National Development and Reform Commission: Strengthen credit information sharing and improve the scale of small and medium -sized enterprises

Author:Zhongxin Jingwei Time:2022.08.26

Zhongxin Jingwei, August 26. According to the public account of the "National Development and Reform Commission" on the 26th, in order to implement the decision -making and deployment of the financing of small and medium -sized enterprises' financing problems on accelerating the pace of credit information sharing of enterprises, on August 25, national development reform reform The Commission held a symposium on "Credit Information Sharing Application to Promote Economic Stability Recovery", deepened the pragmatic cooperation between the national SME financing credit service platform and banking institutions, promoted financial support policies and tools to land, and consolidated the foundation of economic recovery development.

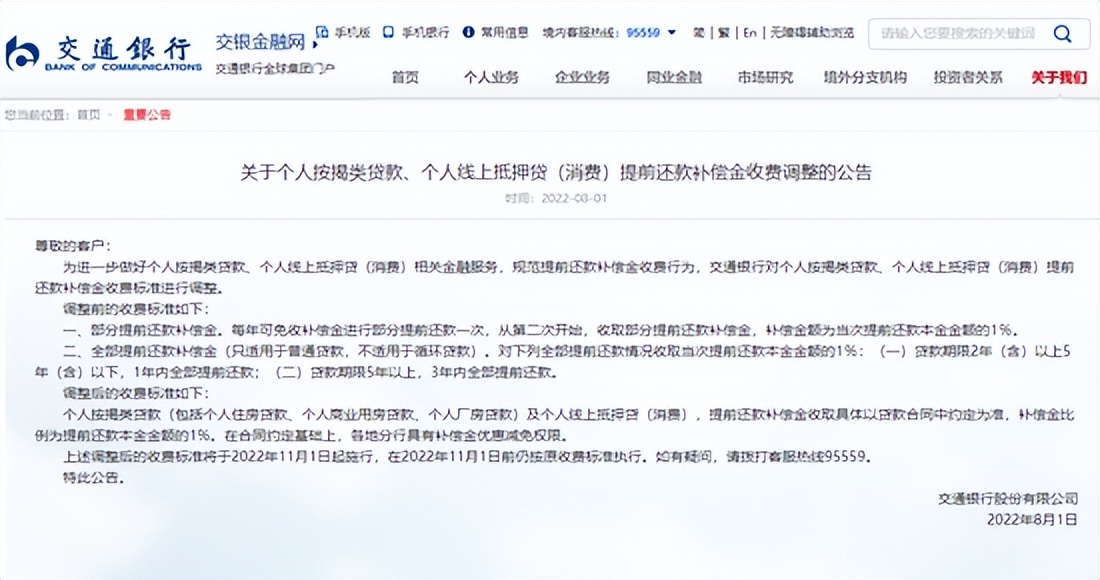

National Development Bank, China Import and Export Bank, China Agricultural Development Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China Postal Savings Bank and other responsible comrades attended.

The meeting pointed out that strengthening the application of credit information sharing to promote the financing of small and medium -sized enterprises is an important measure to stabilize market entities. Since the beginning of this year, various regions and departments have conscientiously implemented the "Notice of the General Office of the State Council on Strengthening the Implementation of Small and Micro -Enterprises' financing implementation plan for the application of credit information sharing to promote the application of credit information sharing" (National Office Fa [2021] No. 52), accelerate the establishment of national integration financing credit credit The service platform network, focusing on promoting the collection and sharing of credit information related to enterprises, has effectively promoted the expansion, increase, and price reduction of small and medium -sized enterprises and individual industrial and commercial households. In the next step, it is necessary to further expand the scope of the collection of credit information related to enterprises, and coordinate the promotion of data collection and sharing at the national and local levels; to further improve the quality of data, strengthen the platform's ability to clean the data; further deepen the platform network network and bank head office and branch. The institutional cooperation is pragmatic and strives to improve the scale of credit loans of small and medium -sized enterprises.

The meeting emphasized that it is necessary to use the financial support policies and tools issued by the country to closely focus on the major national development strategies and major plans, and strengthen project docking, factor guarantee and supervision and management. (Zhongxin Jingwei APP)

- END -

Behind Bank

Produced | WEMONEY Research RoomEdit | Liu ShuangxiaOn August 2nd,#8 8 8 8 8 8 8 8...

Shandong Yinan: Eight college classes boost the overall momentum of the industry

Taking time to help the company, listen to the business of the company, and understand the difficulties and problems encountered by the enterprise. This is Li Guijie, the director of the New Material