The "Daily Evaluation" cycle and the track collectively recovered again, and the market continues to deteriorate after the disadvantaged rotation

Author:Federation Time:2022.08.30

After the broader market opened, the shock fell, and the GEM finger led. On the market, the super -declined theme stocks performed active, and low -level sectors such as Internet e -commerce, media, communications, education, and education have taken turns. It is worth buying a daily limit of 20cm. The strength limited rotation is faster. In terms of decline, cyclical stocks are collectively adjusted, coal, gas and other sectors lead the decline, and Shanmei International and Delonghui have lost their daily limit. Circuit stocks have weakened again, and photovoltaic -related sectors are adjusted to the top, and three -dimensional chemistry and first flights have daily limit. Overall stocks fell more, and over 2,500 stocks in the two cities fell. The sales of Shanghai and Shenzhen today were 838.5 billion, a shrinkage of 7.3 billion compared with the previous trading day. In terms of sectors, pet economy, media, Internet e -commerce, education and other sectors have risen, and coal, gas, optical power generation, virtual power plants and other sectors have fallen.

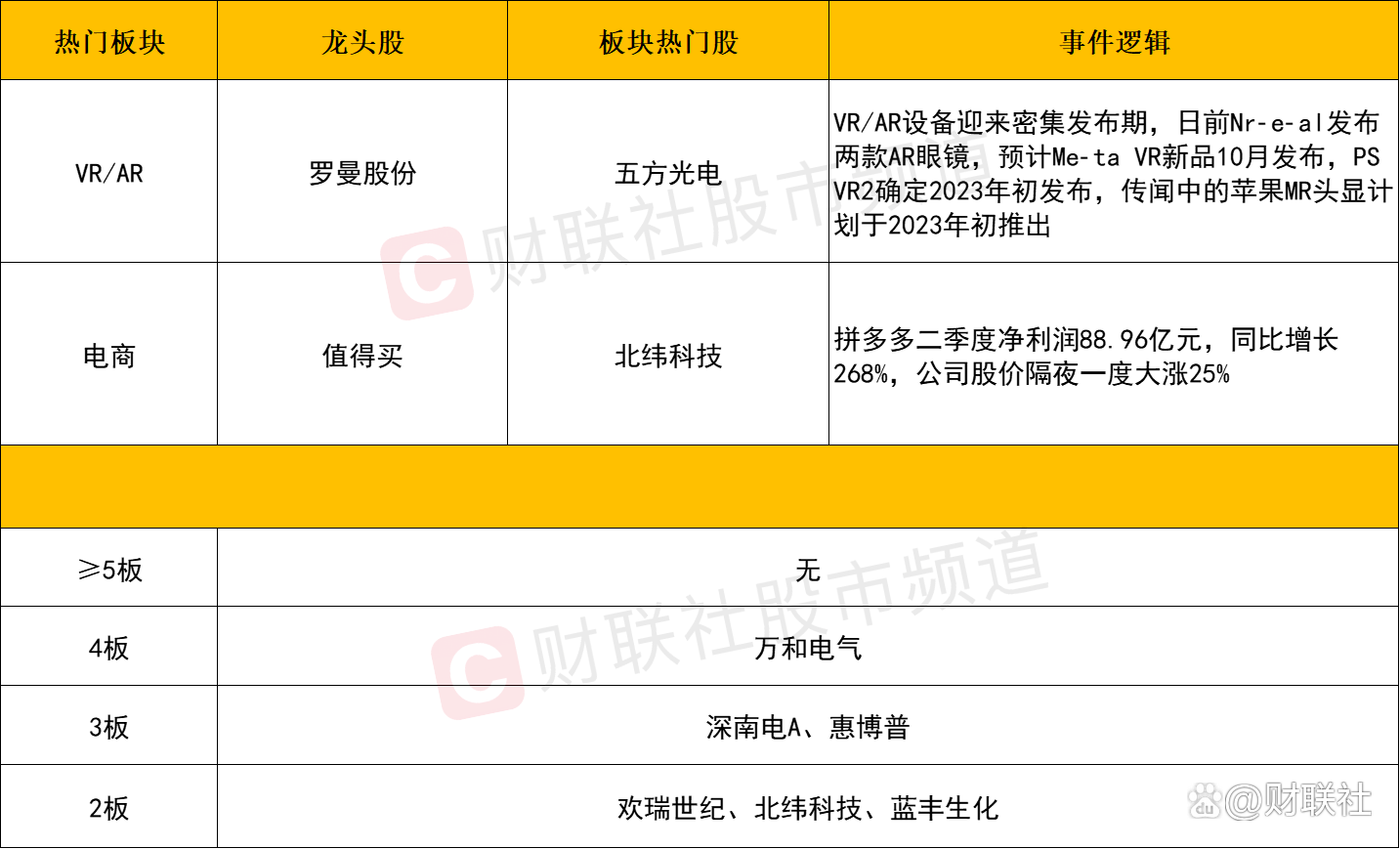

Plate

Yesterday's strong cyclical energy shares ushered in collective callbacks today, and the coal sector fell the top. Among them, Shanmei International, Shanxi Coking Coal, Huayang Co., Ltd., and Jinkong Coal Industry fell more than 8%. Today's futures market has plummeted coking coal futures, the main contract of coking coal futures has plummeted by more than 5%, and the main contract of coke futures in the morning also plummeted by more than 4%. Although the collective fermentation of the stock resource stock yesterday, it is foreseeable that it can be differentiated today. But today's callback is far exceeded expected. Not only did the yang line completely devour yesterday, it also effectively fell below the large number of long red lows last Thursday. From a technical perspective, the short -term has shown obvious weak doubts. From the short -term and then there are high bombs, consider or be more secure from the perspective of risk control.

On the other hand, the direction of photovoltaic, energy storage, and photoelectric power generation also ushered in collective callbacks. Among them, Hemai shares fell more than 15%, Electricity Investment Energy, and Shouhang Hi -Tech daily limit. Popular stocks such as Huangshi Group, Dongxu Blue Sky, Lixin Energy also fell more than 8%. As the recent evaluation has been emphasized, the track direction has experienced significant signs of loosening after the continuous recovery of last week. The short -term probability will experience staged collation. Pay attention to the corresponding risk control. As of now, the risk of the track of the track has not been fully released, and it is more secure to wait for the patience and wait for it again.

In the context of the weakening of the above -mentioned high direction, funds are gradually trying to tap some low directions. The concepts of media, Yuan Universe, VR/AR and other concepts have increased. Longfei fiber and other individual stocks have daily limit. In terms of news, the VR/AR device ushered in a dense release period. Recently, NREAL released two AR glasses. It is expected that the new Meta VR product is released in October. PS VR2 is determined to be released in early 2023. The rumored Apple MR headset is planned to be launched in early 2023. From the current point of view, VR, as a new generation of consumer electronics, may not be far from large -scale commercialization, it is expected to drive a new round of technology investment.

CITIC Securities is expected to reach 32.5 billion yuan in total revenue in 2025, and it is also optimistic about potential long -term opportunities. Therefore, from the perspective of investment, the current node can pay attention to the direction of the VR industry first: 1) Optical components, as the most important part of the upstream VR equipment, will usher in rapid development opportunities. Pay attention Subsidate value direction company; 2) VR whole machine, pay attention to the new overseas technology giants and the layout of the domestic company; 3) VR content, and pay attention to content companies with advanced layout.

Individual stocks

First of all, pay attention to the Ningde era. Since the trend of high and low on August 24, the Ningde Times has fell to close 5 consecutive yin all the way. Looking back, the concerns of the Ningde Times with the help of good performance in Ningde Times are slowly becoming a reality. As the absolute weight of the GEM and the general leader of the track stocks, in the context of its delay, for the game, for the game, for the competition The next trend of the Tao should not have too high expectations.

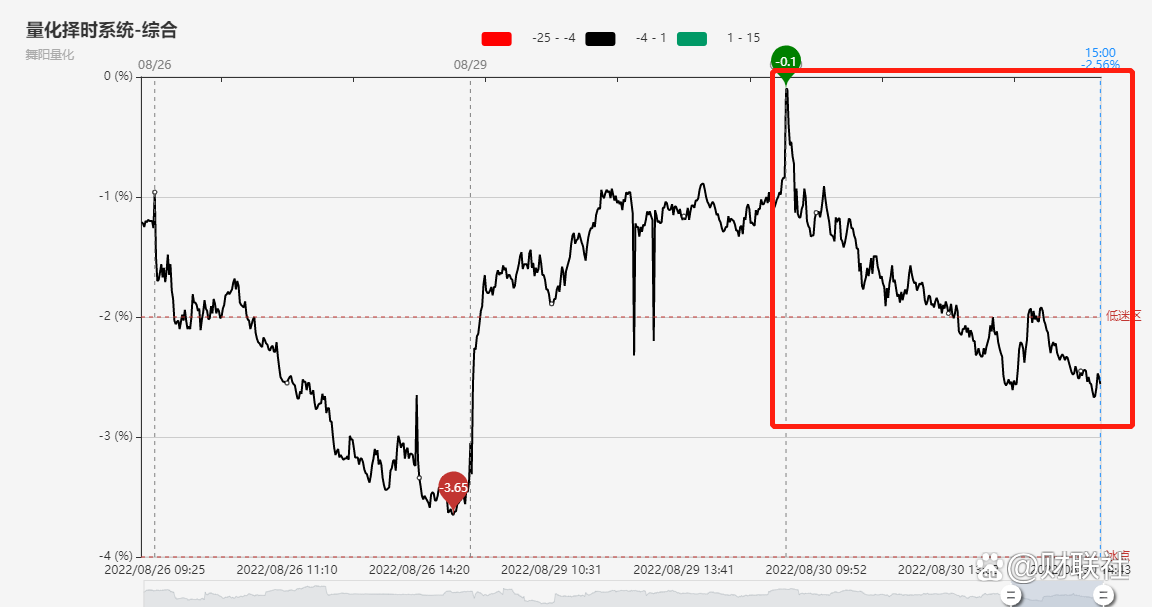

Looking at the short -term market, today's short -term emotions continue to cool down. The number of stocks with a daily limit in the market has been reduced to less than 40 (excluded ST), and only three -board stocks with more than 2 boards have three three stocks, electrical, Shennan Electric A, and Huibopup. Yesterday, the black sesame seeds of the 4th board and the Daqing Huacco of the 3rd board were nucleated to deep water. They were eventually pressed on the limit limit. The negative feedback of some high -level stocks showed obvious suppression of the emotional end. It is also worth noting that Guoguang Electric staged the "Floor" in the afternoon. First, the rising rising touched the daily limit, and then dived sharply and sealed the daily limit at the end. Essence In the context of lack of continuity in the current market, it is better to consider more than to look at the short -term emotions of the market from the perspective of capital security. Patiently wait for the short -term emotions of the market to recover, and it is more secure after re -emergence.

Join market analysis

As of the close, the Shanghai Index fell 0.42%, the Shenzhen Index fell 0.39%, and the GEM index fell 0.7%. The north -wing funds sold 4.98 billion yuan throughout the day, of which 1.804 billion yuan was sold at the Shanghai Stock Connect and 3.176 billion yuan in Shenzhen Stock Connect.

Today, the market has once again declined. Although the overall decline is not large, in the context of continuing the disadvantaged rotation of various sectors, the overall environment of the market is continuing to deteriorate. Sex cannot be guaranteed, and the market is filled with the mood of observation. In terms of the index, the focus of the follow -up attention is still above the GEM. From the short -term perspective, at present, the GEM shows a decline in a volatile and has not yet appeared in the short -term stop signal. 2610 effectively falls below, so the form of decline is formally established, and the time and space of subsequent entrepreneurial sectors will be further stretched. Shanxi Securities believes that A shares have long seen the foundation of harvesting structural conditions, but due to the impact of liquidity and corporate profit margin, the high probability of A shares is still at the stage of adjustment. Shanxi Securities also recommends focusing on the large -scale stocks and industry leaders with strong profitability, strong defense capabilities and valuation repair space.

In terms of individual stocks, 2,213 rises, a decrease of 815 compared with the previous trading day. In the case of excluding ST shares and new stocks, there are 35 daily limit, a decrease of 24 compared with the previous trading day; 16 frying boards, a decrease of 2 more than the previous trading day; Home, the same day as the previous trading day; the daily limit is 0, which is the same as the previous trading day.

In terms of emotions, today's market emotions and index resonances have lowered all the way to below the low -dimensional area, and follow -up may further explore the freezing point.

Focus on the market

1. From today, the power supply in Sichuan and Chongqing region is returning to normal

Financial Press August 30th, from the National Grid that since today (30th), all large industries and general industries in Sichuan have resumed normal power supply. normal. The tight power supply caused by extreme high temperatures in the southwestern region of my country was effectively relieved, and the supply of power supply was smooth and orderly.

2. The United States launched an anti -survey of Hua Aluminum Alloy Plate Double Anti -Cases

Financial Association August 30th, according to China Trade Relief Information Network, the US Department of Commerce recently announced that the application submitted by the ordinary aluminum alloy board working group and its members of the American Aluminum Association will be imported from the Chinese aluminum alloy plate (Common Alloy Aluminum Sheet/CaaS) Anti -dumping and counter -subsidy cases were launched by counter -dumping and anti -subsidy cases. The censorship was produced by 4017 aluminum alloy to avoid anti -dumping and anti -subsidy taxes for aluminum alloy plates. 6.3 mm 4017 fixed -foot aluminum plate or aluminum roll.

- END -

Grasp the quality of food to keep the "tongue tip" safety

Recently, the quality and safety inspection team of winter jujube in Dali County i...

The Financial Bureau of Surabaya County Multi -measure and fully support the development of small and medium -sized enterprises

In order to effectively improve the market share of small and medium -sized enterprises and effectively promote the healthy development of SMEs in Surabaya County, the Surabaya County Finance Bureau h