Capital has a strong willingness to invest in "hard technology"!"Shanghai Science and Technology Finance Ecology Annual Observation" is released

Author:Pudong Observation Time:2022.08.27

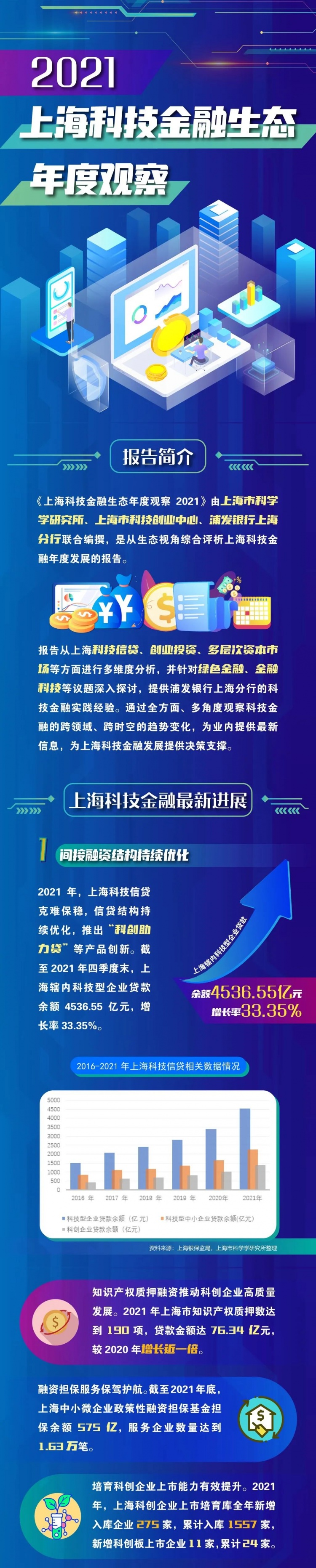

At the 2022 Pujiang Innovation Forum Achievement Conference held on the morning of August 27, the "Shanghai Science and Technology Finance Ecological Annual Observation 2021" was released. The report was jointly compiled by the Shanghai Institute of Science, Shanghai Science and Technology Entrepreneurship, and Shanghai Branch of Pudong Development Bank, which comprehensively evaluated the development of Shanghai Science and Technology Finance from an ecological perspective.

2021 is the beginning of the "Fourteenth Five -Year Plan" plan. It is also the first year when the new journey of building a new socialist modern country and entering the second century of struggle is started. In order to support the self -reliance of science and technology and accelerate the construction of the Shanghai Science and Technology and Innovation Center, a number of financial support policies have been introduced, the indirect financing structure continues to optimize, the direct financing "hard technology" attributes are outstanding, and the "double carbon" goals have achieved new results. Shanghai International Financial Center The linkage effect with the Science and Technology Innovation Center is increasing. For example, in 2021, a total of 73 companies in the domestic and overseas markets were listed, of which 22 were listed on the science and technology board, reaching a total of 30%, and the atmosphere of the science and technology innovation was even stronger.

"80%of the listed companies of science and technology boards are concentrated in hard technology. It can be seen that the emergence of science and technology boards promotes 'hard technology' enterprises." Jin Aimin, deputy director and deputy researcher of the Science and Technology Entrepreneurship Research Office of Shanghai Sciences, express.

The report shows that in 2021, the Shanghai equity investment market is concentrated in IT, semiconductor, biomedicine, Internet, logistics, chain and retail. From the perspective of the overall distribution, the three leading industries correspond to the three major pioneers in Shanghai, reflecting the strong willingness to invest in the "hard technology" industry. Among them, from the perspective of investment in various regions of Shanghai, the investment cases and investment amounts in Pudong New District topped the list.

Taking the field of biotechnology/medical and health as an example, thanks to the strong strength of Zhangjiang Yaogu, the number of investment and investment in Pudong New District ranked first, from 116 and 24.8 billion yuan, respectively.

The report also shows that the leverage of government funds has continued to make efforts. As of the end of 2021, the Shanghai Venture Investment Guidance Fund has promised to invest 10.79 billion yuan, and the leverage amplification ratio is 6.14 times. The "dual carbon" of science and technology financial services achieved new results. In 2021, the national carbon market opened. Shanghai Environment Energy Exchange launched financial products such as carbon neutral index and carbon emissions quota pledge loan guarantee insurance. In order to achieve "dual carbon" The target provides strong support.

Responsible editor Xu Ling

Text Yang Zhenying

Source Pudong released

- END -

Guilin, Guangxi: "Small special" party building leads the food safety industry Daianlian

Is the Market Supervisory Authority? I found that a batch of small cabbage was sus...

High temperature continues to actively take measures to defend the "vegetable basket"

In the past few days, the southern region of my country has continued to have high temperatures, which has an impact on the output and price of vegetables. However, the latest data released by the Min