[Cai Zhi Headline] The cost of 900 is tens of thousands of, and the mattress "assassin" Mu Si is harvested?

Author:China Well -off Time:2022.08.31

Picture source: network

Since the "Assassin" of the ice cream, the mattress "Assassin" -Mu Si appeared in the public vision.

Recently, Musi mattresses appeared on Weibo hot search due to price issues, selling mattresses with a unit cost of less than 1,000 yuan to thousands of yuan or even tens of thousands of yuan. Because of the total cost of investing in the three years of research and development, it was less than that of the advertising costs that were invested in one year, and was questioned by smashing money marketing, establishing a high -end image, and specializing in social elites.

In the previous prospectus incident, the black history of Mursey's suspected false propaganda was unveiled, selling low -cost mattresses to tens of thousands of yuan, and the gross profit margin was as high as 60%.

Many people also recognize the true face of Mu Si, that is, domestic goods wearing foreign shells.

Mu Si put on foreign vests

"Royal Design", "European Series" and "Old Old Man" are all gimmicks promoted by Murde.

Under the crazy bombardment of Murde's advertising, many consumers regard Murde as overseas brands. In fact, Musi is a local brand in Dongguan, with 100 % domestic domestic goods. Due to the English name DE RUCCI and the "Old Old Man" image, it seems quite characteristic of foreign brands and is also accused of suspected "pretending" foreign brands.

On October 29 last year, the Securities and Futures Commission released the "Feedback of Mu Si Health Sleep Co., Ltd. to publicize the first public offering of the stock application documents", and asked for 59 questions, including whether the "Old Old Man" advertisement was suspected of false publicity, revenue, and revenue, and revenue, revenue, and revenue. The profit growth rate, the source of income and the distribution model is extremely single -class hidden dangers, the dealer reports its suspected tax evasion and the relationship between the European home furnishing.

So who is "Old Old Man"?

According to the previous prospectus released by Mu Si, the image of the "Old Old Man" is a very recognizable "Elderly Image" brand visual hammer to pass the company's professional and focused craftsmanship to the majority of consumers. It has been deeply rooted in the hearts of Murus mattresses in the domestic market.

In other words, "Old Old Man" may be just a model.

According to its prospectus, the old man named Timothy James KingMan signed the "Agreement" with Timothy James Kingman in August 2009, agreed that Timothy James Kingman authorized Mu Si to use a portrait photo and its film. The use period is permanent use.

In the early years, in the advertisement that appeared in this "foreign old man", Musi often added words such as France, Europe, and royal designers. 10,000 yuan bedding.

After creating high -end "human settings", and European descent, Murde's shares were widely questioned, and they still did not give up the brand logo of "Old Old Man". In the introduction of the official website, it claims that specialty stores are located in more than 20 countries and regions around the world, providing a healthy sleep experience for millions of customers.

However, Murus shares, which are packaged as foreign goods, account for less than 3%in the overseas market in recent years.

According to its prospectus, Murde's main business income is mainly derived from the domestic market, and East China and South China are the main sales areas. From 2019 to 2021, Mu Si East China ’s revenue accounted for 37.71%, 36.41%, and 37.28%, respectively; in the same period, South China’ s revenue accounted for 19.8%, 22.52%, and 23.84%, respectively.

The proportion of Mu Si overseas market revenue is below 2%. Data show that from 2019 to 2021, Mu Si achieved overseas revenue accounted for 2.5%, 1.92%, and 1.6%, respectively. The overseas markets announced by Mu Si, including Australia, the United States, Germany, etc., as the so -called French designer brand, but did not mention the French market.

Photo source: Murus Shares Prospectus

"Wool is on the sheep"

Wang Bingkun, chairman of Mu Si, borrowed the marketing routine of multiple furniture brands that had been represented and packaged into high -end international brands from France.

Not only that, in order to create a "high -end" image, Mu Si also spent a lot of money for brand promotion and publicity.

From 2019 to 2021, the sales expenses of Mu Si were 1.21 billion yuan, 1.105 billion yuan and 1.596 billion yuan, respectively, and the sales costs were as high as 31.32%, 24.82%and 24.63%, respectively. Among them, advertising expenses account for a big head. During the same period, Mursey's advertising costs were 445 million yuan, 396 million yuan and 480 million yuan, respectively.

Photo source: Murus Shares Prospectus

Mu Si's marketing costs are mainly invested in offline platforms such as airports, high -speed rails, buildings, and online new media platforms such as Douyin and Xiaohongshu.

Each year, it also reports advertising to attract target customers such as social elites, high -end business people, high -quality white -collar workers and young people.

In addition to the national CCTV, airport and high -speed rail advertisements, Mursey also sponsored star concerts such as Andy Lau, Zhang Xueyou, Eason Chan, Tan Yonglin, Xu Wei, Li Zongsheng, etc.; Competition; variety shows such as "Let's Love" and "Good Voice of China".

In addition, celebrities also invited celebrities to endorse. In 2020, Murde signed a brand spokesperson Li Xian; August this year, he announced that table tennis player Zhang Jike served as spokesperson and launched a mattress with Zhang Jike.

Each year, hundreds of millions of yuan are hit in marketing, the brand awareness also increases, and the price of the product is much higher than other peers. On the whole, the comprehensive gross profit margin of Mu Si from 2019-2021 was 53.49%, 49.28%, and 44.45%, respectively. The average period of the same period was 37.69%, 34.73%, and 29.58%, respectively, which is much higher than Xilinmen, Meng Lily, Gujiajia Home, and Fun Sleeping Technology of the same industry.

The explanation given by Mu Si is that the company mainly operates independent brands and enjoy a higher brand premium.

Photo source: Murus Shares Prospectus

The prospectus shows that the mattress, as the main product of Murde, has contributed nearly half of its revenue and over half of the profits.

From 2019 to 2021, the cost of the unit of Mursen mattress was 939.11 yuan, 855.37 yuan, and 873.43 yuan, respectively, and the corresponding average unit price was 2419.93 yuan, 2102.6 yuan, and 2041.97 yuan, and the gross profit margin was as high as 61.19%, 59.32%, and 57.23% Essence

Photo source: Murus Shares Prospectus

Mu Si, which is directly operated by direct -operating, direct supply, and e -commerce, has maintained its gross profit margin at a relatively high level.

From 2019 to 2021, the gross profit margin of Mursey's direct operating channels was 78.32%, 75.89%, and 73.85%, respectively; the gross profit margin of e-commerce channels was 69.02%, 61.58%, and 58.92%, respectively.

The performance changes, the stock price breaks

Mu Si was just launched in June this year. At that time, Mu Si gave expectations to the performance of the first half of this year in the prospectus.

From January to June 2022, Mursey's operating income is expected to be 2.95 billion yuan to 3.15 billion yuan, an increase of 5.02%to 12.14%over the same period last year; the net profit attributable to shareholders of the parent company is expected to be 310 million to 350 million yuan. , Changed -5.03%to 7.23%compared to the same period last year.

However, the recently released semi -annual report has faced.

On August 19, the semi -annual report released by Murde's shares showed that revenue achieved revenue of 2.752 billion yuan in the first half of the year, a year -on -year decrease of 2.03%; the net profit attributable to shareholders of listed companies was about 307 million yuan, a year -on -year decrease of 5.95%; Later net profit was 308 million yuan, a year -on -year decrease of 4.2%.

In revenue and net profit, both financial indicators are not as good as previous expectations.

Mursey explained that in the first half of 2022, various uncertainty intertwined together, the new crown epidemic continued to repeat in China, and the company experienced a more complicated operating environment than the previous year's epidemic. Among them, the serious epidemic occurred in Shenzhen, Dongguan, and Shanghai during the March to May, which to a certain extent influenced the company's normal operation of South China East China Base and offline sales in the two regional markets of East China.

The mattress of the revenue is not colorful. In the first half of 2022, Mursey's mattress achieved revenue of 1.287 billion yuan, accounting for 46.76%of the total revenue. However, compared with the same period last year, the income of mattresses fell by 9.68%, and the proportion of the total revenue also dropped to less than half.

Picture source: Mursey's half -annual report of 2022

And another product classification of another revenue is bedding business. The announcement shows that the revenue of bedding in the first half of the year was 180 million yuan, a year -on -year decrease of 22.88%, and the proportion of the total revenue dropped to 6.52%, a decrease of 1.77 percentage points from the same period last year.

It should be noted that Murde's shares that have just been listed in June this year have also fluctuated. As of August 30, the closing price was 39.18 yuan/share, and the latest market value was about 15.672 billion yuan.

The issuance price of Murus Co., Ltd. on the main board of the Shenzhen Stock Exchange was 38.93 yuan/share, and the closing price on the first day of listing was 56.06 yuan/share, which was 44%higher than the issuance price. Since then, it has declined all the way. As of today, the closing price has fallen below the issue price.

Picture source: snowball

(WeChat public account "Cai Zhi Headline" comprehensive self: Future Network, Interface News, Surging News, etc.)

Edit: Bai Jing

School pair: Yuan Kai

Review: Gong Zimo

- END -

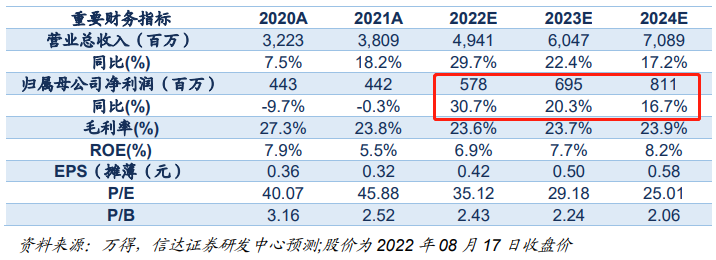

"Fengkou Research Report · Company" VR/AR+Lidar precision parts+smart car HUD has become a new growth point for this optical leader. The performance of the interim reporter exceeds analysts expectations.

① VR/AR+Lidar Precision Parts+Smart Motors HUD has become a new growth point for ...

Chaozhou City introduced twelve measures to stabilize and develop grain production

Chaozhou Industrial Enterprise ushered in good news! Recently, the municipal government issued the Several Policies and Measures on Further Supporting High -quality Development of Industrial Enterpri