Lifetime securities market forbidden!Fraud issuance, cumulative incremental income increased more than 800 million yuan, "with illness", and the punishment came

Author:Costrit Finance Time:2022.08.29

Following the administrative penalties of the CSRC's issuance of the Lantashan Science and Technology Fraud and related intermediaries, the CSRC has recently updated a decision on the administrative penalty decision that the CSRC recently updated. The investigation and trial were conducted.

The Securities and Futures Commission decided to give warnings and places to Tan Yan (then chairman and general manager of Lanshan Science and Technology) and Zhao Ruimei (then a director of Lanshan Technology, which was the actual controller of Lantashan Technology). Fined fines and fines for other parties.

In addition, according to the market forbidden decision disclosed disclosed by the CSRC on the same day, the CSRC adopted a lifelong securities market forbidden measures on Tan Yan and Zhao Ruimei.

Cumulative incremental income of more than 800 million yuan

After investigation by the Securities Regulatory Commission, from 2017 to 2019, Lantashan Technology passed virtual bank deposits, fictional sales business, fictional R & D expenditure, and fictional freight expenses to increase income, assets and profits.

From 2017 to 2019, Lantashan Technology increased sales revenue of 810.926 million yuan through the above means, and the total increase in profit increased by 88.483 million yuan (the impact of profit margin calculated by the corresponding comprehensive gross profit margin based on the actual income, the same below) Essence Among them: In 2017, the sales revenue of virtual increase was 292,242,600 yuan, accounting for 43.20%of the total revenue of the disclosure period, and the total profit increase of 39.6629 million yuan, accounting for 51.90%of the total profit of the period, and the total assets at the end of the year were 151.4829 million yuan, accounting for the end of the year of the year, accounting for the end of the year. The total assets were 13.69%; in 2018, the sales revenue of virtual increase was 18,7403,600 yuan, accounting for 29.18%of the total revenue disclosure, and the total profit increase of 10.195 million yuan, accounting for 22.16%of the total profit of the period, and the total assets at the end of the year were 220.626 million yuan , Accounted for 20.56%of the total assets at the end of the year; in 2019, the sales revenue of virtual increase was 3312.764 million yuan, accounting for 49.17%of the total revenue of the disclosure period, and the total profit increased by 38.629 million yuan, accounting for 80.67%of the total profit of the period, and the assets of the end of the year increased the annual assets. The total amount was 16.621 million yuan, accounting for 14.20%of the total assets at the end of the year.

In terms of fictional disposal of assets, in December 2019, Lan Mountain Technology and Cymbica adjusted the production model to deal with the sales of production equipment, with a sales amount of 43.818 million yuan (including tax). After investigation, Lanshan Technology Fictions sells production equipment business. The purchase of Fang Eopis is actually a Lan Mountain Technology related party and Lanshan Technology has not actually received the sale of money. Including taxes), accounting for 4.89%of net assets at the end of 2019.

Public issuance of documents to make major false content

On April 29, 2020, Lantashan Technology submitted the "Public Offering Manual" to the National Stock Transfer Company and made an announcement. It intended to open no more than 80 million shares to unspecified investors. On September 22, Lantashan Technology submitted the "Application for Publicly Published and Listed on the Selected Floor" to the National Stock Transfer Company to the National Stock Transfer Company, and applied for the withdrawal application documents. On September 25, the National Stock Transfer Company decided to terminate the review of the Lan Mountain Science and Technology Selection Listing Application Document.

Lantashan Technology's publicly issued documents "financial accounting information", "business and technology", "corporate governance and independence" partially fabricated major false content.

Tan Yan, then chairman and general manager of Lan Mountain Technology, and then director Zhao Ruimei, organized, planned, instructed, and implemented financial fraud in financial fraud such as virtual bank deposits, fictional sales revenue, fictional R & D expenditure, and fictional disposal assets. Chen Hai, the then supervisor Chen Hai, the manager of the marketing department assisted Tan Yan to implement the fictional procurement and sales business, and participated in and implemented the fraud in Lanshan Technology at all aspects of procurement, sales, capital transfer, and forgery intermediary agencies to visit the site. Essence As the deputy manager of the production department of Lan Mountain Technology, Chen Manman, as the deputy manager of the production department, knew that Lantashan Technology did not have actual production, and participated in the preparation of false documents related to the production department in accordance with Zhao Ruimei's instructions. Zhou Quan, then deputy general manager of Lanshan Technology, as the manager of the R & D department. He learned that Lanshan Technology did not have the ability to develop and develop and put into production in accordance with Zhao Ruimei's instructions. False behavior. Jie Pinghai, then Secretary of the board of directors, is mainly responsible for information disclosure and investor relationship. He also serves as the manager of the production department and is in charge of the production and procurement business of Lanshan Technology.

There are situations such as the official seal of the other unit stamped with the official seal of the other unit

The CSRC reviewed the defense opinions made by some parties.

Among them, in response to the opinions of Chen Manman's statement, the CSRC believes that: First, according to the relevant employee transcripts and work documents, Chen Manman specifically participated in the production and procurement business, participated in the approval of the employees of the production department, and actually fulfilled the deputy manager of the production department of the production department. Responsibilities. Second, part of Chen Manman participated in the false purchase and sales business: First, the marketing department and the production department produced false sales contracts based on Chen Manman's "Inventory Commodity Table". The false contract produced by Shan Science and Technology employees is the official seal of the opponent of the opponent of Chen Manman's preliminary trial; the third is that the purchase and sales contract of the affiliated parties involved in the case is also determined by Chen Manman. Third, Chen Manman participated in financial fraud and still signed the issuance of documents and annual reports to ensure that the relevant content was true, accurate and complete, and did not work hard. In the end, there were false records of the annual reports of Lantashan Technology from 2017 to 2019, and the Securities Regulatory Commission decided that: Tan Yan and Zhao Ruimei were given warnings. As direct responsible supervisors, they fined 1 million yuan for the two. As an actual controller, a fine of 1 million yuan was imposed on the merger.

For Lan Mountain Science and Technology fraud issuance, the CSRC decided to warn Tan Yan and Zhao Ruimei. As direct responsible supervisors, they fined 1 million yuan for the two as actual controllers. fine.

For the merger of illegal behavior of Chen Hai, Chen Manman, Zhou Quan, and Jiepinghai, the annual reports of false records and fraudulent issuance behaviors of Lantashan Technology from 2017 to 2019. Manman, Zhou Quan, and Xie Pinghai were warned and fined 500,000 yuan.

Awe -not market rules, do not "take a disease to break through the level"

On April 29, 2020, Lantashan Technology announced the application documents issued publicly and listed on the selection layer to unspecified investors in unspecified investors. During the self -discipline review of the national stock transfer company and the on -site inspection of the Securities Regulatory Commission, it was found that the authenticity of the Blue Mountain Science and Technology Information Information Disclosure was doubtful.

The Securities and Futures Commission has imposed administrative penalties for illegal acts of Lanshan Technology. The intermediary agency is also difficult to blame. When the Securities Regulatory Commission previously notified 20 typical illegal cases in the 2021 Securities and Supervisory Investigation and Investigation, Hualong Securities Co., Ltd., ZTE Caiguanghua Accounting Firm, Beijing Tianyuan Law Firm, Kaiyuan Asset Evaluation Co., Ltd. Provide relevant securities services for Lanshan Technology, and has not been checked carefully in accordance with business rules, and there are false records issued by the reports.

The Securities Regulatory Commission pointed out that the New Third Board Company should be in awe of market rules. Do not "break through the level". Related intermediary agencies should diligently perform their duties and jointly maintain the healthy development of the New Third Board market.

- END -

Official announcement: Wuhan East Station opened on August 12, and the ticket has just been launched!

Jimu Journalist Pan XizhengCorrespondent Wu TiexuanJust now, the opening date of W...

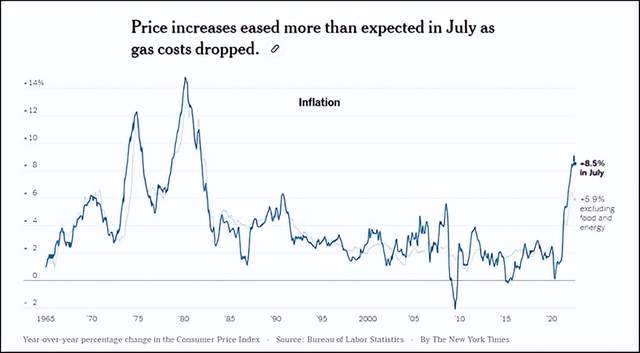

The United States, is it stable?

Author: Liang YouzhiAccording to the latest data released by the U.S. Labor Statis...