ETF Weekly: Three new ETFs were established in the week, and 463 ETFs have increased to a positive, up to 19.55%

Author:Capital state Time:2022.06.19

In terms of ETF, three ETFs were newly "born" this week, with a total of 2.056 billion yuan; in terms of performance, 463 stock ETFs have cumulatively increased in the week, with three increases exceeding 10%; in terms of scale, 372 ETF realizes realization The scale increased during the week, up to 2.483 billion yuan.

As of the closing of this Friday (June 17, the same below), the three major Indoices of A shares opened low, and the Shanghai Index closed up 0.96%to re -stand on 3300 points. 2.77%.

From the perspective of extended time, the three major indexes of this week (June 13th-June 17th, the same below) have all increased. Specifically, the Shanghai Stock Expine Index has increased by 0.97%within the week, and the cumulative increase of 2.46%within the weekly index, and the GEM refers to the cumulative increase of 3.94%during the week. During the week, there were 2,779 stocks in the Shanghai and Shenzhen cities, and there were 1946 stocks that had fallen. The average daily turnover of the two cities exceeded trillion yuan, reaching 1.33 trillion yuan.

In terms of ETF, three ETFs were newly "born" this week, with a total of 2.056 billion yuan; in terms of performance, 463 stock ETFs have cumulatively increased in the week, with three increases exceeding 10%; in terms of scale, 372 ETF realizes realization The scale increased during the week, up to 2.483 billion yuan.

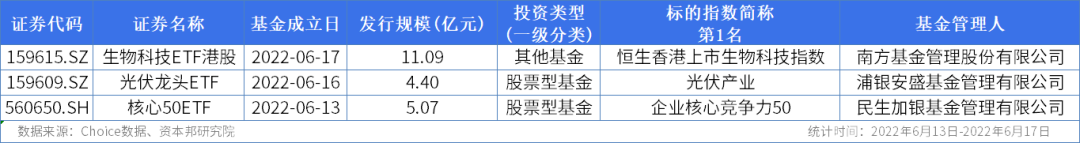

Issuing: 3 new ETFs are established during the week, involving the themes of biotechnology, photovoltaic and other themes

Data statistics show that the establishment date of the fund is the statistical caliber. As of Friday, 59 new ETFs have been established in the market since 2022, including 55 stock ETFs. Compared with 117 ETFs in the same period last year, the rhythm of ETFs has slowed down this year.

This week's new "birth" 3 ETFs are Biotechnology ETF Hong Kong stocks (159615), photovoltaic leader ETF (159609), and core 50ETF (560650). 20.56 billion yuan.

According to the data, the Southern Fund's Biotechnology ETF Hong Kong Stock (159615) began raised on June 6, 2022. The original raising deadline was July 6, 2022, and the final raising deadline was advanced to June 13, 2022. The fund is closely tracking the Hang Seng Hong Kong Listing Biotechnology Index (HSHKBIO), which mainly uses a complete replication strategy, replacement strategy and other appropriate strategies to better track the target index to achieve the fund investment goal and strive to control the annualized tracking error at 4% Inside.

According to the data, the photovoltaic leader ETF (159609) began raised on March 29, 2022. It was originally scheduled for June 28, 2022, and finally advanced to June 10, 2022. The fund is closely tracking the photovoltaic industry index (931151). The index from the main business of the Shanghai and Shenzhen markets involves the model of listed companies in the photovoltaic industry chain, the middle and lower reaches of the listed company securities, and the selection of not more than 50 most representative listed company securities as the index as the index Samples to reflect the overall performance of securities in the Shanghai -Shenzhen -Shenzhen market -listed company.

According to data from the CSI Index Company, as of June 17, 2022, the top ten rights heavy shares of the photovoltaic industry index were Tongwei, Longji Green Energy, Special Transformer, Central Power Supply, Pioneer Intelligence, Crystal Australia Technology. Tianhe Light, Foster, and Jingsheng Electromechanical, the top ten heavy stocks accounted for 61.34%, and the distribution of index component stock industry was mainly concentrated in semiconductor, electrical components and equipment, electronic components, etc.

Chart source: CSI Index Company

The core 50ETF (560650) managed by Minsheng and Silver Fund, from March 16, 2022 to June 7, 2022, the fund closely tracks the core competitiveness of the enterprise 50 index (931526). In the market, 50 securities with higher and large market value of governance, finance, innovation and social responsibility are selected as index samples, providing investors with a variety of investment targets.

According to data from the CSI Index Company, as of June 17, 2022, the top ten of the top ten of the company's core competitiveness 50 indexes were Oriental Wealth, Hikvision, Wanhua Chemistry, Mai Rui Medical, Hengrui Medicine, Tongwei Shares , Conch cement, Changchun High -tech, Fuyao Glass, Hang Seng Electronics, the distribution of index component stock industry is mainly concentrated in finance, information technology, medical and health, raw materials, etc.

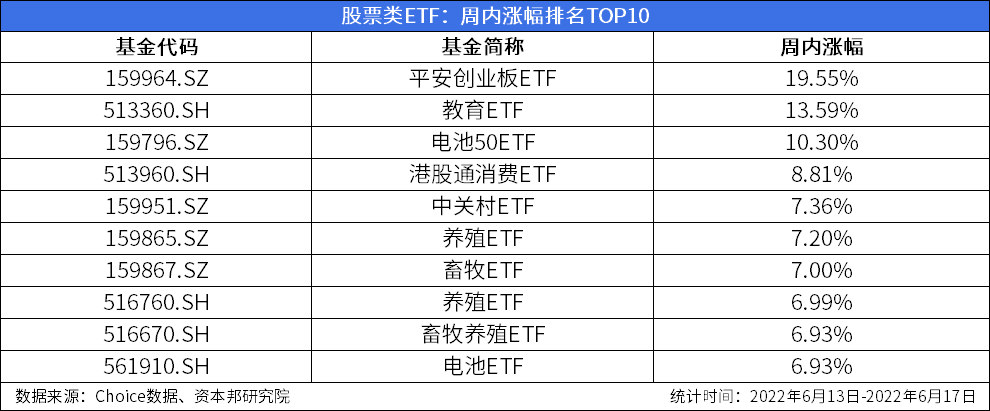

Performance: 463 stock market ETFs rose, three rose exceeded 10%

Data show that as of Friday, the total of 463 ETFs in the ETF fund in 630 stock markets was positive. From the perspective of themes, in the ETF of TOP10 in the week, it mainly involves education, battery, consumption, breeding, and animal husbandry industry theme products.

Specifically, in the TOP10 of the ETF weekly increase list in the stock market, the three increases exceeded 10%. Ping An Fund, Boshi Fund, and Huitianfu Fund ETF (159964), Education ETF (513360), and battery 50ETF (159796) rose at 19.55%, 13.59%, and 10.30%. The top three.

Recently, New Oriental's live broadcast and cargo new platform East selected the "fire out of the fire". Because of the unique "bilingual", the number of fans in the live broadcast room exceeded 10 million, which led to Shanghai, Hong Kong and Shenzhen represented by New Oriental and other representatives Education stock prices rose.

Driven by the sector and individual stocks, the Education ETF (513360) under the Boshi Fund has attracted much attention as the only educational theme ETF in the Shanghai and Shenzhen markets. Choice data shows that from June 10th to June 17th, the fund's net value increased by 14.20%, with a daily average turnover rate of 40%, and active trading. In the same period, the fund size increased by more than 100 million yuan to 732 million yuan.

There are also Hong Kong Stock Connect Consumption ETF (513960), Zhongguancun ETF (159951), breeding ETF (159865), and animal husbandry ETF (159867), respectively, respectively 8.81%, 7.36%, 7.00, 7.00 during the week. %, Ranking third to seventh.

In the top ten of the weekly increase list, there are also breeding ETF (516760), animal husbandry breeding ETF (516670), and battery ETF (561910), which rose 6.99%, 6.93%, and 6.93%, respectively.

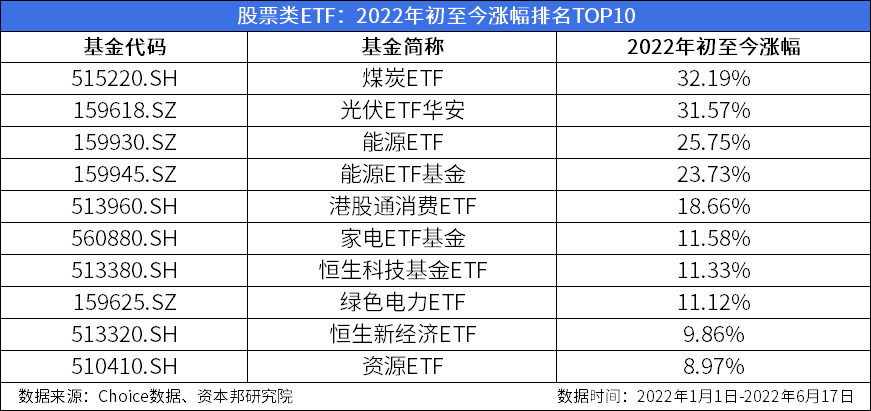

In terms of increased year, as of Friday, as of this Friday, the total of 42 ETFs in ETFs in the total of 630 stock markets have been positive. From the perspective of rising, more than 30%of ETFs, 2, 20%-30%of ETFs with a total of 2, 10%-20%ETFs totaling 4, 8%-10%of ETFs with a total of 2.

Specifically, the coal ETF (515220) and photovoltaic ETF Hua'an (159618) ranked among the top two in the beginning of the year to the present, with a cumulative increase of 32.19%and 31.57%, respectively. At the same time, energy ETF (159930) and Energy ETF Fund (159945) increased by 25.75%and 23.73%during the year.

Hong Kong Stock Connect Consumption ETF (513960), Home Appliance ETF Fund (560880), Hang Seng Technology Fund ETF (513380), Green Electric ETF (159625) cumulative increases of over 10%, respectively, 18.66%, 11.58%, 11.33%, 11.12% , Ranked fifth to eighth. In the top ten of the increase list during the year, there are also the Hang Seng New Economy ETF (513320) and the ETF (510410) of the resource, and the cumulative increases were 9.86%and 8.97%, respectively.

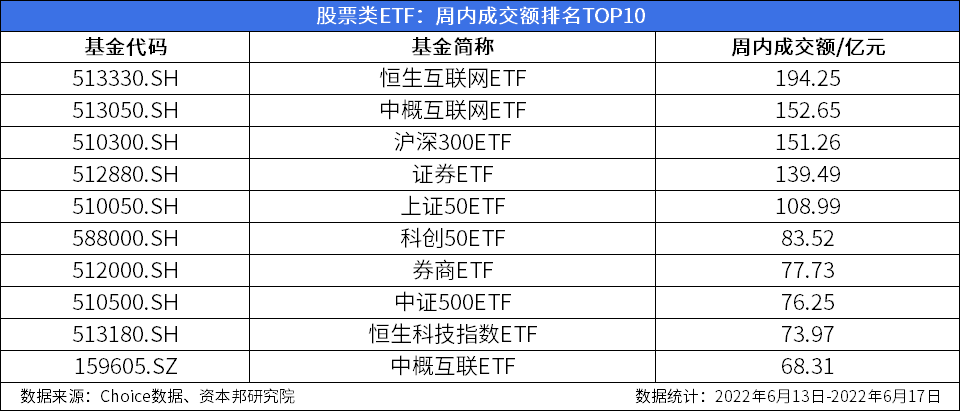

In terms of turnover, among the top ten stock markets this week, in the ETF in the stock market, the ETF turnover in the five stock markets exceeds 10 billion yuan, and the transaction of 1 ETF is between 800 and 9 billion yuan. The turnover is between 7 and 8 billion yuan, and the transaction of 1ETF is more than 6 billion yuan.

Specifically, the Hang Seng Internet ETF (513330), the China Internet ETF (513050), the CSI 300ETF (510300), the Securities ETF (512880), and the Shanghai Stock Exchange 50ETF (510050) have been traded in a total of 19.425 billion yuan, 15.265 billion yuan, and, and 15.126 billion yuan, 13.949 billion yuan, and 10.899 billion yuan, ranking among the top five in the transaction list.

Among the top ten ETFs of the turnover list, there are also science and technology innovation 50ETF (588000), brokerage ETF (512000), CSI 500ETF (510500), Hang Seng Technology Index ETF (513180), and China Connected ETF (159605). A total of 8.352 billion yuan, 7.773 billion yuan, 7.625 billion yuan, 7.397 billion yuan, and 6.831 billion yuan were sold respectively.

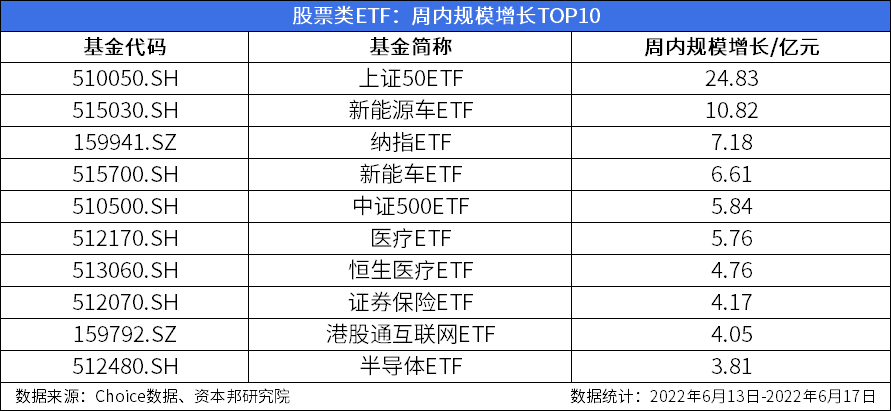

Scales: The scale of ETFs in 372 stock markets increased, up to 2.483 billion yuan

Data show that as of the close of Friday, 372 ETFs in the market in the market in the market have achieved growth rate of 372 in the ETF fund in the market, of which the top ten ETFs in the top ten were added 7.783 billion yuan. From the perspective of the theme, new energy vehicles, medical, securities insurance, Internet, and semiconductor ETFs are favored by funds. In addition, many wide -foundation ETFs, such as Shanghai Stock Exchange 50ETF and CSI 500ETF, also increased the scale in the week.

Specifically, the Shanghai Stock Exchange 50ETF (510050) and the new energy vehicle ETF (515030) increased in the weekly scale of more than 1 billion yuan, an increase of 2.483 billion yuan and 1.082 billion yuan, ranking first and second.

There are more than 500 million yuan during the week's scale, as well as the Naqi ETF (159941), the new energy car ETF (515700), the CSI 500ETF (510500), and the medical ETF (512170), which were added 718 million yuan, 661 million yuan, and, respectively. 584 million yuan and 576 million yuan.

In the top ten in the week, there are also Hang Seng Medical ETF (513060), Securities Insurance ETF (512070), Hong Kong Stock Connect Internet ETF (159792), and semiconductor ETF (512480), respectively, 476 million yuan, 417 million yuan, and 417 million yuan, respectively. 405 million yuan, 381 million yuan. From the perspective of the fund company, the total scale of ETFs in the stock market of 12 fund managers has increased by more than 100 million yuan this week, including Southern Fund, Huaxia Fund, Guangfa Fund, Huabao Fund, Ping An Fund, and Castrol Fund Wait, the size of the Southern Fund increased the largest to 1.023 billion yuan, and Huaxia Fund and the Guangfa Fund increased by 967 million yuan and 939 million yuan, respectively.

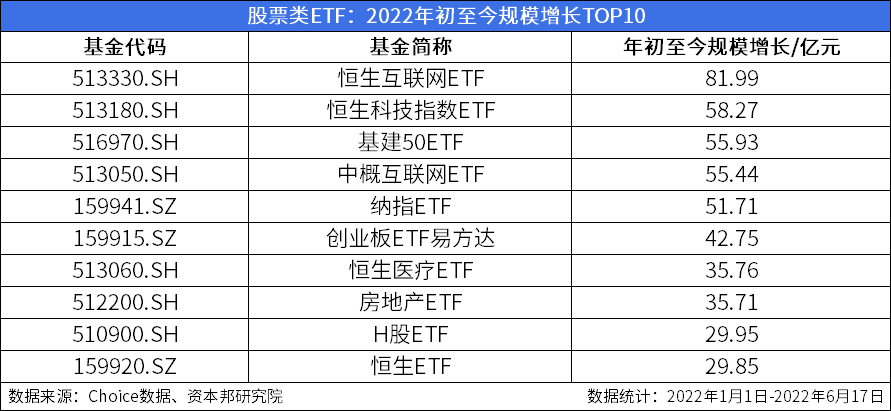

From the perspective of extended time circuits, the scale of 172 stock ETFs in the entire market has increased from early 2022 to the present, of which the 14 size increased by more than 2 billion yuan.

In the TOP10 list since early 2022, the Hang Seng Internet ETF (513330) and Hang Seng Technology Index (513180) of the Hang Seng Internet ETF (513180) under the beginning of the scale increased by 8.199 billion yuan and 5.827 billion yuan, ranking among the top two of the growth list. Infrastructure 50ETF (516970), China Internet ETF (513050), and Naqi ETF (159941) have increased by 5.593 billion yuan, 5.544 billion yuan, and 5.171 billion yuan, respectively.

Among the top ten lists during the year, the GEM ETF ETF ETF (159915), Hang Seng Medical ETF (513060), Real Estate ETF (512200), H shares ETF (510900), and Hang Seng ETF (159920) increased by 4.275 billion respectively The yuan, 3.576 billion yuan, 3.571 billion yuan, 2.995 billion yuan, and 2.985 billion yuan.

The China Galaxy Research Report released the media in the mid -2022 mid -term strategy that it is optimistic about the two main lines of the game and the Internet industry. Influenced by short -term epidemic disturbances and macroeconomic weakness, the Internet industry is currently at the bottom stage of performance. It is believed that as the policy is better, the restoration after the epidemic is driven by the epidemic. recovery.

Galaxy China also believes that the game version number has been pressed for the start -up key, and the pace of distribution is gradually showing a normalization trend. The restarting number may make some games that have been released overseas to regain the domestic market in the future. The center of gravity is shifted, and markets at home and abroad may make game manufacturers a dual increase in the second half of the year. At present, the industry is at a low valuation, and it is believed that the Internet and game industries are expected to usher in the turning point of the market.

Recomm

- END -

Agricultural distribution of southeast Guizhou Southern Branch has taken multiple measures and stabi

Agricultural distribution of southeast Guizhou Southern Branch has taken multiple ...

"Partner" helps enterprises, paired in 31 small and micro enterprise parks in Ningbo has &

Zhejiang News Client reporter Li HuaWhat are the conditions for the mortgage loan ...