The even buying model opened, and the net inflow of smart funds in the monthly inflow of nearly 60 billion yuan!

Author:China Fund News Time:2022.06.19

Source: Data treasure

Northern Fund has accumulated a total of 58.664 billion yuan in net inflows in June.

The net inflow of the north in June is nearly 60 billion yuan

This week, the A -share market fluctuated, and the Shanghai Index stood stabilized by 3,300 points, rising by 0.97%a week.

Securities Times · Data Bao statistics, the north funds of the north have made a net inflow of 4 consecutive trading days this week, with a net inflow of 17.404 billion yuan a week. The cumulative net inflow of this month has 58.664 billion yuan. Monthly net inflow.

From the perspective of the industry, the trend of capital increase in funds in the north this week is relatively concentrated. Eight industries such as agriculture, forestry, animal husbandry and fishing, communications, and coal have obvious positions in the north, and the shareholding ratio has increased by more than 3%month -on -month. The cyclical stocks are surrounded by a small amount of funds from the north. The retail, steel, and petroleum petrochemicals are the top three of the north of the north.

According to statistics from data treasure, the agricultural, forestry, animal husbandry and fishing stocks have risen significantly this week, and the industry index has risen by 4.57%a week, ranking second in all industries. Judging from the news, the agricultural sector rises or is affected by pork prices. In terms of cost profit, pig prices have exceeded 16 yuan/kg, and the price has approached the cost line. The loss of the farm losses has gradually reversed. The amount of sows can decline from the high point in June 2021, and the cumulative decline has reached 8.5%.

CITIC Securities believes that when the history of re -inventory is generally launched, the pig price is characterized by the "low season" characteristics. Although this round of cycle is affected by the new crown epidemic, the average price of pig price rose 2.24 yuan/kg. It has broken 16 yuan/kg, or it can be regarded as the new round of cycle.

From the perspective of the continuity of the increase or decrease and holding holdings, the recently increased funds in the north are the transportation industry. In terms of reducing holdings, the real estate industry has been reduced to the north to reduce its holdings in the north for eight consecutive weeks. The industry has recently recovered slightly. Since the first quarter of this year, the sales data of the real estate sector is generally weak. With the continuous optimization of the real estate regulation policy, the real estate market in May does not meet the expectations of the data in May. , But the data has improved a lot.

The Ningde era was sold by 3.6 billion yuan in the north of funds

According to statistics from Data Bao, a total of 36 shares on the north will be on the northward capital transaction active list; in terms of its industries, the total sales and sales of electrical equipment and food and beverage industries exceed 20 billion yuan. More than 10 billion yuan; before the net purchase of food beverages and bank stocks; the power equipment and non -ferrous metal stocks have obvious net outflows.

Yili shares received continuous net inflow of funds this week, with a total net inflow of 2.26 billion yuan. It is worth noting that the net inflow of Yili shares has exceeded 2 billion yuan for two consecutive weeks. On the news, Yili shares issued the fifteenth short -term financing coupon for the fifteenth issue of 2022 this week, with a total issuance of 1.5 billion yuan and a issuance rate of 2%.

In the Ningde era, the funds were sold at 3.615 billion yuan in the north, and the net outflows were all 5 consecutive days, of which 1.627 billion yuan was net outflow on Thursday alone. In addition to the Ningde era, the funds in the north have also reduced their holdings of multiple lithium battery concept stocks, including Ganfeng Lithium, Salt Lake shares, and Shengxin Lithium. In addition, the new energy vehicle leader BYD's net outflow this week is second only to the Ningde era, which is 1.268 billion yuan.

Since the beginning of last week, it has been reduced to some lithium battery concept stocks. The reduction of holdings this week has been further increased, or it is related to the high valuation of the current sector.

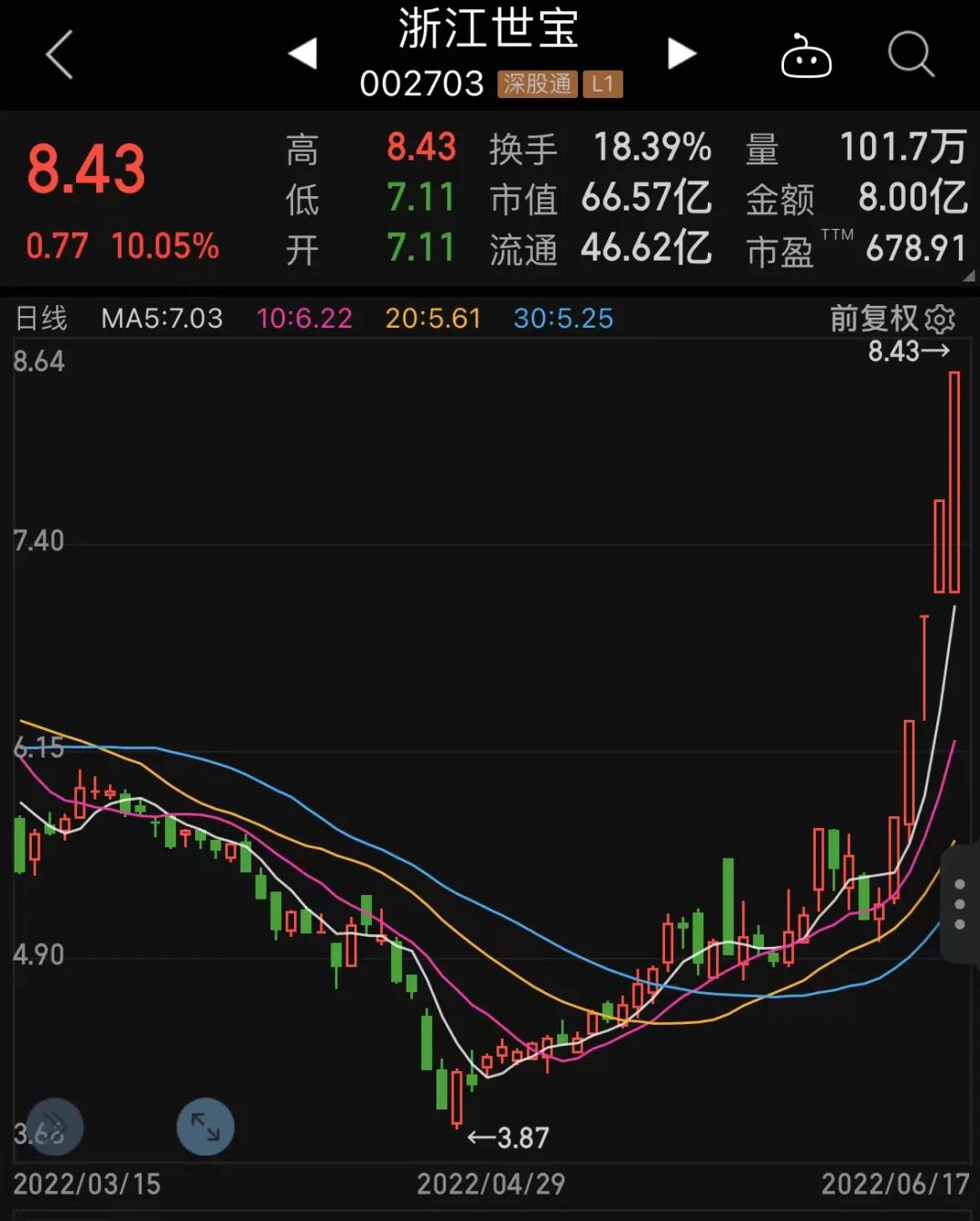

According to the statistics of data treasure, in terms of increasing positions, the stocks that have been newly included in the land stocks this month have been eliminated. There are 28 shares this week. The latest holding of 2.089 million shares, an increase of 222.7%month -on -month; followed by Jinshi resources, Chuanheng shares, and Alde, with a month -on -month increase of 198.59%, 158.65%, and 133.87%.

Zhejiang Shibao has harvested five daily limit boards this week. On the news, the company recently stated on the investor Q & A platform that the company has hundreds of patents, which are mainly concentrated in the technical fields related to the car steering system.

25 shares were greatly reduced by funds in the north, and the holdings of the shareholding decreased by more than 50%month -on -month. Huijin, Yongyi, and Broadcom's integrated Beishang funds decreased by 75.03%, 73.75%, and 68.03%, respectively.

29 shares have been added to the north for seven consecutive weeks to increase the position

According to statistics from data treasure, 29 shares have been increased for seven consecutive weeks of funds in the north, concentrated in new energy, chemical and pharmaceutical sectors. From the perspective of the increase in shareholding, GCL Integration and Oriental Yuhong increased their holdings with the largest number, both of which were more than 70 million shares.

GCL Integration has rebounded more than 40%since the year. The company recently responded to the exchange inquiry letter, saying that the decline in operating income and losses in the past three years is mainly due to the company's conformity to the industry's change in the impairment and processing of the production capacity of small -sized components and component production capacity. The company's first quarter report has turned a profit to make a profit, achieving a net profit of RMB 22 million.

This week, some of the funds in the northward funds have performed well, with an average increase of 1.24%a week. Power equipment stocks performed the best. Mai Mai and Mingyang Smart Week increased by more than 7%.

- END -

Next week's market value of nearly 100 billion yuan, 7 new shares are purchased, intelligent vision and nuclear radiation protection will attract attention!

Wen | Zhao ZiqiangThis week, the A -share market fluctuated higher, and the three ...

Jinchuan District: Multiple measures to run a farmer professional cooperative to help the countryside revitalize and run out of "acceleration"

In recent years, Jinchuan District has conscientiously implemented the deployment ...