Just now, the China Banking Regulatory Commission: Principles agree that the two banks enter the bankruptcy process!

Author:China Fund News Time:2022.08.27

China Fund News Yan Ying

Two small and medium -sized banks in Liaoning Province were approved by bankruptcy.

On August 26, the official website of the China Banking Regulatory Commission showed that the CBRC officially approved the bankruptcy application of Liaoyang Rural Commercial Bank and the village bank of Liaoning Edward He Village Town, and agreed to enter the bankruptcy procedure of the two banks in principle.

The CBRC stated that the two banks should carry out follow -up work in strict accordance with relevant laws and regulations. In case of major situations, they should report to the CBRC in a timely manner.

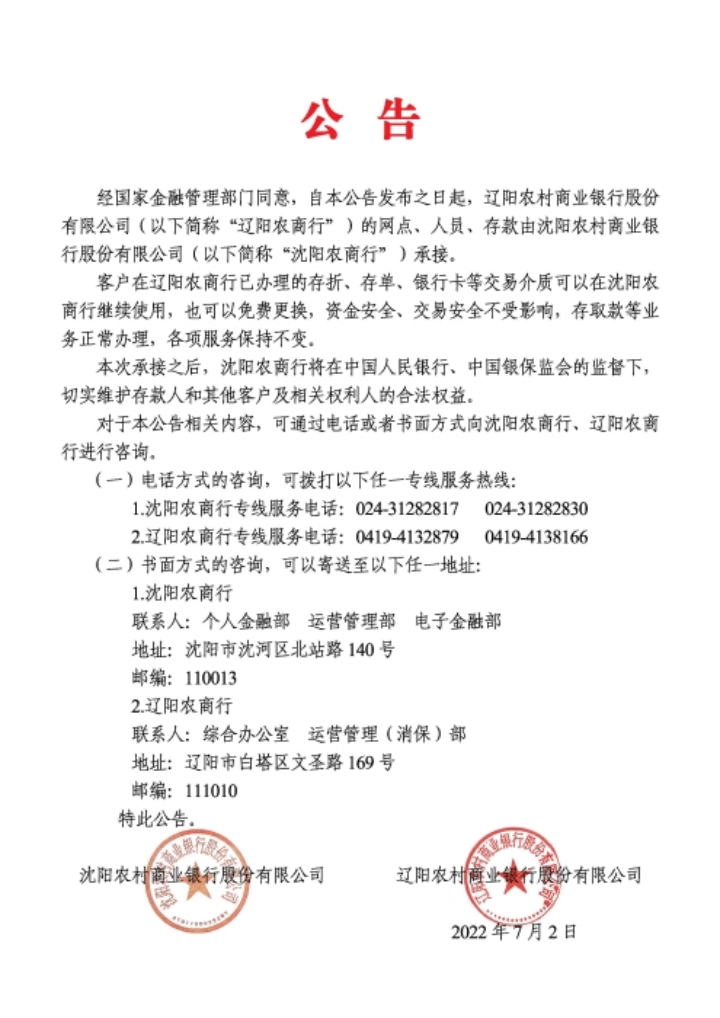

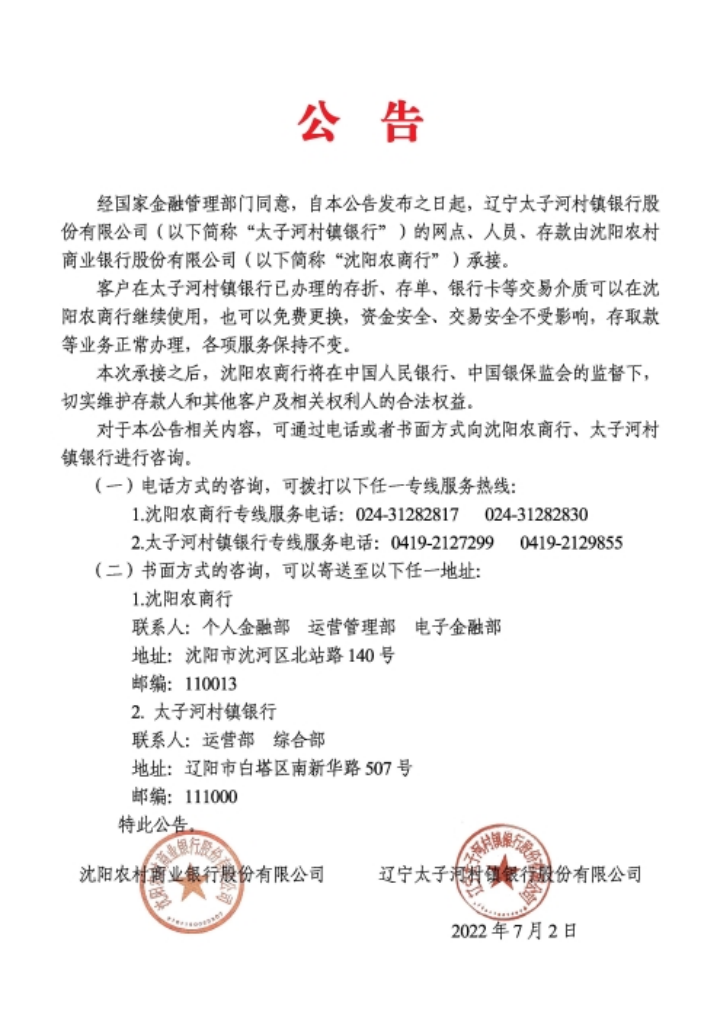

Prior to the news of the "official announcement" of bankruptcy, the outlets, personnel, and deposits of the two banks had been undertaken in July this year, and the undertaking party was Shenyang Rural Commercial Bank.

Liaoning banks enter the bankruptcy procedure and get approval

On August 26, the CBRC announced the approval of the application for bankruptcy of the Rural Commercial Bank of Liaoyang and the bankruptcy of Liaoning Prince He Village Town Bank. Principles agreed to enter the bankruptcy procedure of the two banks.

According to public information, the Liaoyang Rural Commercial Bank opened in June 2016. Based on the new merger of the Rural Credit Cooperative Cooperative of Liaoyang City, Prince Edward River District, and Sanjia District Rural Credit Cooperative Cooperative in Hongwei District, Liaoyang City, Prince Edward River District, and Gong Changling District.

The information of Tianyancha shows that Liaoyang Rural Commercial Bank (formerly Rural Credit Cooperative Cooperative in Hongwei District, Liaoyang City) is one of the sponsor of the Village Bank of Edward River Village and subscribed to the largest shareholder of the village bank.

After entering the bankruptcy procedure, the CBRC stated that the two banks should carry out follow -up work in strict accordance with relevant laws and regulations. In case of major situations, report to the CBRC in a timely manner.

Outlets, personnel, and deposits have been undertaken

Before the "official announcement" bankruptcy, the outlets, personnel, and deposits of the two banks had been undertaken, and the undertaking party was Shenyang Rural Commercial Bank.

In July of this year, Shenyang Rural Commercial Bank disclosed that with the consent of the national financial management department, since the announcement of the announcement, the outlets, personnel and deposits of Liaoyang Rural Commercial Bank and the Liaoning Prince He Village Town Bank were undertaken by Shenyang Rural Commercial Bank. The safety of transaction is not affected, and the business such as deposits and other businesses shall be handled normally.

On July 17, the person in charge of the relevant departments of the Banking Insurance Regulatory Commission stated that due to comprehensive factors, in the past period, the financial risks of Liaoning regional have accumulated. According to the deployment of the Party Central Committee and the State Council, with the support of the relevant central departments, the Liaoning Provincial Party Committee and Provincial Government take the responsibilities, fully pursue the losses, seriously pursue accountability, resolutely punish corruption, accelerate the reform of small and medium -sized bank reform, Important stages, the existing risk is orderly, and the incremental risk is effectively curbed.

The person in charge said that with the joint efforts of all parties, the risk disposal of Liaoyang Rural Commercial Bank has taken the lead in obtaining a new breakthrough. During the risk disposal of Liaoyang Rural Commercial Bank, Liaoning's local small and medium -sized banks in Liaoning Province had sufficient funds, normal business, and stable operation. At present, Liaoning Province is continuously promoting local small and medium -sized banks to deepen reform and resolve risks.

On August 12, the China Banking Regulatory Commission reported again that since the Shenyang Rural Commercial Bank successfully undertakes the Liaoyang Rural Commercial Bank, the Town of the Village and Town Bank of the Village, the people and deposits on July 2, the business outlets have the normal exhibition industry, the normal operations of various businesses, the safety The security of the transaction is not affected, and the equity of the depositors and other creditors is fully protected. At present, all the assets and liabilities of the Liaoyang Rural Commercial Bank and the Town Bank of Edward Heshi Village have been clarified and properly handled in accordance with the law.

Edit: Joey

- END -

The "colorful" road to spread the village revitalization

Poverty alleviation is not the end, but the starting point for new life and new struggle. Since the beginning of this year, Lhasa has attached great importance to the increase in the income of poverty

Henan Provincial Management Enterprise: The rent has been reduced by 224 million yuan in the first half of the year, and more than 7,000 people are planned to recruit

Since the beginning of this year, Henan Province's management enterprises have not...