Real Estate · 2022 Half -annual Daily | Ocean Group: The total sales of the agreement in the first half

Author:Daily Economic News Time:2022.08.31

On August 31, the Ocean Group (03377.HK, the stock price of HK $ 1.15, a market value of HK $ 8.759 billion) released the 2022 semi -annual report.

During the reporting period, the total sales of the Ocean Group achieved the total sales of the agreement (the same below) 43.01 billion yuan, a year -on -year decrease of 18%; the turnover was 23.412 billion yuan, an increase of 14%over the same period last year; , Together with the non -adopting credit line of nearly 220 billion yuan.

The semi -annual report shows that the property development business of the Ocean Group has maintained the greatest contribution, and its turnover accounts for about 79%of the Group's total turnover. In the first half of 2022, the proportion of property development revenue from Beijing, Bohai Rim, East China, South China, Central China, and West China accounted for 13%, 36%, 13%, 10%, 23%, and 5%, respectively.

During the reporting period, the Ocean Group completed the delivery of about 22,000 houses; gross profit was 4.311 billion yuan, a 7%decrease from the same period last year; the gross profit margin was 18%, a decrease of 4 percentage points from the same period last year.

In terms of soil storage, during the reporting period, the Ocean Group obtained a total of 5 new projects, adding 420,000 square meters of soil reservoir, and the average land cost of the land was about 6,000 yuan per square meter. At present, the second -level development of the Ocean Group has nearly 50 million square meters of land reserves, distributed in more than 60 cities. Based on the available area, the average land cost is about 6700 yuan per square meter.

During the reporting period, the owner of the Ocean Group should account for 1.087 billion yuan, and the basis and diluted loss of 0.143 yuan per share were 0.143 yuan. The Oceania Group stated that the loss of the loss was mainly due to the exchange loss caused by the depreciation of the RMB against the US dollar during the reporting period; the division of joint ventures to decline; and the overall domestic real estate market downturn and the new crown pneumonia's epidemic caused a decline in gross profit margin.

Daily Economic News

- END -

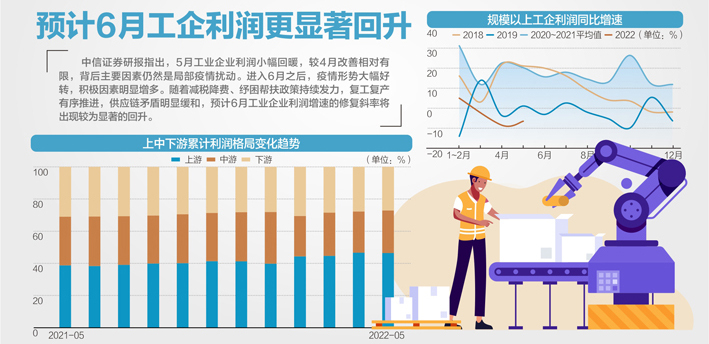

Production and operation gradually restore the decline in the profit decline in the industrial enterprise in May

The latest industrial enterprises' profit data is fresh.On June 27, the website of...

Agricultural Issuance Nanping Branch has launched the province's largest single amount and the city's first infrastructure fund project

Agricultural Issuance Nanping Branch has launched the province's largest single amount and the city's first infrastructure fund projectRecently, the Nanyan Branch has successfully launched the provinc...