Federal Reserve President Powell Eagle Speech Affects the Asia Pacific market on Monday Falling on Monday

Author:Cover news Time:2022.08.29

Cover Journalist Zhu Ning

The Federal Reserve President Powell's speech at the Eagle Conference at the Jackson Hall Global Central Bank on Friday (August 26) caused the US stock market to suffer a major blow on the day. The shock waves spread to the Asia -Pacific market on Monday.

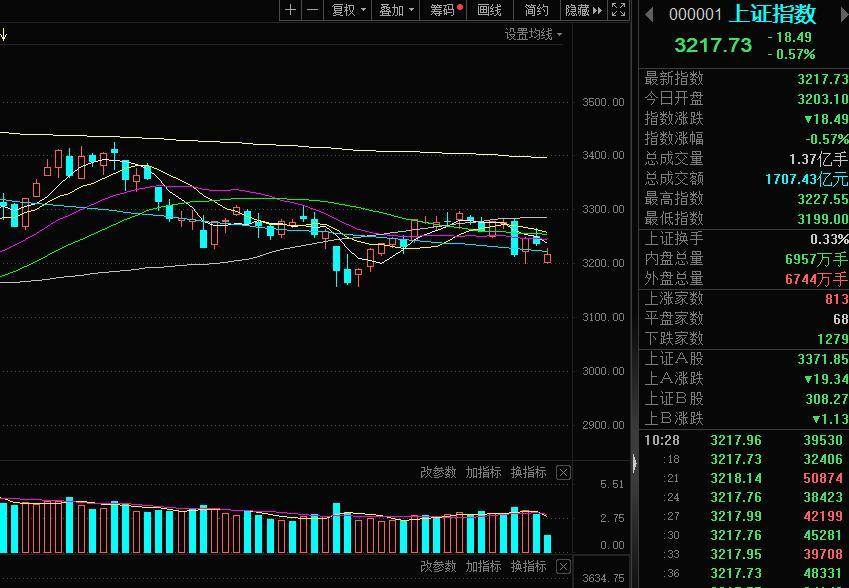

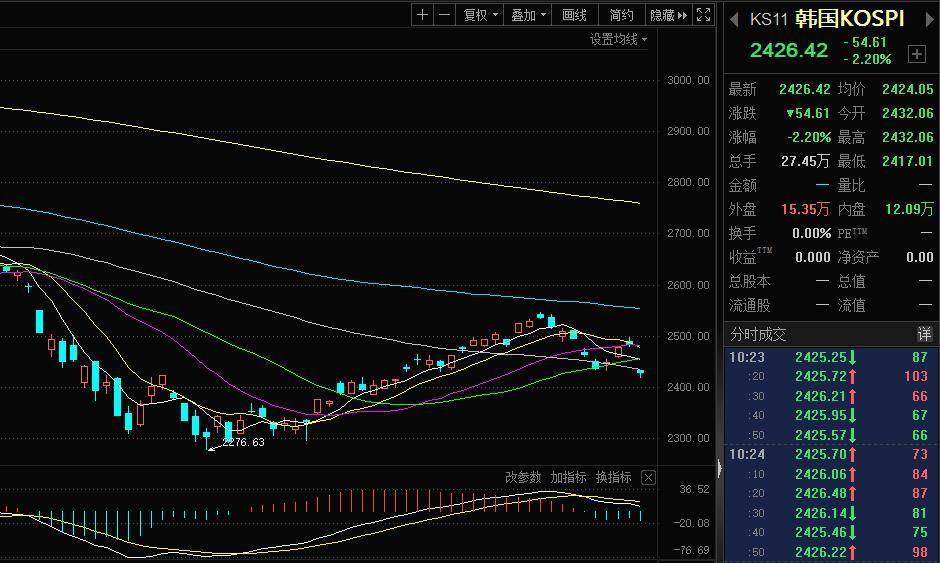

Japan, South Korea and Australia's stock market fell sharply after the opening on Monday. Among them, the Nikkei 225 index fell 758.88 points within the day, down 2.65%to 27882.5 points; the South Korean KOSPI index fell 61.97 points, a decrease of 2.50%, at 2419.06 points. The three major A -share indexes were low in collective, and the Shanghai Index fell 1.02%, the Shenzhen Index fell 1.23%, the GEM index fell 1.53%, and the port shipping sector opened the market.

For the U.S. economy, in addition to the Eight Federal Reserve interest conferences each year, the most noticeable is the annual annual meeting of the Global Central Bank of Jackson Hall hosted by the Kansas Fed. The Federal Reserve and other central bank officials often use this meeting to issue a major statement on the dynamics of the policy.

From August 25th to August 27th, the Annual Meeting of the Jackson Hall Global Central Bank was held. Fed Chairman Powell delivered a speech to reiterate the stance of continuously tightening monetary policy.

Powell said in his speech that restoring price stability is likely to need to maintain a constrained monetary policy within a period of time.

He also reiterated that the Fed may raise interest rates again at the September interest rate interest meeting, but the interest rate hike will depend on the data they will be announced. Although interest rate hikes, decline in economic growth, and weak employment markets reduce inflation levels, it will also bring some pain to families and enterprises. These pains are the cost of reducing the unfortunate cost of inflation. But if the price is not restored, there will be greater pain.

Powell's speech triggered the market's re -evaluation of the future interest rate hike cycle. The Federal Reserve's interest rate hike cycle may last longer, and investors have corrected expectations that the Federal Reserve will turn to loose in advance. At present, the market's expected interest rate hike cycle will last until March 2023, and the end of the interest rate hike will rise to nearly 3.7%.

Panic and falling emotions quickly fermented after the annual meeting of the Global Central Bank of Jackson Hall. Last Friday, the severe selling of the United States has lowered the major US stock index for two consecutive weeks, and basically removed all the gains since the end of July. The Dow Jones Industrial Index fell 1008.38 points throughout the day to 32283.40 points, a drop of 3%, setting the largest single -day decline since May.

Later, it opened on Monday and spread to the Asia -Pacific market. As of the press release, the Nikkei 225 index fell 2.77%to 27849.0 points; the South Korean KOSPI index fell 2.20%to 2426.42 points. The A -share and Shanghai Index fell 0.57%to 3217.73, and the Hang Seng Index fell 1.00%to 19968.33.

- END -

Creative H5 丨 Five -year changes in Jilin in the eyes of a foreign businessman

His name is Zhang Fusheng, a Shandong entrepreneur.In the process of investing in ...

More than 500 Hebei Enterprises will participate

The service trade will be held in Beijing from August 31st to September 5th.Great ...