The head securities firms were not good in the first half of the year, but the performance in the second quarter has surged from the previous quarter.

Author:Federation Time:2022.08.27

Listed securities firms disclosed this week's semi -annual report that poor performance in the first half of the year has gradually become a fact.

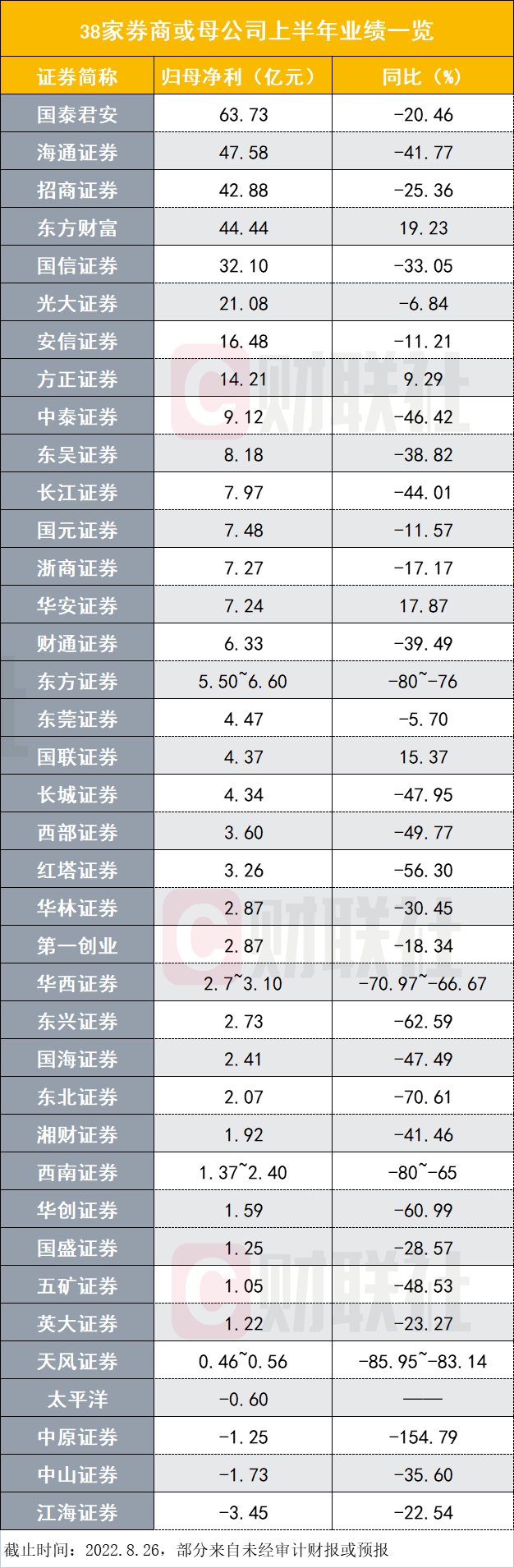

On August 26, 11 listed securities firms disclosed the semi -annual results of 2022. At present, a total of 38 listed brokers have released their performance in the first half of this year. At present, the top 10 brokerage companies who have reached the top of the mother are Guotai Junan (63.73 ), Haitong Securities (4.758 billion yuan), Oriental Fortune (4.444 billion yuan), Guoxin Securities (3.210 billion yuan), Everbright Securities (2.108 billion yuan), Anxin Securities (1.648 billion yuan), Founder Securities (1.421 billion yuan ), Zhongtai Securities (912 million yuan), Soochow Securities (818 million yuan), Changjiang Securities (797 million yuan).

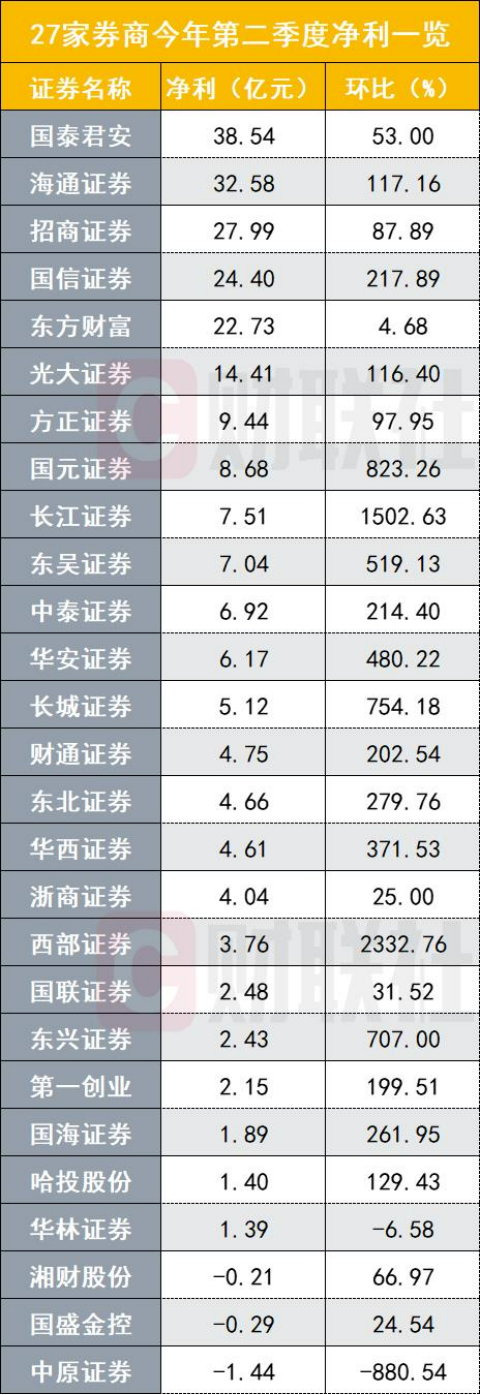

Brokers' performance in the first half of the year was not good, but the signs of heating in the second quarter were obvious. In the second quarter of this year, the average rate of net profit in the single quarter of 27 brokerage companies reached 332.49%, of which 17 of the net profit rolling in 17 were more than doubled.

The head of head brokers' net profit decline exceeded 40 %

The overall performance of the brokerage firms in the first half of the year declined. Among the 38 brokerage or parent company's performance, only 3 brokerage companies returned to their mother's net profit to the same year -on -year growth, namely Oriental Wealth (19.23%), Founder Securities (9.29%), and Huaan Securities (Huaan Securities ( 17.87%), Guolian Securities (15.37%).

In addition, the four brokers lost their losses in the first half of the year, namely the Pacific (-060 billion yuan), Central Plains Securities (-25 million yuan), Zhongshan Securities (-173 million yuan), and Jianghai Securities (-345 million yuan).

The first half of this year is not good for the first half of this year.已披露半年报的4家规模较大券商表现欠佳,国泰君安今年上半年实现归母净利润63.73亿元,同比下降20.47%;海通证券归母净利润为47.58亿元,同比下降41.77%;招商The net profit attributable to the mother of securities was 4.288 billion yuan, a year -on -year decrease of 25.36%; the net profit of Guoxin Securities was 3.210 billion yuan, a year -on -year decrease of 33.05%.

比 27 brokerage firms increased by 3 times from the previous month

Despite the poor performance of brokers in the first half of the year, the improvement of improvement has gradually emerged, and the majority of net profit in the second quarter of the second quarter of the second quarter has grown rapidly.

In the second quarter of this year, the average rate of net profit in the single quarter of 27 brokers was 332.49%, and there were 25 brokerage firms with a month -on -month growth rate, accounting for 92.59%, of which 17 net profit rolling in the single quarter was more than doubled.

In the second quarter of this year's single -quarter net profit, the top -month -old brokerage firms were Western Securities (2332.76%), Changjiang Securities (1502.63%), Gu Yuan Securities (823.26%), Great Wall Securities (754.18%), and Dongxing Securities (707.00) %), Soochow Securities (519.13%), Hua'an Securities (480.22%), Huaxi Securities (371.53%), Northeast Securities (279.76%), Guohai Securities (261.95%).

The net profit growth rate of large -scale brokerages is not low in the single quarter, such as Guotai Junan (53.00%), Haitong Securities (117.16%), China Merchants Securities (87.89%), Guoxin Securities (217.89%), Oriental Wealth (4.68%) Everbright Securities (116.40%).

Among the 24 brokerage firms, 24 of the second quarters of this year were profitable in the second quarter of this year, and only 3 brokers or parent companies lost money, namely Xiangcai (-21 billion yuan), Guosheng Financial Holdings (-29 million yuan), and Central Plains Securities (-144 million Yuan).

According to Guoyuan Securities, in the second quarter, with the gradual stability of the securities market, the company actively adjusted the investment structure, strictly controlled investment risks, and the loss of securities investment decreased.

Datong Securities Non -Silver Research News pointed out that under the recovery of the market in the second quarter, the performance of the brokerage firms rebounded rapidly. Although it was still less than the same period last year, the signs of warming were obvious in the first quarter of last year. It is expected that on the basis of the overall market in the second half of the year, the major securities company's achievements will continue to strengthen and gradually go out of the trough brought about by the first quarter.

BOC Securities Research reports that the reform of the capital market and the transfer of residential assets is the long -term driving force for promoting transformation and improving the valuation center of the brokerage sector. It is expected that the performance low is over, and it will gradually improve the repair of valuation in the future.

是 Self -operated business structure is the key

In the first half of this year, the secondary market performed poorly, and the self -operated business dragged out the performance of the brokerage firms, but it also formed a strong assistance in the second quarter of this year. "Cheng Ye Xiao He is defeated and Xiao He" is talking about the self -operated business of the brokerage firm.

In the first half of this year, the average of 22 companies' self -operating business decreased by 65.19%year -on -year; 20 of them declined from net self -operated income, accounting for 90.91%. Zhongtai Securities (-033 million yuan), Huaxi Securities (-040 million yuan), Dongxing Securities (-173 million yuan), Guoyuan Securities (-199 million yuan), and Changjiang Securities (-21 billion yuan).

The head securities firms have not been spared. From the perspective of growth rates, such as Guotai Junan (-46.45%), China Merchants Securities (-42.00%), Haitong Securities (-89.80%), etc.

Only two brokerage companies have increased their own business year -on -year, namely Guilian Securities (12.59%) and Founder Securities (69.91%). Therefore, the two brokers performed well in the first half of the year. , 9.29%. The strategy of self -employed business is different, which has a great impact on its own business income and even the company's performance in the first half of this year.

He Ya Gang, director of the Founder Securities Executive Committee and secretary of the board of directors, said at the company's 2022 semi -annual performance briefing that the self -operated rights and interests of the company obtained a positive income in the first half of the year, which was caused by adhering to the investment in non -directional risk and neutral equity investment.

It is reported that Founder Securities is committed to vigorously developing neutral strategies and vigorously developing non -directional businesses, and has persisted for many years.

Guolian Securities stated that the company's equity investment business has always adhered to the value investment concept, focusing on industries and companies with low valuations and good growth, and the yield has greatly won the Shanghai and Shenzhen 300 index; The capital intermediary business of characteristic fixed income products, while the business scale expands, strictly controls risks and achieves stable returns; the comprehensive transaction service capacity of equity derivatives has continued to improve. The trading business income "data ranking, Guilian Securities ranked 10th, which looks particularly conspicuous in a number of head securities firms.

Xiangcai Co., Ltd. pointed out that in the first half of the year, affected by factors such as the macro environment and the new crown epidemic, the domestic securities market had fluctuated, and a certain decline in the overall increase. A significant decline; at the same time, the company's industrial sector is still losing money as a whole, which together leads to a loss of net profit attributable to shareholders of listed companies.

Changjiang Securities said that in the first half of the year, the equity investment market generally fell, and the market performance was weaker than the same period last year, which led to a significant reduction in the income of equity investment business; fixed income investment business focused on market opportunities, increased investment scale, and adjusted according to the trend change. Risk exposure, improve the combination of credit qualifications. Based on other creditor's investment interest income, fixed income investment business income has been improved.

Hualin Securities pointed out that on the one hand, the company has increased investment in financial assets. As of the end of June, financial asset investment accounted for 49.85%of the company's total assets, an increase of 26.85 percentage points from the beginning of the year; on the other hand, from the perspective of investment types, the company The types of investment in financial assets in time are more inclined to invest in non -equity investment varieties such as government bonds and bank bills, adhere to value investment, and are committed to creating a stable income curve.

In addition, it is worth noting that Hualin Securities has greatly increased the investment in information technology during the reporting period. In the first half of 2022, the company's information technology investment reached 131 million yuan, an increase of 102.12%year -on -year. In the previous year, Hualin Securities had invested over 340 million yuan in the development of scientific and technologicalization, and information technology investment accounted for 25.17%of operating income.

Click "watching

"Stocks make a lot of money

- END -

Through the article, TMSA and Sire2.0 Those things

This article will explain in detail what TMSA is, what is Sire2.0, and the relatio...

The two departments regulate the credit card business to take effective measures to reduce the burden of customer interest and fees

Zhongxin Jingwei, July 7th. According to the website of the CBRC, the China Banking Regulatory Commission and the People's Bank of China issued the Notice on Further Promoting the Standardous Healthy...