Ko Tuo's once again sprinting the IPO failure gross profit margin for three consecutive years lower than the peer peers for three consecutive years

Author:Cover news Time:2022.08.31

Cover reporter Ma Mengfei

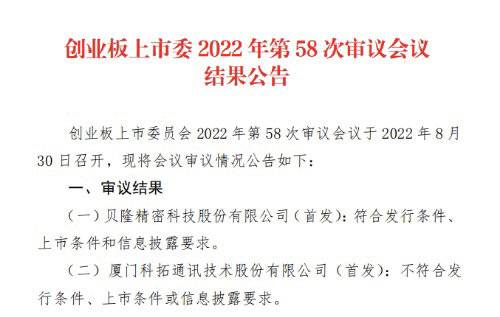

On the evening of August 30, the official website of the Shenzhen Stock Exchange disclosed that the GEM IPO of Xiamen Keituo Communication Technology Co., Ltd. (hereinafter referred to as "Ko Tuo Co., Ltd."). At the review meeting, the Shanghai Municipal Party Committee mainly raised four major issues to Koto's shares.

In fact, this is the second time Kakoto's shares broke through, but still ended in failure. The company has declared the GEM list in April 2017, but then withdrew the order. Kakoto's main business is the research and development, production, and sales of smart parking management systems, as well as providing smart parking operation management services.

It can be found that the timeline of the Kok Tuo IPO can be found that it has been queuing for more than a year. On June 24, 2021, the prospectus of Koto's shares was accepted, and then it entered the inquiry status on July 15th, but it was not considered until August 30 this year.

The prospectus shows that the impact of the GEM listing, Ko Tuo plans to raise 587 million yuan, and invest in the intelligent manufacturing technical reform project of the parking industry, the rapid parking operation management project, the R & D center construction project, the purchase and construction project of the headquarters building, and the headquarters building, and the purchase and construction project of the headquarters building, and Supplement of mobile funds.

From the perspective of performance, from 2019 to 2021, Ko Tuo's share revenue and net profit were in a year-on-year growth trend, of which about 442 million yuan, 561 million yuan, and 719 million yuan were achieved. RMB 40 million, 80 million yuan, and 090 million yuan, but the growth rate of net profit is slowing.

In addition, the performance of Koito's shares in the first half of this year was not ideal. The net profit attributable to was about 1.18 million yuan in the first half of the year, a year -on -year decrease of 26.98%. In addition, Ko Tuo's gross profit margin for three consecutive years is lower than the comprehensive gross profit margin of the company in the same industry for three consecutive years.

It is worth noting that although the company's performance is growing, there is a certain risk of decline. During the reporting period, the comprehensive gross profit margin of Ko Tuo's shares was 45.71%, 46.51%, and 45.86%, respectively, which was lower than the average comprehensive gross profit margin of the company in the same industry for three consecutive years.

Whether the IPO is this time, the Shanghai Municipal Party Committee has raised four major issues on Ko Tuo's shares.

For example, Zhongqing Huijie is the fifth largest customer of Kok Tuo shares in 2020, and in 2020, Ke Tuo and Zhongqing Huijie successively signed a parking lot investment operation management cooperation agreement, equipment sales contract and software sales contract, equipment sales contract payment period It is 8 years.

In this regard, the Shenzhen Stock Exchange requires that Ko Tuo shares combined with the specific content, price basis, delivery process, payment progress and external evidence of the above transactions, to illustrate the rationality and business logic of the transaction, and whether the relevant information disclosure is accurate and complete.

- END -

Shenzhen Stock Exchange held a 2022 member meeting

Our reporter Xing MengOn July 29, the Shenzhen Stock Exchange held a 2022 member meeting. Representatives of 121 member units attended the meeting. Special member units representatives, directors, sup

Dahongmen area transformed the Capital Business New Area Nanzhongxian Cultural Science Park in September opened the park in September

Xinyahui International Clothing Market Transformed into an Experience Comprehensive Shopping Center Heasheng Plaza, Facheng Trading Market transformed into Fengtai District Government Service Center a