Jiuling Lithium IPO, can there be "lithium" throughout the world?

Author:Value Planet Planet Time:2022.08.31

Author | Yang Chengchun

Edit | Tang Fei

By the Dongfeng of New Energy Vehicles, battery -related companies have set off a wave of listing.

Jiangxi Jiuling Lithium Co., Ltd. (hereinafter referred to as "Jiuling Lithium") is one of them. According to the data, Jiuling Lithium Industry was established in 2011 and was known as one of the "Four Dragons" of Lithium Cloud Mother. It has the world's first 10,000 -ton lithium Yunmu lithium production line.

Jiuling Lithium's listing of Dongfeng by new energy vehicles can be described as logical, but the market is not very optimistic about this IPO. Judging from the information disclosed by Jiuling Lithium Industry Prospectus, Jiuling Lithium is not obvious in terms of finance and technology, and the shortcomings are highlighted.

From the perspective of the industry, Jiuling Lithium has been a leading company in the industry, but now it has gradually fallen out of the first echelon. Half of the valuation.

This not only reflects the change of lithium industry pattern brought about by the outbreak of new energy vehicles, but also reflects the situation of second -tier lithium companies -where is the second -tier lithium enterprise out of the way?

Lost, thousands of miles away

Jiuling Lithium ownership products are lithium salt products. This product is mainly extracted from lithium ore and salt lake. After processing, it forms industrial -grade lithium carbonate and battery -grade lithium carbonate and lithium salt intermediate products.

Jiuling Lithium Industry entered earlier. Relying on the rich lithium cloud mother resources in Jiangxi, the company's vertical integrated production capacity of lithium salt products such as lithium carbonate and lithium hydroxide is a leading position.

However, Jiuling Lithium did not follow the outbreak of new energy production capacity and "flying yellow Tengda", but the gap with head lithium companies became bigger and bigger.

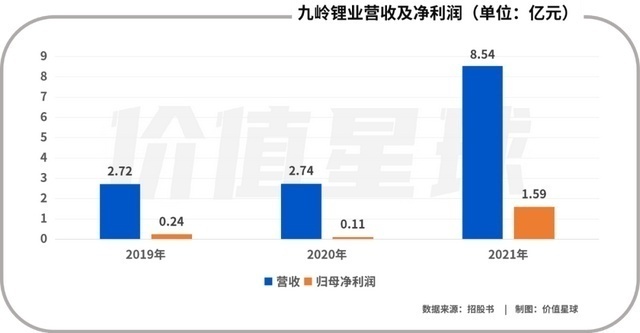

In 2021, the revenue of Jiuling Lithium was 854 million yuan, and the total revenue of Ganfeng Lithium and Tianqi Lithium industry had reached 11.16 billion and 7.663 billion, respectively.

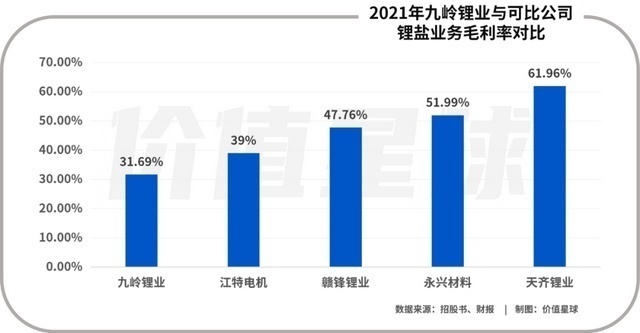

From the perspective of lithium -hairsy interest rates, in 2021, the rise in raw materials such as lithium carbonate benefited the entire industry. In 2021, the gross profit margin of Tianqi Lithium was 61.96%, Ganfeng Lithium was 47.76%, and Jiuling Lithium Industry was only 31.69%, and did not have obvious advantages.

In terms of market value, Ganfeng Lithium and Tianqi Lithium have reached 173.5 billion and 184.6 billion, respectively, while Jiuling Lithium has only 12.5 billion valuations, less than two other zero.

The main reason for the huge difference today is the difference in route and the ability to grasp the timing.

Jiuling Lithium uses domestic lithium Yunmu as raw materials, and uses Yunmu lithium lifting technology. Tianqi Lithium and Ganfeng Lithium Industry purchases a large number of foreign energy pyroxyls for processing.

At the beginning of the Jiuling Lithium, the lithium ore initiated rights tightly. This is understandable, but the hidden danger is that the quality of lithium ore is large. Jiuling Lithium has low lithium minerals with mining rights, and the average content of lithium oxide is 0.51%. A considerable part of the pyroe is a fine lithium ore, and the content of lithium oxide can reach 1%-1.5%, or even higher. The difference in production costs brought by quality differences directly reflected in the gap between the gross profit margin of the enterprise.

Low -quality lithium ore will also extend from extracting lithium ore to production as a cycle that can be used for the standard of new energy battery specifications, which leads to a large explosion of new energy vehicles in the second half of 2020 to the first half of 2022, and lithium ore When the supply is in short and the price rises, the bonus cannot be eaten on a large area.

In addition, the lithium -cloud lithium -lifting industry technology is not yet mature, and the market acceptance is relatively low. The bargaining ability of lithium salt products is not as good as the Ganfeng lithium industry and Tianqi lithium industry with a large number of lithium pyroxin.

Other leaders "eat meat", Jiuling can only "drink soup", but also in Jiuling's lithium industry to largely misjudge the lithium demand situation.

In the first half of 2020, the lithium carbonate market was sluggish, and the gross profit margin of lithium salt products fell from 14.32%in 2019 to 4.95%. Jiuling Lithium Industry Selected to stabilize and slow down the releasing capacity of the back end of the lithium salt product.

I never thought that this downturn is really to suppress it first. After the cold winter, it is directly connected to the midsummer, and the demand for lithium batteries will soon explode. In the second half of 2020, the industry recovered, and lithium prices soared. Tianqi Lithium and Ganfeng Lithium Industry won a large amount of lithium mine resources in advance, and in this wave of upstream companies of power batteries, they won hemp.

Jiuling Lithium, who did not choose to expand against the trend, was caught off guard and was behind other companies behind it.

Can the strong men break the wrist, can it come back?

In March of this year, through a series of equity operations, the overall valuation of Jiuling Lithium industry reached 12.5 billion yuan, but in this IPO, Jiuling Lithium intends to issue 15%of the equity and raise 760 million yuan for project construction for project construction Correspondingly, the overall valuation was 5067 billion yuan, and the valuation of the first and secondary markets had inverted.

Jiuling Lithium would rather reduce the "blood volume" to the IPO, which confirmed the urgency of its listing to a certain extent.

When the outbreak of the production capacity, the Jiuling lithium industry failed to follow up the raw material resources in time; down, because the price of lithium carbonate such as lithium carbonate has risen in time, and measures such as raw material locks in advance, causing profitable space to be compressed by compression space being compressed Essence

In order to alleviate this problem, Jiuling Lithium has spent some efforts in research and development. According to its prospectus information, from 2019 to 2021, the R & D expenses of Jiuling Lithium industry were 12.465 million yuan, 11.574 million yuan, and 14.7259 million yuan, respectively.

Even so, the R & D investment of Jiuling Lithium is still low in the industry. According to the report, the total R & D expenses of 272 lithium battery concept stocks were 116.4 billion yuan in the same period, with an average R & D expenses of 428 million yuan, which is much higher than the Lithium of Jiuling. Picture source: prospectus

Even compared with the same company, Jiuling Lithium is outdated. The prospectus shows that the average R & D cost rate of companies in the industry in 2021 was 2.39%, while the R & D cost rate of Jiuling Lithium was only 1.72%.

The lack of research and development also affects the patent accumulation of Jiuling Lithium. The prospectus disclosed 37 invention patents in Jiuling Lithium, which has a significant gap with the 98 items of Ganfeng Lithium and the 145 items of Tianqi Lithium.

Photo source: 查 : :

Limited by its own quality, the technical cost of lithium Yunmu was originally higher. According to such R & D investment, it is difficult to be competitive in terms of cost reduction and efficiency.

With the fully release of lithium ore capacity, the situation of lithium raw materials in short supply has been greatly eased, and the price of raw materials such as lithium carbonate has also stopped rising.

The benefits of upstream buying ore are far inferior to the previous two years. It is a reasonable route to convey important materials to downstream power batteries. However, due to the current technology and financial situation, Jiuling Lithium Industry is difficult to seize the opportunity in this Red Sea.

Coupled with Jiuling Lithium as a family business, it does not have significant superiority in the enterprise management system. According to the current situation, it is difficult for Jiuling Lithium to go further in the first -level market. Putting attention to the secondary market is one of the few choices.

There are two key points of Jiuling Lithium IPO -allowing the industry to see the self -sufficiency of its lithium ore is guaranteed; letting the market see that its lithium salt products can improve the profit. These two points are not difficult.

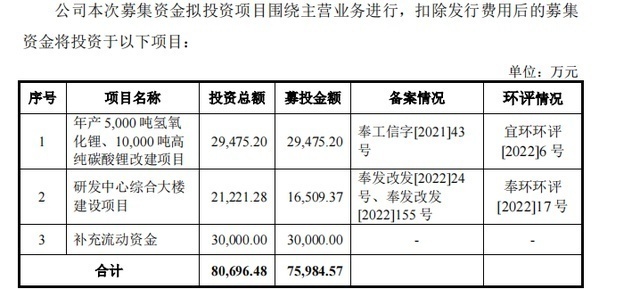

The prospectus mentioned that Jiuling Lithium mentioned the production capacity of 295 million yuan to raise 295 million yuan to increase the annual output of 5,000 tons of lithium hydroxide and 10,000 tons of high pure lithium carbonate. This is the killer of Jiuling's IPO, but it is also likely to further expose the lack of their raw materials.

Picture source: prospectus

Another large -scale fundraising project is the construction of a comprehensive building of the R & D center. This move is obviously aimed at making up the shortcomings on the research and development of Jiuling Lithium Industry Technology.

Picture source: prospectus

If you can raise funds through an IPO, for technical investment, and optimize the internal management and talent structure, Jiuling Lithium is not possibly possibly of the possibility of turning over.

Where is the second -line lithium company?

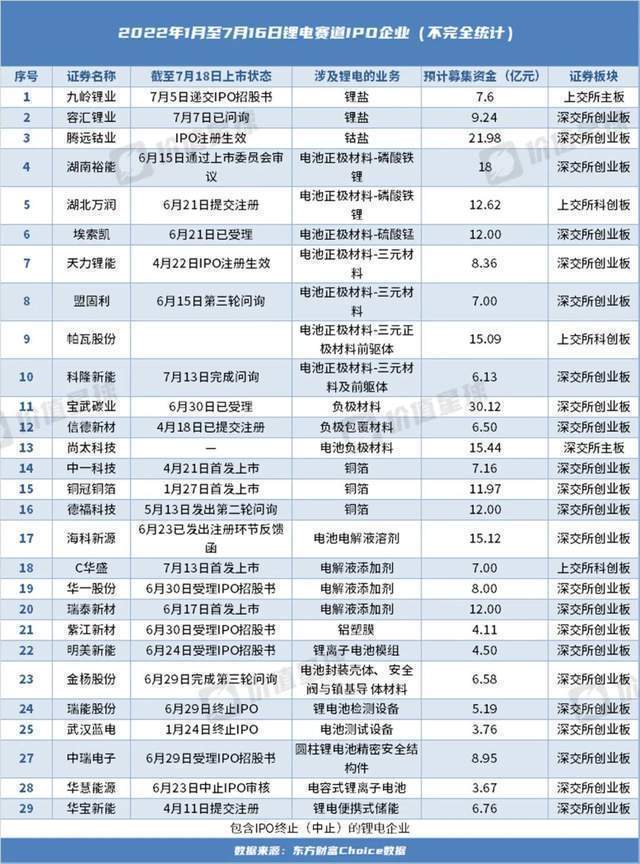

In addition to Jiuling Lithium Industry, many lithium companies have rushed to the market in the past six months.

According to incomplete statistics, 30 lithium battery companies have sprinted IPOs since this year. The 6 companies were successfully listed, and 24 companies were in the IPO sprint process. Among them, the three have been reviewed by the listed committee; the six have been submitted to the registration or registration, and the five are in the inquiry stage. The seven have just completed the submission and acceptance of the prospectus. There are three other departures and have been suspended for review.

Of the six companies that have been listed, 5 lithium battery companies have more funds than expected. Among them, Huasheng Lithium Electric raised funds of 700 million yuan, and the fundraising of 2.574 billion yuan was completed on July 4; the copper crown and copper foil plan raised funds of 1.197 billion yuan, and the actual raised funds were 3.579 billion yuan. 2.198 billion yuan, in fact, the funds raised were close to 5.5 billion yuan.

The emergence of super -raising indicates that the market is optimistic about lithium materials. However, the Matthew effect of this market is increasing, and the industry head enterprises have occupied most of the capacity.

The production capacity of Tianqi Lithium has reached 44,500 tons/year lithium carbonate, 05,000 tons/year lithium hydroxide, 04,500 tons of lithium chloride, and 800 tons of metal lithium. It is expected that the output of lithium salt equity this year will reach 141,700 tons; The lithium industry reaches 126,000 tons of lithium salt production capacity. It is expected that by 2025, it will form a lithium product supply capacity of 300,000 tons of LCE; Jiangte Electric will be about 2-27,000 tons of lithium salt in 2022, and 20,000 will be invested at the same time. Ton lithium salt project.

In other words, there are not many living space left to second -tier lithium companies.

The lithium battery industry is located in the midstream of the new energy vehicle industry. Inside the lithium battery industry, it can be divided into upstream raw materials; key material suppliers in midstream battery; mid -tier -end battery manufacturers; downstream product application terminals.

Compared with power batteries, there are already mature patterns and stable downstream car company cooperative manufacturers. Lithium -sized materials companies located in the middle and upper reaches of the industry have to be sorted out as a whole, especially the fate of second -tier companies, and the result of this IPO storm. closely related.

From the perspective of future situations, the future of Jiuling Lithium is also full of challenges. Some brokers analyzed that lithium supply and demand in 2023 will reach a state of tight balance.

Li Liangbin, chairman of the Ganfeng Lithium Industry, publicly stated at the China Lithium Industry Conference that lithium resources are enough to meet the needs of the development of new energy vehicles worldwide. With the climax of the global lithium project, the price of lithium salt may be reversed. In addition, according to data disclosed by the U.S. Geological Survey, the global resource volume of lithium resource in 2021 was 88.56 million metal tons. Last year, the global lithium ore production was equivalent to 105,000 metals, only 0.48%of the proven reserves.

With the increasingly saturated market and production capacity, the production capacity of LFP materials, electrolytes, lithium batteries and copper foils is close to the apex. Breakthroughs will be the victory of decision or failure.

Reference materials:

[1] "Great performance increased valuations reversed inverted, what are the" victors and defeats "of Jiuling Lithium Industry IPO?", Investor Network [2]" The gross profit margin is not as good as expected to expand production, Jiuling Lithium Industry may have missed the opportunity to develop ", Aiji Wei APP

[3] "30 companies sprint ipo, lithium battery industry ushered in a big explosion", surging news

*This article is based on public information, which is only used as information exchange, and does not constitute any investment suggestions

- END -

Digital transformation into a "compulsory course": The scale of the related IT market has exceeded 2 trillion, and the business model will change

Southern Finance All Media Reporter Li Runze Intern Gao Yi Guangzhou ReportAt present, my country's digital transformation and development has gradually entered a new stage of improvement from the ini...

The "Top Ten Strategy" Exploration of Huixian ② | From "advantage" to "victory", Huixian reconstruction economic development growth pole

Top News · Henan Business Daily reporter Song Hongsheng intern Jin Ping correspon...