Anta opened the iron curtain of double giants, and the sports market has changed

Author:36 氪 Time:2022.08.27

After FILA, Anta needs "the next trump card".

Text | Ren Cairu

Edit | Qiao Yan

Source | 36 氪 Future Consumption (ID: LSLB168)

Cover Source | Vision China

Finally, in the first half of the year, Anta Group, which was established in the first half of the year, surpassed Nike China for the first time in income volume, and took the lead in the Chinese sports market.

Ding Shizhong, CEO of Anta Group, proposed "the first market share to occupy the Chinese market share by 2025" at a strategy meeting last year. Now this goal is achieved 3 years in advance.

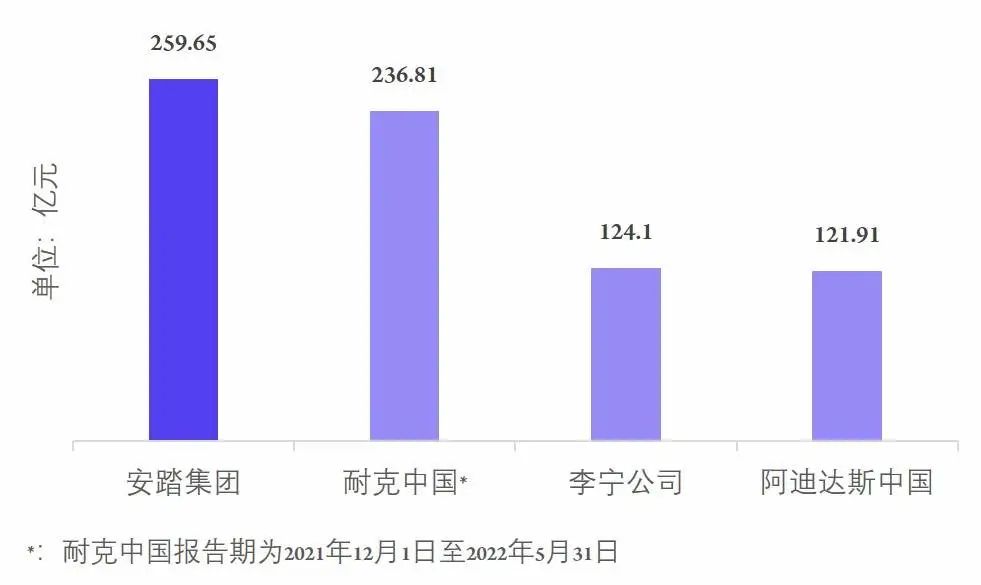

According to the financial report, in the first half of 2022, Anta Group achieved a total revenue of 25.965 billion yuan, an increase of 13.8%year -on -year. The income volume was equivalent to 1.1 Nike China, 2.1 Li Ning, and 2.13 Adidas of the same period.

At the same time, Li Ning and Tubu, which are two or three domestic sports brands, also handed over a good first half of the transcript in the first half of the year: Li Ning's revenue profit increased doubled, and the income increased by 21.7%to 12.409 billion yuan. 37.5%to 5.684 billion yuan, ranking first in the three major domestic sports brands.

The other side of the domestic brand is the dim performance of international giants. Nike's revenue in the Chinese market declined in the Chinese market for three consecutive quarters, and Adidas' decline has lasted for five quarters. The day before the Anta semi -annual report was released, Adidas exposed the mistake in China, and CEO will step down early next year.

In the first half of 2022, the comparison of the main sports brand revenue (Source: Financial Report; Drawing: 36 氪)

From the perspective of the brand, the Anta brand revenue in the first half of the year was 13.36 billion yuan, a year -on -year increase of 26.3%; the FILA brand revenue was 10.777 billion yuan, a year -on -year decrease of 0.5%; the revenue of all other brands was 1.828 billion yuan, a year -on -year increase of 29.9%. The proportion of the total income of Anta, FILA, and all other brands accounted for 51.5%, 41.5%, and 7%, respectively.

However, while the overall revenue of the group reached a record high, Anta's "cash cow" FILA has continued the slump last year in the first half of this year. The key financial indicators have fallen. It seems that it has completed its second growth curve. Historical mission began to fall into bottlenecks.

In the case of FILA difficult to revive, can Anta's main brands and new brands under the group successfully take over the growth goal? Which step is "Anta of the World"?

Revenue and profit drop, FILA can't run anymore

In the first half of the year, FILA moved from "growing stall" to "increased from incremental".

In March of this year, when Anta Group issued an annual report of 2021, he gave guidance to the annual growth of 2022, and proposed that FILA's growth will be maintained at 15%to 20%, but half a year has passed, and the completion is not optimistic.

In 2021, the growth rate of FILA's revenue slowed down, and the growth rate in the second half of the year even had only a single digit. However, in the first half of 2022, FILA's core financial indicators not only did not increase again, but also declined: 10.777 billion yuan in revenue, a decrease of 0.5%year -on -year. The gross profit margin and operating interest rates decreased by 3.7 and 6.5 percentage points, respectively.

Among them, due to the plunge of FILA in business profits, the Anta Group's overall trapped in increasing income and increasing profits, the total profit in this cycle decreased by 1.9%.

Regarding the reduction of FILA's income, Anta's attribution is the epidemic.

According to the financial report, the physical stores that have been suspended in the first half of the year are concentrated in high -end cities and shopping malls, and FILA, as a high -end brand, has a large layout in high -end cities and has affected more. Essence

However, in addition to the impact of the epidemic, FILA is difficult to return to the era of high -speed growth. From high -speed growth to high -quality growth.

For Anta Group, the next step in the growth pressure came to the main brand and a series of new brands.

Anta, the main brand that broke up upwards, shows good pressure. Since 2018, the proportion of revenue in the entire group has been declining year by year, from 59.4%to 48.7%in 2021. However, its share has rebounded for the first time in the first half of this year, and returned to more than 50%.

According to the financial report, the income growth of the Anta brand is mainly due to the growth of DTC business and e -commerce business. The income of the two major businesses in the first half of the year increased to 6.64 billion yuan and 4.569 billion yuan, respectively, and the former increased by 80 % year -on -year.

The essence of the DTC business is to recover the dealer system directly. The DTC transformation starting from Anta in 2020 realizes the efficient opening of Anta and retail terminals.

It is worth mentioning that Anta has pointed out at the performance exchange meeting at the beginning of the year that the DTC model in 2022 will still have a certain impact on the main brand Anta, but this impact will be less than 2021, which also causes the outside world to suspect that the Anta brand in 2022 The income will be difficult to maintain high growth, but the latest financial report obviously breaks this concern.

The growth of the e -commerce business helped Anta better buffer the channel risk caused by the epidemic. The financial report mentioned that "in addition to the strength of traditional e -commerce platforms such as Tmall and JD.com, the group is also in Douyin, Xiaohongshu, etc. The platform accelerates the layout, and the business growth of Douyin is particularly fast. " As far as the new brand is concerned, the epidemic in the first half of the year was repeated, and the outdoor boom unexpectedly rose, which drove the Descente and KOLON SPORTs that drove Anta Group to eat dividends. The income during the reporting period increased significantly by 29.9%. FILA two major brands. In addition, Anta Sports held a joint company holding Amer Sports' revenue of 21.1%year -on -year to 9.67 billion yuan, which completed a loss from loss in the first half of the year.

However, these rapidly growing new brands are still small, and the proportion of the overall revenue of the group is less than 10 %. To carry the large -scale growth flag, it may take more time and investment.

Two major concerns still exist: inventory and foundry

Under the influence of the epidemic, the pressure of inventory turnover is becoming a hidden concern of the entire industry.

In the first half of the year, Anta's average inventory turnover date reached 145 days, an increase of 28 days over the same period last year, and the inventory amount reached 8.192 billion yuan, of which exceeded 90 % of the finished products. The reason for consideration is the influence of two major factors. One is that the product circulation under the epidemic slowly slows down, and the other is that the continuous DTC transformation requires the group to buy some goods from the original channel vendors, which has led to the rise in the overall inventory level.

From the perspective of two other domestic sports brands in horizontal, in the first half of the year, Li Ning's average inventory turnover period was 55 days, an increase of 2 days over 2021; Tubu was 106 days, an increase of 27 days over the same period last year.

The turnover speed is also slowing down, but Anta's turnover cycle is still significantly higher than other brands. And history countless times that the backlog of inventory often becomes the beginning of the business crisis. This crisis even requires the brand to digest it in decades. reason.

Take Anta as an example. During the reporting period, the expenses generated by advertising and publicity and marketing activities increased, and the proportion of total income increased by 0.9 percentage points again. In addition to marketing, the gross profit margin of FILA also attributed the gross profit margin of FILA Retail discount.

The B side of heavy marketing is another hidden concern of Anta, that is, the lack of power for R & D and quality control.

Anta Sports's R & D cost in 2021 accounted for 2.3%of the income, which was the lowest value of the past five years. In the first half of 2022, this proportion remains unchanged. This proportion is higher than Li Ning and Tub, but it is still lower than the international brand. Nike and Adi’s R & D expenses account for nearly 10%. Nike's first "Air Cushion Air Technology" and other help brands have maintained for a long time. Professional and fresh. In contrast, the Anta brand's scientific and technological strength has a significant insufficient possession of the market.

The uncertainty of the quality control end is reflected in the disorders of the proportion of self -production to the foundry. In the first half of 2022, the main brand Anta's self -produced shoes and clothing accounted for 21.6%and 9.7%, respectively, a year -on -year decrease of 4.8 and 0.8 percentage points. The proportion was 7.6%and 3.7%, respectively, a year -on -year decrease of 15.7 and 0.2 percentage points.

In other words, consumers buy 100 double -Anta shoes, nearly 80 pairs are foundry production, and 100 double FILA shoes are purchased, and 92 doubles are foundry production.

Compared with several other domestic brands, the proportion of Step's self -produced shoes in the first half of 2022 was 37%and 8%, while the data of 361 degrees were 45%and 25%, respectively, which was much higher than Anta Group.

In order to optimize the cost and stability of the supply chain, Nike and Adi also adopted the foundry model. However, for Anta, how to ensure that quality is worthy of vigilance under such a high -foundry ratio. On the black cat complaint platform, the amount of complaints between the Anta brand and FILA is as high as 3998 and 4607, respectively, of which the quality of the product is a major reasons for complaints.

In general, due to the influence of various factors such as consumer concepts and political stances, Nike and Adi, the two global head brands, are experiencing an unprecedented crisis in China. In addition, the rise of sports outdoor trends will bring domestic sports brands Whether you can grasp, grasp, and how long you can grasp, how to grasp, and how long it is to catch up with the best window period is the question that the brand expects to answer.

For Anta, now it has been settled in the domestic market, but to the goal of "not being a Chinese Nike, to be the world's Anta" that Ding Shizhong once said, Anta will also be in a new climbing period, running The solid third growth curve, the impact of the digestive epidemic, and the formation of more solid brand barriers are the goal of playing monsters in front.

36 The official public account of its subsidiary

I sincerely recommend you to follow

wx_fmt = png "data-nickname =" 36 氪 Future consumption "data-alias =" lslb168 "data-signature =" See the future of consumption. 36 氪's official account. "Data-from =" 0 "data-is_biz_ban = "0" />

The sports market has changed

- END -

The leaders of the Provincial Trademark Brand Association visited Nanyuan New Materials in Nanyuan

On the afternoon of July 13, Zhu Zenghui, president of the Hunan Provincial Tradem...

Apple price increase has become a foregone conclusion?I ca n’t sell my mobile phones, why do I dare to increase the price?

In the world's mobile phone market, there are often two types of mobile phones, on...