The performance of listed brokers accelerated the self -operated business and became a "watershed"

Author:Securities daily Time:2022.08.30

With the performance of CITIC Securities of "Brokerage Brother", the performance performance of A -share listed brokers in the first half of 2022 became clearer. Under the characteristics of high fluctuations in the first half of the year, due to the influence of self -operated business, the performance of brokerage firms has intensified. Of the 27 listed brokers that have been disclosed in the semi -annual report, only two have achieved revenue and net profit "dual growth" year -on -year.

CITIC Securities' net profit in the first half of the year decreased by 8.21% year -on -year

On the evening of August 29, CITIC Securities disclosed the performance of the first half of 2022. The company achieved operating income of 34.885 billion yuan, a year -on -year decrease of 7.52%; net profit was 11.196 billion yuan, a year -on -year decrease of 8.21%.

In terms of main business, in the first half of the year, CITIC Securities brokerage business achieved revenue of 8.274 billion yuan, a year -on -year decrease of 10.54%; the asset management business achieved revenue of 6.091 billion yuan, a year -on -year decrease of 4.24%; ; Securities underwriting business achieved revenue of 3.41 billion yuan, an increase of 30.36%year -on -year.

As of the press release, 27 A -share listed brokers who had disclosed their performance in the first half of 2022 were Shanxi Securities, Guolian Securities, Pacific Securities, Huaan Securities, Guoyuan Securities, Soochow Securities, Zhejiang Shang Securities, etc. Operating income increased year -on -year. In addition, three companies including Hua'an Securities, Guolian Securities, and Founder Securities have achieved net profit growth year -on -year.

It can be seen that as of now, only Hua'an Securities and Guolian Securities brokerage companies have achieved revenue and net profit "dual growth" year -on -year. Among them, Hua'an Securities achieved operating income of 1.648 billion yuan, an increase of 9.89%year -on -year; net profit was 724 million yuan, an increase of 17.87%year -on -year. Guilian Securities achieved operating income of 1.274 billion yuan, an increase of 12.71%year -on -year; net profit was 437 million yuan, an increase of 15.37%year -on -year.

It should be noted that although CITIC Securities' revenue and net profit in the first half of the year have doubled year -on -year, it is still the only listed broker with a net profit of more than 10 billion yuan.

Actively explore diversified non -directional investment models

In the first half of the year, in the main business, the performance of the listed brokers continued to differentiate performance due to the differences in professional capabilities. Among them, due to market factors, the directional self -operating business drags the performance of most securities firms, but there are also many brokerage companies to strengthen non -directional investment strategies, develop and use derivative financial instruments to iron market fluctuations, and enhance performance stability.

After the "net income+fair value change net income" method measures the self -operating strength of the broker business, found that of the above 27 brokers, CITIC Securities, Guotai Junan, China Merchants Securities, and Guoxin Securities' self -operated business income are all self -operated business revenue More than 3 billion yuan. In addition, four self -operated business income is negative.

In terms of growth rate, in the first half of the year, BOC Securities' self -operated business revenue increased first year -on -year, reaching 78.37%; Founder Securities was temporarily ranked second, a year -on -year increase of 56.19%; Pacific Securities and Guolian Securities followed closely. 20.27%, 12.93%. Hua'an Securities' self -operated business revenue dropped slightly by 2.14%year -on -year, and the remaining listed brokers decreased by more than 20%year -on -year.

In the above background, the current investment in securities firms is changing towards the direction and diversified transactions. Among them, the income income of BOC Securities has increased sharply due to the increase in investment income of transaction financial assets. In the first half of the year, BOC Securities' equity investment continued to strengthen the construction of the investment and research system, and at the same time actively explored the low fluctuation profit model, steadily promoted the transformation to the diversified investment management model, and strengthened the development and application of non -directional investment strategies. At the same time, the company actively promotes the preparations for the business of external financial derivatives; in terms of financial derivatives business in the venue, it mainly promotes the development of quantitative strategies for equity categories from the aspects of consolidating scientific and technological capabilities and improving quantitative strategies.

The performance of Founder Securities in the first half of the year has achieved anti -city growth, mainly due to its average level of winning the industry in the traditional self -operated investment business. Cui Xiao, a member of the Founder Securities Executive Committee and vice president, said at the performance briefing, "In recent years, the company has focused on multi -variety, multi -strategy, and multi -model business layout to ensure the stability of income and vigorously develop derivatives business and neutral strategy business. , Sales and transaction non -directional business has always been a strategic direction that the company has adhered to. In the first half of the year, the company's optional existence scale increased by 109.05%year -on -year, and the scale of revenue swap increased by 1486.07%year -on -year. Non -directional business revenue increased by 214%year -on -year. "

At the same time, Guolian Securities achieved 576 million yuan in self -operated business revenue in the first half of the year, an increase of 12.93%year -on -year, and it was mainly due to the increase in the floating profit of derivative financial instruments. Among them, the fair value change income was 597 million yuan, an increase of 437.1%year -on -year. In 2021, Guilian Securities' revenue based on counter and institutional customers' opponents' transaction business revenue increased by 5802.73%year -on -year. Guolian Securities stated that in the second half of the year, the company's equity investment business will focus on the layout of the medium and long -term opportunities, further selecting growth stocks, supplemented by strategic investment models such as fixed increase and convertible bonds. To achieve the balance of risks and income, and to carry out stock investment business steadily.

Zheng Jisha, chief analyst of China Merchants Securities Non -Silver Financial Industry, said, "Guolian Securities Derivatives, active transactions, expanding varieties, and positive impacts on reducing performance fluctuations., Steading to the qualifications of the first -level dealers. "(Responsible editor: Wang Qingyu)

- END -

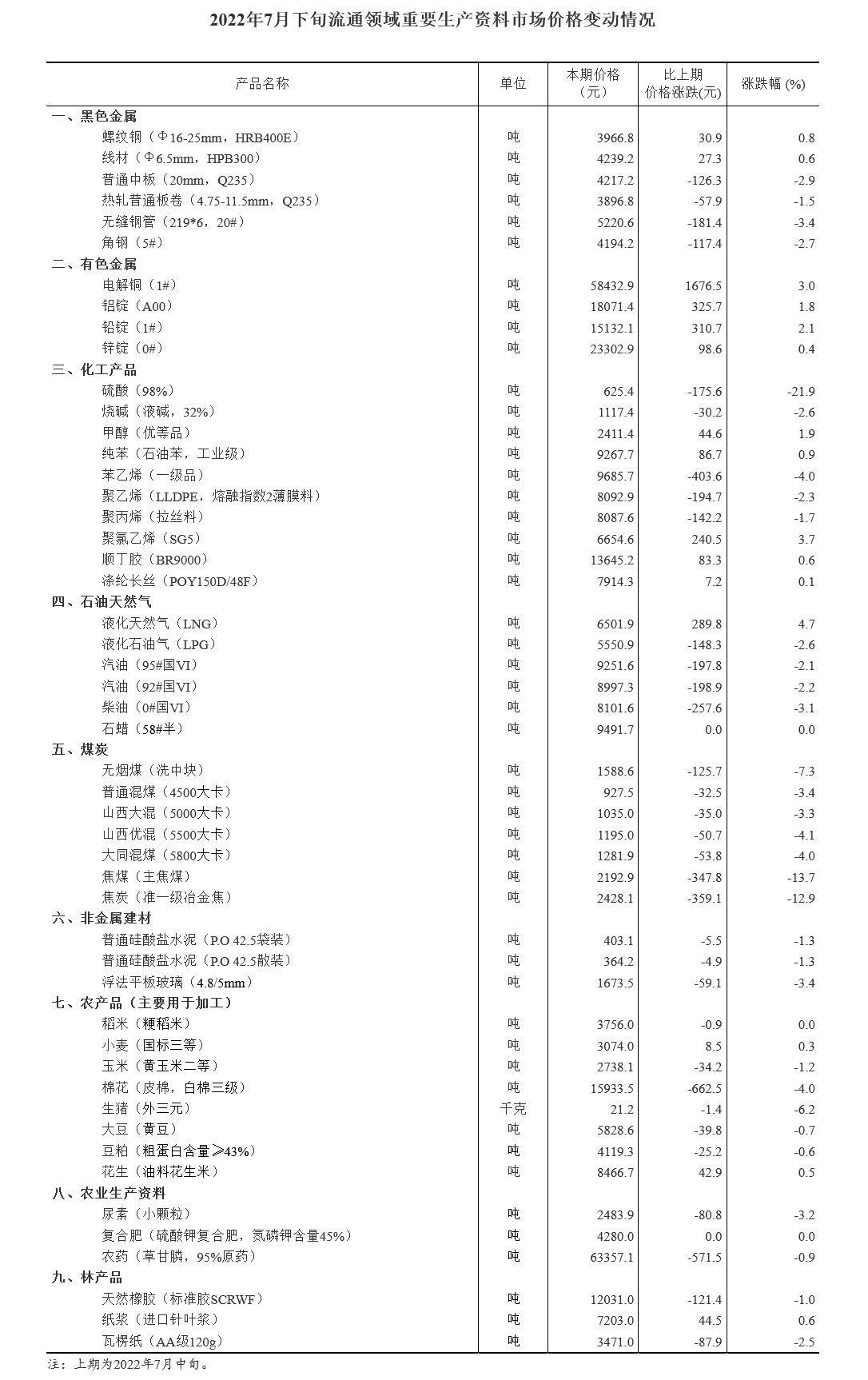

National Bureau of Statistics: The price of pigs fell 6.2% in late July

Zhongxin Jingwei, August 4th. According to the website of the National Bureau of S...

Escort food safety, do this in Lintong County

Dahe Daily · Yu Video Reporter Liu Guangchao Correspondent SangsieIn recent years, Lintong County has closely focused on the main points and key work arrangements of food safety work in provinces and