Real Estate · Half -annual Report Interpretation | In the first half of the year, the net profit of returning to the mother has changed a year -on -year loss, and the Chinese enterprise plans to broaden the investment channels

Author:Daily Economic News Time:2022.08.31

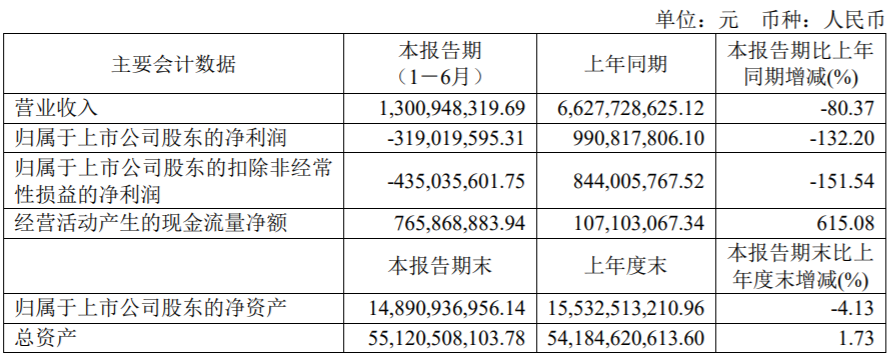

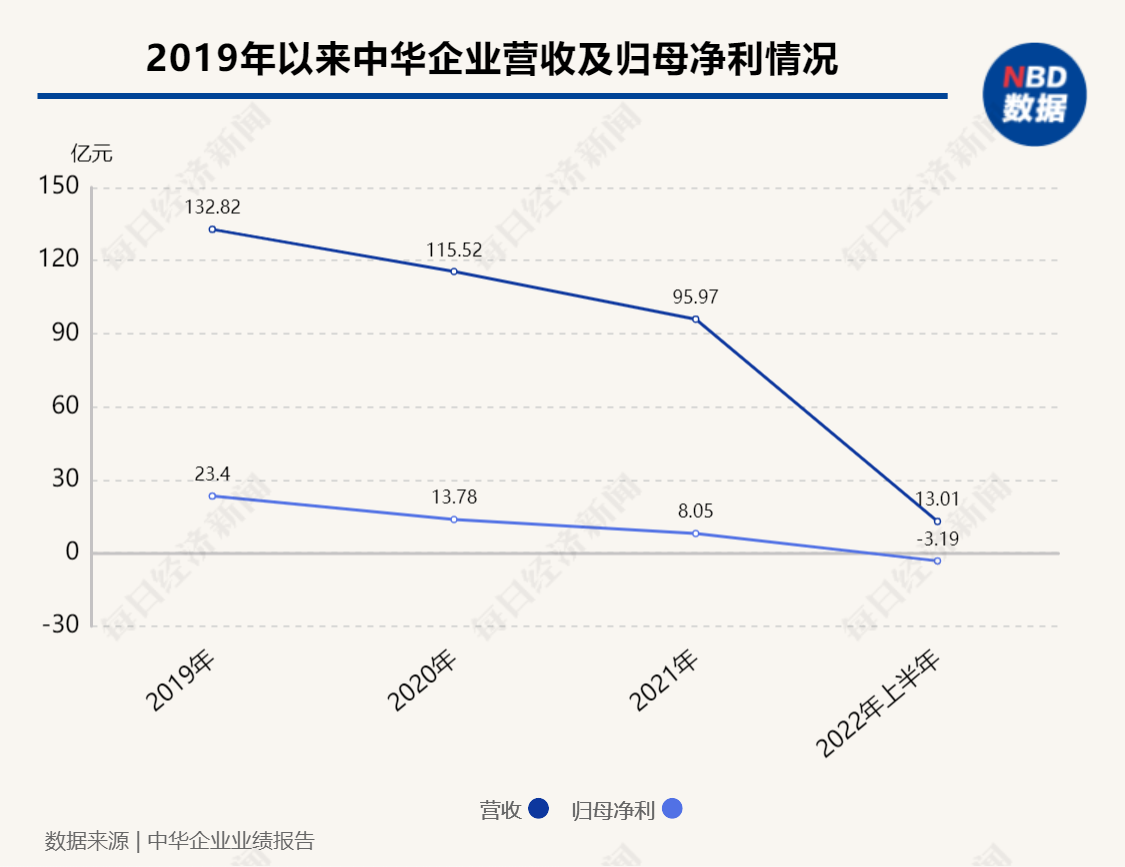

On August 26, China Enterprise (SH600675, stock price was 2.71 yuan, and a market value of 16.521 billion yuan) released the 2022 semi-annual report showed that the operating income achieved 1.301 billion yuan in the first half of the year, a decrease of 80.37%year-on-year; net profit attributable to shareholders of listed companies -3.19 100 million yuan, a year -on -year decrease of 132.2%.

It is worth mentioning that in the same period of 2021, the net profit of Chinese enterprises was 990 million yuan, which failed to maintain a profit state in the first half of this year. Regarding the reason why the net profit returning to the mother, the Chinese enterprise explained that the operating income during the reporting period was significantly reduced compared with the same period of the previous year, and the gross profit margin decreased compared with the same period of the previous year.

In fact, the performance of Chinese companies has declined for three consecutive years. However, the reporter of "Daily Economic News" noticed that during the concentrated supply of new housing in Shanghai this year, two projects of China Enterprises Yunjiang Bay and China Enterprise Guanghua Yajing developed by Chinese enterprises were promoted. That is, it is sold out; another project in the project Hai Rui Binjiang also achieved liquidation.

Source: Chinese Enterprise Semi -annual Report

The revenue has been reduced for three years, and the net profit of returning to the mother will turn losses

Compared with the same period last year, the operating income was 6.627 billion yuan and the net profit of home was 991 million yuan. In the first half of this year, the performance of Chinese enterprises changed significantly.

Chinese enterprises said that the cause of the changes in operating income is mainly during the reporting period, and the projects with the condition of rotating operating income have been significantly reduced compared with the same period of the previous year.

Inquiring about the performance report of Chinese enterprises in recent years, it can be found that from 2019 to 2021, Chinese enterprises have achieved operating income of 13.282 billion yuan, 11.552 billion yuan, and 9.597 billion yuan respectively. Yuan. There have been negative values in cash flow of operating activities.

As of the end of the first half of this year, the cash flow of Chinese enterprises' operating activities suddenly reached 766 million yuan, an increase of 615.08%year -on -year; the balance of currency funds was 15.061 billion yuan, an increase of 5.10%over the beginning of the year.

"During the reporting period, the company's projects received the fund -raising deposit, and other cash related to business activities had increased from the same period of the previous year." Chinese enterprises said in the performance report.

During the reporting period, Shanghai and Jiangsu are the main areas of Chinese enterprises, followed by Zhejiang, Anhui and Jilin. In the Shanghai market, especially the two projects of China Enterprise Yuncuijiang Bay and China Enterprise Guanghua Yajing. These two real estate opened in December 2021.

It is understood that in the first half of the year, in order to speed up the funds, Chinese enterprises established a mortgage bank resource library, connected to multiple banks, sorted out the loan policy, comprehensively and judged the quality service quality of each bank's mortgage loan, and accelerated the return of funds. During the Shanghai epidemic sealing, Chinese enterprises in the three new projects of Hairui Binjiang, Yuncuijiang Bay, and Guanghua Yajing through "Live Promotion+Cloud Seeing House" to maintain customer stickiness with customers interacting with customers. At the end of the reporting period, the company's various businesses achieved a recovery of about 2.891 billion yuan.

It is worth noting that in the semi -annual reports disclosed by many real estate companies recently, OCT A, China Merchants Shekou and other housing companies mentioned that the decrease in the gross profit margin of real estate business has led to the decline in the company's profits. According to Wind terminal statistics, in the first half of this year, the sales gross profit margin of Chinese companies decreased by 57.21%year -on -year.

The sales side is exerting force and plans to broaden the investment channel

It is worth noting that in July, Chinese companies began to work on the sales side.

On July 2nd, Yunjiang Bay, a China Enterprise Yunjiang Bay, located on Jiangwan City Road, Yangpu District, was sold in the opening. A total of 224 suits of houses were sold out on the day of opening. On July 14, the Chinese Enterprise Hairui Binjiang, located in the Pugs of the North side of Shanghai Lujiazui, launched 188 suits of houses. The shortlisted ratio was 2.5. In the end, 475 groups of buyers were shortlisted, with a finalist score of 82.21 points.

On July 19, the Light and Yajing Realm of Gucun Laipan, Shanghai Baoshan District, launched the last 144 suite home. The project was divided into 58.2 points. As a result, a total of 259 groups of buyers were shortlisted. In the end, after the selection of house selection of the finalists, the remaining houses were bought by 50 groups of house buyers, and the project was sold out. Data from Mingyuan Yunke showed that the project's sales amount was 670 million yuan.

On August 12, Chinese enterprises said on the interactive platform that the company's Shanghai project Hai Rui Binjiang, Yuncuijiang Bay, and Guanghua Yajing have all been sold out. The company will actively participate in the Shanghai open market land auction in 2022, continuously expand investment channels, and participate in equity and acquisition projects.

In addition to showing signs of residential sales, Chinese enterprises also stated that they have made substantial progress in the urban renewal track during the reporting period. In October 2021 The area 9 of the area was officially started in February 2022, 4 months after the land, and the current construction of the block is in the basement structure and the upper structure construction stage.

"The company's self -sustaining office building project is superior. It is mainly based on the core areas such as Lujiazui, Beibinjiang, and East Bund. In the future, it will effectively increase the company's business scale and become the stabilizer and compressor stone of the company's performance." Chinese enterprises are in the Chinese enterprise. The performance report said.

As of the end of the reporting period, Chinese enterprises have achieved zero -step lines against the "three red lines" to maintain the "green file" level.The asset -liability ratio after pre -collection was 67.34%, the net liability ratio was 38.55%, the cash short debt ratio was 8.12, and the balance of the currency funds was 15.061 billion yuan.[Original real estate, if you like it, please pay attention to WeChat Real-ESTATE-CIRCLE]

Daily Economic News

- END -

In the first half of this year, Dongguan's foreign trade maintained growth

Since the beginning of this year, the impact of the new coronary pneumonia's epide...

Live+expansion, shake the next battlefield or in the industrial layer

The acceleration of short videos/live broadcasts with various industries has exten...