WeChat and Alipay have changed new!

Author:Harbin Daily Time:2022.08.26

Recently, the Alipay "borrowing" sector added a new credit card cash withdrawal function caused heated discussions.

It is reported that Alipay, WeChat, and some banks have launched the "credit card cash" function, which is currently open to users in a small -scale open test. The 21st Century Business Herald searched in Alipay with "credit card cash" and entered the small program. "Sorry, the service has not been opened to you yet."

The authorized user information shows that the credit cards of Everbright Bank, Ping An Bank, and Ningbo Bank can be cash on Alipay channels. One of the bank credit card business people told the 21st Century Business Herald reporter that the function is still in the trial operation stage, and the market conditions and customer experience have yet to be further observed.

For Alipay and WeChat's "credit card cash" function, market evaluations are mixed:

Supporters believe that "credit card cash withdrawal" is one of the basic functions of credit cards. This is just to add a cash withdrawal channel to the holder of the credit card, which is more convenient than before;

Opponents believe that "credit card cash" is similar to the platform's consumer loan products, which will further promote some credit card holders, especially young groups, to increase the burden on life.

It is worth noting that for a small number of users who have the "credit card withdrawal" function page display, the bank credit card that has not been opened for the time being "Please look forward to". Carrying out related cooperation with Alipay, "Please look forward to" is not "our cooperation means on the road", and there are some misleading.

Free handling fee

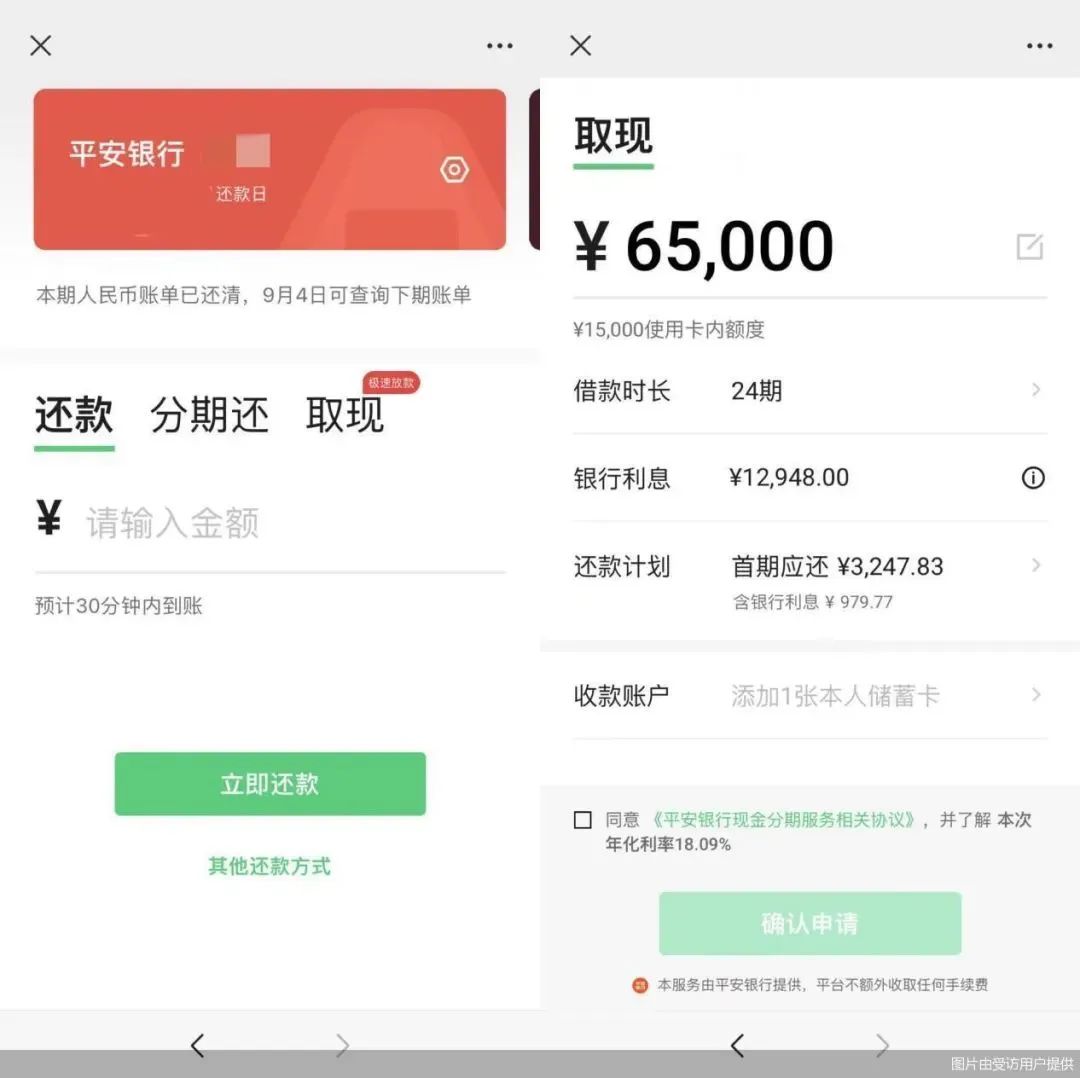

According to the Beijing Commercial Daily, in addition to Alipay, WeChat also shows users the cash entrance of some banks. At the credit card repayment operation page, you can view and cash withdrawal. In self -operated channels such as bank apps, credit cards can also be found.

At present, WeChat and Alipay are available for free credit cards. The interest calculation method is basically the same as the bank's own channels, but the specific approval work is still completed by the bank.

Picture source: Beijing Commercial Daily

The WeChat and Alipay -related service agreements obtained by the reporter show that the above -mentioned cash withdrawal service is actually provided by the bank. The amount and interest rate are reviewed by the bank, and the Internet platform does not charge any additional fees. The service protocol also shows that the cardholder can use the credit card withdrawal service within the cash withdrawal amount given by the card issuer, and you can choose two types: "single month" and "monthly return".

The funds from the binding credit card can only be withdrawn to a bank debit card bound to the cardholder himself. This means that the use of cash withdrawal funds will be carried out in accordance with the bank's capital management and control requirements.

The dean of the Zero One Research Institute Yu Baicheng said that the maximum cash withdrawal amount of the credit card is 50%of the total credit line. Therefore, the demand scenario of credit cards is very similar to consumer credit products such as "borrowing".

According to the First Financial, "Credit Card withdrawn is actually a function that has always existed before, but it has been operated on the ATM and the bank online app. The new feature of the Internet platform is online. Online auxiliary methods provide traffic and purchase channels. "Wang Pengbo, a senior analyst at the financial industry, also told reporters.

For the Internet platform, this not only enriches its own product system, increases product diversity, but also is also conducive to the improvement of user stickiness and driving income increase; for banks, it is equivalent to increasing a large channel. "It turns out that this channel is self -employed by banks, and now it has increased the Internet channels, which is conducive to improving marketing opportunities." The person in charge of a city commercial bank credit card center told reporters.

Is it compliant?

Borrowing cash annualized interest rate 18.25%

In 2016, the central bank issued the "Notice on Credit Card Business Related Matters". The document clearly, the credit card pre -borrowing cash business includes cash withdrawal, cash transfers and cash recharge.

Among them, cash withdrawal refers to the cardholder through the self -service tools such as the cabinet and the automatic teller (ATM), and obtain the credit card pre -borrowing amount within the amount of cash in the form of cash; Internal funds are transferred to my bank settlement account; cash recharge means that the cardholder transferred the credit card pre -borrowing the capital within the amount of the funds to the payment account opened by his non -bank payment institution.

The document stipulates that cardholders handle cash withdrawal business through self -service machinery such as ATM, and each card must not exceed RMB 10,000 daily; cardholders handle cash extraction business through the counter, and each card of various channels for cash transfer business through various channels The daily limit is agreed by the card issuer and the cardholder through the agreement; the card issuer can independently determine whether it provides cash recharge services, and agreed with the cardholder agreement to agree on the daily limit of each card. The card issuer shall not transfer the funds within the amount within the amount of the cardholder's credit card to other credit cards, as well as a non -cardholder's bank settlement account or payment account.

"Allows to settle accounts and pay cash transfers and cash recharge to my bank's settlement account and my account. The card issuer should carry out related businesses based on the principles of risk -controllable and commercial sustainable business." The central bank also said.

It can be seen that the credit card pre -borrowing cash business corresponds to different names in different cash ways.

Taking a bank as an example, the 21st Century Economic Herald reporter searched for "cash" from the bank's credit card app, which can enter the cash withdrawal page. Page introduction, the pre -borrowing cash fee is 1%of each cash transaction amount, a minimum of 10 yuan/pen, and a maximum cap of 300 yuan/pen, you can enjoy the handling fee discount; Calculating the resuscitation, the receipt card is debit card, and supports multiple banks. At present, Alipay's "Credit Card Cash Cash" function page shows that the funds from the binding credit card can only be withdrawn to the bank debit card bound by the cardholder himself; The review decision, the Internet platform does not charge any additional fees; the fees are exempted.

It can be seen from the above -mentioned documents that in fact, the credit card pre -cash can also be recharged to the payment account issued by non -bank payment institutions. For banks, there is still further innovative space.

Credit card business shrinks

Each family is actively rescued

Behind the cooperation between banks and Alipay and WeChat, it reflects the difficult situation of the development of the credit card business at the moment.

According to the Shanghai Securities Journal, many listed banks have recently disclosed that the 2022 semi -annual report mentioned that due to the impact of many factors, the consumption recovery is not as expected, and the credit card business has been affected by a lot. Plots, even negative.

For example, a retail postal savings bank declined in credit card credit balance in the first half of the year. As of the end of June 2022, the bank's credit card credit balance was 174.555 billion yuan, a decrease of 0.18%over the end of the previous year.

Under the contraction of credit card business, the changes in asset quality also have hidden concerns. Recently, the Pinja Payment System Operation Report recently announced by the People's Bank of China showed that as of the end of the first quarter of 2022, the total credit card overdue for half a year of unpaid credit was 1092.676 billion yuan, an increase of 7.71%month -on -month. This means that the overdue pressure of credit cards is increasing.

In fact, the aforementioned listed bank's credit card adverse rate in the first half of the year has risen. Ping An Bank said that in order to strengthen risk control, the entry threshold and quota management of credit cards has been greatly tightened.

After the implementation of the new credit card regulations in July this year, the bank strengthened the rectification of the credit card business. On the one hand, it restricted trading behaviors. On the other hand, the "sleep card" was cleared. The expansion of the scale of the credit card has ended.

In this context, some banks and users with more than 1 billion Internet platforms cooperate with the cash withdrawal function on the water test line, which is naturally regarded by the industry as its own user's use of credit cards.

"For banks, credit cards have a big entrance, which is conducive to increasing users' activity and business volume." Yu Baicheng, Dean of the Research Institute of Zero One Research Institute, believes.

Source: 21st Century Business Herald, Shanghai Securities News, Beijing Commercial Daily

PSAs

- END -

Yajin Technology: 97 million shares of shareholders An Fu Energy pledged, accounting for 2.59% of the total share capital

On August 22, 2022, Yajin Technology (830806.NQ) issued an announcement of equity pledge.The announcement shows that the company's shareholder Anhui Anfo Energy Technology Co., Ltd. (hereinafter refer...

Rainbow Group was listed on the market for the first time to be reduced by major shareholders' holdings of marketing and "counterfeiting" dual power but no major breakthroughs.

Rainbow Group's online marketing investment is large, but it has failed to achieve...