The slow sales of the new crown vaccine, Kangshino's net profit in the first half of the year decreased by 98.69% of the quadrilateral streaming brain combined vaccine sales this year.

Author:Daily Economic News Time:2022.08.29

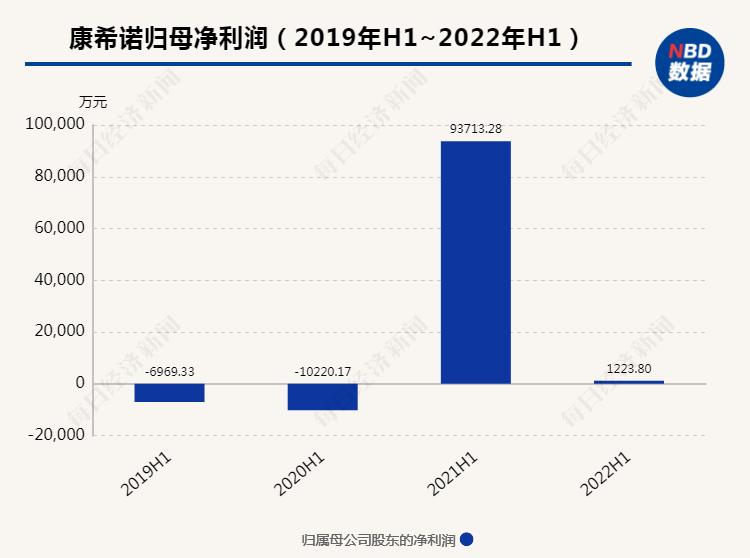

On the evening of August 28, Kangshino (SH688185, a stock price of 130.60 yuan, a market value of 32.3 billion yuan) released the 2022 semi -annual report. A year -on -year decrease of 98.69%.

In the same period last year, Kangsino's income and net profit attributable to their mother all achieved a profit.

The new crown vaccine is the main reason for the company's performance. Regarding the decline in performance in the first half of the year, Kang Xino said that it is mainly due to the slowdown in the growth of the global new crown vaccine vaccination rate, the decrease in vaccine demand, the price adjustment of vaccine products and the existence of signs of impairment.

On the 29th, the stock price of Kangxino fell more than 10%, and as of the closing of 15.08%.

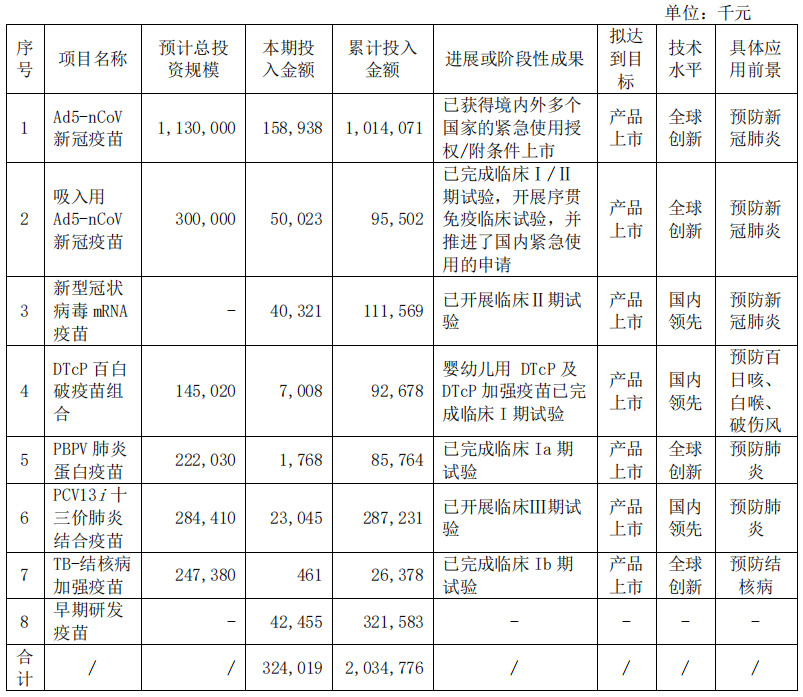

At present, the new crown vaccine is still an important composition of the company's research. In the first half of the year, the sum of the amount of investment in the company's new crown vaccine, inhalation with the new crown vaccine and the new crown MRNA vaccine accounted for 77%of the total investment in research projects.

The slowdown of the new crown vaccine has dragged down the performance, and the loss in the second quarter exceeded 100 million yuan

As an innovative vaccine company, in the past two years, Konno became famous for developing the first approved adenovirus carrier new crown vaccine in China. As the domestic new crown vaccination rate is close to saturation, the company's performance is also close to the end.

The semi -annual report shows that the net profit returned to the mother in the first half of the year was 12.238 million yuan, a decrease of 98.69%year -on -year; after deducting non -recurring profit or loss, the company's net loss was 56.769 million yuan, which changed from "turning loss to profit" in 2021 to a loss again. Essence

The changes in performance are mainly due to the slowdown in the growth of the global new crown vaccine, decreased demand for vaccine, and the price adjustment of vaccine products and signs of impairment.

Related performance was not fully revealed in the first quarter. The company's first quarter report shows that with the continuous commercial sales of the product, Kangshino achieved operating income of 499 million yuan, an increase of 6.98%year -on -year, which is 79%of the company's revenue in the first half of the year; 10 times.

The net profit returned by Kangshino in the second quarter was about -109 million yuan, and the performance plummeted.

Among the risk factors stated in the semi -annual report, Kangshino also said: "At present, it is impossible to accurately estimate the development trend of the new crown epidemic and the final results of the new crown virus pneumonia in various countries. The change makes the product unable to continue commercialization. "" If the market environment changes, and the intensified competition, the inventory (new crown vaccine) is difficult to monetize, and it still faces a certain risk of impairment pressure and price decline. "

Judging from the investment amount of the project, the total investment of AD5-NCOV new crown vaccine, inhalation with AD5-NCOV new crown vaccine and new coronary virus MRNA vaccine in the first half of the year is 249 million yuan, accounting for all in all research project investment 77%; the cumulative investment amount of the last two projects that have not been listed has reached 207 million yuan. In the future, how many returns can be replaced in the future will still be closely related to the new crown epidemic.

According to the records of investor relations in June this year, the company said that the promotion of the new crown vaccine sequence has the characteristics of non -immunization planning vaccine. The company needs to carry out more marketing and education work. Configuration, etc., is expected to rise in 2022.

R & D expenses decreased by 42.44%year -on -year, and the self -built team promoted the fourth -price stream brain -combined vaccine

Since the company's reorganization of new coronary virus vaccine (5 adenovirus vectors) ("AD5-NCOV") was commercialized in 2021, and in the development progress and research and development phase of the research and development of products, Kangshino's research and development investment in the first half of the year was 326 million. Yuan, a year -on -year decrease of 42.44%.

In addition to the over 70 % of the new crowns in the research project, Kangxino's PCV13i thirteen -valent pneumonia combined vaccine in the first half of the year was 230.45 million yuan, which is one of the company's cumulative investment amount. At present, the product's phase III clinical trial is promoted smoothly, and the clinical site work is expected to be completed by the end of 2022.

In addition, the company's clinical trials of the company's DTCP Baibai vaccine combination, PBPV pneumonin vaccine and TB-tuberculosis enhanced vaccine are steadily advanced.

In the first half of 2022, Conchino was studying the project.

In the second half of the year, Kangsino was approved at the end of last year (hereinafter referred to as MCV4) approved by the end of last year, and it was also the first and only domestic and only commercial binter -combined vaccines covering A, C, W135, and Y in China. It will become a major highlight that affects the performance trend of the company.

In June of this year, Kangshino publicly stated that he would terminate the cooperation with Pfizer to promote the vaccine, saying that the company has established a complete commercial operation center. The company's commercial team will be responsible for domestic and foreign market strategies and marketing activities planning and implementation.

According to the June 2022 investor relationship records disclosed by Kangxino in the same month, the termination of cooperation with Pfizer will not affect the commercialization process of MCV4. At present, there are about 400 commercial teams at home and abroad, including about 300 sales teams. The company is confident to do a good job of promoting MCV4. As of then, the company's MCV2 has completed the access of more than 20 provinces, and MCV4 has completed the access of nearly 10 provinces. The investor relationship record also shows that the company's overall combination of brain vaccines this year is the main point of MCV4, which is the main attack point.

The company predicts that the sales of streaming brain vaccines this year began to volume in the third quarter, and 2023 is the first complete sales year. The company's expectations for the combination of streaming products are to hope that after the three complete sales year, the overall market share will reach 20%to 30%.

In addition, the company revealed in that exchange that the goal of MCV4 at the beginning of R & D is to include the international market, and the company has been in contact with local drug supervisors and partners.

On August 29, the reporter of "Daily Economic News" contacted Kangshino through WeChat and sent an interview email to the company's mailbox, but as of the time, the press published did not receive a reply.

Daily Economic News

- END -

Consolidate the results of poverty alleviation drawing the scroll of rural revitalization

Consolidate the results of poverty alleviation drawing the scroll of rural revitalizationAfter winning the battle of poverty alleviation, Jilin Jiutai Rural Commercial Bank closely connected the strat

New Da's losses in the semi -annual loss of 16.433 million yuan in 2022 expanded by 217.90% year -on -year

On August 8th, Xinda (code: 838584.NQ) released the performance report of the 2022 semi -annual report.From January 1, 2022-June 30, 2022, the company realized operating income of 11.3278 million yuan