Central Plains Bank: "Three Primary Colors" physical outlet service upgrade

Author:Henan Daily Client Time:2022.08.30

Henan Daily client reporter Wang Yinan

Xiang Shanli, responsibility first. With the rapid development of fintech, the demand and consumer behavior model of personal customer financial services are undergoing profound changes. The development of banks must return to the origin and give full play to the value proposition of the main business of the financial main responsibility in order to provide customers with better financial and non -financial services.

The Central Plains Bank completed the absorption and merger on May 27. After the establishment of the New Central Plains Bank, the number of physical outlets reached 750, becoming the largest city commercial bank in the province. How to give full play to the key role of the online service of physical outlets and online services, and set up a face -to -face emotional interaction platform with customers, Central Plains Bank has conducted a lot of thinking and exploration.

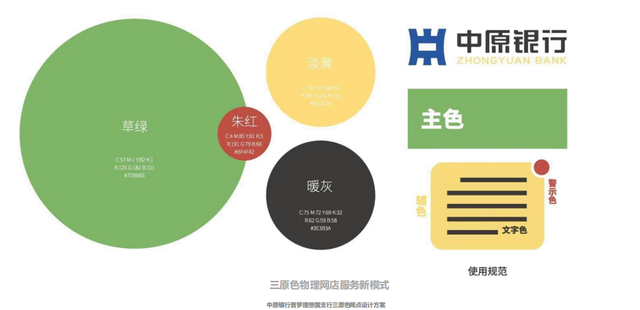

Central Plains Bank proposed the "four -in -one" main channel service matrix, launched the physical outlet service logic reshapeing project, and took the lead in the financial industry to propose a new model of "three original colors" physical outlet service. Provide the value positioning of financial products, and practice the social responsibility of commercial banks; start designing the entire scenario intelligent digital "financial supermarket" product shelves and physical layout, and further give full play to the value proposition of the main business of financial responsibility.

"Sanyuan color" service connotation

The prevention of financial risks is a top event such as the financial industry, and it is also the foundation and prerequisite for financial reform and innovation. Financial institutions should strengthen social responsibility, attach importance to the impact of their business behavior on public safety, and further establish a responsible corporate social image. At the same time, the popularity of financial knowledge, especially the awareness of financial risk prevention should be synchronized with the development of the financial industry. It is necessary to effectively identify the public in various ways to improve literacy, understand risks, and effectively identify various products and services in the market.

New Central Plains Bank assumes social responsibility and puts forward the three primary concepts of "green, yellow, red", and use three basic colors to distinguish the functional partition of the physical outlets to guide and enhance the awareness of social risks. With temperature, through the intuitive and true experience of customers, start with details, start from reality, and build a social credit system with customers.

The scope of the "three original colors"

Starting from the client entering the outlets, through the bright color partition, the business risk is distinguished, the fast risk identification is achieved, and the awareness of risk prevention is enhanced. Creating the "three -primary color" benchmark physical outlet is the value -added services provided to customers in addition to meeting the needs of basic financial services.

Green: cash business, smart equipment area

Green represents safety, nature, and calmness. For decorative cash business, intelligent equipment area, etc., customers generally handle in this area are generally withdrawal business, regular savings business, and information maintenance business.

Yellow: Fortune business area

Yellow represents attention, warmth, hope. For decorative wealth management business areas, etc., the business handled by customers in this area is generally a medium -sized financial management business in business risk.

Red: Public business and loan business areas

Red represents risks, challenges, and warnings. It is used to decorate public business and loan business areas. Customers are generally paid for public business and loan business with high degree of business risk.

What does the "three original color" physical outlets look like?

Outlet positioning: Focus on the main financial business, and build the outlets to obtain financial knowledge, handle financial business, and experience financial services

Create goals: Golden Horn and silver edge, reasonable layout, dignified atmosphere, warm and comfortable, and outstanding features; reflecting positive innovation, highlighting the "best service, the best pricing, the highest efficiency" brand connotation

Low risk zone:

Mid -risk zone:

High -risk zone:

New starting point, new journey. The clear mission vision and the strategic goal of "three small and one big" are guiding the solemn commitment of Central Plains Bank to practice "service strategy, service entity, service enterprise, and service people". Adhering to the concept of "intimate, professional, cooperative, and win -win" service concept, the Central Plains Bank will also continue to bring their original intentions, dreams of dreams, move forward with courage, and forge ahead, and provide better financial and non -financial services for the Central Plains people.

- END -

"Finance and Economics" Liu Shijin: Several issues on "steady growth" of the current economy

Liu Shijin: Several issues of steady growth of the current economyFinance / / /...

Six departments jointly issued a new round of rural road construction and transformation

CCTV News: Recently, six departments including the Ministry of Transport, the Nati...