What's wrong with Bank of Communications?In the first half of the year, net profit was surpassed by Industrial Bank

Author:Jihe.com Time:2022.08.29

As the semi -annual disclosure season of listed companies comes, the performance of the first half of the listed banks has emerged one after another.

As the "old end" in the State -owned Bank of China, it is well known to be surpassed by the "One Brother" of the Bank of China by the Bank of China. The gap between multiple indicators such as revenue, net profit, and non -performing loan ratio is still getting bigger and bigger.

However, in the first half of this year, not only did the Bank of Communications fail to narrow this gap, but instead was surpassed by another shares of Xingxing Bank in terms of net profit.

As a state -owned bank with a century -old history, will the gap between the Bank of Communications and the Industrial Bank be the same as the China Merchants Bank? What is the difference between the other indicators between the two? We will find out through the half -year report.

01

Net profit is surpassed by Industrial Bank

According to the semi -annual report, at the end of June this year, the total assets of the Bank of Communications were 1258.576 billion yuan, and the Industrial Bank was 8984.747 billion yuan. The former is above trillions of size, and the latter has not yet reached.

From the perspective of the growth rate of assets, the total assets of Bank of Communications have also greater than the growth of the Industrial Bank compared with the end of the previous year. The total assets increased by 7.84%and 4.44%compared with the end of the previous year.

Although the scale and growth rate of total assets are leading, the net profit of the Bank of China in the first half of the year has been lost to Industrial Bank.

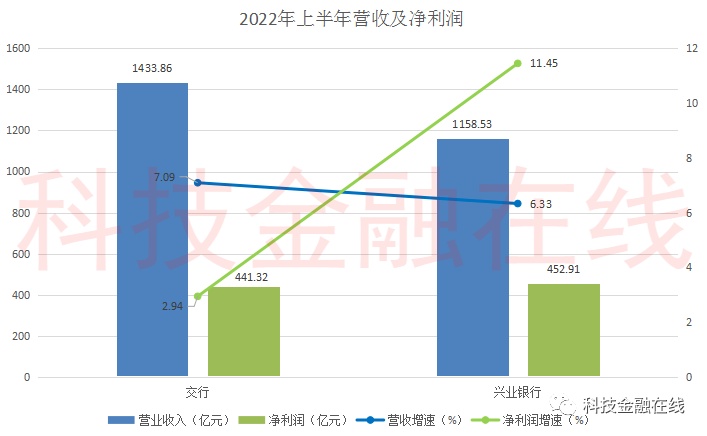

In the first half of the year, the Bank of Communications achieved a net profit of 44.132 billion yuan, while the net profit of Industrial Bank was 45.291 billion yuan, earning 1.159 billion yuan than the Bank of Communications.

This is once it was surpassed by the second joint -stock bank after being surpassed by China Merchants Bank (net profit of 70 billion yuan in the first half of the year).

In terms of growth rate, the year -on -year growth rate of the net profit of Industrial Bank was as high as 11.45%year -on -year, which increased in double -digit growth; the year -on -year growth rate of net profit of Bank of Communications was only 2.94%. The difference between the two is 8.51 percentage points.

Although the net profit lost to Xingye Bank, in fact, the revenue of the Bank of China is higher than that of Industrial Bank.

In the first half of the year, the revenue of the Bank of Communications increased by 7.09%year -on -year to 14.386 billion yuan, while the revenue of Industrial Bank was 115.853 billion yuan.

The revenue of Bank of Communications is 27.533 billion yuan higher than that of Industrial Bank.

Since the revenue is slightly better, what exactly is the net profit that caused more revenue to have more revenue to the Industrial Bank with less revenue?

Looking at the two -year report of the two found that the business and management Fei of Bank of China in the first half of the year were 10.303 billion yuan higher than Xingye Bank; credit impairment loss was 3.212 billion yuan higher than Xingye Bank; while other business costs were 5.622 billion yuan higher than that of Industrial Bank.

You know, when calculating net profit, the above categories need to be deducted from the revenue.

Therefore, although the revenue of the Bank of China is higher than that of Industrial Bank, after deducting more cost and impairment loss than the Industrial Bank, its net profit was thrown behind the Industrial Bank behind.

02

The intermediate business income is almost the same

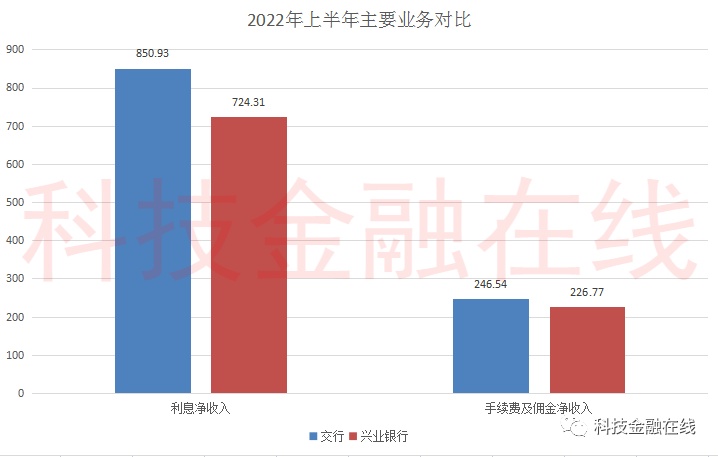

From the perspective of the main business, although the Industrial Bank is still a gap between interest income and the Bank of China, the intermediate business income is very close to the Bank of China.

The semi -annual report showed that the net interest revenue in the first half of the year was 85.093 billion yuan, an increase of 8.42%year -on -year, and the proportion of revenue was nearly 60%.

The net interest income of Industrial Bank in the first half of the year was 72.431 billion yuan, an increase of 0.72%year -on -year, and the proportion of revenue was 62.52%.

The net interest income of the Bank of Communications is 12.662 billion yuan higher than that of Xingye Bank.

However, in terms of intermediate business revenue, the net handling fee and commission revenue of the Bank of China in the first half of the year was 24.654 billion yuan, while the Industrial Bank was 22.677 billion yuan. The difference is less than 2 billion yuan.

At the same time, the net income of Bank of Communications and commissions accounted for 17.19%in revenue, while the Industrial Bank was 19.57%. Industrial Bank is 2.38 percentage points higher than the Bank of Communications.

As we all know, the banking industry is paying more and more attention to the development route of light capital and light assets. Light capital and light -funded business, which are dominated by intermediate business income, can increase bank capital yields.

From this point of view, the proportion of intermediate business income in Industrial Bank is higher than that of Bank of Communications, and the net income of intermediate business is similar to the Bank of Communications. It can be seen that the income structure of Industrial Bank is slightly better than the Bank of Communications.

03

Bad loans near Xingye Bank twice

Bad loans and non -performing loans have always been the two important indicators to measure the quality of bank assets. Generally speaking, the smaller the data, the better the quality of the bank's assets.

At the end of June this year, the amount of non -performing loans of Bank of Communications exceeded 100 billion yuan, which was 103.232 billion yuan, an increase of 6.436 billion yuan from the end of the previous year.

From this rough calculation, the amount of non -performing loans from Bank of Communications is 48.226 billion yuan higher than that of Industrial Bank, which is about 1.87 times that of Industrial Bank.

In addition, the non -performing loan ratio of Bank of Communications is slightly higher than that of Industrial Bank.

As of the end of June 2022, the non -performing loan ratio of Bank of Communications was 1.46%, and the non -performing loan ratio of Industrial Bank was 1.15%. The non -performing loan ratio is 0.31 percentage points higher than Xingye Bank.

In terms of preparation coverage, as of the end of June 2022, the coverage rate of the Bank of Communications was 173.1%, and the Industrial Bank was 251.3%.

The coverage of the Bank of Communications is lower than the Industrial Bank.

As a state -owned bank with a century -old history, the previous business indicators of the Bank of Communications have been lost to the China Merchants Bank with a history of only 30 years. Over time, the gap between the two in certain indicators is still expanding.Nowadays, the Bank of China is thrown behind the Industrial Bank in terms of net profit. Can it be overtaken in the future?Regarding the "dignity" of its own national ownership, it is worthy of continuous attention.

- END -

Sichuan Hejiang "Political and Bank Enterprise" helped enterprises on the same stage to help the company's 9 companies signed a contract of 849 million yuan on the spot

Cover Journalist Jiang YuenOn June 17, Hejiang County, Sichuan Province held a fin...

Chinese securities firms "国际" International Financial Center

China Fund reporter Mo Lin Cao WenzhengHong Kong securities trading has a long his...