Fund manager "fixed investment group" provoked controversy!

Author:China Fund News Time:2022.06.19

China Fund reporter Zhang Yanbei Fangli intern Wang Jialin

The public offering industry quietly set off the fund manager's "Ding -Investment Group" boom. More than ten fund managers of many fund companies took the lead in paying for their own investment in self -management funds, and exposed investment bills on the Internet sales platform. Under the leadership of the fund manager, many investors have entered the "fixed investment group" formed by the fund company and made a fixed investment.

However, this move has also triggered a series of controversy, such as the compliance of fund companies' operations, whether they are suspected of misleading investors. Interviewed people in the industry said that the current fund manager's leading investment has become a fund sales method. Therefore, it is necessary to clarify their sales positions to investors, and at the same time propaganda methods must be compliant, and they must be alert to "investing in education and marketing."

Fund manager fixed tide up

Recently, the fund industry has set off a trend of fixed investment, and the fund manager's leading investment has become the latest boom. According to incomplete statistics from reporters, at least 10 fund managers have publicly announced the products they manage.

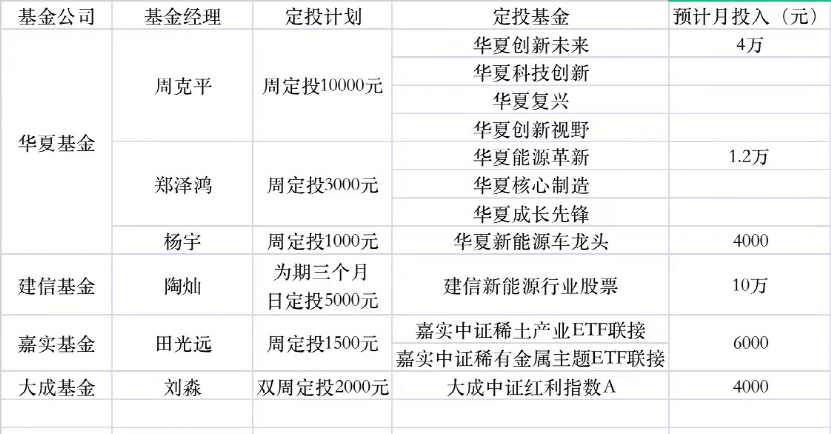

The latest case is Liu Miao, a fund manager of Dacheng Fund. In early May, Dacheng Fund Liu Miao opened a fixed investment plan and promised that each share was held for at least three years. According to Liu Miao, based on the personal judgment of "relatively reasonable valuation" in the current market, he opened a weekly fixed investment in the Dacheng CSI Dividend Fund.

This year's largest fund manager "Dingdou Group" came from Huaxia Fund.华夏基金5月25日发起定投团活动,由12名基金经理和基金经理助理带头定投,该“定投团”成员包括周克平、郑泽鸿、杨宇、屠环宇、孙蒙、王泽实、荣膺、鲁亚运、 Xu Meng, Lu Jiawei, Xia Yunlong, Yuan Yingjie and so on. Their fixed investment amount is between 1000-10,000 yuan per week; the fund manager releases the "fixed investment diary" simultaneously, showing investment screenshots and sharing investment concepts.

Tao Can, a fund manager from CCB Fund, announced on May 18th that a fixed investment event called the "Arc Plan" was launched. Starting from the end of April, it took three months to make a fixed investment of 5,000 yuan per day. Fund products you manage. As early as April, Tian Guangyuan, the manager of the Castrol Fund Fund, launched the "Double Rare" Fund Fixed Investment Plan, which is 1500 yuan a week to invest in the rare earth and rare metal theme ETF products. In addition, Castrol Fund has recently released a "smile fixed investment" brand.

Under the leadership of the fund manager, many investors joined the fixed investment army. Data from a third -party platform show that as of May, this year, more than 10 million investors who have invested in the market with funds in the city have been put into the market. According to people familiar with the matter, with the shock rebound of the market since the end of April, investors who have invested in fixed investment in the group have gained something.

Talking about the reasons for the rise of this wave of "fixed investment groups", a fund company said that the subjective reason is that fund companies prefer fixed investment customers, because such customer characteristics are often mature investment experience, good profit experience, stable funds for redemption, and stable funds, and stable funds, and stable funds, and stable funds. The investment mentality is good; the objective reason is that the market is shocking this year, and the number of users' purchase is not good. It is a good time to promote fixed investment and attract long -term funds.

Dr. Yao Hui, a senior analyst at the Shanghai Securities Fund Evaluation and Research Center, analyzed, "We think that the A -share market has continued to fluctuate and declined since this year. Fund sales have increased difficulty. "

"Second," Dr. Yao Hui further pointed out that "fixed investment", as a very "ancient" investment strategy, may be a better choice for ordinary investors in the current continuous fluctuation market; The model can also be regarded as a response to the fund manager's self -purchase policy to a certain extent, that is, the China -Foundation Association recently issued the "Guidelines for the Performance Evaluation and Salary Management of Fund Management Company", which requires that "fund managers should not be less than that of the year's performance of the year's performance 30%of the salary purchases the public offering funds managed by the company, and should be purchased by the public offering funds I managed. "

The reporter learned that even though some fund companies have not yet launched the fund manager's settlement group, they have always advocated and encouraged fund managers to purchase fund products they managed. For example, the Great Wall Fund stated that in addition to the fund manager, the company has also encouraged other employees to purchase the company's fund products. In particular, in the case of a sluggish market, the company also issued a self -purchased proposal inside the company. A call for internal self -purchase.

However, the Great Wall Fund also emphasized that the company did not force everyone to buy. From the actual situation, some fund managers have adopted a fixed investment method, and some fund managers are bought in batches according to market conditions. "At the same time, the employee's self -purchase is based on the fund investor as a relatively mature investment concept. On the basis of the market judgment and the understanding of fund products and fund managers, the company does not restrict its own purchase of products. "Great Wall Fund relevant persons introduced.

Industry or dispute

From the perspective of the China Fund News reporter, the fund manager is one -time or fixed investment in its own fund is "normal", and there are also some companies in this publicity model industry who are willing to follow, and there are plans to have similar plans. However There are controversy in this model.

"Fund manager's fixed investment behavior belongs to self -purchases, and can maintain the consistency of long -term interests with the holder." A source in South China fund company said that the establishment of a fixed investment official WeChat group may over -renders the fund manager to participate in the fixed investment. Investors are likely to have a certain misleading situation of neglecting their own risk tolerance due to the professionalism of trust fund managers, blindly following the situation of their own risks. Another industry insider said that participating in fixed investment and self -purchase supervision did not prohibitively regulations, but the key publicity methods must be compliant. For example: Do not mention that a specific fund is involved in the fixed investment, only as an investor education, but now there are some aggressive situations.

Yao Hui, a senior analyst at the Shanghai Securities Fund Evaluation and Research Center, believes that it is well known that timing is one of the biggest difficulties of financial product investment. Passionate effective investment strategy. Fund managers appear to help more investors understand this way of investment, which is an effective way for "investor education".

Yao Hui believes that the identity of the non -independent third -party identity of the fund manager determines that the phenomenon of the "fund manager setting investment group" can only be defined as a means of fund sales, not a securities fund investment consulting business. Gourd, self -selling and boasting "is a very common means of sales.

Therefore, Yao Hui believes that the fund manager's fixed investment is self -purchased. As a "sales" method, the fund company, as a legal agency, promotes public investors, and uses the past performance of the fund. It should be within a reasonable range. However, this "fixed investment group" method is very similar to the professional live broadcast fund. If fund companies and fund managers cannot clarify the concept of "independent third parties" to investors, it is really likely that the fund manager of the fund manager is very likely Professional and suspected of misleading.

A public equity person in Shanghai also believes that the fund manager's fixed investment is self -purchased and can maintain the consistency of the long -term benefits of the holder to a certain extent. However, the establishment of a fixed -investment official WeChat group may over -render the fund manager to participate in the fixed investment. Investors are likely to have the professionalism of their own risk tolerance due to the professionalism of the trust fund manager and blindly follow the situation. Sexual, in the industry, you need to be alert to the "investment in education and marketing."

There are also doubts about the effect of the fund manager take the lead in fixed investment. "In fact, investors need a complete 'solution', which can only solve the problem of buying in person, which is equivalent to the dispersion of risks when buying. To the funds with low correlations, etc., they have not solved the problem of selling points. Do investors do not invest? Still has not solved the problem, and investors are still anxious. "A public officer in South China said It is also a question whether the fund manager can also tell you when selling.

Some publicly funded people in the industry said that they would be more willing to look at the matter positively, but the fund manager took the lead in the fixed investment to reflect another problem. The above -mentioned South China public offerings bluntly stated that the fund manager's attention to investors is a good phenomenon. Through personal demonstration of fixed investment, it also helps to guide investors' investment behavior. The starting point is good.

"However, it should be noted that," the person emphasized that the core responsibility of the fund manager is to manage fund products and be responsible for fund performance. This is also the source of the benefits of holders. However, fund performance does not mean the income of the holder. Providing investors with investment suggestions should be the role of investment consultants. The fund manager provides investment suggestions and is also suspected of ‘Wang Po sells melon’. With the launch of the fund investment consulting business pilot, the buyer's investment advisory will play such a role to fill the gap between the investment consulting service between fund managers and investors for a long time. "

The shock market frequently blows "fixed investment"

Guide investors reasonable investment

In 2022, the A -share market has been shocked. In this context, the fund's fixed investment model of "small amounts and multiple times" investment has become the focus of marketing of major fund companies. Not only the fund manager took the lead in fixed investment, but also other fixed investment propaganda appeared in major friends circle or financial platforms.

According to the China Fund News reporter, from the current WeChat public account of some large fund companies, many fund companies frequently push the funds of the fund's fixed investment articles. Taking a large fund company as an example, it has been pushed in fixed investment since March.

- END -

Zhongyuan Securities Liu Ran: The valuation of the food and beverage industry has fallen, the market reverses, and high -quality assets are expected to obtain excess returns in segments

[Dahe Daily · Dahecai Cube] (Reporter Chen Yuyao Zhang Keyao) On June 25, Central...

Damo's "clearance" reduced holdings, Tencent also cash out 700 million Hong Kong dollars!New Oriental is virtual?

How miserable is the time when holding, how miserable it is when killing.In the pa...