Senior price salary accounted for 84%of the revenue, dragging the semi -annual report of Shang Tang Technology

Author:Cover news Time:2022.08.31

Cover news reporter Meng Mei

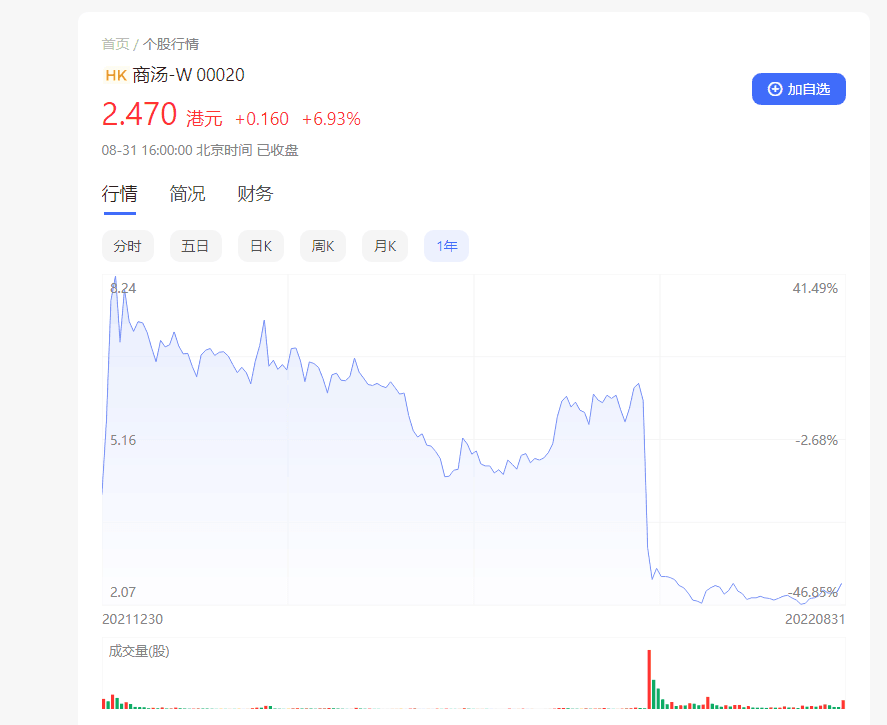

On August 25, Shangtang Technology disclosed the financial report in the first half of 2022: revenue was 1.415 billion yuan, a year -on -year decrease of 14.3%; net loss was 3.208 billion yuan, a year -on -year narrowing 13.6%. But the income is far from the speed of burning money.

From the perspective of financial reports, the previous revenue has remained positive growth. The stock price also dropped directly from the 8.2 Hong Kong dollars on the fourth day of the listing to 2.1 Hong Kong dollars per share. Although the stock price has risen on the day of its financial report release, the stock price has still stayed at a historical low. Compared with the HK $ 300 billion of HK $ 300 billion on January 4th, the market value is higher than January 4th. Point, about 75%.

The loss continues, and the superposition revenue and gross profit margin fell, which made Shangtang's technology -based stock price worse at a low stock price. On the day of the release of the financial report, Shangtang Technology fell 2.55%to close the Hong Kong dollar per share of 2.29, which was greatly lower than the issuance price of Hong Kong stocks when it was listed.

Being below the issue price, the cornerstone investor's step -by -step departure has shown the current attitude towards Shangtang Technology. It once had the "AI's first share" aura Shangtang Technology, and the follow -up weakness was obvious.

The main business continues to decline

Judging from the semi -annual report data, the two major sectors of smart business and smart cities are the core of Shangtang Technology's business, and the income generated accounts for more than 70%of the total revenue. In the first half of this year, the smart commercial sector realized revenue of 570 million yuan, a year -on -year decrease of 12%; the smart city sector realized revenue of 430 million yuan, a year -on -year decrease of 45%. Although other business segments such as smart life and smart cars have increased, but because the proportion of total revenue is too small, it has a limited contribution to the overall performance.

According to the financial report data, from 2018 to 2021, Shangtang's operating income was 1.853 billion yuan, 3.027 billion yuan, 3.451 billion yuan, and 4.7 billion yuan, and revenue grew every year.

However, the net losses of Shangtang Technology during the same period were 3.433 billion yuan, 4.968 billion yuan, 12.158 billion yuan, and 17.1 billion yuan, respectively. sum.

From the perspective of specific businesses, in fact, the outer skin of the smart city and smart business of Shangtang technology is the essence of the network security system. In this track, not only are you firmly controlled the half -wall of the domestic intelligent security market, but even in the field of global video surveillance, it has maintained the market share of Hikvision for many years. compete.

High costs are not as high as senior executive salary. The proportion is too high

On one side is the decline in income, but the cost is still increasing. Among them, the high R & D investment increased by 14.88%year -on -year to 2.035 billion yuan, and the cost of sales continued to increase, and the net loss of the impairment of financial assets and contract assets that doubled year -on -year. High gross profit.

In the first half of this year, Shangtang's gross profit was 930 million yuan, a year -on -year decrease of 22.5%; gross profit margin was 66%, a year -on -year decrease of 7%.

In addition to investing in new business and marketing, the salary of employees of Shangtang Technology is also sky -high expenditure. The financial report shows that Xu Li, Wang Xiaogang and Xu Bing of Shangtang Technology have a total salary of 1.192 billion yuan, with an average of 397 million yuan per person. In the first half of this year, the company's revenue was only 1.415 billion yuan in the first half of this year, and the salary of the three executives accounted for 84%of the company's revenue.

Although Shangtang Technology has attributed its performance to the epidemic factors, the problem that I have to think about is that in the current environment of weak economic situations, how long can its business logic be supported by huge loss of money all year round?

Business transformation is difficult to monetize

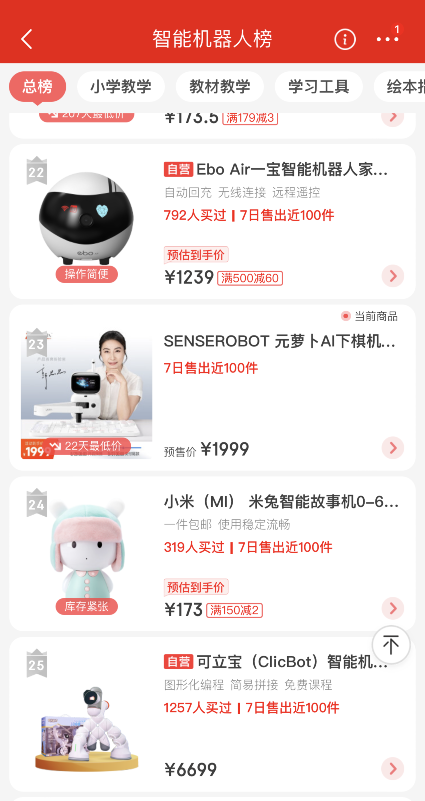

In August of this year, Shangtang Technology launched a new product for the C -side- "Yuan Radish Senserobot" AI chess robot, priced at 2,000 yuan.

It was endorsed by Guo Jingjing, and it iterated nine times. The first consumer artificial intelligence product known as Shangtang Technology, but the real sales of "Yuan Radish SenseRobot" were very bleak.

The "big movement" is in sharp contrast to the actual sales volume. As of press time, the pre -sale page of the flagship store on the Tmall and Jingdong platform,

For more than ten days for this robot, only more than 200 people were scheduled to be "meta -radish Senserobot".

The sales volume of low sales and the difficulty of market voices are obviously difficult to offset the huge cost of early investment. This product seems to have been destined to enter the mainstream market to become profitable products. In addition, the AI industry where Shangtang Technology is located generally has pain points such as unknown technological landing scenarios, lack of scenario applications and C -end products, and slow profitability. People can't see the expected future.

Wang Peng, a researcher at the Beijing Academy of Social Sciences, believes that from the mid -term performance announced by Shangtang Technology, its overall growth rate is a trend of slowing down, and the specific manifestation is that the revenue capacity and structure have changed very much. Technology is undergoing a difficult self -rescue development.

At the same time, Wang Peng believes that after the artificial intelligence industry has experienced the complicated hustle and bustle of the previous years, the development of the industry is moving towards a calm period.So, for artificial intelligence heading companies, at this time, whether it can be able to get the fist products, how deep the construction of the moat, and the health of revenue are not healthy."At present, Shangtang Technology does not have a perfect answer as a head enterprise. Instead, this question mark will become bigger and bigger over time." He said.Wang Peng further explained that its technical research and development capabilities for artificial intelligence are very strong, but there may not be a good exploration in terms of income from landing, and the market will not really pay.Especially in the fields of smart cities and smart life that are very valued in Shangtang, the profit margins have fallen seriously."From this perspective, Shangtang's science and technology prospects are not very optimistic. In the future, major strategic adjustments need to be made in order to adapt to more intense market competition."

- END -

Entering Deep Blue | 2022 World Sea Cucumber Industry (Yantai) Expo was held at Yantai International Expo Center

China is not only the world's largest sea cucumber production, processing and distribution center, but also the world's largest import and exporter and consumer country. The output value of the entir...

The new "good luck" of medical insurance will be fully explored and promoted, and the insured will make money or earn it?

In the life of a person, the ancestors used four words to make accurate summary, w...