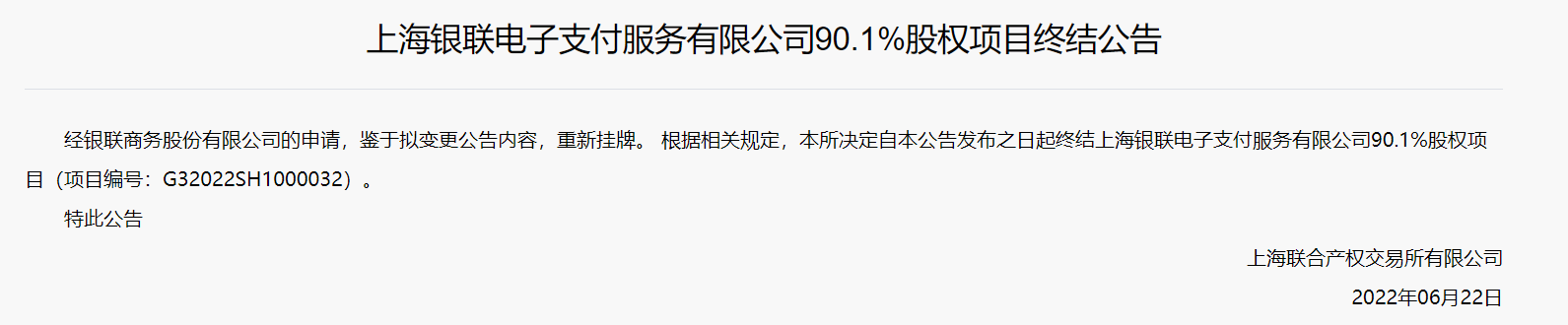

In addition, each reporter discovered the traces of the transfer of Shanghai UnionPay Electronic Payment Service Co., Ltd. on the website of the Shanghai United Property Exchange. On June 22 this year, the Shanghai United Property Exchange issued the "Announcement of the End of the 90.1%Equity Project of Shanghai UnionPay Electronics Payment Service Co., Ltd.", which shows that through UnionPay Business Application, the content of the announcement is to be changed. According to relevant regulations, the Institute decided to end 90.1%equity projects of Shanghai UnionPay Electronic Payment Service Co., Ltd. (project number: G32022SH1000032) from the date of issuance of this announcement.

According to the national enterprise credit information publicity system, Shanghai UnionPay Electronic Payment Service Co., Ltd. is wholly -owned by UnionPay Commerce.

Expert: Platform company or the main force of equity acquisition

Broadcom analyzed the senior analyst of the financial industry Wang Pengbo in an interview with a reporter's WeChat interview that the reason why UnionPay Business transferred its payment license is because the "Regulations" required the same legal person to hold two or more non -bank payment institutions of 10%or more. The same actual controller shall not control two or more non -bank payment institutions. "Although at the stage of soliciting opinions, UnionPay Business already has the action of paying a payment license. As the head of the industry, it plays a good leading role in compliance. There may be similar payment institutions to follow up in the future."

Wang Pengbo said that as far as his own business is concerned, UnionPay Business will not be affected at the management level because he holds a national bank card receipt license, and the operating right will be more concentrated. From the perspective of the payment industry, the current payment market is relatively stable. Under the premise that the real stock merchants do not have significantly increased, UnionPay Commerce transfer payment licenses will not fluctuate in the payment market. An important reason for the side.

Senior analyst Su Xiaorui, a senior analyst in the financial industry, said in an interview with a reporter WeChat that the transfer of equity listing of Beijing Yinshi mainly responded to the previous regulatory spirit and integrated according to the documents such as the Regulations. "The payment license caused by UnionPay Business' Slimming" is a positive and positive signal for the industry. Buyers who have demand for external demand can obtain the existing payment license resources through compliance channels, which will also be the payment industry. Bringing 'living water', promoting the healthy and orderly development of payment, and playing a more useful role for the real economy. "Source of data: the official website of the People's Bank of China

It is worth noting that UnionPay Commerce will transfer the equity and assets of Beijing Yinshi at the same time this time, requiring the intention of the intention of asset projects to be established in accordance with the law, and in Beijing, which has the qualifications of bank card receipt business business in Beijing. Corporate legal persons or their branches should have good financial conditions and payment capabilities.

In an interview with a reporter's WeChat interview with a reporter, lawyer Huang Xijuan, a lawyer of Beijing Yingyi (Shanghai) Law Firm, said that the equity is the equity of the shareholders to the company, including the original value of the equity and the right to the income obtained according to the ratio of the equity. The right to return is owned by others. Assets belong to all the property of the company, not the personal property of the shareholders. Asset transfer means that the property under a company's name is transferred to other companies or individuals. The decrease in the company's assets will affect the value and benefits of shareholders' equity.

"The main body of the equity and the asset itself is different, and can be transferred to different subjects." Lawyer Huang Xijuan told a reporter.

Wang Pengbo believes that this action of UnionPay Business means that UnionPay Business is ready to completely draw from Beijing's silver merchants. "Equity transferee and asset transferee may not be the same subject. The equity acquisition party may not want the new business to be involved in the original business, but only hopes to hold a payment license to facilitate the compliance industry in the future. In addition, let the same local banks also owns local banks The transfers of the obtaining a single qualification institution can make the transferee more smoothly undertake the original local real merchant, and better protect the rights and interests of employees, which is conducive to local enterprises and social stability. "

Although the asset transferee is limited to "players in the circle", the transfer of equity projects has no limit.

For the intention to transfer the equity transfer of Beijing Yinshi, Wang Pengbo believes that generally speaking, for the payment license with both Internet payment and bank card acquisition qualifications, the acquisition threshold is high and the buyer's capital strength also has higher requirements. Those who tend to buy such payment licenses are more platform -based companies on the large group. In addition, the buyer needs to have real needs for the payment license. One is the needs of compliance, such as avoiding "two Qing", and the other is the need for payment -based business business. "Enterprises with the above characteristics may be the ideal next home, and it is also the main purchasing power of this license."

Su Xiaorui also told a reporter: "Because the licenses with Internet payment qualifications can play a large role in compliance applications in the Internet field, they are more favored by Internet institutions, including large groups or a certain segment area. Internet leader waiting. "

Daily Economic News

- END -

Solve the two demands and look at the splendid city of Han Tingzhi

Not long ago, due to business expansion, Shandong Victoria Trading Co., Ltd. had a...

Shanquan Village, Antu County, grasp the "Fungus Industry to get rich" and pave the way for rural rejuvenation

Shanquan Village, Mingyue Town, Antu County was once a well -known poor village in...