"Daily Evaluation" A shares reproduce the independent market!After the bottom of the Shanghai Stock Exchange, the rebound was opened after a slightly reddish red, and the rebound opened?

Author:Federation Time:2022.08.29

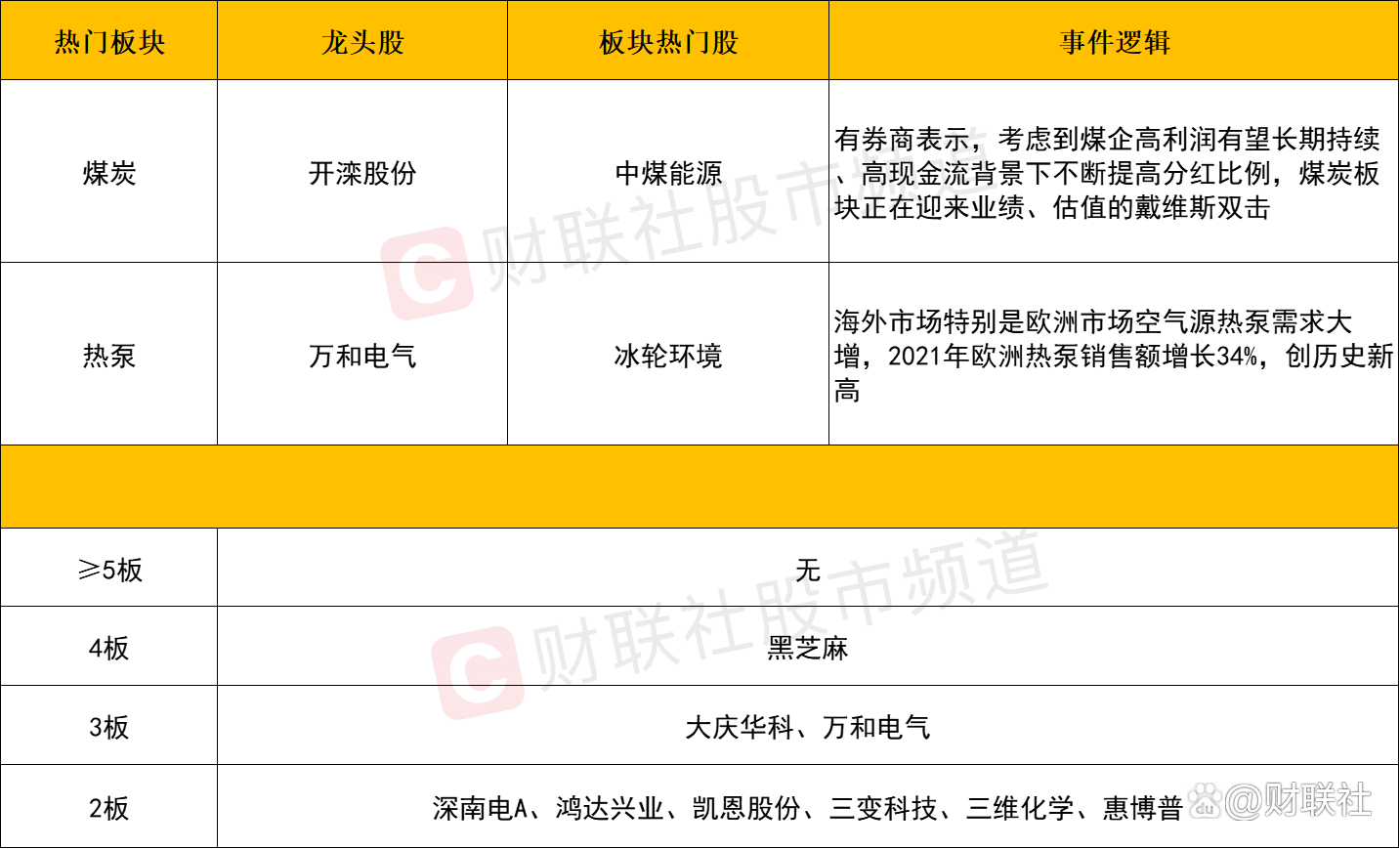

The broader market has risen throughout the day, and the three major indexes have risen and declined, and the Shanghai Index is relatively strong. On the market, the track stocks rebounded in the early trading, the photovoltaic -related sectors led the rise, and Mubang Hi -Tech and Tuoji Xinneng were daily limit. The consumer stock market has strengthened, the hotel tourism, food processing and other sectors lead the rise, black sesame 4 consecutive boards, and the daily limit of Haixin Food and Manor Ranch. The energy -related sector is activated again in the afternoon. The heat pumps, virtual power plants, oil and gas, coal and other sectors have risen sharply. Wanhe Electric, Whberpu, Kaizhen shares have daily limit. In terms of decline, the pharmaceutical -related sector has been adjusted. Overall stocks rose more, and about 3,000 stocks in the two cities rose. The sales of Shanghai and Shenzhen today were 845.8 billion, a shrinkage of 83.4 billion from the previous trading day. In terms of sectors, the increase in heat pumps, oil and gas, HJT batteries, virtual power plants and other sectors have risen, and medical services, CROs, small metals, cloud games and other sectors have fallen first.

Plate

In terms of sectors, the hotspots of today's market seem to be relatively scattered. The direction of the track, energy storage, heat pumps, and traditional energy direction coal, oil and gas and other sectors in the track of the track are increasing in the market. Expand. On the news, Modvedev, vice chairman of the Russian Federal Security Conference, raised his prediction of natural gas prices. It is expected that the price can rise to 5,000 euros per thousand cubic meters by the end of the year, exacerbating the market's expectations for the European energy crisis. Chen Guo, chief strategist at CITIC Construction Investment, even directly believes that energy problems are the core contradictions of the current economic adjustment period and the most noteworthy direction at the moment.

In terms of subdivision, the photovoltaic sector in the direction of the track today ushered in a repair rebound. Among them, Baoxin Technology, Mubang Hi -Tech, Yibin Optoelectronics Daily limit, and on the news, the Ministry of Industry and Information Technology and other five departments jointly issued a plan to accelerate the green and low -carbon innovation development action plan for power equipment. The technology industrialization of perovskite and stacking battery components, carry out the research and application of new high -efficiency and low -cost photovoltaic battery technology, and carry out smart photovoltaic pilot demonstrations and industry applications. It can be seen that for photovoltaic, whether it is policy orientation or prosperity, it still maintains a good trend. However, due to the rise of the long band in the early stage, there is a certain demand for the overall valuation of the overall valuation. On the other hand, in the return of last week, a large number of stock chips inside the sector also showed significant signs of loosening. It is better to repair the anti -pumping.

The concept of air energy heat pump concept stocks continued to strengthen, of which Wanhe Electric 3 consecutive boards, sunrise Oriental, Ice Wheel Environment, Kangsheng Co., Ltd., and Da Yuan pump industry daily limit. As a substitute for natural gas heating, the air source heat pump has the advantages of energy saving and power -saving, pollution -free, and the export volume of my country's air source heat pumps will be further increased with the stimulation of European "gas shortage". According to the data of the industry online, my country 2022 In the first half of the year, the size of the air source heat pump outlet market was 3.45 billion yuan, an increase of 68.2%year -on -year. The advantages of the air source heat pump in the background of the energy supply in the background of the energy supply in Europe were prominent. It is expected to maintain high -speed growth. Therefore, for the heat pump sector, it is still expected to accompany the logic of the European energy crisis and repeatedly active.

In the afternoon of the capital return resources, the coal sector fluctuated and strengthened. Among them, Kaifang's stock daily limit, China Coal Energy, New Energy, and Huaibei Mining increased. The continuous strengthening of coal originated from the EU's ban on Russia's coal and other goods on August 10, and the price of international power coal prices has stimulated. On the other hand, as of August 28, a total of 3305 listed companies disclosed the semi -annual report. The performance growth rate of the overall stocks inside the coal sector ranked among the growth rate, which once again showed the growth of the coal industry. Guosheng Securities Research Report pointed out that considering that the high profits of coal companies are expected to continue to increase the proportion of dividends under the context of high cash flow, Davis, which is welcoming performance & valuation, double -click under the context of high cash flow. From the perspective of the market, after the coal sector experienced the differentiation of Friday, today we ushered in a strong background, reflecting that the appearance of funds still has a strong recognition of it. In this context Essence

In addition, the internal differentiation of the consumer sector that the market is more concerned in the near future is still obvious. Judging from the performance of liquor such as Luzhou Laojiao and Yanghe shares announced on the weekend, the net profit growth rate of the second quarter of Luzhou Laojiao was 29%, which is almost equivalent to the level before the epidemic. The quarterly growth rate still increased by 6%. However, these two stocks have a significant high opening and low trend in the plate. From the perspective of the performance of funds, the recognition of the brewing direction is still not high, and the interim trend of most individual stocks has not been completely reversed. In the short term, it has formed in the short term The probability of the main promotion band market is low, and it can only be viewed from the perspective of the mid -length configuration layout.

Individual stocks

In the context of the return of funds in the track direction, the short -term emotions are significantly recovered. Among them, the daily limit of the two photovoltaic popular stocks such as Baoxin Technology and Mu Bang Hi -Tech also means that the money effect of the high -level track is eased. However, it should be noted that the overall volume of the rebound of the light board today is small, and the overall strength is still weak. Therefore, the internal division of the subsequent sector may further intensify. More stocks may return to the lowering pattern, so under the consideration of the security of funds, for the direction of photovoltaic, the side of the risk control is still more secure when the short -term bullet is high. The hottest thermal pump is the hottest theme today, with 5 stocks inside the sector. Because the European energy crisis is difficult to improve in the short term, the short -term energy themes such as heat pump may be repeatedly active. In this context, you can pay attention to the 3rd consecutive board Wan He and Electric and the Dayuan pump industry that takes the lead in completing the anti -package. When the above stocks can continue to continue to move up in the future, you can pay attention to the low -level replenishment opportunities in the direction of the heat pump.

Join market analysis

As of the close, the Shanghai Index rose 0.14%, the Shenzhen Index fell 0.34%, and the GEM index fell 0.37%. Northern Fund bought a net purchase of 2.145 billion yuan throughout the day; of which 1.306 billion yuan was bought at the Shanghai Stock Connect, and the Shenzhen Stock Connect net purchase was 839 million yuan.

Today, in the background of a sharp decline in the peripheral market on Friday, A shares once again showed their own toughness. Among them, the Shanghai index bottom of the bottom rising was finally slightly red, and the short -term showing signs of stability appeared. However, it should be noted that today's market volume can shrink again, on the one hand, it means that the market's selling hand has been obviously reduced after the continuous return of the market, and it also reflects the current market watching emotions and no much funds. Therefore, the trend of tomorrow is more critical. When the motherboard can continue to rebound and re -stand on the 5 -day moving average, how much confidence in the overall market will bring more boost. For the GEM, the unfavorable inertia of the shock is still continuing, and the short -term is still unstoppable.

In the near future research report, CICC believes that the overall domestic market may still show a weak oscillating pattern. The overall stability is required, and then seek to advance, pay attention to maintaining flexibility, grasping market rhythm, focusing on structure, low valuation, stable growth related sectors related sectors Or the focus of attention in the short term. After the growth style rebounded in the early stage, the cost performance has weakened. At the end of August, it was the peak period disclosed by the A -share listed company. It also needs to focus on the profitability of the enterprise.

In terms of individual stocks, it rose 3028, an increase of 1,285 from the previous trading day. In the case of excluding ST shares and new stocks, there are 59 daily limit, an increase of 22 more than the previous trading day; 18 frying boards, a decrease of 19 from the previous trading day; Home, an increase of one more than the previous trading day; the limit of 0 limit is the same as the previous trading day.

In terms of emotions, as the track stocks ushered in the restoration of the short -term emotions, it has recovered, and it has shocked to the top of the downturn.

Focus on the market

1. European natural gas prices have fallen since April, the largest decline in Dutch natural gas in the Netherlands has fallen 16% in recent months

The price of natural gas in Europe has fallen since April. Previously, Germany said that its natural gas storage tank was faster than the plan before winter than the plan. The Dutch natural gas fell 16%in recent months to 286 euros/MWH, reversing nearly 40%of the rise last week.

2. Five departments: Promote the technology industrialization of TOPCON, HJT, IBC and other crystal silicon solar battery technology and perovskite and stack battery components

Financial Press August 29th, the Ministry of Industry and Information Technology, including the Ministry of Industry and Information Technology, jointly issued and distributed the planning plan for the green and low -carbon innovation development action plan for power equipment. The "Action Plan" proposes to carry out test verification and pilot applications. Focusing on new power equipment such as green source, Zhiwang, Loin, and new reserves, the construction of the first (set) major technical equipment test verification platform that meets the actual situation of engineering applications. Give full play to the role of major engineering traction, encourage areas with basic and conditions, and actively promote technology and product promotion and application of key areas of power equipment. Among them, in terms of solar energy equipment, the technology of crystal silicon solar cells such as TOPCON, HJT, IBC and the technology industrialization of olty orerite, stacked battery component technology, carry out new high -efficiency and low -cost photovoltaic battery technology research and applications, carry out smart photovoltaic pilot demonstrations and industry application. In terms of thermal power equipment, it is applied to the application of 630 ° C and 650 ° C to clean and efficient coal power equipment. Promote the application of supercritical carbon dioxide power generation technology. Build a full -process integrated large -scale carbon dioxide capture and use and sealing application project

- END -

Borrowing costs have been significantly impacted in the U.S. real estate market

High inflation has suppressed the actual capacity of American residents, and the F...

Moutai Mooncake Gift Box was "sold back" at high prices of oxen cows. Moutai International Hotel: Resolutely resist, please consumers rationally consumption

Today (August 24), in response to the acting of some merchants in the market to sell Moutai International Hotel Mooncake Gift Box, Moutai International Hotel responded: We resolutely resist, please c