Silicon carbide into a beautiful semiconductor semiconductor landscape A shares followed?

Author:Federation Time:2022.08.27

When the US -stock semiconductor giant is still hovering at a low position, the silicon carbide giant has reached a record high under the air outlet of new energy.

Ansonami's stock price hit a record high within this week (August 25), and Wolfspeed, the same sector, has also recently risen. The stock turn on August 18 is as high as 1.65 billion US dollars.

Ansonmei stock price K line chart

Wolfspeed stock price K -line chart

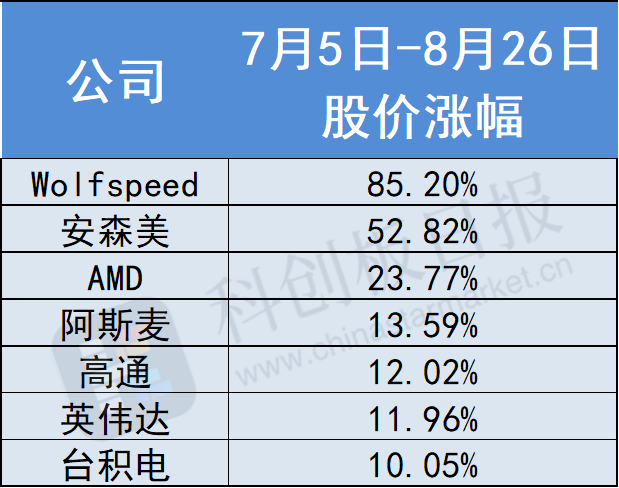

Looking at it for a long time, from the low on July 5th, within two months, Anson Midea has risen 52.82%, Wolfspeed has increased by 85.2%, becoming the most dazzling chip stock in the Philadelphia semiconductor index.

TSMC, Nvidia, Asumi, Qualcomm, AMD and other semiconductors with a market value of more than 100 billion US dollars are relatively inferior (see the figure below).

Wolfspeed's silicon -based base market share is the world's first, and Ansonmei is also vigorously expanding silicon carbide. The two in the secondary market are like breaking bamboo, and they are inseparable from the multiple positive signals they have recently passed on.

Wolfspeed's revenue in the first quarter of 2023 was set to $ 233 to 248 million, which was higher than the previously expected US $ 226 million. The revenue in 2026 was expected to increase by 30%-40%from the US $ 2.1 billion target at the end of last year.

Anson Michards raised the expected silicon carbide revenue in 2022 to "three times year -on -year", which was doubled before; the company expects that the business revenue will exceed $ 1 billion by 2023; The amount exceeded $ 4. billion, and the previous disclosure was $ 2.6 billion.

At the same time, Ansonmei restarted the stock repurchase plan in the second quarter, which is the first time for more than two years.

The need for silicon carbide of electric vehicle customers is strong

It is worth noting that Wolfspeed and Anson Mimi said at the performance meeting that the company's silicon carbide production basis is a strong demand for electric vehicle customers. Among them, 90%of Ansonmei's silicon carbide demand is related to cars. Wolfspeed was obtained in Q4 2022 Q4 DESIGN-in (referring to the new product development plan), 70%-75%is related to the car.

As a head company in the field of silicon carbide, the profitability of Wolfspeed and Ansonami and expanding production are all important vane of the industry. They tend to make a consistent statement and a positive outlook on the silicon carbide industry, reflecting the car -level silicon carbide products The penetration rate is better than expected.

On new energy vehicles, silicon carbide devices are mainly used in main drive inverters, OBC (vehicle charger), DC-DC vehicle power converter and high-power DCDC charging equipment. As major car companies have successively launched the 800V voltage platform, in order to meet the needs of large current and high voltage, the main drive inverter of the motor controller will inevitably replace the silicon-based IGBT to SIC-MOS. It is expected to bring huge growth. space.

Weilai ET7 and Xiaopeng G9 have adopted silicon carbide devices. Many domestic power semiconductor suppliers are also actively deploying silicon carbide. It is expected to accelerate the speed of silicon carbide in China.

来The decline in costs usher in sweet and sweet silicon carbide. It is expected to accelerate penetration

In addition to new energy vehicles, photovoltaic, energy storage, charging piles, rail transit, and smart grids will also be used in large -scale silicon carbide power devices.

Taking photovoltaic power generation as an example, compared with the traditional inverter based on silicon-based devices, the photovoltaic inverter using SIC-MOS as the basic material is smaller, the conversion efficiency can be increased from 96%to more than 99%, and the energy loss can be reduced. More than 50%of the equipment cycle increases by 50 times, which can reduce production costs.

Wolfspeed's non-automotive business has grown rapidly. In Q4 in Q4 in Q4, the value obtained by the business in this business was twice as much as the last quarter. Design-win (refers to the customer order).

At the same time, silicon carbide is continuously declined according to the price of products. According to CASA surveys, the actual transaction price of 1200V SIC SBD has been reduced to 2-2.5 times.

Guosheng Securities said that if system costs (surrounding heat dissipation, substrates, etc.) and energy consumption are considered, silicon carbide products have already been competitive, and their prices have reached "sweet spots."

As the industry chain technology is more mature and the production capacity is continuously expanded, market applications such as downstream new energy vehicles, photovoltaic inversion, and consumer electronics in the future are expected to accelerate penetration.

The research institution Yole predicts that by 2027, the silicon carbide device market will increase from US $ 1 billion in 2021 to more than $ 6 billion, with a compound annual growth rate of 34%.

The silicon carbide industry chain can be divided into: substrate, extension, device, terminal application. Foreign companies mostly deploy the entire industry chain in IDM models, such as Wolfspeed, Rohm, and Semiconductor (ST), while domestic enterprises focus on single link manufacturing.

Specific companies include: Tianke Heida, Tianyue Advanced, Luxiao Technology, Tony Electronics, Han Tiancheng, Dongguan Tiandi in the field of extension, Star Semiconductor, Seranian, and Taico in the device field. Tianrun; Yangjie Technology, Hongwei Technology, and Xinjie Neng in the field of packaging. San'an Optoelectronics is one of the few companies in China that lay out silicon carbide IDM industry chain.

Click "watching

"Stocks make a lot of money

- END -

China Gold News Agency held a new office area opening ceremony

On the morning of July 1st, China Gold News Agency held a new office area opening ...

Hengxin Oriental: The controlling shareholder and actual controller Mr. Meng Xianmin accumulated a total of about 85.68 million shares

Every time AI News, Hengxin Oriental (SZ 300081, closing price: 10.14 yuan) issued...