News!Henan Zhongcheng Technology A -share IPO registration is approved

Author:Dahe Cai Cube Time:2022.08.31

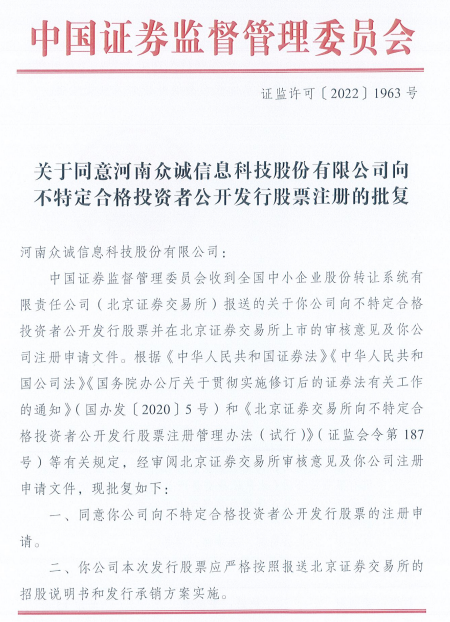

[Dahecai Cube News] On August 31, the CSRC approved and agreed that Henan Zhongcheng Information Technology Co., Ltd. (hereinafter referred to as Zhongcheng Technology) publicly issued an application for stock registration to unspecified investors.

Prior to this, Zhongcheng Technology IPO had been reviewed by the Municipal Party Committee on August 5. On August 11, Zhongcheng Technology submitted an application for registration to the CSRC.

Zhongcheng Technology is located in Zhengzhou City. It is a service provider positioning in the ICT system and application development comprehensive solution. It mainly serves the government, enterprises, military industry, medical care, electricity and other units, and undertakes various types of information and digital services. The business includes an integrated solution for digital government affairs, virtual simulation platforms and industry applications and resources.

The company is a list of national specialized new "Little Giant" companies that are recommended by the Ministry of Industry and Information Technology for the first batch of new "little giants" enterprises and selected the Ministry of Industry and Information Technology.

Data show that Zhongcheng Technology ’s audited operating income in 2021 and 2020 was 514.5627 million yuan and 457.6721 million yuan, respectively, and net profit (calculated based on the basis of deducting non -recurring profit or loss) of 31.482 million yuan and 3758.63. For 10,000 yuan, weighted the average net assets yields (calculated the basis for deducting the low before and after non -recurring profit or loss) were 14.78%and 26.70%, respectively, and the net assets attributable to shareholders of the listed company were 225.814 million yuan and 197.726 million yuan. In line with the financial conditions of the listing of the Beijing Stock Exchange, which meets Article 2.1.3 of the Listing Rules.

In this IPO, Zhongcheng Technology plans to issue 16 million shares of shares (if it is not considered without the options of excess and sale), or no more than 18.4 million shares (under the circumstances of excessive sale options issued by this stock), the issuance is issued. The price is not less than 7 yuan/share, and the funds raised 130 million yuan are used for digital solution development platform upgrade construction projects, digital technology application research and development center construction projects, marketing and service platform construction projects, and supplementary mobile funds.

Responsible editor: Chen Yuyao | Review: Li Zhen | Director: Wan Junwei

- END -

National Lottery Sales in May 2022

1. National lottery sales situationIn May, a total of 32.765 billion yuan was sold...

The three major indexes have risen and declined, pharmaceutical stocks are adjusted, and car stocks rose up

On July 7, Capital State learned that the three major indexes of Hong Kong stocks rose and declined. As of the close, the HSI rose 0.26%to 21643.58 points, the Hang Seng State Index fell 0.09%to 7538.